The Good and Bad about Funded Trading Plus

Funded Trading Plus has rapidly established itself as a leading provider in the proprietary trading industry, and this growth is easily understandable when you consider the diverse range of programs they offer. They are known for their straightforward and uncomplicated rules, generous profit split options of up to 90%, and competitive pricing. The entry-level program begins at $12,500, and traders have the opportunity to manage accounts with balances as high as $2,500,000. Funded Trading Plus also stands out for offering trading opportunities in Forex, indices, commodities, and the most extensive range of cryptocurrencies available.

Pros

- Trustpilot rating varies, please verify current score on Trustpilot website.

- Weekend Holding Allowed on Experienced & Premium Trader Program

- No Minimum & Maximum Trading Day Requirements

- Four Unique Funding Programs

- Professional Trader Dashboard

- Profit Share 80% up to 90%

- Overnight Holding Allowed

- News Trading Allowed

- Weekly Payouts

- Scaling Plan

- A Large Variety of Trading Instruments (Forex Pairs, Commodities, Indices, Cryptocurrencies)

Cons

- Low Leverage up to 1:20 on All Funding Programs

- Mandatory Stop-loss on Advanced Trader Program

- No Weekend Holding on Advanced & Master Trader Program

- Trailing Drawdown on All Funding Programs

Pros

- Excellent Trustpilot rating of 4.9/5

- Weekend Holding Allowed on Experienced & Premium Trader Program

- No Minimum & Maximum Trading Day Requirements

- Four Unique Funding Programs

- Professional Trader Dashboard

- Profit Share 80% up to 100%

- Overnight Holding Allowed

- News Trading Allowed

- Weekly Payouts

- Scaling Plan

- A Large Variety of Trading Instruments (Forex Pairs, Commodities, Indices, Cryptocurrencies)

Cons

- Low Leverage up to 1:30 on All Funding Programs

- Mandatory Stop-loss on Advanced Trader Program

- No Weekend Holding on Advanced & Master Trader Program

- Trailing Drawdown on All Funding Programs

Funded Trading Plus is dedicated to helping traders achieve success in their careers. They empower traders to maximize their profits by allowing them to trade accounts ranging from $12,500 up to $200,000 before becoming eligible to scale their accounts further, up to an impressive $2,500,000. Traders have the flexibility to select from various evaluation options, including a single assessment phase, two two-phase assessment challenges, or direct funding. Upon successfully completing these challenges, traders can enjoy Profit splits of up to 80% on their earnings.

Who Is Funded Trading Plus?

Funded Trading Plus is a proprietary trading firm that was officially incorporated on November 2, 2021, and launched on December 16, 2021. The firm is headquartered in London, UK. Funded Trading Plus provides traders with the opportunity to trade accounts ranging from $12,500 to $200,000, with the potential to scale up to $2,500,000. They have partnered with Eightcap, an ASIC-regulated broker based in Melbourne, Australia, to facilitate their trading activities.

Their main office is located at 7 Bell Yard, London, England, WC2A 2JR.

Video Review

Funding Program Options

Funded Trading Plus provides traders with four distinct programs to select from:

