REGULATIONS

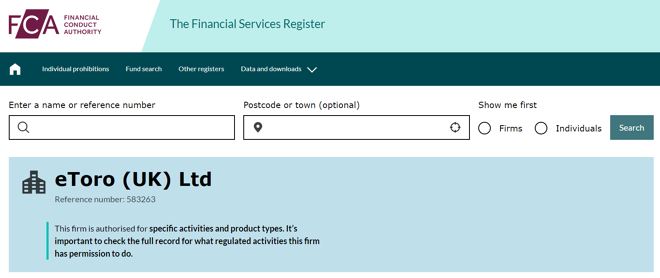

eToro is regulated by various financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies impose standards and requirements on financial service providers to ensure investor protection and market integrity. However, regulatory requirements can vary by jurisdiction and may change over time. It’s essential to verify the current regulatory status and compliance of eToro or any other financial service provider in the relevant jurisdictions before engaging with their services.

- eToro (Europe) Ltd is a financial company based in Europe that offers online trading and investment services. They provide a platform for trading various asset classes, including stocks, cryptocurrencies, commodities and more. This entity is regulated by CySEC.

- eToro (UK) Ltd is a subsidiary company of eToro. It is a global multi-asset trading platform that provides services to eToro users in the UK. It operates similarly to its parent company, offering online trading and investment opportunities across various asset classes. This entity is regulated by FCA.

- eToro AUS Capital Ltd is an Australian based subsidiary company of eToro that provides services to users in Australia. This entity is regulated by ASIC.

- eToro USA Securities Inc is a subsidiary company of eToro, operating as a registered broker-dealer in the United States. It provides online trading services to users within the U.S, while complying with relevant regulatory requirements in the U.S market. This entity is regulated by FINRA in the United States.

- eToro (Seychelles) Ltd is a subsidiary company of eToro, operating from the Seychelles. This entity is regulated by FSA and provides services to users from regions where eToro’s other subsidiaries may not operate.

ACCOUNT TYPE

eToro offers a variety of trading and investment options through its unified CFD trading account, suitable for margin trading. The terms of this account may vary depending on your account balance and tier within the ‘eToro Club’ program. While the platform accepts multi-currency deposits, it is worth noting that non USD deposits are subject to a conversion fee. Furthermore, eToro allows swap-free trading with its Islamic Accounts.

Before opening any account, you should consider an account that aligns with your goals, needs, and ambition in the market. Factors like the accounts minimum deposit requirement, its spreads and commission, the execution method, and any other relevant factors should also be considered.

Standard Account

The Standard account is for retail trading and copying trades. This eToro account features a minimum deposit anywhere from $10 – $10000 depending on the trader’s country of residence. The Standard account allows transactions to be made across all assets on eToro, including stocks, cryptocurrencies, and Forex markets.

PRO Account

The PRO account is a professional account that requires traders to meet specific criterias before they can be qualified to use the account.

There are three criterias

- You must have a minimum of 12 months working experience in the financial sector

- You should possess a financial portfolio exceeding EUR 500,000

- You should have conducted a minimum of 10 large transactions quarterly over a one year period

The eToro CFD Trading account provides commission free trading and floating spreads from 1.0 pips, with accessibility ensured by a minimum deposit of just $50. Accessing eToro’s live chart, weekly chart analysis, and live webinars requires a minimum deposit of $3000, qualifying you for a silver account membership. With a gold membership, you can earn interest on your balance, generating passive income without active trading.

Higher tier membership (platinum, platinum+, and diamond) offers additional benefits, such as higher interest rates, commission free withdrawals, and exclusive access to advanced insights from TradingCentral.

eToro operates as a market maker, ensuring superior execution standards, supporting fast and precise order execution, and mitigating the risk of negative slippage by acting as a counterparty to its customers orders.

eToro provides demo accounts to familiarize traders with its services and enable them to refine their strategies in a risk free environment. Demo accounts can easily be set up alongside the live CFD account. Additionally, your eToro account can be linked to either your Google or Facebook account.

COMMISSION AND FEES

Opening an account on eToro platform and closing long positions on stocks is free. Stocks listed on US stock exchanges are the most popular, however, stocks from other markets are available as derivatives and are subjected to trading fees in the form of spreads. Fees also apply to short positions and leveraged orders.

eToro offers varying spreads on FX pairs, from low to high, and average spreads on share CFDs, with average to high spreads on commodities and indices. Trading share CFDs with eToro is particularly advantageous as there are no fixed commissions imposed by the broker on these instruments.

The company exclusively accepts and allows withdrawals in US dollars. There is a conversion fee ranging from 0-50 pips on deposit and withdrawals made in another currency. eToro club members enjoy anywhere from 50-100% reduction on currency conversion. If a client’s account shows no activity for a period of 12 months, the broker levies an inactivity fee of $10.

