Libertex offers an extensive range of CFD underlying assets, forex pairs, metals, shares, ETFs, options and more, providing ample trading opportunities for clients. With competitive fees and versatile account types, Libertex caters to various trading preferences and experience levels. Additionally, clients have access to multiple trading platforms, including the flagship Libertex platform as well as MetaTrader 4 and 5, ensuring flexibility and convenience in trading execution.

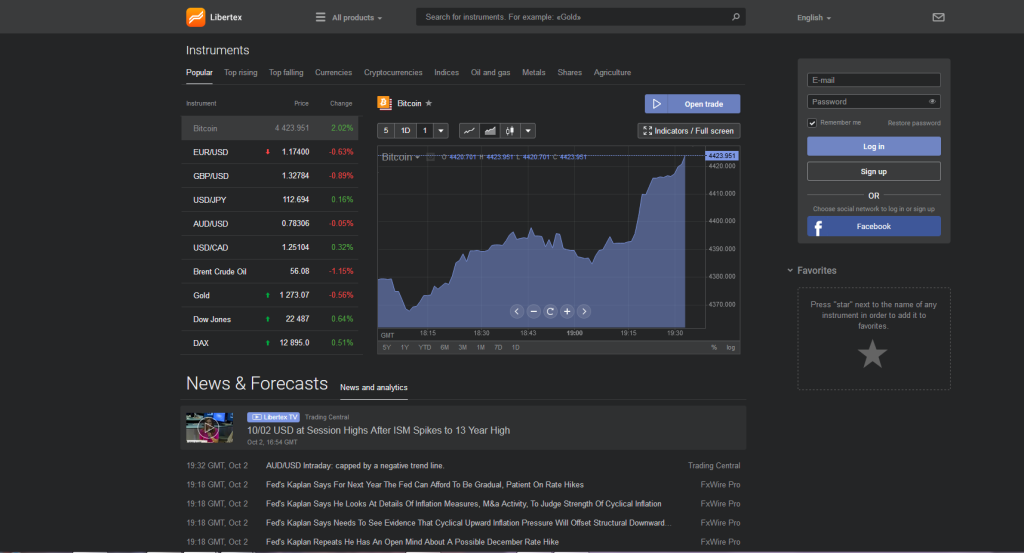

One of the key advantages and distinguishable features of Libertex is its proprietary web trading platform, which is tailored for novice traders. This platform stands out for its user-friendly interface. Additionally, it offers high information content, empowering traders with comprehensive market insights and analysis tools. Furthermore, the platform boasts advanced technical functionality, enabling users to trade efficiently and effectively.

Libertex is a Cyprus investment firm regulated by the Cyprus Securities and Exchange Commission.

ACCOUNT TYPES

Libertex offers various account types, depending on the chosen trading platform and whether traders prefer CFDs or stock investments. Notably, USD is not available as a base currency option, which means trading instruments denominated in US dollars are subjected to conversion fees. Additionally, Libertex does not offer swap-free trading. The broker provides accounts in four base currencies: EUR, GBP, CHF, and PLN, catering to the preferences of different traders.

Libertex account types include Libertex Real, Libertex Invest, MetaTrader 4 and 5 (Libertex EU).

Libertex Real

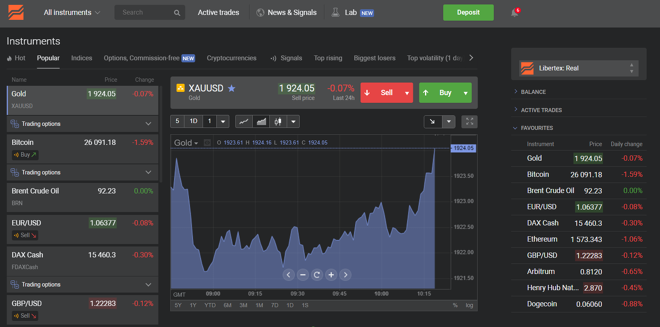

Libertex Real is a Libertex platform account that features a leverage of up to 1:30 for retail clients, with commission fees starting from 0.0003%, a minimum trading volume of 20 euro, a minimum deposit of 100 euro, and spreads from 0.1 pips. Trades are executed in real time through market execution. Trade volume is indicated in the accounts currency, providing transparency and clarity for traders. This account type offers a demo account.