- Experienced trader program

- Advanced trader program

- Premium trader program

- Master trader program

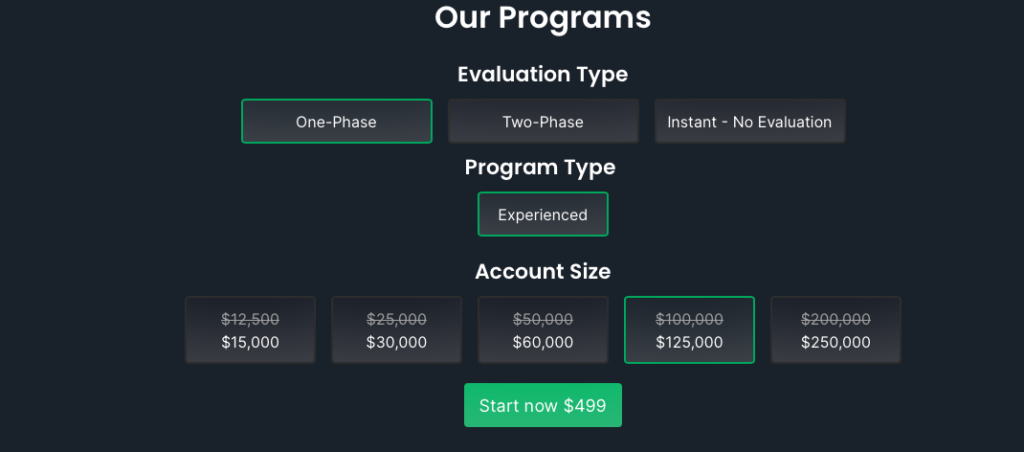

Experienced Trader Program

The Funded Trading Plus Experienced Trader Program offers traders the opportunity to fulfill evaluation requirements without any time constraints, providing the freedom to trade with 1:20 leverage.

During the evaluation phase, traders must achieve a profit target of 10% while ensuring they do not exceed the 3% maximum daily loss or 6% maximum trailing drawdown rules. Importantly, there are no specific minimum or maximum trading day requirements during this phase, allowing traders to set their own trading pace.

Upon successful completion of the evaluation phase, traders receive a funded account where they are not bound by profit targets. Instead, they are solely required to adhere to the 3% maximum daily loss and 6% maximum trailing drawdown rules. Payouts can be requested once a week, provided the trader has achieved a profit exceeding $50. It’s important to note that traders commence with an 80% profit split, which can be increased to 90% when they scale their account for the first time.

Experienced Trader Program Account Scaling Plan:

Experienced trader program accounts also come with a scaling plan, as displayed in the spreadsheet above. To become eligible for scaling your account, the only requirement is to reach a profit target of 10%. You can make withdrawals before scaling up; however, you must have a 10% profit in the account to initiate scaling.

Here’s an example to illustrate this process:

- Starting account balance: $200,000

- After a drawdown, the balance is fixed at $200,000.

- After a withdrawal of $6,000: $210,000

- Adding the profit of $16,000: $226,000

- Scaling up the account to $426,000 with a profit, and the drawdown is now fixed at $400,000.

- After another withdrawal of $10,000: $416,000

This example demonstrates how a trader can manage their account by withdrawing profits along the way while also having the option to scale up.

The trading instruments available for the experienced trader program account include forex pairs, commodities, indices, and cryptocurrencies.

Experience Trader Program Rules:

- Profit Target: Traders must achieve a specific profit percentage before they can complete the evaluation phase, withdraw profits, or scale their account. The evaluation phase profit target is set at 10%.

Maximum Daily Loss: This represents the maximum allowable daily loss a trader can incur before their account is considered violated. For all account sizes, the maximum daily loss is capped at 3%.

Maximum Trailing Drawdown: The maximum trailing drawdown is defined as the difference between the highest account balance achieved and the maximum drawdown. Similar to the maximum daily loss, all account sizes have a maximum trailing drawdown limit of 6%.

There are also risks associated with third-party copy trading and third-party EA usage:

Third-Party Copy Trading Risk: When using third-party copy trading services, it’s important to be aware that other traders may already be employing the same trading strategy. This can potentially lead to denial of a funded account or withdrawal if the maximum capital allocation rule is exceeded.

Third-Party EA Risk: Similarly, when utilizing third-party EAs (Expert Advisors), there may be other traders using the same trading strategy. This could also result in denial of a funded account or withdrawal if the maximum capital allocation rule is exceeded.

Traders should take these rules and associated risks into consideration when participating in the Experience Trader Program at Funded Trading Plus.

