ACCOUNT TYPES:

AMarkets is a modern ECN broker that is more suitable for professional trading. The broker best accommodates trading with EAs as that is their strength.

Opening an account at AMarkets is easy, as the process is fully digital. There are four main trading accounts provided by AMarkets, Standard, Crypto, Fixed, and ECN.

Standard Account

AMarkets Standard account features market and instant order execution with a rapid speed of 70ms. With a minimum deposit of $100 and a leverage of up to 1:3000, it is suitable for day, medium, and long-term trading styles and time frames.

This account has no commission fee, a minimum spread value of $13, and a floating spread from 1.3 pips.

Crypto Account

This account type offered by AMarkets is designed for trading various assets excluding stocks, with the account denomination in Bitcoin. The unit of the account is MBTA, equivalent to 0.01 Bitcoin. This account has no commission fee, a minimum spread value of $13, and a floating spread from 1.3 pips.

Fixed Account

This AMarkets standard account for MetaTrader 4 offers order execution speeds of around 100ms, a minimum spread value of $30, and leverage of up to 1:3000.

ECN Account

This account is tailored for professional high frequency trading and to execute automated trading strategies, featuring fast order execution speeds from 30ms. The minimum deposit required is $200, with spreads starting from 0 pips, and a minimum spread value of $0. Additionally, traders can enjoy leverage of up to 1:300.

REGULATION

AMarkets has been operating for 16 years and its different entities are regulated by different regulatory bodies.

AMarkets Ltd is registered and licensed as an offshore broker on the island of Mwali. As an international online broker all clients accounts are protected and supervised by the Mwali International Services Authority.

AMarkets LLC is registered in the Cook Islands and is a relevant registry operated by the Financial Supervisory Commission.

AMarkets Ltd is also registered in Saint Vincent and the Grenadines as a relevant registry operated by the Financial Services Authority.

The forex broker is also a member of the Financial Commission and a compensation fund is available to clients in the event of insolvency.

COMMISSION AND FEES

At AMarkets, there are no hidden fees, and no deposit fees are charged. However, a withdrawal fee is applicable, which varies depending on the type of transfer and payment system used by traders.

The broker may charge additional fees for transferring positions overnight. For ECN accounts, there’s a fixed fee of $2.5 in one direction which amounts to $5 per 1 full standard lot. These fees are important considerations for traders as they influence the overall cost of maintaining positions and trading activities.

Account types offered at AMarket all have a withdrawal commission placed on them.

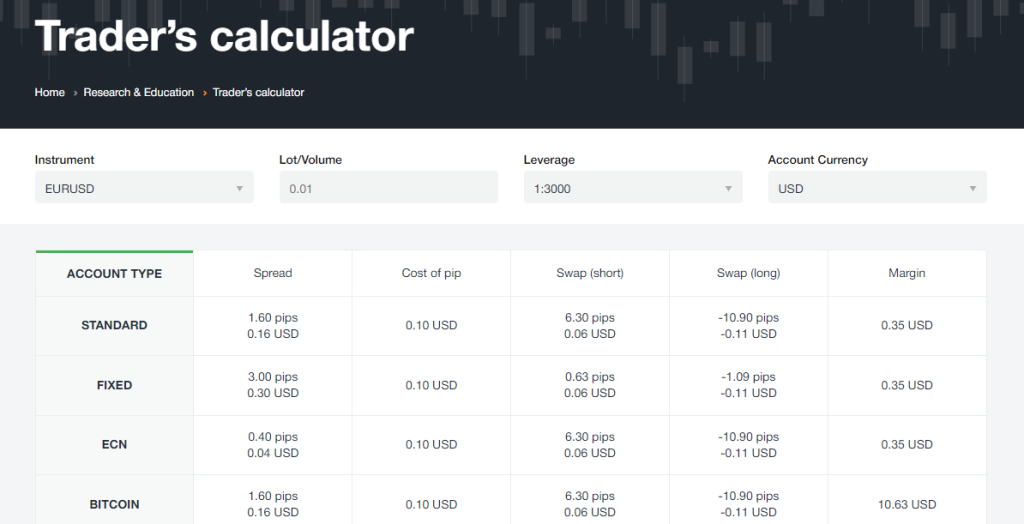

AMarket also features trading fees, non trading fees, and swap fees. Swap fees are the cost of holding a position overnight.

Swap fees can either be swap long, which is the cost/credit of holding a buy position overnight, or swap short, which is the cost/credit of maintaining a sell position overnight.

AMarkets does not charge inactive accounts.