It is necessary to note that the broker does apply an overnight fee for carrying positions over to the next trading day.

The broker provides commission free trading across all major markets except for crypto assets (excluding CFDs). For buying and selling cryptos, eToro imposes a 1% commission in addition to the spread cost. Notably, eToro doesnt charge a commission for copying other traders’ strategies on the platform.

DEPOSIT AND WITHDRAWAL

eToro charges no fees on deposits, but there is a $5 fixed fee on withdrawals, along with any applicable third-party banking fee.

Funds from eToro accounts can be withdrawn through debit cards, bank accounts via SWIFT or IBAN, as well as electronic payment systems like Neteller, Skrill, and Sofort. The processing time for transactions varies depending on the chosen withdrawal method, ranging from several minutes to 7 working days. Other withdrawal methods include eToro money (GBP), PayPal, iDeal, Przelewy24.

The minimum withdrawal amount for bank transfers is $500, while for all other methods it is $30. The broker exclusively allows withdrawals in US dollars, with other currencies converted to USD with corresponding fees.

eToro’s deposit methods includes: eToro money (GBP), Credit/Debit card, Wire transfer, PayPal, Neteller, Skrill, iDeal, Sofort Banking, Trustly, and Przelewy24.

INVESTMENT OPTIONS

Clients of eToro can earn passive income through the broker’s investment offers without directly trading any financial instrument. Additionally, participating in the partnership program offers opportunities for added income.

Smart Portfolio, Copy Trader and Popular Investor

eToro specializes in social trading, offering optimal conditions for both trading signal providers and their subscribers, including novice investors. Currently, eToro provides the following investment solutions

- Smart Portfolios: Long-term investment portfolios curated by investment experts, who oversee their management and rebalancing.

- CopyTrader: A service enabling subscribers to replicate trades of successful traders. Subscribers pay standard trading fees with no additional charges and the minimum amount for copying a position is $1.

- Popular Investor: For traders with at least 2 months of successful trading experience, they are allowed to offer their strategies for copying by other eToro clients across four levels: Cadet, Champion, Elite, and Elite Pro, each with a different profit percentage.

Each eToro investment program requires a specific minimum deposit amount. Smart Portfolio has a necessary minimum deposit amount of $500. For the Popular Investor program, a minimum account balance of $1,000 is required. Connecting to the CopyTrader platform mandates a deposit of $200 or more.

eToro Partnership Program

eToro offers its partners a share of its income generated from new users who open an account with the broker using a referral link. The rewards are based on Cost Per Acquisition (CPA) indicators and are available through three commission plans with monthly rewards of $100, $200, and $250.

The broker initiates reward payments once it receives at least $10 in fees from the referred users. Partners have the flexibility to promote eToro through various methods, including publishing direct links and banners, sending newsletters, and advertising via email.

TRADABLE INSTRUMENTS

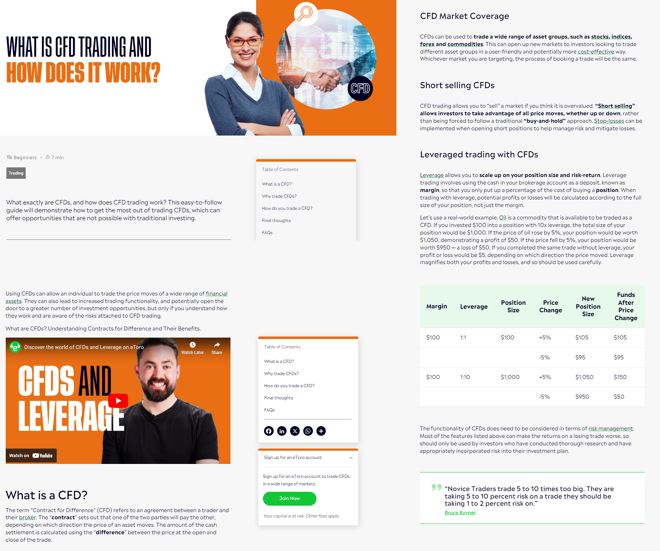

eToro offers a diverse portfolio with a variety of instruments spanning across various markets, traded as Contracts for Differences (CFDs). CFDs encompass both low risk securities and higher yield/risk assets.

Contracts for Difference (CFDs) are financial derivatives utilized to speculate on the price movement of an underlying asset without the need for physical delivery. A primary advantage of trading CFDs is the ability to swiftly enter and exit the market, enabling traders to capitalize on even minor fluctuations in the derivative’s price.

Clients can also invest in actual stocks and a wide array of cryptocurrencies, broadening their investment opportunities. Despite the extensive range of instruments, finding a specific one on eToro’s platform is straightforward.

