The Good and Bad about Blue Guardian

Blue Guardian adheres to the principle that to gain an advantage in the financial markets, one must possess ample capital and a finely honed trading strategy.

Pros

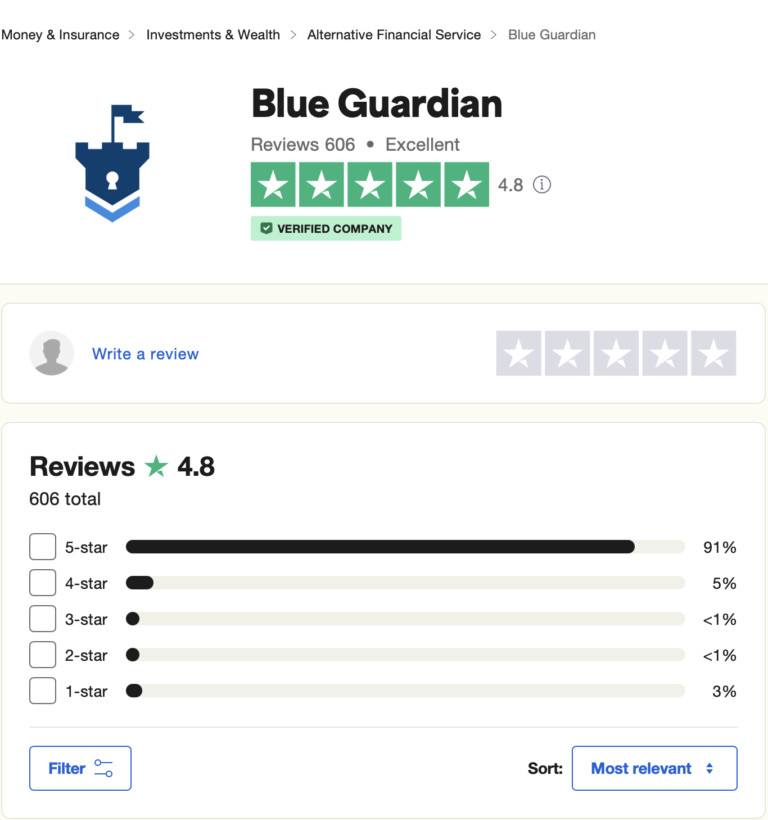

- Excellent Trustpilot rating of 4.8/5

- Maximum balance of standard account up to $400,000

- 85% profit split

- Three Evaluation Program Options

- Unlimited evaluation period

- Leverage up to 1:100

- Low evaluation profit targets 8% and 4%

- Scaling plan with balance up to $2,000,000

- News trading allowed

- Overnight and weekend holding allowed

- A large variety of trading instruments

- Well-structured user dashboard

Cons

- No free trial

- 5 Minimum trading day requirement on Elite Guardian

- Trailing Drawdown on Rapid Guardian

Blue Guardian fosters a culture of success among its traders. They place a primary emphasis on discipline, effective risk management, and a dedication to long-term consistency in their clients. Traders have the opportunity to manage account sizes of up to $200,000 and enjoy profit splits of 85%. These earnings can be attained through trading various instruments such as forex pairs, commodities, indices, and cryptocurrencies.

Who is Blue Guardian?

Blue Guardian is a proprietary trading firm that was established in June 2019. They transitioned to the public market in September 2021, providing dashboard traders with the opportunity to operate with capital balances of up to $2,000,000 and profit splits of 85%. They have established partnerships with Eightcap and Purple Trading Seychelles to serve as their brokers.

The formal name of the company is Iconic Exchange Limited, trading as Blue Guardian.

They have their main office situated at 2 Highlands Court, Cranmore Avenue, Solihull, West Midlands, England, B90 4LE.

Funding Program Options

- Unlimited Guardian Evaluation

- Elite Guardian Evaluation

- Rapid Guardian Evaluation

Unlimited Guardian Evaluation

The Unlimited Guardian Evaluation program at Blue Guardian is designed to recognize dedicated and skilled traders who demonstrate consistency in a two-phase evaluation period. Traders in this program are eligible for 1:100 leverage.