INVESTMENT OPTIONS

AMarkets brokers provide investors the opportunity to engage in copy trading.

AMarkets’ copy trading feature presents traders the chance to generate passive income. A perk of copy trading is that investors only reward successful strategies. Traders can earn up to 50% of the investor’s profits. Additionally, investors have the flexibility to disconnect from the trader’s account whenever they choose.

Another option for copy trading provided by the broker is MetaQuotes’ built-in social trading services on MT4 and MT5 platforms

AMarkets Partnership Program

AMarkets provides two types of partnership programs;

- The Agent (IB) program entails earning a reward based on a percentage of referrals’ trading volume and the fees they pay. This program allows for a three level partner system with the following reward structure:

- Level 1 partners receive 100% reward from their clients’ trading volume, plus 15% of the reward of level 2 partners, and 5% of the reward of level 3 partners.

- Level 2 partners receive 100% from trades of their clients, plus 15% of the reward of level 3 partners.

- Level 3 partners receive 100% reward from their clients’ trades.

The reward amount varies depending on the referral’s account type and trading volume, ranging from $2 to $15.

- The Webmaster (CPA) program is tailored for website and blog owners adept at managing web traffic. Rewards range up to $10 for clients registrations and up to $500 for client deposits.

TRADING CONDITIONS

AMarkets offers attractive trading conditions for traders seeking long-term cooperation and professional growth. With a minimum deposit of $100, traders can access leverage up to 1:100 on the Crypto account. AMarkets STP and ECN models execute orders at high speeds, averaging 30-50 ms and up to 100 ms. This rapid order execution enhances successful trading.

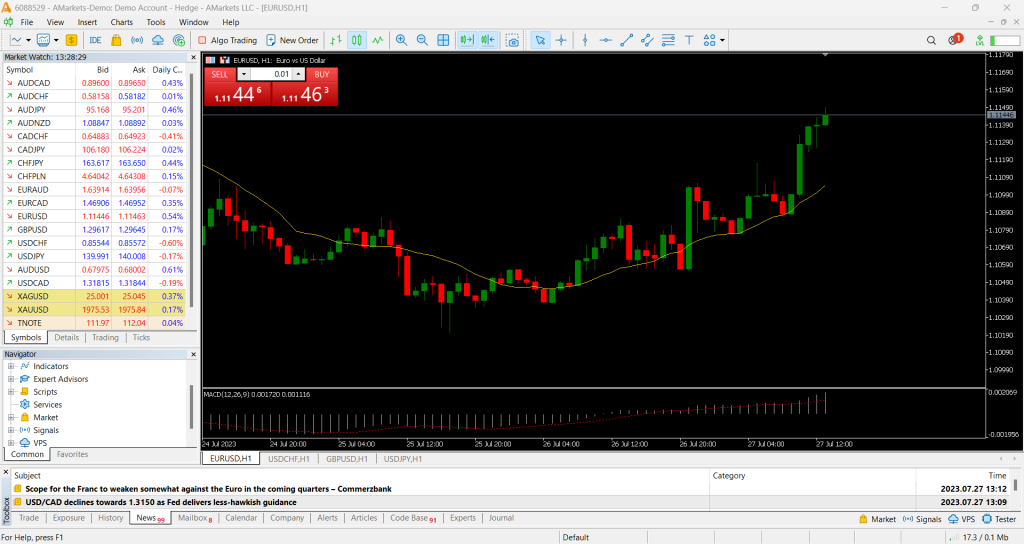

Clients benefit from trading new phone dealings, and negative balance protection. The use of ready-made robots and EAs is permitted. AMarkets provides accounts with floating spreads from 0.0 pips and fixed spreads from 3 pips. The ECN account has a $2.5 commission per lot, while the Standard and Fixed accounts have no commission per lot.

Traders can access MT4, MT5 platforms, and MultiTerminal for managing multiple accounts simultaneously. Additionally, AMarkets offers incentives such as cashback, bonuses for switching brokers, promotions, real money for income earned on demo accounts, and lotteries.

These features contribute to a comprehensive trading experience tailored to traders’ needs and preferences.

Some of AMarkets best features includes

- Fast order execution speeds anywhere from 35 ms to 50 ms, whereas the average market indicator is 200-500 ms

- An average market spread from 0.3 pips. The average market indicator is from 0.5 pips

- A range of analytical tools such as signals, risk management tools and algorithmic trading, are integrated into the users account

- Compensation funds of up to 20,000 euro per each client

- AMarkets provides traders with negative balance protections

TRADING INSTRUMENTS

AMarkets stands out with its extensive range of available CFD instruments. In addition to offering a wide variety of assets in forex, metals, energies, indices, shares, and cryptocurrencies, the broker also provides less commonly found CFDs such as bonds, ETFs, futures, and soft commodities like cotton.