TRADING PLATFORMS

eToro’s Platform

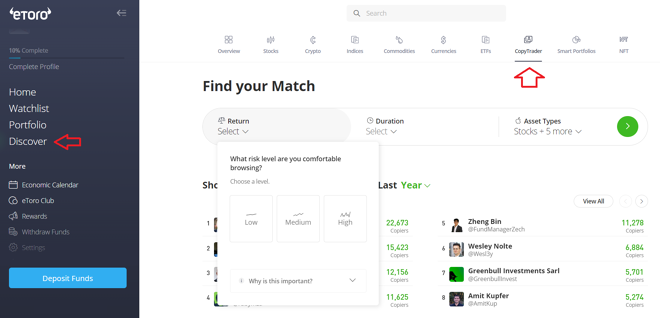

eToro has developed its own feature rich web trader platform alongside a highly practical mobile app. The platform supports copy trading and access to this copy trading function is straightforward. Furthermore, the platform enables you to search for strategies that match your criteria, such as duration, average risk, and traded assets, simplifying the process of finding a match that aligns with your trading style.

The user-friendly design of the platform allows easy access to the latest financial news, current market sentiment, and important information about instruments to be traded. This ensures an efficient and informative trading experience.

The integration of charts from TradingView is another advantage of the eToro’s platform. This feature caters to the needs of experienced chart artists looking to conduct in-depth technical analyses.

The eToro platform also has an intuitive ‘Delta Tool’ which is designed to simplify performance tracking of portfolios and accounts with eToro. This feature can be very useful as it enables trades and investment in multiple ways.

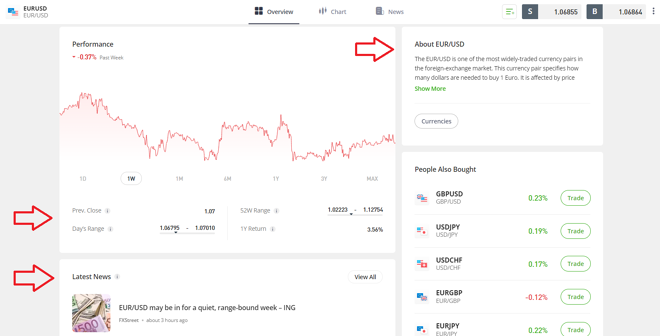

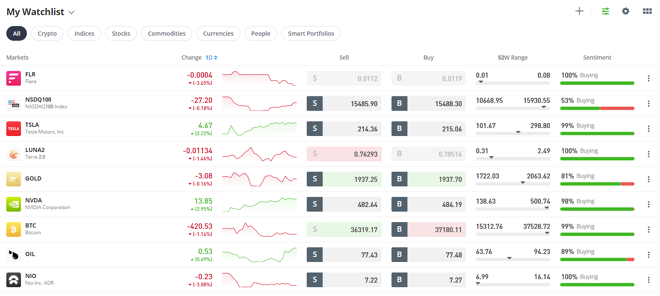

The Web Trader platform features a watch list of selected instruments and charts which are detailed and well suited for conducting thorough technical analyses. This trading platform also incorporates a sophisticated news screener, which allows access to current market developments.

Charts

The chart screen of the platform aids technical analysis by offering an overview of the price action behavior and granting traders access to various analytical tools and chart configuration options. Having a good chart facilitates easy scaling of price action.

This platform also allows the application of numerous technical indicators and drawing tools without obscuring the price action. This feature simplifies the identification of potential breakouts or breakdowns from established trends, enhancing the platform’s utility for conducting thorough technical analyses.

Orders

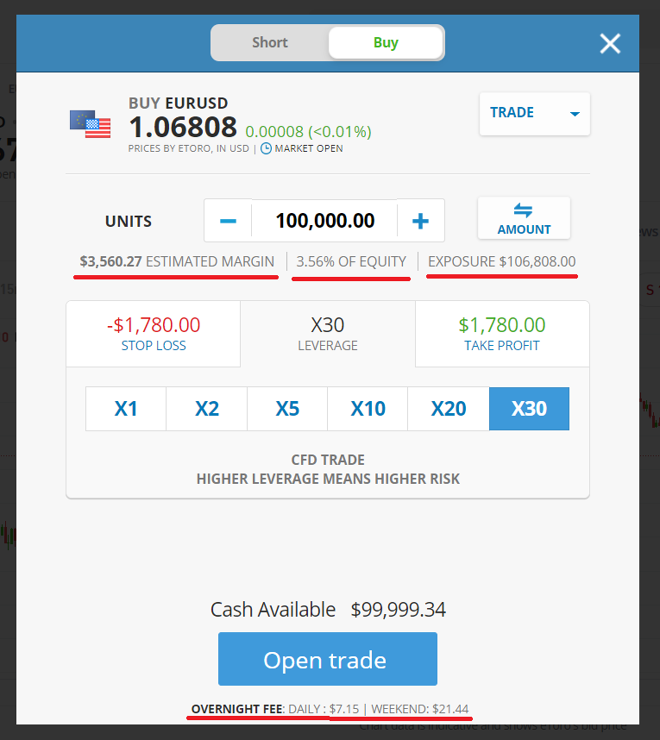

The eToro’s platform has a significant advantage, in that traders can configure their desired leverage before executing a trade. This offers greater flexibility in managing risk based on past trades, underlying strategy parameters, market volatility, and other factors.

