The Good and Bad about FundedNext

FundedNext is a prop trading firm that dedicated two and a half years to development before launching its live operations. With a global reach, they have crafted funding solutions to benefit traders worldwide, all while maintaining a presence in four distinct locations.

Pros

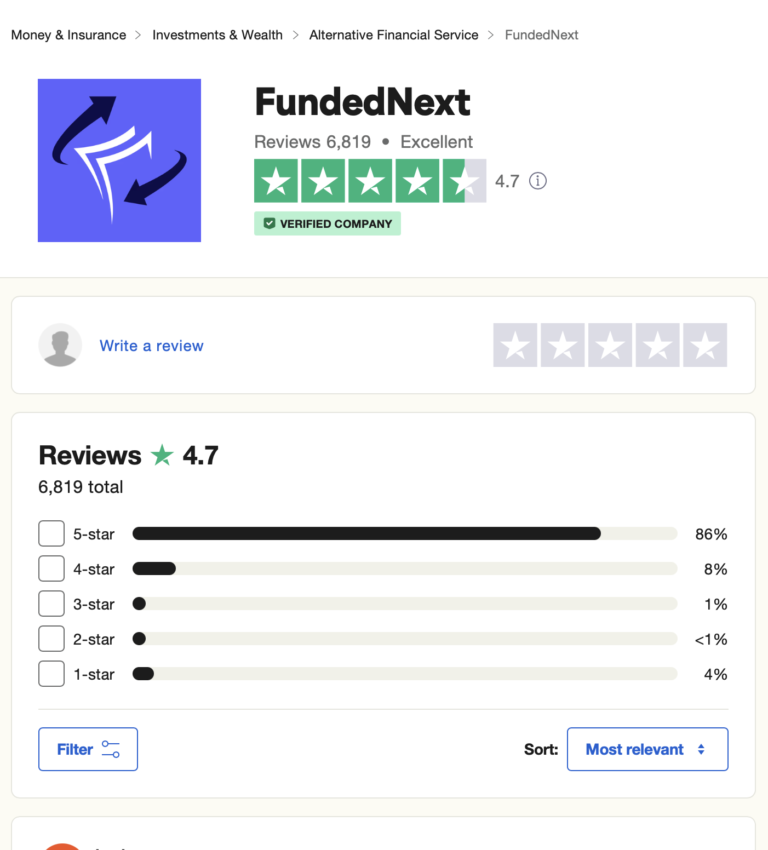

- Excellent Trustpilot rating of 4.7/5

- No Maximum Trading Period (Except the Evaluation Model)

- News Trading Allowed (Except Consistency Express Model)

- Overnight & Weekend Holding Allowed

- 15% Profit Split From Demo Phases

- No Commission Fees on Indices

- Professional Trader Dashboard

- Five Unique Funding Programs

- Profit Share of 60% up to 95%

- Balance-based Drawdown

- Leverage up to 1:100

- Swap-free Accounts

- Bi-weekly Payouts

- Scaling Plan

- A Large Variety of Trading Instruments (Forex Pairs, Commodities, Indices)

Cons

- Minimum Trading Day Requirements of 2 or 5 Days

- Maximum Trading Period with Evaluation Model

- High 25% Profit Target with Consistency & Non-Consistency Express Model

- No News Trading with Consistency Express Model

- Consistency Rule for Consistency Express Model

FundedNext places a strong emphasis on nurturing trader success. They prioritize clients who demonstrate discipline, effective risk management, and a commitment to long-term consistency. This dedication to traders’ growth is evident in their scaling plan, which offers substantial opportunities with a maximum cap of $4,000,000. Depending on the chosen funding program, traders can enjoy profit splits ranging from 60% to 90%. These profits can be attained through trading various assets, including forex pairs, commodities, and indices.

Who Is FundedNext?

FundedNext is a prop trading firm that was established in March 2022. They offer funding opportunities to forex traders, empowering them financially to trade full-time and potentially scale their trading activities further. FundedNext provides traders and broker with various funding program options, including the Evaluation Model, Express Model, One-step Stellar Challenge, and Two-step Stellar Challenge. Their aim is to support traders in their journey to become successful and consistent in their trading careers.