AMarket also offers tools that aids in building trading system, the include;

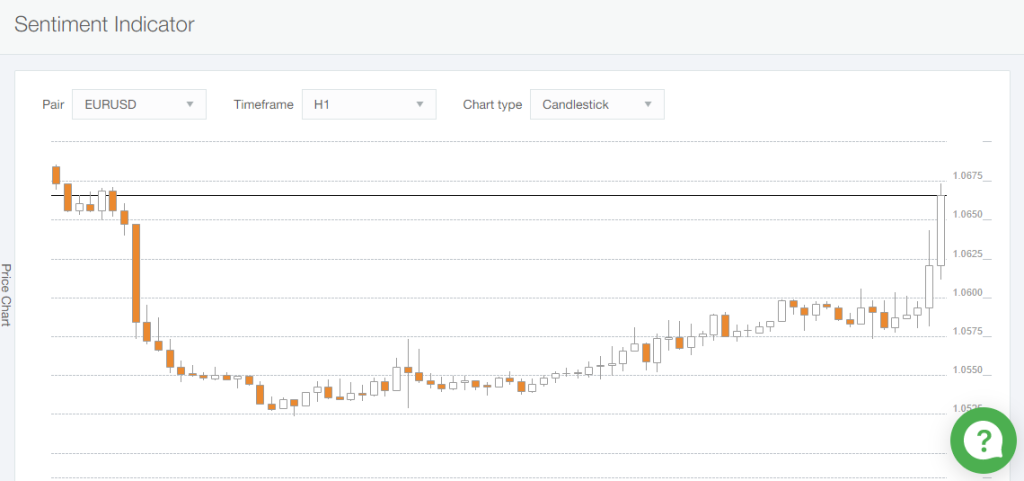

- Sentiment indicators. It demonstrates the extent of dominance by either buyers or sellers. Its values range from 0 to 100.

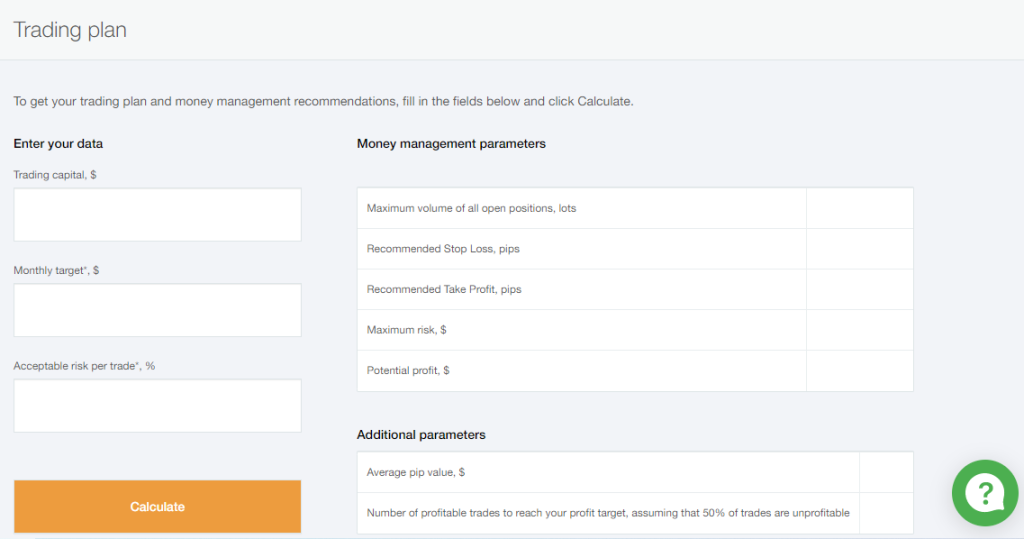

- Trading plan. This tool is used to calculate the optimal level of risk per trade and the overall risk, utilizing input data.

- Trader’s calculator. This tool computes margin, pip value, spread, and swap based on account type, leverage, and trade volume.