Account Size

Price

$10,000

$87

$25,000

$187

$50,000

$297

$100,000

$497

$200,000

$947

Unlimited Guardian Evaluation Phases:

Evaluation Phase One: In this phase, traders aim to achieve a profit target of 8% without exceeding a 4% maximum daily loss or 8% maximum loss. There are no specific trading day requirements during this phase. To progress to Phase Two, traders must meet the 8% profit target while adhering to the daily and maximum loss rules.

Evaluation Phase Two: In this phase, traders aim to achieve a profit target of 4% without exceeding a 4% maximum daily loss or 8% maximum loss. Similar to Phase One, there are no specific trading day requirements. To qualify for a funded account, traders must meet the 4% profit target while adhering to the daily and maximum loss rules.

Upon successfully completing both evaluation phases, traders receive a funded account. With this funded account, there are no profit targets to meet, and the only rules to follow are a 4% maximum daily loss and an 8% maximum loss. Traders can expect their first payout after 14 calendar days from placing their first trade on the funded account, and they will receive an 85% profit split based on the profits earned.

Unlimited Guardian Evaluation Scaling Plan:

To scale your account, you need to achieve a profit target of 12% or more within a three-month period, where at least two out of the three months were profitable. Upon meeting this criteria, your account balance dashboard will increase by 30% of the original account balance.

Here’s an example of how the scaling works:

- Initial Account Balance: $200,000

- After 3 months of meeting the profit target: Your account balance increases to $260,000.

- After the next 3 months: Your balance of $260,000 increases to $320,000.

- After another 3 months: Your balance of $320,000 increases to $380,000.

This scaling process can continue as long as you consistently meet the profit target within the specified time frame.

Unlimited Guardian Evaluation Program accounts allow trading in a variety of instruments, including forex pairs, commodities, indices, and cryptocurrencies.

Unlimited Guardian Evaluation Rules:

- Profit Target: Traders must achieve a specific percentage of profit before they can complete an evaluation phase, withdraw profits, or scale their account. Phase 1 requires a profit target of 8%, while Phase 2 has a profit target of 4%. Funded accounts have no profit targets.

Maximum Daily Loss: The maximum daily loss is the highest amount of daily loss allowed before the account is considered violated. For all account sizes, the maximum daily loss is 4%.

Maximum Loss: The maximum loss is the highest amount of overall loss allowed before the account is considered violated. All account sizes have a maximum loss limit of 8%.

Third-Party Copy Trading Risk: If you intend to use copy trading services from a third party, be aware that there may be other traders using the same strategy. This could potentially affect your eligibility for a funded account or withdrawal if you exceed the maximum capital allocation rule.

Third-Party EA Risk: If you plan to use a third-party Expert Advisor (EA), keep in mind that other traders may also use the same EA and trading strategy. Using a third-party EA may pose a risk to your eligibility for a funded account or withdrawal if you exceed the maximum capital allocation rule.

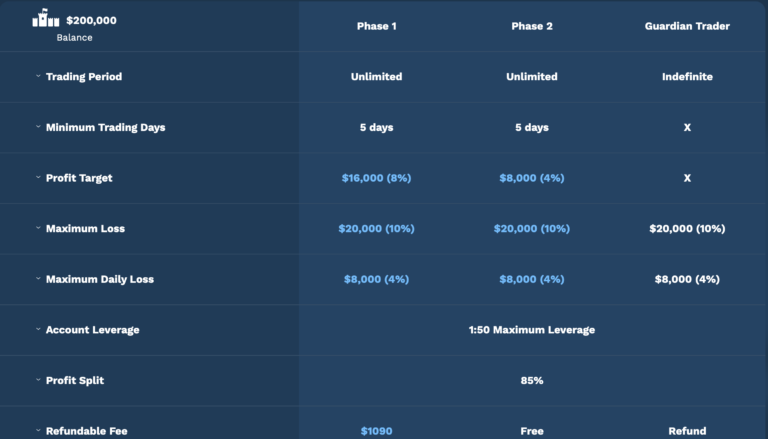

Elite Guardian Evaluation

The Elite Guardian Evaluation Program account at Blue Guardian is designed to recognize skilled and disciplined traders. These traders are rewarded for their consistency in a two-phase evaluation period. The Elite Guardian Evaluation Program offers a leverage of 1:50 for trading.

