Who Are Lux Trading Firm

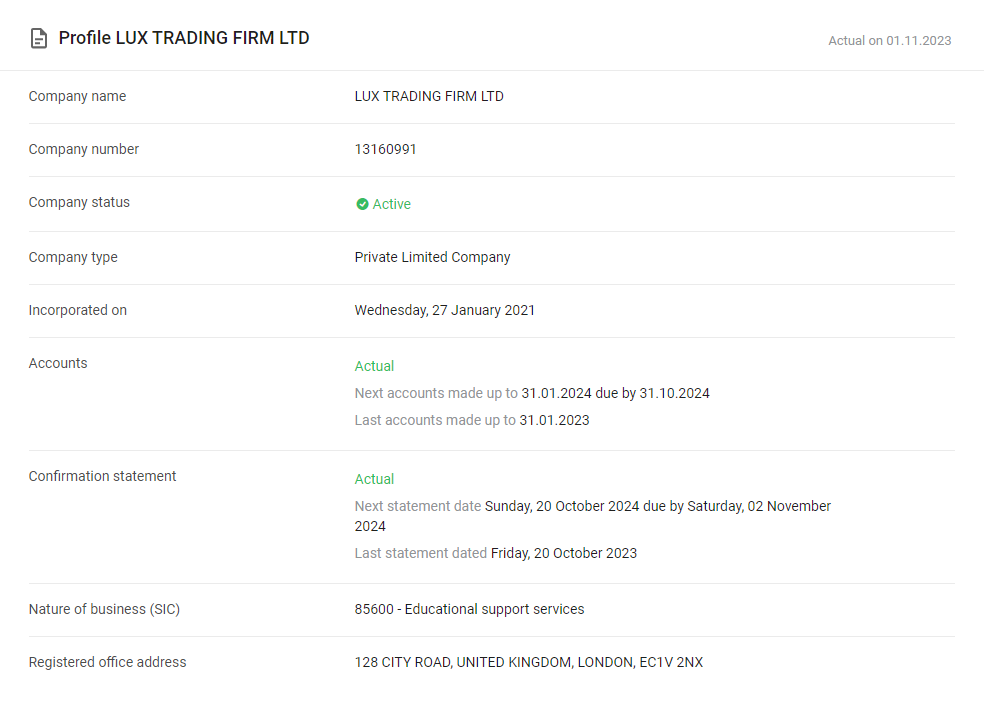

Lux Trading Firm is a proprietary trading firm incorporated under the legal name Lux Trading Firm Ltd on the 27th day of January 2021. It is a London-based prop firm located at 128 city road, London ECIV 2NX, United Kingdom with other subdivisions situated in Dubai and the United Arab Emirates.

Lux Trading Firm offers two account types: a One-step evaluation and a Two-step evaluation for traders to choose from while in partnership with Ox securities as their broker.

Funding Program Options

Lux Trading Firm provides two funding option to its traders:

- Two-step evaluation

- One-step evaluation.

Two-Step Evaluation:

