Who are Direct Funded Traders?

Direct Funded Trader under the legal name GFT GROUP LLC, is a proprietary trading firm that was established on February 28, 2023. They are managed by CEO Arthur Kaziu. Direct Funded Trader offers traders the opportunity to choose between two account types, a two-step evaluation and a one-step evaluation. Direct Funded Trader is in partnership with Blueberry Market as their broker.

Direct Funded Trader is based in Dubai, United Arab Emirates, with their headquarters situated at Business Center 1, The Meydan Hotel, Nad Al Sheba, Dubai, United Arab Emirates.

Funding Program Option

Direct Funded Trader offers traders two distinctive funding programs options:

- Evaluation Program

- Fast Funding

Evaluation Program

The Trader’s Evaluation Program is designed to identify talented traders who demonstrate profitability and risk management skills throughout the two-step evaluation period. Traders have the opportunity to manage accounts ranging from $15,000 to $200,000 and trade with up to 1:100 leverage.

During Evaluation phase one, traders are required to achieve a profit target of 8% without exceeding their 5% maximum daily loss or 10% maximum loss rule. Notably, there are no maximum trading day requirements during phase one, however, there is a minimum of five trading days requirement in order to proceed to phase two.

During Evaluation phase two, traders are required to achieve a profit target of 5% without exceeding their 5% maximum daily loss or 10% maximum loss rule. Notably, there are no maximum trading day requirements during phase two, however, there is a minimum of five trading days requirement in order to proceed to a funded account.

Upon completing both evaluation phases, you will receive a funded account. There are no minimum withdrawal requirements, however, you are obligated to the 5% maximum daily loss and 10% maximum loss rule. Your initial payout is 30 calendar days from the day you place your first trade on your account. All subsequent withdrawals can be processed bi-weekly. Based on the profit made on the funded account you are eligible for a profit split of 80%. Moreover, there is a $3 cashback on each lot traded during the evaluation period.

Evaluation Program Scaling Plan

The Evaluation Program also has a scaling plan. If a trader generates a 25% profit. they become eligible for an account size increase equal to 50% of the initial account size

Example:

After Generating a Profit of 25%: A qualified $50,000 account increases to $100,000

After the Next 25% profit: A qualified $100,000 account increase to 150,000

After the Next 25% profit: A qualified $150,000 account increase to 200,000

Evaluation program trading rules and objectives

- Profit Target: Traders must meet a specific profit target in order to successfully complete an evaluation phase, withdraw earnings or scale their trading account. Phase 1 requires achieving a profit target of 8% while Phase 2 requires reaching a profit target of 5%. Funded accounts do not have any specified profit targets.

- Maximum Daily Loss: The maximum daily loss in all account sizes is 5%.

- Maximum Loss: The maximum loss limit on all account sizes is 10%.

- Minimum Trading Days: There is a minimum trading day requirement of 5 days for both evaluation phases.

- No Martingale: Traders are not allowed to use any form of martingale strategy during their trading activities.