Account Size

Price

$10,000

$120

$25,000

$240

$50,000

$370

$100,000

$570

$200,000

$1,090

Elite Guardian Evaluation Phases:

Evaluation Phase One:

- Profit Target: Reach 8% profit without exceeding a 4% maximum daily loss or 10% maximum loss.

- Trading Days: No specific maximum trading day requirements, but you must trade for a minimum of five days to proceed to the next phase.

Evaluation Phase Two:

- Profit Target: Achieve a 4% profit without exceeding a 4% maximum daily loss or 10% maximum loss.

- Trading Days: Similar to phase one, there are no specific maximum trading day requirements, but you must trade for a minimum of five days to advance to a funded account.

Upon successfully completing both evaluation phases, you will be granted a funded account. In this funded account, you are not bound by profit targets. However, you must adhere to the 4% maximum daily loss and 10% maximum loss rules. Your initial payout will be issued 14 calendar days from the date you initiate your first trade on the funded account. You will receive a profit split of 85% based on the profits you generate in your funded account.

Elite Guardian Evaluation Phases Scaling Plan:

Scaling Plan:

- Profit Target: Achieve a profit of 12% or more within a three-month period.

- Eligibility: Two out of the three months must be profitable.

Scaling Increase:

- Upon meeting the above criteria, you will receive an account increase of 30% of your original account balance.

Example:

- Let’s say you start with a $200,000 account.

- After 3 months, if you achieve the profit target, your account balance will increase to $260,000.

- After the next 3 months, your balance of $260,000 will increase to $320,000.

- This process continues with the potential to further increase your account balance.

Trading Instruments:

- Traders in the Elite Guardian Evaluation Program have the opportunity to trade a variety of financial instruments, including forex pairs, commodities, indices, and cryptocurrencies.

Elite Guardian Evaluation Phases Rules:

Profit Targets:

- Phase 1 Profit Target: Traders must achieve a profit of 8% or more.

- Phase 2 Profit Target: Traders must achieve a profit of 4% or more.

- Funded accounts have no profit targets.

Maximum Daily Loss:

- Traders are not allowed to exceed a maximum daily loss of 4% of their account balance.

Maximum Loss:

- The maximum overall loss allowed is 10% of the account balance.

Minimum Trading Days:

- Traders must actively trade for a minimum of 5 trading days during each phase of the evaluation.

Third-Party Copy Trading Risk:

- Traders using third-party copy trading services should be aware that using the same trading strategy as other traders could lead to issues with exceeding the maximum capital allocation rule.

Third-Party EA Risk:

- Traders using third-party EAs (Expert Advisors) should be cautious, as using the same EA strategy as others could also result in exceeding the maximum capital allocation rule.

These rules are put in place to ensure fair and responsible trading practices during the evaluation phases. Meeting the profit targets and risk management requirements is essential for traders looking to progress to a funded account within the Elite Guardian Evaluation Program.