FundedNext operates from multiple locations and provides traders with the potential to access funds ranging from thousands to millions of dollars, depending on the chosen funding program. They encourage traders to demonstrate discipline, effective risk management,

Video Review

Funding Programs

At FundedNext, traders have the opportunity to select from a range of four distinct program options:

- Two-step Stellar Challenge Model

- One-step Stellar Challenge Model

- Evaluation Model

- Express Model

- Consistency Express Model

- Non-consistency Express Model

Two-step Stellar Challenge Accounts

The two-step Stellar challenge model account at FundedNext is designed to recognize dedicated and skilled traders, rewarding them for their performance in a two-phase challenge period. This challenge program account enables traders to operate with a leverage of 1:100.

Account Size

Price (Standard)

Price (Swap-Free)

$6,000

$59

$65

$15,000

$119

$131

$25,000

$199

$219

$50,000

$299

$329

$100,000

$519

$571

$200,000

$999

$1,099

Account Size

Price (Standard)

Price (Swap-Free)

$6,000

$59

$65

$15,000

$119

$131

$25,000

$199

$219

$50,000

$299

$329

$100,000

$519

$571

$200,000

$999

$1,099

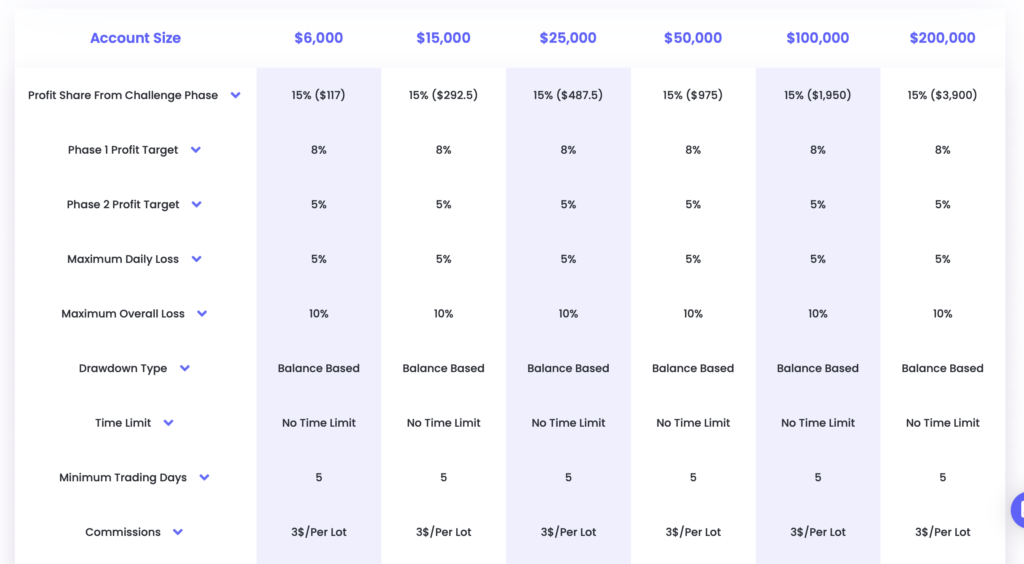

The first phase of the challenge in the two-step Stellar challenge model requires traders to achieve an 8% profit target while staying within the limits of a 5% maximum daily loss or 10% maximum loss. There are no specific time limitations in this phase, but you must trade for a minimum of five days to advance to the second phase.

In the second phase of the challenge, traders must reach a profit target of 5% while adhering to the same 5% maximum daily loss and 10% maximum loss rules. Similar to the first phase, there are no specific time restrictions, but a minimum of five trading days is required to progress to a funded account.

Upon successful completion of both challenge phases, traders are rewarded with a funded account. In this funded account, there are no profit targets to meet. Traders are only obligated to abide by the 5% maximum daily loss and 10% maximum loss rules. Initially, the profit split is set at 80% based on the generated profits. Additionally, traders receive a 15% profit share for each challenge phase once they achieve a 5% return on their funded account. After the first payout, subsequent payouts are provided on a bi-weekly basis.

The scaling plan for two-step Stellar challenge model accounts is designed to reward traders who achieve a 10% or higher profit within a four-month period, with at least two of those months being profitable, and the last month concluding with a profit. In such cases, traders will receive an account increase equivalent to 40% of the original account balance. This account balance increase has the potential to reach up to $4,000,000. Additionally, the profit split for traders will increase to 90% when they successfully scale their account for the first time.

Here’s an example of how the scaling plan works:

- Initial account balance: $200,000

- After 4 months: Account balance increases to $280,000.

- After the next 4 months: The balance of $280,000 increases to $360,000.

- After the subsequent 4 months: The balance of $360,000 increases to $440,000.

- This process continues, allowing traders to further increase their account balance with each successful scaling period.

Trading instruments available for two-step Stellar challenge model accounts include forex pairs, commodities, and indices.