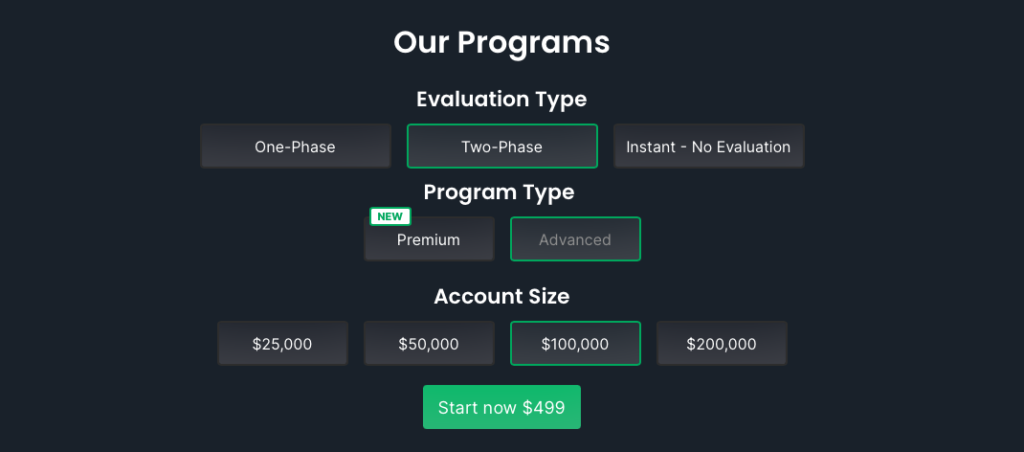

Advanced Trader Program

Funded Trading Plus’s advanced trader program account is designed to identify dedicated and skilled traders. It follows a two-phase evaluation period, allowing traders to use 1:30 leverage.

In the first evaluation phase, traders must achieve a 10% profit target without exceeding a 5% maximum daily loss or a 10% maximum trailing drawdown. There are no specific minimum or maximum trading day requirements to progress to phase two.

The second evaluation phase requires traders to reach a 5% profit target while adhering to the same 5% maximum daily loss and 10% maximum trailing drawdown rules. Similar to phase one, there are no trading day restrictions.

Upon successful completion of both evaluation phases, traders are granted a funded account with no profit targets. The only requirements are to observe the 5% maximum daily loss and 10% maximum trailing drawdown rules. Profits can be withdrawn by achieving over $50 in profit each week. Initially, traders start with an 80% profit split, which can be increased to 90% when they scale their account for the first time.

Advanced Trader Program Scaling Plan:

The advanced trader program accounts also offer a scaling plan, which is detailed in the spreadsheet above. To become eligible to scale your account, the only requirement is to reach a profit target of 20%. You can make withdrawals before scaling up, but you must have a 20% profit in the account to be eligible for scaling.

For example:

- Starting account balance: $100,000

- Drawdown, now fixed at $100,000: $116,000

- New balance after withdrawal: $110,000

- New account balance after adding profit: $126,000

- Scaled-up account with profit, drawdown now fixed at $200,000: $226,000

- New balance after another withdrawal: $216,000

This example illustrates how a trader can manage their account by withdrawing profits while also having the option to scale up.

The trading instruments available for the advanced trader program account include forex pairs, commodities, indices, and cryptocurrencies.

Advanced Trader Program Rules:

- Profit Target: Phase 1 has a profit target of 10%, and Phase 2 has a profit target of 5%. Funded accounts have no profit targets.

- Maximum Daily Loss: The maximum daily loss for all account sizes is 5%.

- Maximum Trailing Drawdown: The maximum trailing drawdown for all account sizes is 10%.

- Stop-Loss Required: Traders must set a stop-loss on every position before opening a trade.

- No Weekend Holding: Traders are not allowed to hold open positions during the weekends.

- Third-Party Copy Trading Risk: When using a third-party copy trading service, there may be other traders using the same strategy. Exceeding the maximum capital allocation rule can result in denial of a funded account or withdrawal.

- Third-Party EA Risk: When using a third-party EA, there may be other traders using the same strategy. Exceeding the maximum capital allocation rule can result in denial of a funded account or withdrawal.