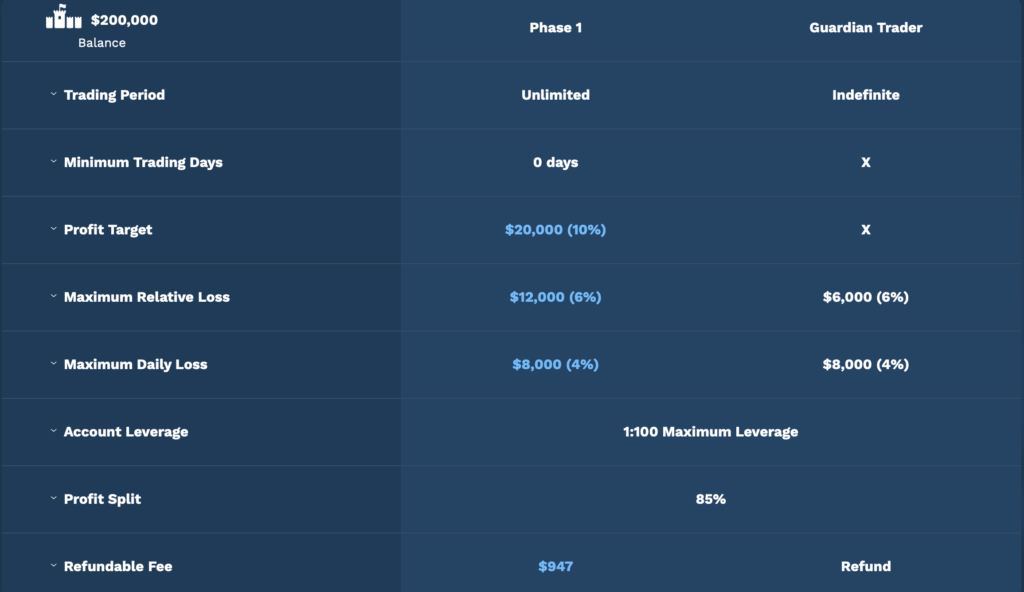

Rapid Guardian Evaluation

Blue Guardian’s rapid guardian evaluation program account is designed to recognize skilled and disciplined traders who can demonstrate their consistency during a single-phase evaluation period. Traders using the rapid guardian evaluation program account have access to 1:100 leverage.

Account Size

Price

$10,000

$97

$25,000

$197

$50,000

$297

$100,000

$497

$200,000

$947

During the evaluation phase, traders are expected to achieve a 10% profit target while ensuring they do not exceed the 4% maximum daily loss or 6% maximum trailing loss limits. The evaluation account imposes no specific restrictions on the number of trading days. To qualify for funding, traders only need to reach the profit target.

Upon successful completion of the evaluation phase, traders receive a funded account with no profit targets. They must, however, adhere to the 4% maximum daily loss and 6% maximum trailing loss rules. The initial payout is processed within 14 calendar days from the first trade placement in the funded account. Subsequent payouts are scheduled on a bi-weekly basis. Traders are entitled to an 85% profit split based on their funded account’s profit.

Rapid Guardian Evaluation Scaling Plan:

The scaling plan for Rapid Guardian evaluation program accounts operates as follows: Traders must achieve a profit target of 12% or more within a three-month period, with at least two out of the three months being profitable. Upon meeting this requirement, traders receive an account increase equal to 30% of their original account balance.

For instance, if a trader starts with a $200,000 account:

- After 3 months: The account balance increases to $260,000.

- After the subsequent 3 months: The balance grows to $320,000.

- After another 3 months: The balance further increases to $380,000.

- And so on…

Rapid Guardian evaluation program accounts offer traders the opportunity to trade a variety of instruments, including forex pairs, commodities, indices, and cryptocurrencies.

Rapid Guardian Evaluation Rules:

- Profit Target: Traders must achieve a specific profit target of 10% equity during the evaluation phase to qualify for a funded account. Funded accounts have no profit targets.

- Maximum Daily Loss: The maximum allowable daily loss for all account sizes is 4%.

- Maximum Trailing Drawdown: The maximum trailing drawdown is defined as the difference between the highest account balance achieved and the maximum drawdown. This drawdown limit is set at 6% for all account sizes.

- Third-Party Copy Trading Risk: If you plan to use copy trading services from third parties, be aware that others may already use the same strategy. Using third-party copy trading services could jeopardize your eligibility for a funded account or withdrawal if you exceed the maximum capital allocation rule.

- Third-Party EA Risk: Similarly, if you intend to use a third-party EA (Expert Advisor), keep in mind that other traders may be using the same strategy. Using third-party EAs may put your eligibility for a funded account or withdrawal at risk if you exceed the maximum capital allocation rule.

Is Getting Blue Guardian Capital Realistic?