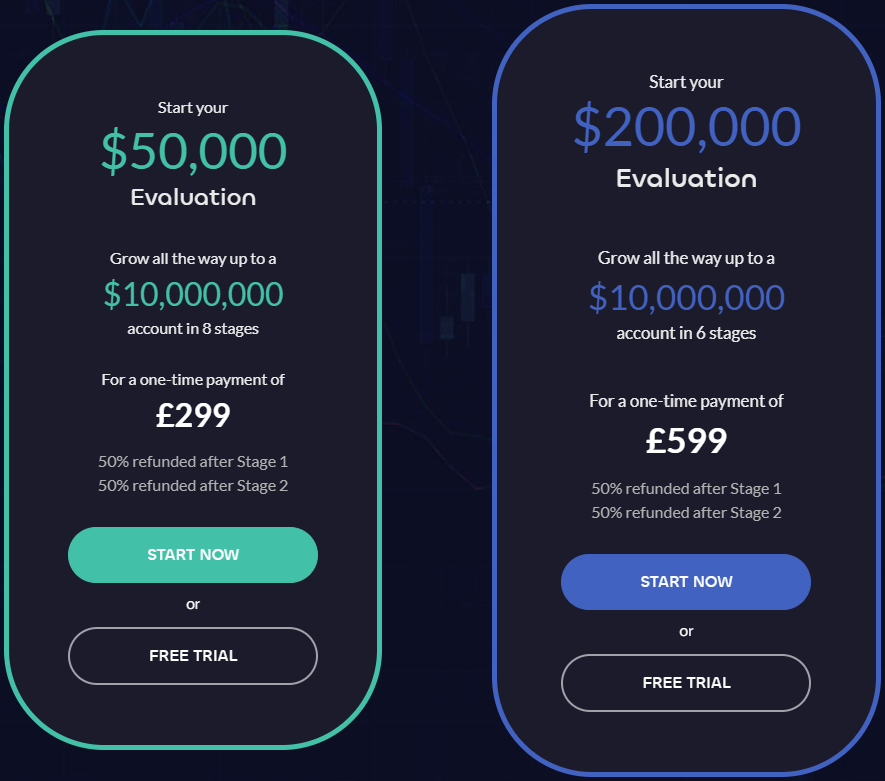

Lux Trading Firm two-step evaluation aims to identify talented traders that can efficiently manage risk and remain profitable. Traders have access to account sizes ranging from $50,000 to $200,000 and can trade with up to 1:30 leverage.

Evaluation phase one requires traders to reach a profit target of 6% without breaching the 6% maximum trading loss rule. For this stage, there are no time requirements. However, traders are expected to trade for at least 29 calendar days or 15 calendar days for swing traders in order to proceed to phase 2 and. A 50% refund is also provided for the traders from their one-time payment fee.

Evaluation phase two, requires a trader to reach a profit target of 4% without surpassing the 5% maximum trading loss rule. There are no minimum or maximum trading day requirements for this phase. This takes off the pressure in trading and gives you enough time to test out your trading strategies before becoming a funded trader. Upon completing the first stage, you’ll receive a 50% refund of your initial one-time fee.

Once both phases are successfully completed, you will receive a funded account. There are no minimum withdrawal requirements and you are expected to respect the 6% maximum trading loss rule. The first payout is made 30 days after your first trading day and subsequent withdrawals are done monthly. A profit split of 75% is given to the traders based on the profit they make in their funded account.

Two-Step Evaluation Scaling Plan:

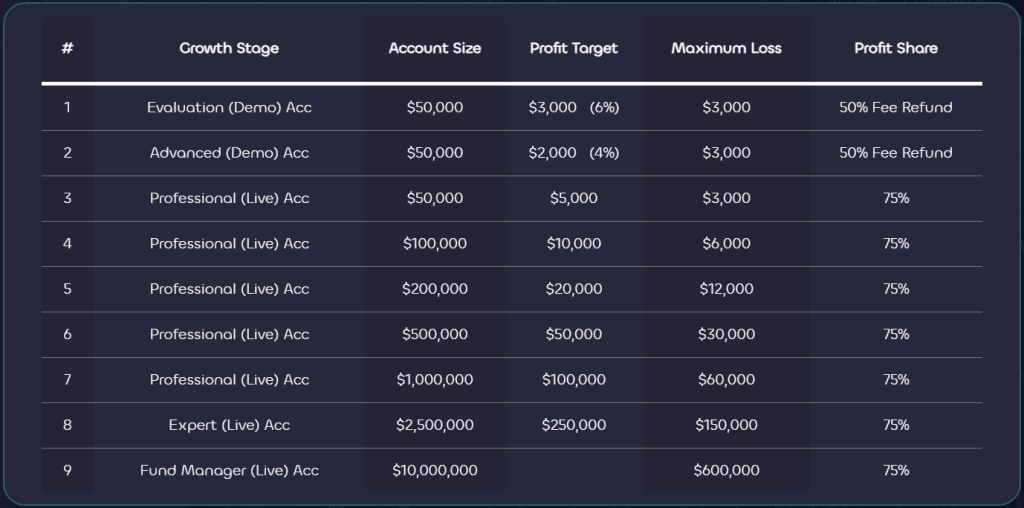

The two-step evaluation also has a unique scaling plan. If a trader meets a 10% profit target on your funded account, you will be able to scale your account to the next account size. Keep in mind that if you decide to scale your account, you still get to keep your profits.

Two-Step Evaluation Trading Rules & Objectives:

Profit Target- Traders must achieve a designated profit percentage to successfully conclude evaluation phases, scale their account and make withdrawals. The profit targets for phase one and phase two are 6% and 4% respectively. There is no specific profit target for funded accounts.

Maximum Trailing Loss- All account sizes have a maximum trailing loss of 6%.

Minimum Trading Days- The minimum trading day requirement for phase one is 29 calendar days (15 calendar days for swing traders), while phase 2 has no minimum trading days requirements.

Stop-Loss Required- Before taking any trade you must use a stop-loss to manage your trades to avoid taking excess loss in a single trade.

No Martingale- Traders are not allowed to use any form of martingale strategy with their trading.

One Segment Of Trading- This means that traders are only allowed to trade one financial instrument using their account. For instance, you can only trade forex pairs or commodities but not both on a single trading account.