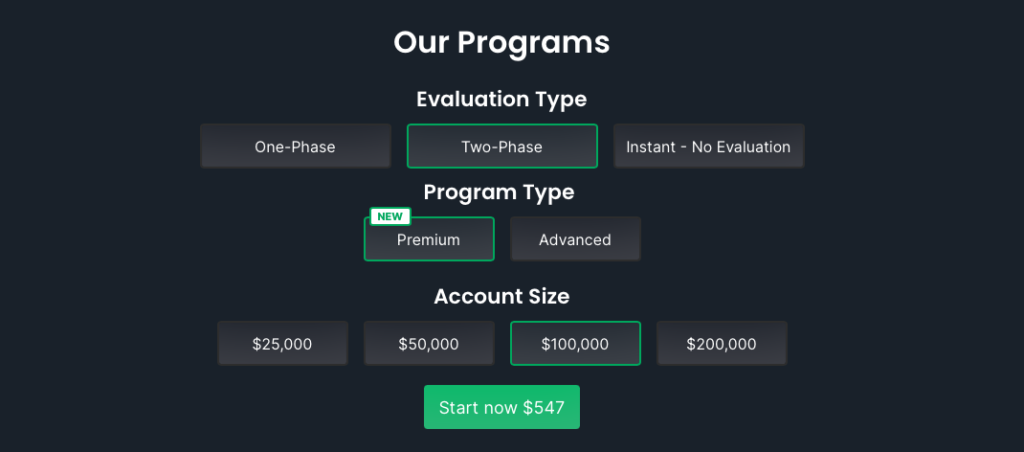

Premium Trader Program

Funded Trading Plus’s premium trader program account is designed to recognize dedicated and skilled traders who demonstrate consistency during the two-phase evaluation period. In this program, traders are allowed to operate with 1:20 leverage.

During evaluation phase one, traders need to achieve a profit target of 8%, while ensuring they do not exceed a 4% maximum daily loss or an 8% maximum trailing drawdown. There are no specific minimum or maximum trading day requirements to proceed to phase two.

Evaluation phase two requires traders to reach a profit target of 5%, again without exceeding the 4% maximum daily loss or the 8% maximum trailing drawdown. Similar to phase one, there are no minimum or maximum trading day requirements to advance to a funded account.

Upon successful completion of both evaluation phases, traders are awarded a funded account where they are no longer bound by profit targets. Instead, they are required to adhere to the 4% maximum daily loss and the 8% maximum trailing drawdown rules. Traders can request payouts by achieving a profit of over $50 once per week. It’s important to note that traders start with an 80% profit split, which can be increased to 90% when they choose to scale their account for the first time.

Premium Trader Program

The premium trader program accounts also offer a scaling plan, as indicated in the spreadsheet above. To become eligible for scaling up your account, the sole requirement is to achieve a profit target of 10%. It’s worth noting that you can make withdrawals from your account before deciding to scale up, but you must maintain a minimum of 10% profit in the account to be eligible for scaling.

For instance:

- Starting account balance: $100,000

- After a drawdown (now fixed at $100,000): $108,000

- After a withdrawal of $3,000: $105,000

- New account balance after withdrawal: $105,000

- Adding $8,000 to this balance: $113,000

- Scaled-up account with profit, with the drawdown fixed at $200,000: $213,000

- After another withdrawal of $5,000: $208,000

This example illustrates how a trader may choose to manage their account by withdrawing profits along the way while also having the option to scale up. The trading instruments available for the premium trader program account include forex pairs, commodities, indices, and cryptocurrencies.

Premium Trader Program Rules:

- Profit Target: Traders must achieve a specific percentage of profit before they can complete an evaluation phase, withdraw profits, or scale their account. Phase 1 requires a profit target of 8%, while Phase 2 has a profit target of 5%. Funded accounts have no profit targets.

Maximum Daily Loss: The maximum allowable daily loss for traders is 4% regardless of account size.

Maximum Trailing Drawdown: The maximum trailing drawdown is defined as the difference between the highest account balance achieved and the maximum drawdown allowed. This limit applies to all account sizes, with a maximum trailing drawdown of 8%.

Third-Party Copy Trading Risk: If you intend to use copy trading services, please be aware that other traders may already be using the same trading strategy through the third-party copy trading service. Utilizing such services may potentially result in denial of a funded account/withdrawal if you exceed the maximum capital allocation rule.

Third-Party EA Risk: Should you choose to use an EA (Expert Advisor), it’s important to consider that other traders may also be employing the same trading strategy with the same third-party EA. Using a third-party EA may potentially lead to denial of a funded account/withdrawal if you surpass the maximum capital allocation rule.