Two-step Stellar Challenge Model Account Scaling Plan

Two-Step Stellar Challenge Model Account Rules

- Profit target is a specific percentage of profit that a trader is required to obtain before they can complete an evaluation phase, withdraw profits, or scale their account. Phase 1 profit target is 8% while phase 2 has a profit target of 5%. Funded accounts have no profit targets.

- Maximum daily loss is the maximum loss a trader can reach on a daily basis before the account is violated. All account sizes have a maximum daily loss of 5%.

- Maximum loss is the maximum loss a trader can reach overall before the account is violated. All account sizes have a maximum loss of 10%.

- Minimum trading days is the minimum period that a trader is required to trade for before they can complete a challenge phase or request a withdrawal. Both phases have a 5 minimum trading day requirement.

One-Step Stellar Challenge Model

FundedNext’s One-Step Stellar Challenge Model Account enables traders to fulfill the one-step challenge criteria with no restrictions on maximum trading days and offers leverage of up to 1:30.

Account Size

Price (Standard)

Price (Swap-Free)

$6,000

$59

$65

$15,000

$119

$131

$25,000

$199

$219

$50,000

$299

$329

$100,000

$519

$571

$200,000

$999

$1,099

Account Size

Price (Standard)

Price (Swap-Free)

$6,000

$59

$65

$15,000

$119

$131

$25,000

$199

$219

$50,000

$299

$329

$100,000

$519

$571

$200,000

$999

$1,099

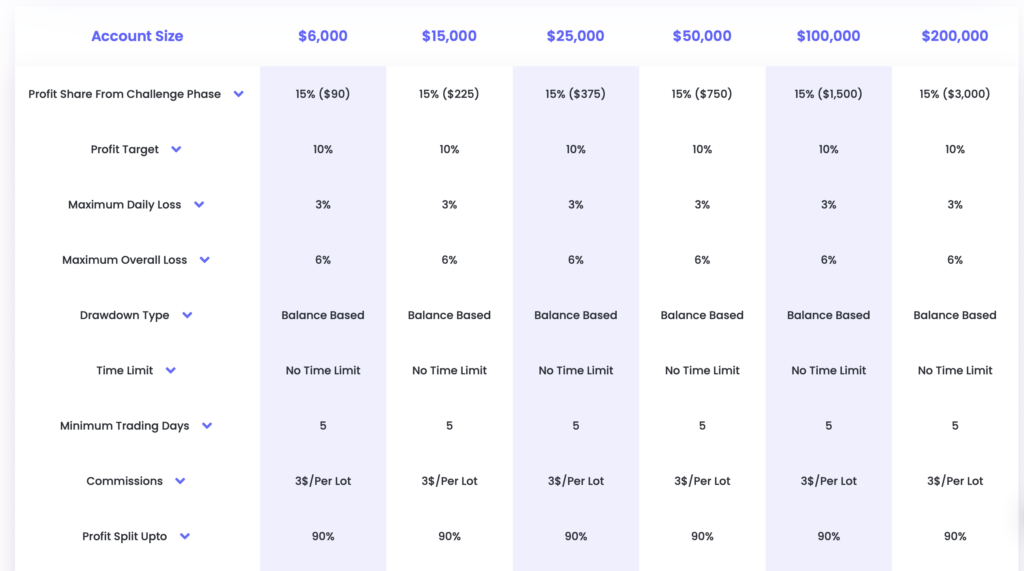

The One-Step Stellar Challenge Model Phase at FundedNext requires traders to achieve a 10% profit target without exceeding the 3% maximum daily loss or 6% maximum loss rules. There are no maximum trading day requirements, providing traders with flexibility in their trading journey. However, you must engage in at least 5 trading days per month. This account type does not impose a consistency rule, allowing traders to operate with few limitations and focus on reaching their profit target.

Upon successfully completing the One-Step Stellar Challenge Model Phase, traders receive a funded account without profit targets. They are only obligated to adhere to the 3% maximum daily loss and 6% maximum loss rules. Similar to the evaluation phase, there are no consistency rules, granting traders significant trading freedom. Nevertheless, traders must participate in a minimum of 5 trading days within each monthly trading cycle.

The initial profit split for this account type is 80%, based on the generated profits. Additionally, traders receive a 15% profit share based on the profits earned during the challenge phase once they achieve a 5% return on their funded account. It’s important to note that the profit split can increase to 90% after the first account scaling.