Fast Funding

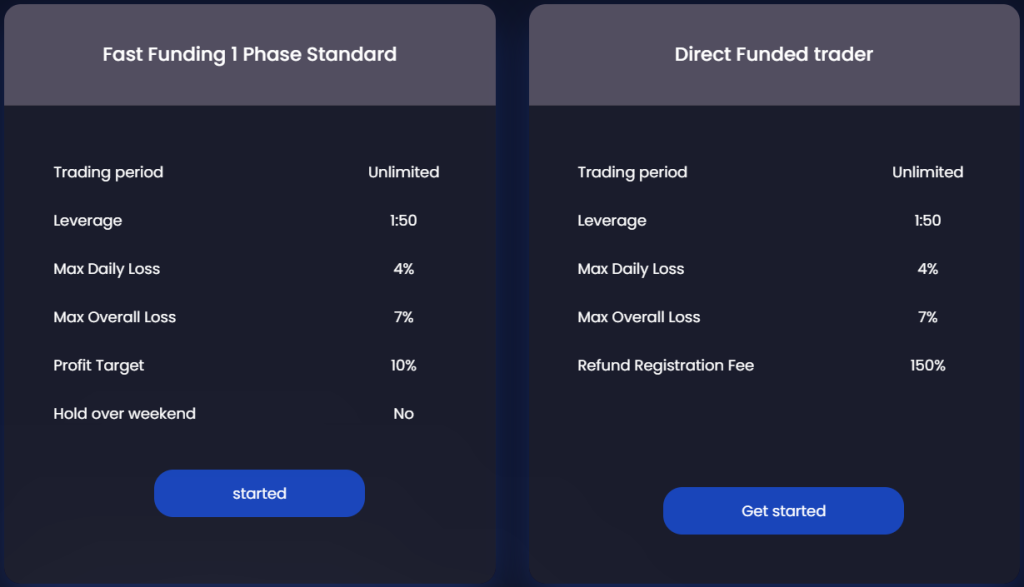

Direct Funded Trader‘s Fast Funding aims to identify talented traders who demonstrate profitability and risk management skills throughout a one-step evaluation period. The program provides traders the opportunity to manage accounts ranging from $15,000 to $100,000.

The Fast Funding program is of two types: the Standard type and the Aggressive type. The Standard Fast Funding option enables trading with leverage of up to 1:50 while the Aggressive Fast Funding option allows trading with leverage up to 1:30.

Another difference between the two Fast Funding options is the Aggressive Fast Funding option offers the opportunity to hold positions over the weekend whereas the Standard Fast Funding option requires you to close all open positions.

During this evaluation phase a trader is expected to achieve a profit target of 10% without exceeding their 4% maximum daily loss or 7% maximum loss rule. Notably, there is no maximum trading day requirement during the evaluation phase, however, there is a minimum of five trading days requirements in order to proceed to a funded account.

By concluding the evaluation process successfully, you are given a funded account. There are no minimum withdrawal requirements, but you have to respect the 4% maximum daily loss and 7% maximum loss rule. Your initial payout is 30 calendar days from the day you place your first trade. Other subsequent withdrawals can be submitted bi-weekly. Based on the profit made on the funded account you are eligible for a profit split of 80%. Moreover, a $3 cashback is received on each lot traded during the evaluation period.

Fast Funding Scaling Plan

Fast Funding also has a scaling plan. If a trader generates a 25% profit. they become eligible for an account size increase equal to 50% of the initial account size

Example:

After Generating a Profit of 25%: A qualified $50,000 account increases to $100,000

After the Next 25% profit: A qualified $100,000 account increase to 150,000

After the Next 25% profit: A qualified $150,000 account increase to 200,000

Fast Funding trading rules and objectives

- Profit Target: Traders must meet a specific profit target in order to successfully complete an evaluation phase, withdraw earnings or scale their trading account. There is a 10% profit target for the evaluation phase. Funded accounts do not have any specified profit targets.

- Maximum Daily Loss: The maximum daily loss limit on all account sizes is 4%.

- Maximum Loss: The maximum loss limit on all account sizes is 7%.

- Minimum Trading Days: The minimum trading duration traders are 5 days for both evaluation phases.

- No Martingale: Traders are not allowed to use any form of martingale strategy during their trading activities.

- No Weekend Holding: Traders are banned from holding trades during the weekend. This means that all trades should end before the Friday market closes. (Aggressive Fast Funding can hold trades during the weekend).

What Makes Direct Funded Trader Different From Other Prop Firms?

Direct Funded Trader sets itself apart from the majority of top-tier prop firms by providing two distinct account options: a two-step evaluation and a one-step evaluation.

Direct Funded Trader’s two-step evaluation (Evaluation Program) requires traders to complete two evaluation phases successfully before they can qualify for payouts. For phase one of the evaluation, a profit target of 8% is required and for phase two 5%. There is a 5% maximum daily and 10% maximum loss rules traders must follow.

Direct Funded Trader’s one-step evaluation (Fast Funding Program) requires traders to conclude a single phase successfully before they can become qualified for payouts. The profit target is 10%. There is a 4% maximum daily and 7% maximum loss rules traders are required to follow. Notably there are no maximum trading day requirements during the evaluation phase, there is however, a minimum of 5 trading days requirements doing this evaluation phase.