In addition, the screen provides comprehensive information regarding the trade you intend to execute before placing an order. This includes details such as estimated margin, market exposure, percentage of equity, and rollover charges.

The orders available on eToro’s platform includes

- Market order: This order is used to buy or sell an instrument at the current market price. This order is ideal for quick position establishment despite the spread cost.

- Limit order: This order is used to buy or sell instruments at a pre-set price or better, allowing traders to specify their entry point without accepting current market prices.

- Stop orders: This order is utilized to safeguard open positions by capping the maximum potential loss in case the market moves unfavorably. These orders are placed at a predetermined price level below or above the current spot price. If the market reaches the stop-loss level, the order is executed as market order and filled at the best available price.

This platform is suitable for in-depth technical analysis and supports risk management strategies, this allows traders to adjust leverage for each trade, thereby increasing control over their trading risk

eToro’s Mobile App

The eToro mobile app maintains nearly all features found in its web trader counterpart, offering traders convenient access to the market and their accounts. The app simplifies order execution and charts are still powered by TradingView. Conducting intricate technical analysis on low-resolution devices like smartphones may present some challenges.

The mobile app trading platform can proficiently manage copy trading and allows traders to swiftly adjust their open positions.

EDUCATION

eToro places special emphasis on educating traders, beginners are provided with fundamental trading basics. The broker’s website offers information about copy trading, leverage, and margin, along with description of how to buy and sell various types of financial instruments. However, for those aiming to explore more advanced topics and strategies, external resources will be necessary to complement this foundational knowledge.

eToro educational materials include:

Educational Courses

eToro’s website features an Academy section that offers 21 trading courses, each of which can be completed in less than 10 minutes. These courses primarily cover general investing topics, with some focusing on specific subjects like ‘ what is Bitcoin’ or ‘what is Forex’. The course materials are supported by graphs, images, and occasionally video content.

While these courses might be beneficial for beginners, they may not provide first time traders with a comprehensive foundation.

Educational Guides

The educational guides provide a basic introduction to trading and investing concepts. Some of these are presented in video format, enhancing accessibility. There is also the inclusion of images and graphs to reinforce written text.

Tutorials

Step-by-step guides about eToro and its services, including instructions on partnership with eToro and becoming an eToro affiliate, are available to assist users in navigating and leveraging the platform’s offerings.

Digest and Invest Podcast

The Digest and Invest series comprises extensive discussions between market experts covering various trading and investment topics. Presented in a podcast format, the content is conveniently accessible, allowing listeners to tune in while driving or engaging in other daily activities.

Account Security

eToro has a dedicated page on how to protect oneself against forex scammers. This is a unique feature of eToro. On this page, users can learn about the most common tactics employed by scammers in their attempts to defraud victims of their funds.

The Help Center also provides information such as ‘what is one-click trading?’, ‘ how to form watchlists?’ and many more.

CUSTOMER SUPPORT

eToro customer support can be reached through various channels, including phone, email, and live chat. However, live chat, and phone support options are exclusively available to active traders with a minimum of $5000 in their accounts.

Ticketing forms can be accessed through the brokers Customer Services Center. Prior to submitting, you’re required to select the type of your query. Additionally, you have the option to submit supporting images. Please note that it may take up to 2 business days to receive a reply.

Customer support is available 24 hrs from Monday till Friday.

CONCLUSION

eToro offers access to investing in assets across various markets. The broker regularly expands the selection of ready made investment portfolios, which are balanced according to risk score and yield percentage. Traders can easily distinguish between lower-risk securities and higher yield/risk assets, thus enabling better risk management.

eToro’a deposit and withdrawal process is quite straightforward as there are hidden costs and any other fees charged by the broker is clearly stated.

eToro stands out from other brokers in the copy and social investing circle by foregoing service fees or commissions for copying other traders and their strategies. This approach prioritizes social trading, making it more accessible to a wider audience. It’s a distinguishing feature that has contributed to eToro’s popularity among those interested in leveraging the expertise of successful traders without incurring extra costs.

eToro is regulated by multiple top-tier regulatory bodies, which enhances its trustworthiness.