One-Step Stellar Challenge Model Accounts Scaling Plan

For One-Step Stellar Challenge Model Accounts, there is also a scaling plan in place. Traders are required to achieve a profit target of 10% or more within a four-month timeframe. During this period, at least two out of the four months must be profitable, and the final month must conclude with a profit. Upon meeting these criteria, traders will receive an account increase of 40% of their original account balance, with the potential to grow their account balance up to $4,000,000.

Example:

After 4 months: If you initially had a $25,000 account, your account balance will rise to $35,000. After the following 4 months: Your balance of $35,000 will further increase to $45,000. After the subsequent 4 months: Your balance of $45,000 will continue to grow to $55,000. And so on…

Traders utilizing One-Step Stellar Challenge Model Accounts can trade various financial instruments, including forex pairs, commodities, and indices.

One-Step Stellar Challenge Model Accounts Rules

- Profit Target: Traders must achieve a specific percentage of profit before they can complete an evaluation phase, withdraw profits, or scale their account. The profit target for the challenge period is set at 10%, while funded accounts have no profit targets.

Maximum Daily Loss: This refers to the maximum loss a trader can incur within a single trading day before the account is considered in violation. All account sizes have a maximum daily loss limit of 3%.

Maximum Loss: Maximum loss represents the highest cumulative loss a trader can reach overall before the account is considered in violation. Regardless of account size, all traders have a maximum loss limit of 6%.

Minimum Trading Days: Traders are required to actively trade for a specified minimum duration before they can complete a challenge phase or request a withdrawal. During the challenge period, traders must trade for a minimum of 5 trading days. Additionally, in each monthly trading cycle, a minimum of 5 trading days is also mandatory. Accounts

Evaluation Model

These rules are applicable to One-Step Stellar Challenge Model Accounts.

The FundedNext Evaluation Model Account is designed to recognize dedicated and skilled traders who demonstrate consistent performance throughout a two-phase evaluation period. Traders participating in this evaluation program have the opportunity to trade with leverage of up to 1:100.

Account Size

Price (Standard)

Price (Swap-Free)

$6,000

$59

$54

$15,000

$99

$109

$25,000

$199

$219

$50,000

$299

$329

$100,000

$549

$604

$200,000

$999

$1,099

Account Size

Price (Standard)

Price (Swap-Free)

$6,000

$49

$54

$15,000

$99

$109

$25,000

$199

$219

$50,000

$299

$329

$100,000

$549

$604

$200,000

$999

$1,099

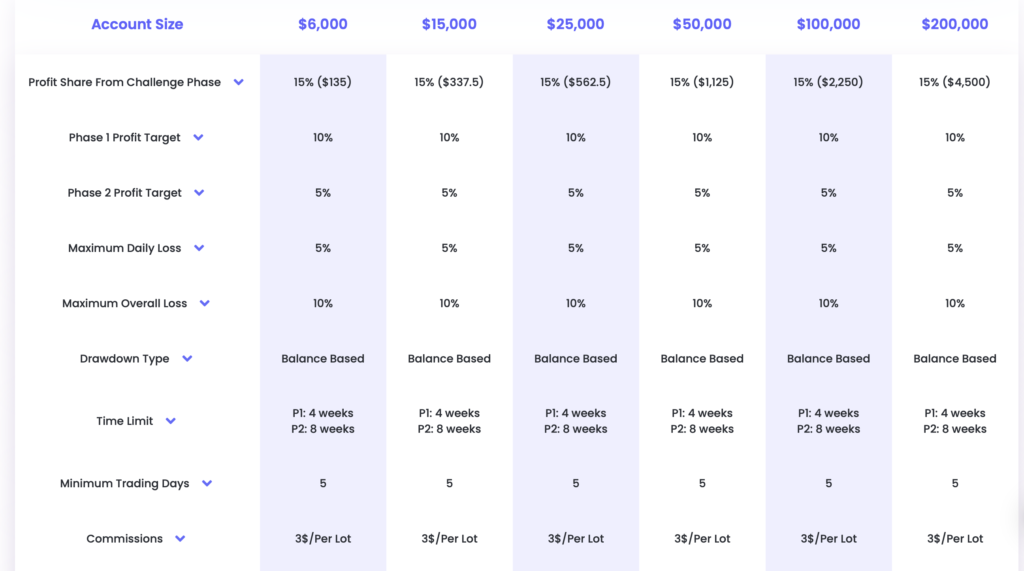

Evaluation Phase One Requirements:

- Achieve a 10% profit target.

- Keep daily losses under 5% and total losses under 10%.

- Reach the profit goal within 30 calendar days from your first trade in the evaluation account.