Libertex Invest

The Libertex Invest account type offers zero commission fees for securities trading on the Libertex platform. Investors only pay the market spread, making it a cost effective option for trading securities.

This account type features a market type execution, a minimum trading volume of 1 unit, and a minimum deposit of 100 euro. It is important to know that this account type does not feature a demo account.

MT 4 and MT 5 (Libertex EU)

This account is designed to be used by the corresponding platform. This account features a minimum trade size of 0.01 lot.

The MetaTrader 4 and MetaTrader 5 platform account features a spread from 0.1 pips, a commission of 6 euro, a market type execution, and a minimum deposit of 100 euro. Both accounts also offer demo accounts.

Libertex demo account is used to explore the functionality of the platform, test various trading strategies, and learn trading basics. This account is completely free and does not require any verification upon registration, allowing users to dive into the trading environment effortlessly.

Precision trading is made possible due to Libertex lack of minimum distance requirement, with the exception of MetaTrader 5 account. This flexibility allows traders to execute trades with precision, without being restricted by arbitrary distance limitations.

Libertex Europe offers investment services to clients from the European Economic Area (EEA) and Switzerland.

REGULATIONS

Indication Investments Ltd is an entity under Libertex group. It is a regulated Cyprus investment firm licensed by the Cyprus Securities and Exchange Commission (CySEC).

Clients of Indication investments ltd are offered negative balance protection, segregated funds, and a minimum leverage of up to 1:30.

Libertex Europe, a member of Libertex group, is a well established brand in the European trading industry with over a decade of operating history.

Libertex is a member of the Investor Compensation fund, an initiative designed to safeguard retail investor accounts by offering compensation in the unlikely event of the company facing insolvency.

Libertex group adheres to the Markets in Financial Instruments Directive and adheres to all local and European regulations under the oversight of CySEC. Additionally, the company must comply with the Investment Services and Activities and Regulated Markets law of the European Union.

COMMISSION AND FEES

Libertex provides spreads that are typically below the industry average across various instruments in most asset classes. While it charges a low round-turn commission on select asset classes, swap rates can vary. Furthermore the broker does not impose fees on deposits and offers some opportunities for charge free withdrawals. Spreads are charged on all account types on Libertex, while fees in the form of a percentage of the trade amount are charged on certain account types. Additionally, Libertex maintains a low inactivity fee, ensuring cost effectiveness for its traders.

The broker’s trading conditions are quite fair. Spreads being charged on all account types, and fees in the form of percentage of trade amount are applied on certain account types.

Libertex offers competitive spreads on Contracts for Difference (CFDs) with underlying assets such as FX pairs, commodities, shares, indices, and cryptocurrencies. Additionally, there is a 6 euro round-turn commission per traded lot charged on the MetaTrader 4 and 5 platform. On the Libertex platform, trading incurs a commission of 0.005% per traded volume, however, commissions are not applicable when trading CFDs on energies, indices or select shares.

It is important to note that about 73.77 of retail investor accounts lose money while trading CFDs. This is because CFDs are complex instruments and the risk of losing money rapidly is due to the leverage it holds.

TRADING TOOLS

Libertex offers its clients access to 150 different asset classes for trading. These include major, minor, and exotic currency pairs, stocks like Apple Inc, Google and RioTinto, cryptocurrencies such as Bitcoin, Bitcoin Cash, and Lite Coin, all while providing a substantial selection of CFDs on commodities, indices and cryptocurrencies. This financial markets broker mainly deals with money trade CFDs.