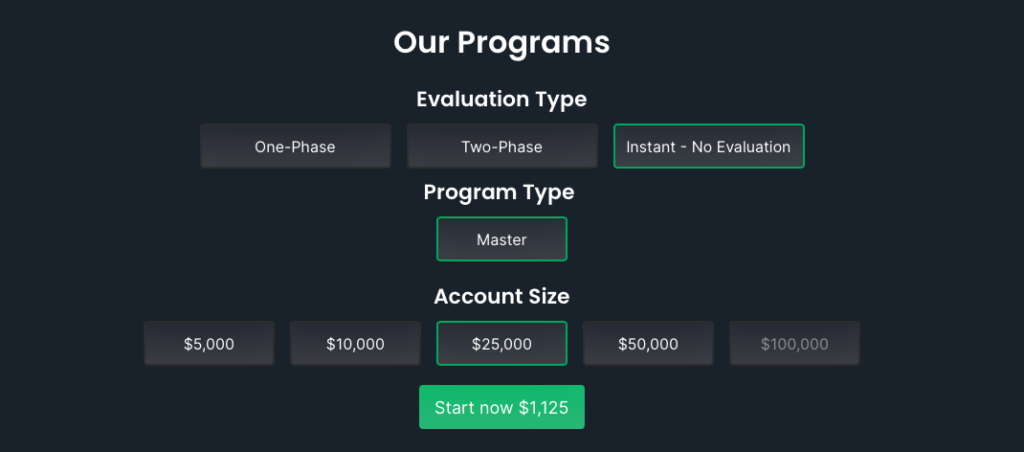

Master Trader Program

Funded Trading Plus’s Master Trader Program account offers traders the unique advantage of bypassing the evaluation phase entirely. This means you can start earning right from the beginning. Profit splits for this account start at 70% and can increase up to 80% based on your trading performance. Additionally, you’ll have the ability to trade with 1:30 leverage

Funded Trading Plus’s Master Trader Program account offers traders the unique advantage of bypassing the evaluation phase entirely. This means you can start earning right from the beginning. Profit splits for this account start at 70% and can increase up to 80% based on your trading performance. Additionally, you’ll have the ability to trade with 1:30 leverage

Master Trader Program Accounts Scaling plan:

Scaling plan for Master Trader Program accounts allows traders to become eligible for scaling their account by reaching a profit target of 10%. Withdrawals can be made before scaling up, but a minimum of 10% profit in the account is required for scaling. Here’s an example to illustrate the process:

- Starting account balance: $100,000

- After drawdown, the balance is fixed at $100,000: $108,000

- After a withdrawal of $3,000, the new balance is $105,000

- Adding $8,000 in profit results in a new account balance of $113,000

- Scaling up the account with a profit of $100,000 brings the total to $213,000, with the drawdown now fixed at $200,000

- After another withdrawal of $5,000, the new balance is $208,000

This example demonstrates how traders can manage their accounts by withdrawing profits along the way while also having the option to scale up. The trading instruments available for the master trader program account include forex pairs, commodities, indices, and cryptocurrencies.

Master Trader Program Accounts Rules:

- Maximum trailing drawdown is defined as the maximum drawdown equal to the difference between the highest account balance achieved and the maximum drawdown. All account sizes have a maximum trailing drawdown of 5%.

No weekend holding means that traders are prohibited from holding open positions during the weekends.

Third-party copy trading risk cautions traders intending to use copy trading services. If you use a third-party copy trading service, be aware that there may be other traders already using it, potentially following the exact same trading strategy. This carries the risk of denial of a funded account/withdrawal if you exceed the maximum capital allocation rule.

Third-party EA risk advises traders planning to use an EA (Expert Advisor) to be cautious. If you use a third-party EA, there may be other traders already employing the same trading strategy. This poses the risk of being denied a funded account/withdrawal if you exceed the maximum capital allocation rule.

What Sets Funded Trading Plus Apart

Funded Trading Plus distinguishes itself from most industry-leading prop firms through its offering of four distinct funding programs: Experienced, Advanced, Premium, and Master. Another notable difference is the flexibility they provide in terms of trading style, allowing traders to engage in news trading, hold positions overnight, and trade during weekends (except for the Advanced and Master programs).

In comparison to other prop firms, Funded Trading Plus’s Experienced Trader Program stands out as an evaluation program that mandates the completion of a single phase before becoming eligible for payouts. The program sets a profit target of 10%, along with a 3% maximum daily loss and 6% maximum trailing drawdown rules. Unlike many other top-tier prop firms, Funded Trading Plus imposes no specific minimum or maximum trading day requirements on participants in the Experienced Trader Program, enabling traders to progress at their own pace.

Conversely, the Funded Trading Plus Advanced Trader Program is a two-phase evaluation program that requires traders to successfully navigate both phases before qualifying for payouts. In this program, traders are tasked with reaching a 10% profit target in phase one and a 5% profit target in phase two, all while adhering to a 5% maximum daily loss and 10% maximum trailing drawdown rules. Much like the Experienced Trader Program, the Advanced Trader Program places no constraints on minimum or maximum trading day requirements, providing traders with the freedom to advance at their preferred pace in comparison to other leading prop firms.