- Complete at least five trading days to move to phase two.

Evaluation Phase Two Requirements:

- Reach a 5% profit target.

- Maintain daily losses below 5% and total losses under 10%.

- Attain the profit target within 60 calendar days from your initial trade in the evaluation account.

- Trade for a minimum of five days to advance to a funded account.

Funded Account Rewards:

- After completing both evaluation phases, you’ll receive a funded account with no profit targets.

- Adhere to the 5% maximum daily loss and 10% maximum loss rules.

- Your initial profit split is 80% based on your profits.

- Additionally, you’ll get a 15% profit share for each evaluation phase once you achieve a 5% return on your funded account.

- Following your first payout, subsequent payouts will be made bi-weekly.

Evaluation Model Accounts Scaling Plan

Evaluation model accounts come with a scaling plan. To scale your account, you must achieve a profit target of 10% or more within a four-month period. During this period, two out of the four months should be profitable, and the last month must end in profit. Upon meeting these criteria, your account balance will increase by 40% of the original account balance, with the possibility to grow your account balance up to $4,000,000. Additionally, your profit split will increase to 90% when you scale your account for the first time.

Example:

After 4 months: If your account starts with $200,000, it will increase to $280,000. After the next 4 months: The balance of $280,000 will grow to $360,000. After the subsequent 4 months: The balance of $360,000 will further increase to $440,000. And so on…

Trading instruments available for evaluation program accounts include forex pairs, commodities, and indices.

Evaluation Model Account Rules

- Profit target is a specific percentage of profit that a trader must achieve before they can complete an evaluation phase, withdraw profits, or scale their account. Phase 1 profit target is 10%, while phase 2 has a profit target of 5%. Funded accounts have no profit targets.

Maximum daily loss is the highest allowable daily loss a trader can incur before the account is considered violated. All account sizes have a maximum daily loss of 5%.

Maximum loss is the highest cumulative loss a trader can reach before the account is considered violated. All account sizes have a maximum loss of 10%.

Minimum trading days refer to the minimum period during which a trader must actively trade before they can complete an evaluation phase or request a withdrawal. Both phases require a minimum of 5 trading days.

Maximum trading days represent the maximum duration within which a trader must achieve a specific profit target or withdrawal target. Phase 1 has a maximum period of 30 trading days, while phase 2 has a maximum period of 60 trading days.

Consistency Express Model Accounts

The FundedNext Consistency Express model account enables traders to fulfill the one-step evaluation criteria with no set limit on the number of trading days and offers leverage of up to 1:100.

Account Size

Price (Standard)

Price (Swap-Free)

$6,000

$49

$54

$15,000

$99

$109

$25,000

$199

$219

$50,000

$299

$329

$100,000

$549

$604

$200,000

$999

$1,099

Account Size

Price (Standard)

Price (Swap-Free)