In conclusion, Direct Funded Trader offers two unique account types, and this has set it apart from other industry leading trading platforms. The account types include a two-step evaluation and a one-step evaluation. Both funding programs have scaling plans, allowing traders to manage even larger account sizes. They both offer unlimited trading periods, an attractive profit split, realistic profit targets, a $3 cashback feature for each lot traded during the evaluation phases, and bi-weekly withdrawals.

Is Getting Direct Funded Trader Capital Realistic?

It is necessary to consider the trading requirements when considering proprietary trading firms to determine whether or not it fits your trading style. Opting for a firm that promises a generous profit split on a well-capitalized account might seem appealing. However, if they anticipate lofty monthly gains coupled with minimal maximum drawdown percentages, their likelihood of success diminishes significantly. It is also necessary to consider other features of the trading platform like time restraints and withdrawal limitations if any to decide whether or not the prop firm meets your trading needs.

Lastly, it is crucial to familiarize yourself with all trading rules during the evaluation process and subsequent funding stages to lessen the risk of accidentally violating your trading account terms.

Receiving capital from the Evaluation Program is feasible mainly because of its realistic profit targets (8% in phase one and 5% in phase two) in addition to its modest maximum loss rules (5% maximum daily and 10% maximum loss). In addition, there are no maximum trading day requirements but there is a minimum trading day requirement of 5 calendar days. Furthermore, upon concluding both evaluation phases, participants are eligible for payouts featuring a favorable 80% profit split.

Receiving capital from Fast Funding is feasible mainly because it offers an average profit target of 10% coupled with slightly above-average maximum loss rules (4% maximum daily and 7% maximum loss). In addition to this, there are no maximum trading day requirements but there is a minimum trading day requirement of 5 calendar days. Furthermore, upon concluding the evaluation phase, participants are eligible for payouts featuring an favorable 80% profit split.

After assessing all aspects, Direct Funded Trader is highly desirable since it offers two unique funding programs to choose from: a two-step evaluation and a one-step evaluation, which all feature practical trading conditions for qualifying for a trading account and payouts.

Payment Proof

Direct Funded Trader is a proprietary trading firm established on February 28, 2023, and boasts a substantial community of traders who have attained funded status and successfully met the criteria for profit split.

Upon achieving funded status through partaking in Direct Funded Trader Evaluation Program or Fast Funding, you will be qualified to receive your initial payout after 30 calendar days. Following your initial payout, you will qualify for subsequent payouts every 14 calendar days upon exceeding the initial account size. Your profit split will consist of a generous 80% based on the profit you generated on the funded account.

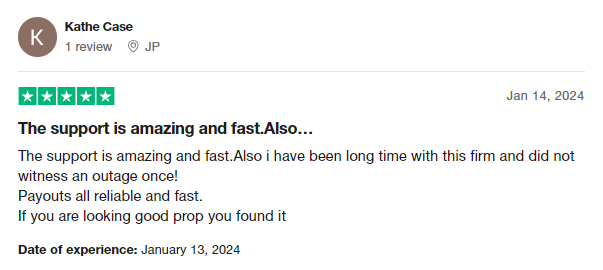

When it comes to Direct Funded Trader payment proof, you can find it on various websites, an example being Trustpilot. On Trustpilot, traders share their experience as well as the process of how they successfully received payouts. Direct Funded Trader Discord channel is another source of payment proof where you can find a significant number of payout certificates from the most successful traders.

Education

Direct Funded Trader does not provide any educational content on its website.

However, the trading platform still provides its clients with a detailed dashboard. This enhances risk management by providing real time data and access to their trading objectives. In addition, it allows traders to test their trading strategy and continuously improve on it.