Is getting Funded Trading Plus capital realistic?

- Experienced Trader Program: This program offers a realistic opportunity to secure capital. It sets an average profit target of 10% and enforces reasonable maximum loss rules (3% maximum daily loss and 6% maximum trailing drawdown).

Advanced Trader Program: Similar to the Experienced Trader Program, the Advanced Trader Program presents realistic chances for funding. It entails average profit targets (10% in phase one and 5% in phase two) and imposes reasonable maximum loss rules (5% maximum daily loss and 10% maximum trailing drawdown).

Premium Trader Program: This program also provides a practical avenue for securing capital. It defines average profit targets (8% in phase one and 5% in phase two) and maintains reasonable maximum loss rules (4% maximum daily loss and 8% maximum trailing drawdown).

- Master Trader Programs: The direct funding nature of the Master Trader Programs makes them highly realistic for traders. With no profit targets to reach and the ability to request weekly withdrawals, they offer a straightforward path to start earning from the outset.

Considering these factors, Funded Trading Plus stands out as a favorable choice for securing funding. It offers a range of funding programs, each with realistic trading objectives and payout conditions, ensuring traders have a practical pathway to funding.

Payment Proof

Funded Trading Plus: A Brief Overview

Funded Trading Plus is a proprietary trading firm that was officially incorporated on November 2, 2021, and subsequently launched on December 16, 2021. They have quickly gained prominence in the trading industry due to their unique funding programs and transparent approach. For evidence of successful payouts and payments, traders can refer to the “payouts” channel on their Discord platform, where payment proofs are regularly shared. This commitment to transparency is a hallmark of Funded Trading Plus, providing traders with confidence in their services.

Support

If you need assistance or have questions regarding Funded Trading Plus, there are several ways to get in touch with their support team:

FAQ Page: Start by checking their FAQ page, which might provide answers to common queries.

Email: You can directly contact them via email at info@fundedtradingplus.com. This is a convenient option for sending detailed inquiries.

Live Chat: Funded Trading Plus offers active live chat support. Simply send them a message, and you’ll receive a reply. If they are not available on live chat, they will respond to your email within 24 hours.

Phone: You can reach them by telephone at +44 333 090 9800. This option is ideal for more immediate communication.

Discord Channel: Visit their Discord channel, where both the support team and the community are available to assist you with any questions or technical issues.

These various support channels ensure that you can reach out to Funded Trading Plus in a way that suits your needs and preferences, making it easier to get the assistance you require.

Conclusion

In conclusion, Funded Trading Plus is a reputable proprietary trading firm that stands out for its flexibility and variety of funding programs: Experienced, Advanced, Premium, and Master.

The Experienced Trader Program is designed as an evaluation phase with a realistic profit target of 10%, accompanied by a 3% maximum daily loss and a 6% maximum trailing drawdown rule. This program offers traders the opportunity to earn up to 90% profit splits and to scale their accounts.

The Advanced Trader Program follows a two-phase evaluation challenge, with profit targets of 10% in phase one and 5% in phase two. The program is complemented by a 5% maximum daily loss and a 10% maximum trailing drawdown rule. Like the Experienced program, Advanced Trader participants can earn up to 90% profit splits and scale their accounts.

The Premium Trader Program also consists of a two-phase evaluation with profit targets of 8% in phase one and 5% in phase two. The program incorporates a 4% maximum daily loss and an 8% maximum trailing drawdown rule. Traders in this program can earn profit splits of up to 90% and have the opportunity to scale their accounts.

The Master Trader Program is unique as it allows traders to skip the evaluation period and trade funded accounts right from the start. There are no time limitations, lot size restrictions, or consistency rules to follow in this program. Participants can earn profit splits ranging from 70% to 90% and have the option to scale their accounts.

Overall, Funded Trading Plus is a solid choice for traders seeking a prop firm with clear and reasonable trading rules. Their four funding programs cater to a wide range of trading styles, making them an industry-leading proprietary trading firm with excellent offerings.

If you found this Funded Trading Plus Review to be informative, you can visit their website here.

You can also discover additional Propfirm reviews here