$6,000

$49

$54

$15,000

$99

$109

$25,000

$199

$219

$50,000

$299

$329

$100,000

$549

$604

$200,000

$999

$1,099

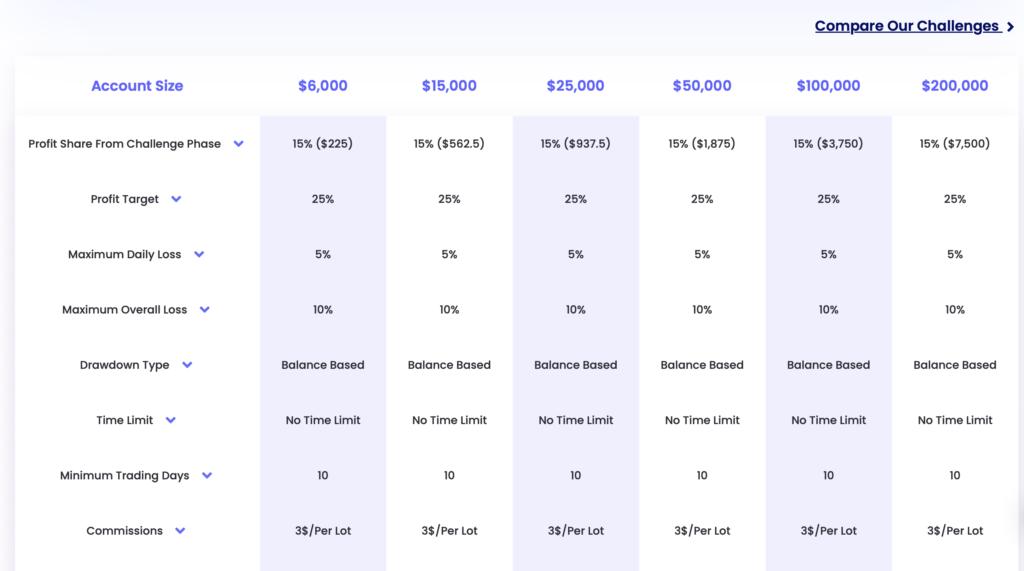

The evaluation phase for the Consistency Express model account at FundedNext necessitates traders to achieve a profit target of 25% without exceeding the 5% maximum daily loss or 10% maximum loss rules. There are no specific constraints on the number of trading days, giving traders flexibility in this regard. However, traders must commit to at least 10 trading days per month. Additionally, traders must adhere to a consistency rule during this phase to cultivate consistent trading habits and ensure that they consistently generate profits until they reach their profit target. Traders will receive a 15% profit share based on their profits during the evaluation phase, calculated over a 4-week trading cycle, until they meet the required profit target.

Upon successfully completing the Consistency Express model evaluation phase, traders are granted a funded account with no profit targets. The only requirements are to abide by the 5% maximum daily loss and 10% maximum loss rules, as well as continue following the consistency rule. Traders must also engage in at least 10 trading days within each monthly trading cycle. Initially, traders receive a profit split of 60% based on their profits. After the first withdrawal, the profit split increases to 75%, and after the second withdrawal, it reaches the final profit split of 90%.

Consistency Express Model Account Scaling Plan

The scaling plan for Consistency Express model accounts entails reaching a profit target of 10% or more within a four-month period. To achieve this, two out of the four months must be profitable, and the final month must conclude with a profit. Traders who meet these criteria will receive an account increase equal to 40% of their original account balance, with the potential to elevate their account balance up to $4,000,000.

Here’s an example to illustrate the scaling process:

- After 4 months: If you initially have a $100,000 account, your account balance will increase to $140,000.

- After the subsequent 4 months: Your balance of $140,000 will further increase to $180,000.

- After another 4 months: Your balance of $180,000 will continue to grow to $220,000.

- This progression continues as you meet the profit target and consistency requirements.

The trading instruments available for Consistency Express model accounts encompass forex pairs, commodities, and indices.

Consistency Express Model Account Rules

- Profit Target: Traders must achieve a specific percentage of profit before they can complete an evaluation phase, withdraw profits, or scale their account. The profit target for the evaluation period is 25%, while funded accounts have no profit targets.

Maximum Daily Loss: The maximum loss a trader can incur on a daily basis before the account is considered violated is 5%, regardless of the account size.

Maximum Loss: The overall maximum loss allowed for a trader before the account is considered violated is 10%, irrespective of the account size.

Minimum Trading Days: Traders are required to engage in trading for a minimum of 10 trading days during their evaluation period. Additionally, a minimum of 10 trading days is required in each monthly trading cycle.

No Weekend Holding: Traders are not permitted to hold open positions during the weekends.

No News Trading: During high-impact news releases, traders are restricted from opening and closing any trades within 5 minutes before and after the news events. This rule applies during both the evaluation period and funded status.

Consistency Rule: Traders must maintain consistent position sizes, risk management, losses, gains, and other account-related characteristics. This means that the account’s performance should not exhibit significant variations.

These rules are designed to ensure discipline, risk management, and consistent trading practices among participants in the Consistency Express model account program.

Non-consistency Express model accounts

The FundedNext Non-consistency Express model account provides traders with the opportunity to fulfill the one-step evaluation criteria without being constrained by maximum trading day requirements. Additionally, traders can utilize leverage of up to 1:100 with this account.

Account Size

Price (Standard)

Price (Swap-Free)

$59

$65

$15,000

$119

$131

$25,000

$229

$252

$50,000

$379

$417

$100,000

$699

$769

Account Size

Price (Standard)

Price (Swap-Free)

$6,000

$59

$65

$15,000

$119

$131

$25,000

$229

$252

$50,000

$379

$417

$100,000

$699

$769

The evaluation phase for the Non-consistency Express model necessitates traders to achieve a 25% profit target without exceeding the 5% maximum daily loss or 10% maximum loss rules. There are no specific requirements for the maximum number of trading days, providing traders with the flexibility to trade at their own pace. Nevertheless, traders are obligated to engage in a minimum of 10 trading days per month. It’s worth noting that this account type does not enforce a consistency rule, granting traders more freedom to trade with fewer restrictions while aiming to achieve the profit target. During the evaluation phase, traders receive a 15% profit share based on their earnings in a 4-week trading cycle until the required profit target is met.