Contracts of Difference (CFDs) are financial derivatives used to speculate on the price movement of the underlying assets without the need of physical ownership or delivery. Trading CFDs offers a significant advantage as traders can swiftly enter and exit the market, enabling them to capture the slightest fluctuations in the derivative’s price. Traders can also benefit from the absence of rollover fees during intraday trading, and for instance, when trading energy, they won’t incur any fixed commissions.

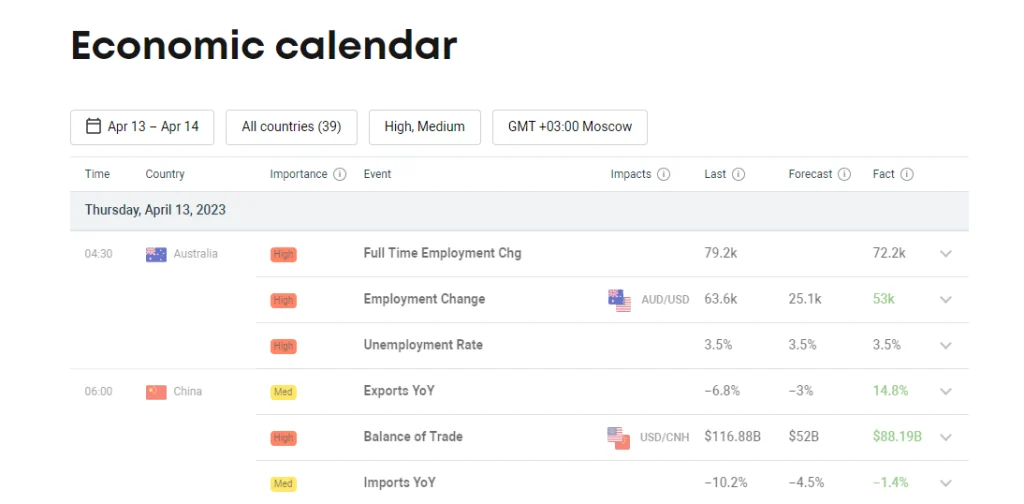

Libertex also provides its clients with an economic calendar which features a comprehensive list of upcoming news and events that are anticipated to have a significant impact on asset values in the short or long term. Users can filter the calendar by country and the importance of the news events, allowing them to stay informed about the critical market moving developments.

TRADING PLATFORMS

Libertex offers the widely used MetaTrader 4 and 5 trading platform, renowned for their user-friendly interfaces catering to both novice and seasoned traders. Additionally, the broker provides a user-friendly mobile app intended for both trading and investment purposes. Libertex does not offer some industry standard features such as one-click trading and alert setting option. Nonetheless, it excels in various other areas, providing traders with a robust and versatile trading experience.

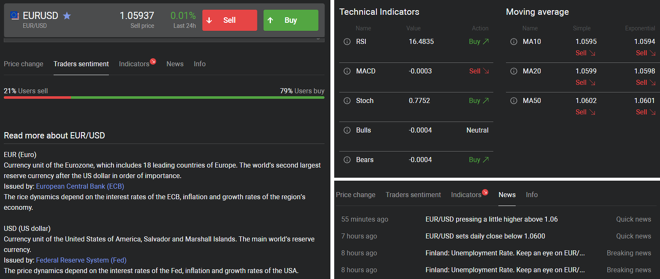

The Libertex trading platform provides essential trading information, such as the latest news and technical indicator data for each underlying asset. Traders can leverage this information to evaluate the underlying market bias and anticipate potential market directions. The platform is useful for high frequency traders as it allows trading volatile markets.

Libertex does not provide VPS hosting for MetaTrader 4 and 5. MetaTrader 5 is particularly adept for executing intricate trading strategies such as scalping due to its one-click trading feature. Additionally, it offers a broader range of timeframes, providing traders with a more detailed insight into price action dynamics.