Earning capital from Blue Guardian is indeed realistic due to their trading requirements, which are designed to be achievable for traders. It’s important to assess the feasibility of meeting the criteria when considering prop firms that align with your trading style. While some firms may offer attractive profit splits on highly funded accounts, unrealistic monthly profit targets and low maximum drawdown limits can make success nearly impossible.

Blue Guardian offers three evaluation programs, each with its own set of requirements:

Unlimited Guardian Evaluation: This program has relatively low profit targets (8% in phase one and 4% in phase two) and average maximum loss rules (4% maximum daily and 8% maximum loss). Traders also have the flexibility of an unlimited maximum trading day period with no minimum trading day requirements.

Elite Guardian Evaluation: Similar to the Unlimited Guardian program, the Elite Guardian program has low profit targets (8% in phase one and 4% in phase two) and reasonable maximum loss rules (4% maximum daily and 10% maximum loss). It also allows for an unlimited maximum trading day period with no minimum trading day requirements.

Rapid Guardian Evaluation: This program features an average profit target of 10% and reasonable maximum loss rules (4% maximum daily and 6% maximum trailing loss). Traders benefit from no minimum trading day requirements and an unlimited maximum trading day period to complete the evaluation phase.

Considering these factors, Blue Guardian provides a practical path to obtaining funding as all three evaluation programs offer realistic trading objectives and conditions for payout eligibility.

Payment Proof

Blue Guardian was initially established in June 2019, but they became publicly accessible in September 2021. To request a withdrawal from Blue Guardian, you must first complete any of their three funding programs successfully, receive your funded account, and generate profits from it. Keep in mind that you can request your initial withdrawal after 14 calendar days, and all subsequent withdrawals will also follow a bi-weekly schedule.

For proof of payments and withdrawal evidence, you can primarily refer to their Telegram channel, where the community often shares such information.

Blue Guardian Traders Feedback

On Trustpilot, they have received a high rating of 4.8/5 based on 606 reviews, which is a testament to their positive reputation and the growth they have experienced since their rebranding and introduction of new updates to their community.

Support

Blue Guardian provides support through various channels. You can visit their FAQ page to find answers to common questions. Additionally, their customer service support team can be reached via email at support@blueguardian.com, and they also offer live chat support during business hours from Monday to Friday, 10 AM to 6 PM GMT+1.

Conclusion

In summary, Blue Guardian is a reputable proprietary trading firm that provides traders with the flexibility to choose from three different evaluation program accounts without imposing strict trading style regulations. Traders have the freedom to trade during news events, hold positions overnight, and even over weekends.

The Unlimited Guardian evaluation programs consist of a two-phase evaluation challenge, where traders need to achieve profit targets of 8% in phase one and 4% in phase two to become funded. These targets are realistic, considering the 4% maximum daily loss and 8% maximum loss rules. There are no minimum or maximum trading day requirements, allowing traders ample flexibility. Successful traders can earn 85% profit splits and have the opportunity to scale their accounts.

Similarly, the Elite Guardian evaluation programs follow a two-phase evaluation process, with profit targets of 8% in phase one and 4% in phase two. Traders must adhere to a 4% maximum daily loss and 10% maximum loss rules. While there are no maximum trading day limits, a minimum of 5 trading days is required during each evaluation phase. Like the Unlimited Guardian program, traders can earn 85% profit splits and scale their accounts.

The Rapid Guardian evaluation programs are one-step evaluations, where traders need to achieve a 10% profit target to become funded. These programs also maintain realistic trading objectives with a 4% maximum daily loss and 6% maximum trailing loss rules. There are no minimum trading day requirements or maximum trading day limits during the evaluation phase. Successful traders can earn 85% profit splits and have the opportunity to scale their accounts.

I would recommend Blue Guardian to traders seeking a prop firm with clear and fair trading rules, especially those who have developed consistent trading strategies. Blue Guardian is an established prop firm that offers favorable conditions for a diverse range of traders. Overall, it stands out as one of the better proprietary trading firms in the industry.

If you found this Blue Guardian Review helpful, you can visit their website here.

You can explore more Propfirm reviews here.