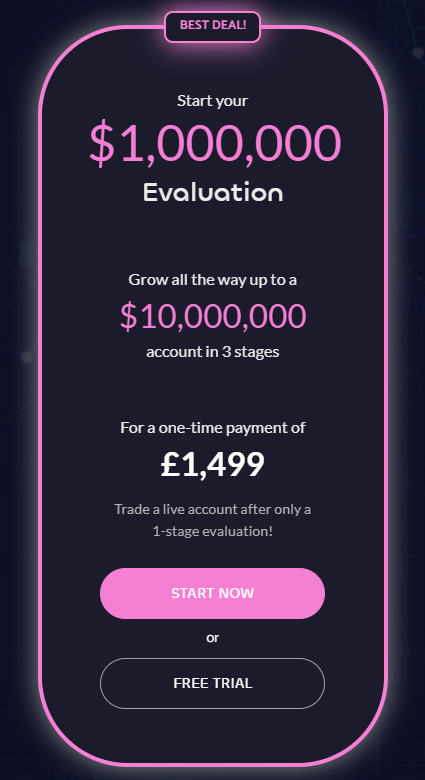

One-Step Evaluation:

Lux Trading Firm one-step evaluation aims to identify talented traders that can efficiently manage risk and remain profitable. Traders have access to account sizes ranging from $50,000 to $200,000 and can trade with up to 1:30 leverage.

The evaluation stage requires traders to reach a profit target of 15% while not breaching the 6% maximum trading loss rule. For this stage, there are no time requirements. However, traders are expected to trade for at least 29 calendar days or 15 calendar days for swing traders. The time period still provides for flexibility in trading and enough time to test your trading strategies before becoming a funded trader.

Once the evaluation process is successfully completed, you will receive a funded account. There are no minimum withdrawal requirements and you are expected to respect the 6% maximum trading loss rule. The first payout is made 30 days after your first trading day and subsequent withdrawals are done monthly. A profit split of 75% is given to the traders based on the profit they make in their funded account.

One-Step Evaluation Scaling Plan

The One-step Evaluation also has a unique scaling plan. If a trader meets a 10% profit target on your funded account, you will be able to scale your account to the next account size. Keep in mind that if you decide to scale your account, you still get to keep your profits.

One-Step Evaluation Trading Rules & Objectives

Profit Target- Traders must achieve a designated profit percentage to successfully conclude evaluation phases, scale their account and make withdrawals. The profit targets for the evaluation stage is 15%. There is no specific profit target for funded accounts.

Maximum Trailing Loss- All account sizes have a maximum trailing loss of 6%.

Minimum Trading Days- The minimum trading day requirement for phase one is 29 calendar days (15 calendar days for swing traders), while phase 2 has no minimum trading days requirements.

Stop-Loss Required- Before taking any trade you must use a stop-loss to manage your trades to avoid taking excess loss in a single trade.

No Martingale- Traders are not allowed to use any form of martingale strategy with their trading.

One Segment Of Trading- This means that traders are only allowed to trade one financial instrument using their account. For instance, you can only trade forex pairs or commodities but not both on a single trading account.

What Sets Lux Trading Firm Apart from Other Prop Firms?

Lux Trading Firm distinguishes itself from other prop trading firms due to its unique offerings: a one-step evaluation and a two-step evaluation. These account types are designed to provide desirable conditions both for experienced traders and beginners.

Lux Trading Firm’s Two-step Evaluation requires traders to successfully complete two stages before receiving a funded account and becoming eligible for payouts. The profit target is 6% in phase one and 4% in phase two, including a 6% maximum trailing loss rule. There are no maximum trading day requirements during either evaluation phase. But, you are required to trade for at least 29 trading days (15 calendar days for swing traders) in phase one. There are no minimum trading day requirements in phase two.

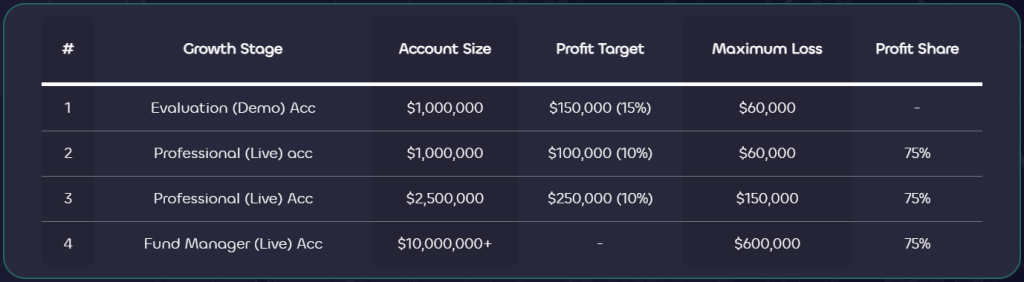

The Two-step Evaluation stands out due to its unique scaling plan, allowing traders to manage even larger account sizes up to $10,000,000. In addition, it has an unlimited trading period and no minimum trading day requirements.