Upon successfully completing the Non-consistency Express model evaluation phase, traders are granted a funded account equivalent to 25% of the challenge amount. For instance, if a trader passes the $100,000 Non-consistency Express model evaluation, they will receive a $25,000 funded account. In this funded account, there are no profit targets to meet, and traders are solely required to adhere to the 5% maximum daily loss and 10% maximum loss rules. Similar to the evaluation phase, there is no consistency rule enforced in this account type, allowing for more flexible trading. However, traders must still meet the minimum requirement of trading for at least 10 days in each monthly trading cycle. The initial profit split is set at 60% based on the profits generated, and it increases to 75% after the first withdrawal. Finally, after the second withdrawal, traders reach the maximum profit split of 90%.

Non-Consistency Express Model Accounts Scaling Plan

Non-consistency Express model accounts come with a scaling plan that offers traders the opportunity to expand their accounts. To qualify, traders must achieve a profit target of 10% or more within a four-month period, with at least two of those four months being profitable and the final month concluding with a profit. Successful traders will see their account balance increase by 40% of the original account balance, with the potential to reach a maximum account balance of $4,000,000.

Here’s an example of how this scaling plan works:

- After 4 months: If you initially had a $25,000 account, your account balance will grow to $35,000.

- After the subsequent 4 months: Your $35,000 balance will further increase to $45,000.

- Following another 4 months: Your $45,000 balance will rise to $55,000.

- This progression can continue as you meet the profit targets and trading requirements.

Non-consistency Express model accounts allow trading across various instruments, including forex pairs, commodities, and indices. This flexibility provides traders with a wide range of options for diversifying their trading strategies and optimizing their profit potential.

Non-Consistency Express Model Accounts Rules

Non-consistency Express model accounts come with specific rules that traders must adhere to. These rules are designed to ensure fair and responsible trading practices. Here are the key rules for Non-consistency Express model accounts:

Profit Target: Traders must achieve a specific percentage of profit before they can complete an evaluation phase, withdraw profits, or scale their account. The profit target for the evaluation period is set at 25%. However, funded accounts have no profit targets, providing traders with more flexibility once they progress to funded status.

Maximum Daily Loss: To manage risk, all account sizes have a maximum daily loss limit of 5%. This rule helps prevent excessive losses in a single trading day.

Maximum Loss: There is a maximum loss threshold for all account sizes, set at 10%. This rule limits the total loss a trader can incur before the account is considered violated.

Minimum Trading Days: Traders are required to actively trade for a minimum number of days before they can complete an evaluation phase or request a withdrawal. During the evaluation period, traders must participate in a minimum of 10 trading days. Additionally, this minimum trading day requirement extends to each monthly trading cycle.

No News Trading: Traders are prohibited from trading during high-impact news releases. This rule aims to protect traders from extreme market volatility and potential losses associated with significant news events. Specifically, traders are restricted from opening and closing any trades within 5 minutes before and after news releases, both during the evaluation period and funded status.

These rules ensure that traders maintain discipline, manage risk effectively, and follow responsible trading practices while participating in the Non-consistency Express model accounts program. Adhering to these rules contributes to a more structured and controlled trading environment.

Is getting FundedNext capital realistic?

Receiving capital from FundedNext is indeed a realistic opportunity for traders who meet the program requirements. When evaluating prop firms, it’s crucial to assess the attainability of their trading conditions based on your individual trading style and goals. Here’s a breakdown of why receiving capital from FundedNext is realistic across its various funding programs:

Two-step Stellar Challenge Model Accounts: These accounts offer below-average profit targets (8% in phase one and 5% in phase two) with reasonable maximum loss rules (5% maximum daily and 10% maximum loss). These objectives are attainable for traders seeking funded status.

One-step Stellar Challenge Model Accounts: With an average profit target of 10% and moderate maximum loss rules (3% maximum daily and 6% maximum loss), receiving capital through one-step Stellar challenge model accounts is realistic for traders aiming for consistent gains.

Evaluation Model: The evaluation model presents industry-average profit targets (10% in phase one and 5% in phase two) along with maximum loss rules (5% maximum daily and 10% maximum loss). These requirements align with common trading standards, making it a realistic path to funding.

Express Model: Despite having a profit target of 25%, the express model offers a realistic opportunity for traders. The key advantage is the absence of maximum trading day limitations. Traders can take their time to steadily accumulate profits and reach their target. Additionally, the option to choose between Consistency and Non-consistency Express model accounts provides flexibility for different trading styles.