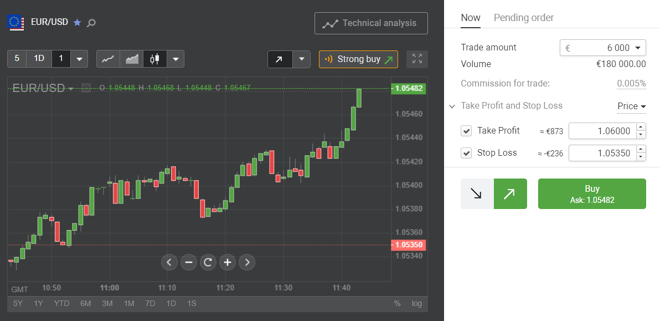

Libertex’s Web Trader Platform

The Libertex trading platform stands out for its user-friendly design and intuitive layout, ensuring a smooth learning curve for traders. With a standard layout featuring a watch list of selected instruments, a central charts window, and account information and setting, navigation is straightforward.

Traders can easily access key information such as put/call prices, daily percentage changes, market conviction, and price changes over the month and year, when viewing the CFDs list. This clarity and accessibility contributes to a seamless trading experience on the Libertex platform.

Charts

The platform’s chart screen successfully predicts technical analysis by examining any price action behavior changes. Additionally, it includes a wide array of technical indicators, drawing tools, and other instruments to support comprehensive technical analysis.

The charts are easy to navigate making it suitable for conducting probing technical analysis.

The available analytical tools and chart configuration on the Libertex web based platform includes

- Technical indicators. They are typically used to forecast the potential direction of the market. These tools can be applied to analyze price action and discern market sentiment. This platform supports a variety of indicators including trend-based, volume-based, oscillators, Bill Williams indicators, and more.

- Drawing tools. They can be used to identify significant support and resistance levels,as well as potential breakdown points. Moreover, the Libertex platform offers support for trend lines, channels, pitchforks, and other technical analysis.

- Timeframes. The Libertex platform enables multi-timeframe analysis of price action, facilitating comprehensive across short-term and long-term periods. However, a major limitation is the absence of timeframes lower than 1 minute, which can pose challenges for implementing scalping strategies.

- Chart types. Price action can be depicted in various formats such as line charts, bar charts, area charts, or various types of candlestick charts. This diversity enables traders to analyze potential trading opportunities from multiple perspectives.

Order

The available order types on the Libertex Web Trader platform are Market order, Limit order, and Stop order.

- Market orders are used for immediate entry at the optimal available price, ensuring volume filling upon activation. However, there may be variation between the requested price and the actual fill price.

- Limit order on the other hand will only be executed if the market price reaches the predetermined execution level.

- Stop order serves to safeguard open positions by capping potential losses if the market shifts unfavorably.

The Libertex platform is well suited for novice chart analysts who engage in intraday trading strategies, particularly focusing on breakouts and breakdowns from key support and resistance levels. Additionally, the platform caters to individuals involved in longer- term swing, day and position trading.

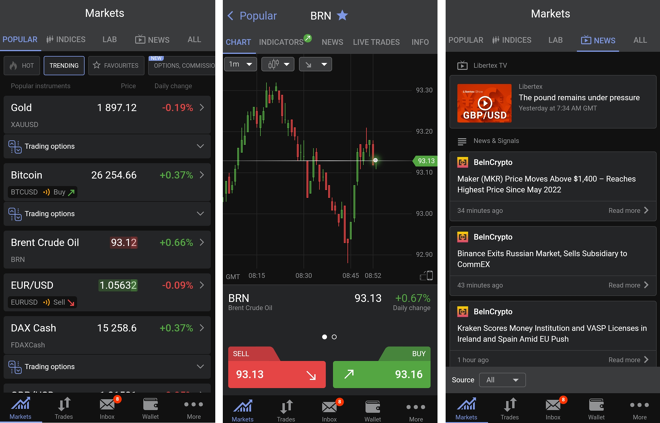

Libertex’s Mobile App

Libertex’s trading app offers traders the ability to execute a market trade while on the move, allowing for quick monitoring and adjustment of running positions. This trading platform supports trading CFDs and investing in real stocks, enabling users to place market, limit, and stop orders, and adjust trade exposure. While the app lacks technical indicators and drawing tools, this is less of a concern as conducting detailed technical analysis on small screens is not recommended.