Trustpilot Feedback

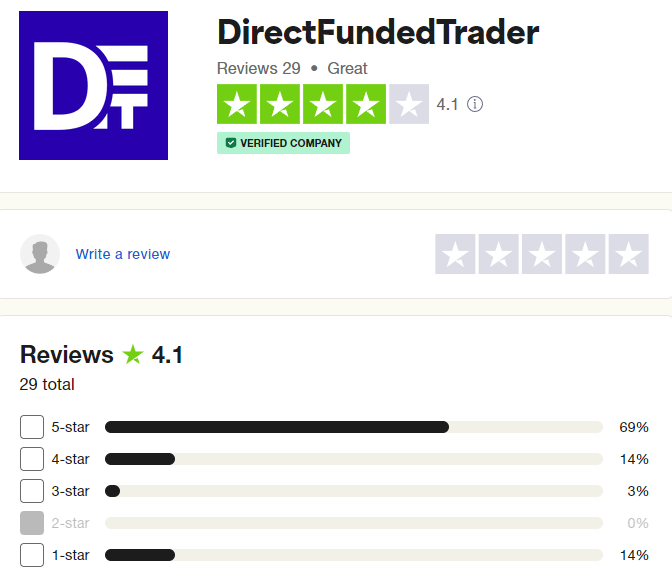

Direct Funded Trader has garnered an impressive score on Trustpilot thanks to their community’s feedback.

On Trustpilot, Direct Funded Trader community has left positive comments and feedback detailing the company services. The firm has amassed a remarkable 4.1 rating out of 5 from a pool of 29 reviews, with a considerable 69% of these reviews awarding Direct Funded Trader the highest rating of 5 stars.

Traders have praised Direct Funded Trader for their exceptional customer support. They also noted the ease in processing payments and how quick the platform is to resolve issues. It has an edge against other prop firms by using modern solutions to improve the trading conditions of professionals. They further recommended Direct Funded Trader to anyone seeking a reliable proprietary trading firm.

So far, clients on Direct Funded Trader have had a good experience on the platform and recommend it to anyone looking to have a long and profitable relationship with a prop firm.

Customer Support

If you have questions or concerns about Direct Funded Trader, you can reach out to customer care through the live chat on the website or via email at support@directfundedtrader.com. Checking their FAQ page could provide you with quick answers but you could get a more detailed response through their Discord channel and Telegram platform.

Conclusion

Direct Funded Trader is a top-tier proprietary trading firm that uses modern solutions to fill the gap in the trading industry. It offers traders the opportunity to choose between two funding programs: the Evaluation Program, which is a two-step evaluation, and Fast Funding, which is a one-step evaluation.

Direct Funded Trader’s Evaluation Program is an industry-standard two-step evaluation. It requires traders to conclude two evaluation phases before becoming qualified to manage a funded account and earn profit splits of 80%. A profit target of 8% is set in phase one and for phase two 5%, Traders must complete both phases in order to become funded. These are realistic trading objectives, considering you have a 5% maximum daily and 10% maximum loss rules to follow. Concerning time limitations, there are no maximum trading day requirements during either evaluation phase. However, there is a minimum of five trading days requirement for each evaluation phase. It is also crucial to note that the Evaluation Program features a scaling plan, providing you with the opportunity to increase your initial account balance.

Direct Funded Trader’s Flash Funding is a one-step evaluation. It requires traders to conclude a single evaluation phase before becoming qualified to manage a funded account and earn profit splits of 80%. A profit target of 10% is set and traders must successfully complete the phases in order to become funded. These are realistic trading objectives, considering you have a 4% maximum daily and 7% maximum loss rules to follow. Concerning time limitations, there are no maximum trading day requirements during this evaluation phase. However, the evaluation phase has a minimum requirement of five trading days. It is also crucial to note that the Fast Funding features a scaling plan, providing you with the opportunity to increase your initial account balance

Direct Funded Trader is available to professional traders worldwide. It is a platform with an extensive vision for the future and one that you should consider when seeking a trading platform to work with. Direct Funded Trader offers features that can easily compete with others in the industry and trading conditions that make it possible for professional traders of all experience levels to grow and continue to reap the benefits of their journey.

If you found this Direct Funded Trader Review to be informative, you can visit their website here.

You can also discover additional Propfirm reviews here