Considering the variety of funding programs FundedNext offers, traders can select the program that best suits their trading preferences and skill level. These programs provide clear and realistic trading objectives, making FundedNext an attractive choice for those seeking funding opportunities in the forex market.

Payment Proof

It’s great to hear that FundedNext has been rapidly growing in the proprietary trading industry since its incorporation on the 18th of March, 2022. The ability to provide payment proof and transparency to traders is an important aspect of building trust and credibility. If you have any specific questions or need more information about FundedNext or their offerings, feel free to ask!

It’s great to know that FundedNext provides payout proofs on various platforms, including Instagram, Discord, and Telegram. This level of transparency can help build trust among traders who are considering joining their programs. If anyone is interested in seeing specific payout proofs or examples, they can check out these platforms as you’ve mentioned. If you have any more questions or need further information, feel free to ask!

FundedNext Traders Feedback

FundedNext has excellent reviews from its community.

FundedNext has received an impressive rating of 4.7 out of 5 on Trustpilot, based on feedback from 6,819 reviews. It’s noteworthy that this achievement has been reached in just a year and a half since their launch on March 18, 2022. This indicates a substantial and growing community of users who have expressed their satisfaction with FundedNext’s services. Such positive feedback and a sizable user base can be valuable indicators of a company’s reputation and the trust it has earned among its customers. However, as with any financial endeavor, it’s essential for individuals to conduct thorough research, understand the terms and conditions, and align their trading goals and strategies before engaging with any trading program or platform. If you have further questions or need additional information, please feel free to ask.

FundedNext has a strong presence on various social media platforms, with a significant following:

- Facebook: They have a Facebook page with 54,000 followers.

- Twitter: FundedNext maintains a Twitter account with 34,000 followers.

- Instagram: They have an Instagram account with 30,000 followers.

- YouTube: FundedNext’s YouTube channel boasts 26,000 subscribers and has uploaded 154 videos.

- Telegram: They also have a Telegram channel with 12,000 members.

- Discord: FundedNext operates a Discord channel with an impressive 45,000 members.

These social media channels provide traders and interested individuals with opportunities to connect, stay updated on company news, and engage with the FundedNext community. It’s clear that FundedNext has successfully built a substantial online presence and community across various platforms.

Support

- FAQ Page: FundedNext has a comprehensive FAQ page where you can find answers to common questions and detailed information.

-

Email Support: You can directly reach out to their customer service support team via email at support@fundednext.com for specific inquiries or assistance.

-

Social Media: You can also connect with FundedNext’s support team through their social media channels for prompt responses to your queries and concerns.

These support options ensure that traders and users have access to the assistance they need to navigate the platform and trading programs effectively.

Conclusion

In summary, FundedNext is a relatively new but reliable proprietary trading firm in the industry, providing traders with several funding models to choose from: Two-step Stellar, One-step Stellar, Evaluation, and Express. These models offer realistic trading objectives and straightforward rules, making them accessible to a wide range of traders.

The Two-step Stellar challenge model requires traders to complete two phases, achieving profit targets of 8% in phase one and 5% in phase two. These targets are achievable, considering the 5% maximum daily loss and 10% maximum loss rules. Traders can earn profit splits ranging from 80% to 90% and have the opportunity to scale their accounts.

The One-step Stellar challenge model involves completing one phase and reaching a 10% profit target. With maximum daily loss limited to 3% and maximum loss at 6%, these objectives are attainable. Profit splits of 80% to 90% and scaling options are available.

The Evaluation model features a two-phase challenge with profit targets of 10% in phase one and 5% in phase two. These targets are realistic alongside the 5% maximum daily loss and 10% maximum loss rules. Traders can earn profit splits ranging from 80% to 90% and have scaling opportunities.

The Express model is a one-step challenge where traders aim to achieve a 25% profit target, respecting the 5% maximum daily and 10% maximum loss rules. It offers both Consistency and Non-consistency Express model accounts with no maximum trading day limitations, allowing traders to take their time. Profit splits vary from 60% to 90%, and scaling is possible.

Overall, FundedNext is recommended for traders seeking a legitimate proprietary trading firm with clear rules and achievable trading objectives. Despite being relatively new, they have established themselves as trustworthy and safe for traders looking to secure capital. FundedNext offers favorable conditions for a diverse range of traders with unique strategies, making them one of the leading proprietary trading firms in the industry.

If you found this Funded Next Review helpful, you can visit their website here.

You can explore more Propfirm reviews here.