The mobile app version retains the flexibility and practicality of its desktop version. The app delivers a comprehensive understanding of price action behaviors.

Before commencing market trade using any trading platform offered at Libertex, it is necessary to familiarize oneself with the trading basics of the platform before engaging in any CFD trading. Additionally, traders who wish to become retail clients should note that about 73.77% of retail investor accounts lose money on trade CFDs. This is due to the high risk associated with the leverage on CFDs.

DEPOSIT AND WITHDRAWALS

Libertex provides a diverse range of deposit and withdrawal options, without imposing handling fees, and transactions are efficiently processed. Additionally, the broker offers transparency by providing regulatory oversight details for each payment method, which enhances trust and security for users.

Deposit methods include: Bank Wire, Credit/Debit Card, PayPal, SOFORT, iDEAL, Trustly, Skrill, Giropay, Multibanco, P24, BLIK, eps, and Neteller.

Deposits on Libertex are instant and typically fee-free, with the exception of SEPA transfers, which may take 3-5 business days to process.

Withdrawal methods include: Bank Wire, Credit/Debit Card, Paypal, Skrill, and Neteller.

Withdrawal requests on Libertex are processed through the Client Portal, with most requests being processed on the same business day. However, transaction times may vary depending on factors such as the chosen withdrawal method and processing times of external financial institutions. Withdrawals are typically processed within 24 hours. However, withdrawals to Visa and MasterCard may take up to 5 business days to complete.

EDUCATION

An analytical and educational section has been established on the official website, providing traders with valuable video resources on platform usage, account opening procedures, and market analysis techniques.

On the brokers website, the educational section provides information such as

- Trading basics for novice traders

- Webinars on technical and fundamental market analyses

- A separate section containing an economic calendar and FAQs

Each of these tools can be tested for free on a demo account.

Libertex group educational content does not provide any full risk warning about CFD trading. However, before you start CFD trading online, it is necessary to be aware of the fact that about 73.77% of retail investor accounts lose money rapidly due to CFD trading. This is because CFDs are complex instruments and the risk of losing money rapidly is due to the leverage it holds.

CUSTOMER SUPPORT

Libertex provides multilingual support during office hours from Monday to Friday, accessible via email, chat, and phone. Additionally, the website features a dedicated FAQ and Help and Support section for addressing more general queries.

CONCLUSION

Libertex Europe, is one of the financial markets best CFD brokers that deals with money trade CFDs. Libertex is a reputable broker that maintains a representative office in Germany registered with BaFin. Founded in 2012, it is a Cyprus investment firm regulated by the Cyprus Securities Commission. Additionally, clients of Libertex Europe residing in the European economic area and Switzerland have access to investment services offered by the broker.

The broker offers a vast array of over 300 CFD underlying assets and more than 300 real stocks for investment. Notably, Libertex stands out for its competitive pricing mechanism, with low-to-average commissions (starting from 0.0003%) and commission-free trading for certain CFDs in asset classes like energies, indices, and shares. Notably, about 73.77 of retail investor accounts lose money while trading CFDs. This is because CFDs are complex instruments and the risk of losing money rapidly is due to the leverage it holds.

Additionally, Libertex offers very low floating spreads, starting from 0.1 pips.

The broker provides a highly customizable and user-friendly web trading platform and mobile app, along with beginner-friendly MetaTrader 4 & 5 platforms. However, it lacks third-party tools. Despite offering diverse in-house educational materials, the absence of third-party content such as Autochartist limits alternative perspectives for traders. Nonetheless, Libertex‘s choice of platforms and low trading fees can benefit both novice and experienced traders, enabling the implementation of various trading strategies, from high-frequency trading to swing and day trading.

If you found this Libertex Review to be informative, you can visit their website here.

You can also discover additional reviews here.