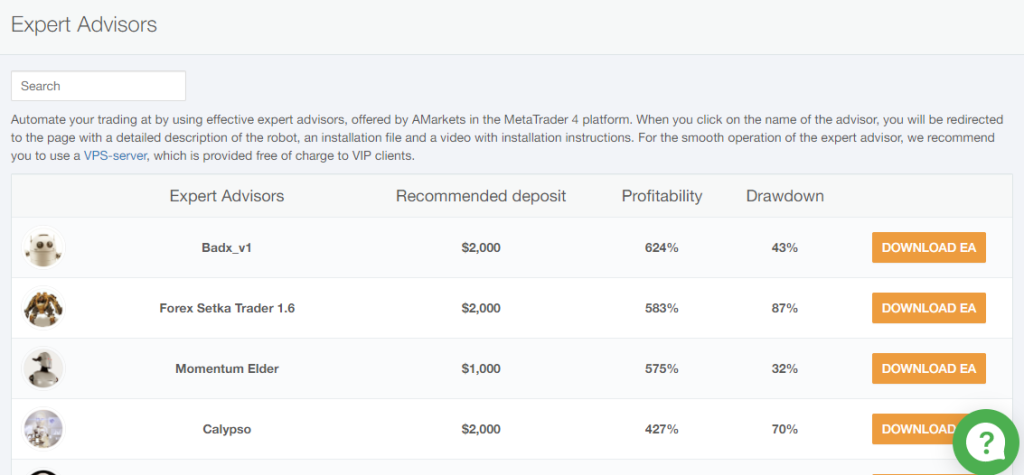

- Expert Advisors are a curated collection of trading advisors that have demonstrated maximum profitability in the recent reporting period. Designed for MT4 and MT5 platforms, these advisors come with templates pre-configured to optimal settings, along with usage recommendation.

- Economic calendar highlights the most relevant news events that could impact asset value.

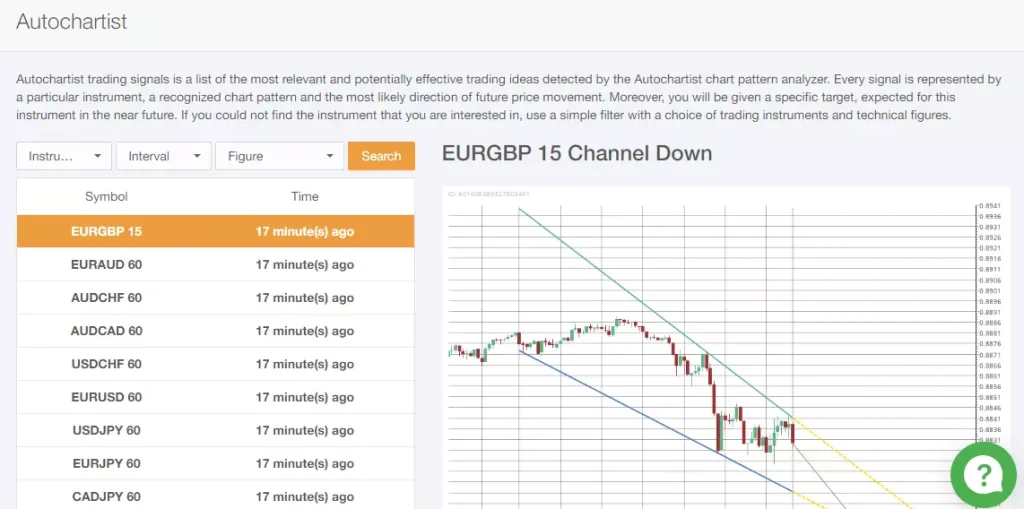

- Autocharist provides a list of trading signals generated by its platform add-on.

- The broker also offers analytical tools and other additional services such as derivatives expiration tables, information about trading schedule, VPS servers, and VPN and AMarkets access extension for google chrome.

DEPOSIT AND WITHDRAWAL

Making deposits or withdrawals at AMarkets is easy as the broker supports a wide range of payment providers. While deposits incur no fees, there are certain charges when you want to withdraw money. Withdrawal requests are typically processed within 24 hours, while the processing time for deposits varies depending on the deposit method used.

AMarkets’ withdrawal and deposit methods include; Visa, Mastercard, USTD, USD Coin, Binance Coin, Bitcoin, Litecoin, Ethereum, ADVcash, Perfect Money, and TopChange. Keep in mind that credit card withdrawal is the most costly option.

AMarkets also offers ease in making withdrawals and deposits. While there are no deposit fees, you do have to face some charges in order to withdraw money.

TRADING PLATFORM

AMarkets provides access to MetaTrader 4 and MetaTrader 5 platforms, alongside an intuitive web-based platform. MetaTrader offers advanced charting features, a diverse array of order types, and is suitable for algorithmic traders.

MetaTrader 5 Desktop

AMarkets provides MetaTrader 5 for desktop, featuring advanced functionalities like copy trading and automated trading. Copy trading allows users to copy other traders’ activities in real time, while Automated trading allows users to develop, test, and apply Expert Advisors (EAs). This platform is available in 52 languages.

MetaTrader 5 offers features such as

- Alerts. This feature notifies traders when an instrument reaches a predetermined price level.

- Watchlists. Traders can create a list of their preferred instruments and monitor love quotes through a market watch panel.

- One-Click Trading. This feature enables traders to execute orders swiftly with a single click, eliminating the need for secondary confirmation. It’s particularly beneficial for short term traders seeking speed and efficiency.

- Trading from the Charts. With MT5, users can conveniently place trades directly from the chart interface.

Order

MetaTrader also offers the following order types;

- Market Order. Traders utilize market orders to instantly buy or sell an instrument at the prevailing market price.

- Limit Order. Traders use limit orders to buy or sell an instrument at a specific price.

- Stop Loss Order. The stop loss order is used to automatically buy or sell an instrument when its price reaches a predetermined level, helping to mitigate losses.

- Stop Limit Order. Traders can precisely manage risk with stop limit orders.

- Trailing Stop Order. The trailing stop loss order is utilized to automatically adjust the stop loss level as the market price moves in a favorable direction. This allows prices to be locked while still allowing potential further gains.

MetaTrader 5 Mobile App

For mobile trading, AMarkets has a mobile app version of the MetaTrader 5 platform, which is available for Android and iOS.

The mobile app platform offers some features seen in the desktop version such as one-click trading and trading from the charts. The MetaTrader 5 mobile app has access to various order types including pending and stop order, however it is worth noting that trailing stop loss orders are exclusively available on the desktop version of the platform.

Web Platform

AMarkets web platform includes popular features like watchlists, one-click trading, and trading directly from the charts.

Traders have access to all standard order types on the web platform, including market limit, and stop loss order. Additionally they can apply time-in-force conditions like Good-Till-Canceled (GTC). This platform also includes TradingView charts that feature time frames, chart types,and technical indicators.

Trades are automatically copied within the web based platform and traders pay a predetermined percentage of profits for the privilege of copying a strategy.

EDUCATION

AMarkets’ website features an educational section that provides courses such as how to start trading, proper market analysis, and what the methods of forecasting are.

AMarkets’ blog offers valuable educational materials including practical guides on setting up your MT4 platform professionally and understanding essential indicators like the MACD.

The FAQ section within the knowledge base covers a wide range of topics from complex subjects like expert advisors to addressing common questions beginners may have about CFD market, MetaTrader basics and trading fundamentals.

Trader’s dictionary provides basic terminologies needed by traders to grasp key concepts and improve their trading skills. Forex market news and forex market review provides analytical insight essential for creating effective trading strategies.

CUSTOMER SUPPORT

AMarkets customer support is available 24 hours, 5 days a week excluding Saturdays and Sundays. They can also be reached via email, live chart, and phone.

The phone number to call and email address is specified on the brokers website. Traders can also reach out through instant messengers and social media.

CONCLUSION

AMarkets, established in 2007, is an international company with dozens of offices in Europe and CIS. The forex broker can be used by both beginner and professional traders. Plus, it can accept clients from different parts of the world due to its various entities. Keep in mind that the broker is a member of the Financial Commission so, there is compensation for clients in the event of bankruptcy.

AMarkets offers four main trading account types, Standard, Crypto, Fixed, and ECN. The lowest variable trading spread available with Standard accounts starts at 1.3 pips. The trading spread with the AMarkets fixed spread account is 3 pips. There is however, a commission fees account option that offers variable spreads starting at 0.0 pips, this account is the ECN account. All account types at AMarkets feature a leverage of up to 1:30.

AMarkets trading platforms includes MetaTrader 4 and 5 in addition to an intuitive web based platform.

The forex broker caters to traders of all experience levels. Both new and professional traders can benefit from reliable customer support and easy-to-use mobile trading platforms. As an international brokerage, it offers innovative trading tools, diverse account types, and a wide variety of instruments to trade in financial markets. In addition, there are educational resources that provide up-to-date information on trading techniques to improve your trading skills and practices.

In general, the company has established itself as one of the top forex and CFD brokers and a desirable choice for traders who want to trade in the global markets with a platform that prioritizes their growth.