Lux Trading Firm’s One-step Evaluation requires traders to successfully complete a single phase before receiving a funded trading account and becoming eligible for payouts. The profit target is 15%, with a 6% maximum trailing loss rule. There are no maximum trading day requirements during the evaluation phase. This is a realistic program for experienced traders that want access to trading capital as quickly as possible.

However, you have to trade a minimum of 29 trading days to pass the evaluation phase. The One-step Evaluation also has a unique scaling plan, giving you access to up to $10,000,000 as trading capital. The program also stands out due to its unlimited trading period.

The profit targets on both account types is modest and there is a 50% refund on your one-time payment if you pass the two-step evaluation. The availability of substantial trading capital up to $10,000,000 gives Lux Trading Firm an edge over other prop trading firms.

Is Getting Lux Trading Firm Capital Realistic?

Evaluating the attainability and market analysis of trading requirements is necessary when considering a proprietary trading firm that aligns with your trading style. Most prop trading firms may appear attractive with their high percentage profit split on funded trading accounts, but the firm could decrease your chance of success if it requires substantial monthly gains with minimal maximum drawdown.

Time constraints is another feature to pay attention to when looking at prop trading firms. Having unlimited trading period or at least a realistic one, takes the pressure off and allows you to acquaint yourself with the prop firm.

Getting familiar with trading rules during evaluation processes and successive funding stages minimizes the risk of accidentally violating your trading account terms.

- Getting capital from the Two-step Evaluation is practical due to its modest profit targets (6% in phase one and 4% in phase two) along with its realistic maximum loss rule (6% maximum trailing loss) . With regards to trading days, there is no maximum trading day requirement however there is a minimum trading day requirement of 29 calendar days in phase one. There are no maximum or minimum trading day requirements for phase two. Moreover, upon successful completion of both evaluation phases, participants are eligible for a payout and a generous profit split of 75%.

- Getting capital from the One-step Evaluation is practical due to its above average profit target of 15% along with its average maximum loss rule (6% maximum trailing loss) . With regards to trading days, there is no maximum trading day requirement however there is a minimum trading day requirement of 29 calendar days. Moreover, upon successful completion of both evaluation phases, participants are eligible for a payout featuring a beneficial profit split of 75%.

In light of all these factors, Lux Trading Firm is highly recommended. It takes into consideration the needs of traders through its unique funding programs: a One-step evaluation and a two-step evaluation. It features highly realistic profit targets and modest trading objectives to qualify for a funded account and subsequent payouts compared to other prop firms.

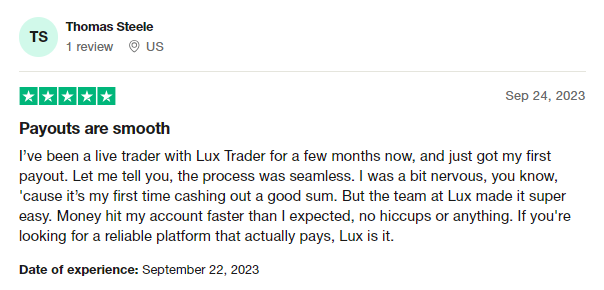

Payment Proof

Lux Trading Firm has garnered a large community of traders who enjoy using it as a trading platform and have reached funded status.

Keep in mind that after the evaluation phases are completed and you have received your funded account, you become eligible for your first payout 30 days after your first trading day. A profit split of 75% is also awarded to traders based on profits generated in their funded account.

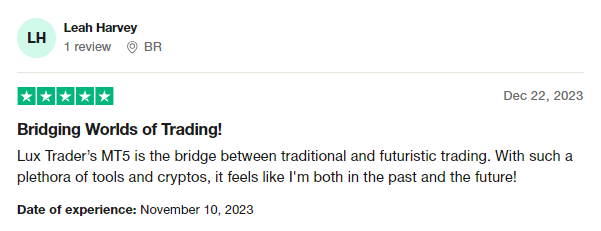

In addition, Lux Trading Firm offers payment proof which can be found in different websites for instance Trustpilot.

Trustpilot is a website that gives the traders the opportunity to comment or give their opinions on working with the company as well as the payment scheme. There traders can find various payment proofs which gives an insight into how successful clients are on the trading platform.

The YouTube platform also serves as another source of payment proof for the prop firm. Here, other potential traders who want to venture into the trading market can find and listen to interviews with numerous successful traders.

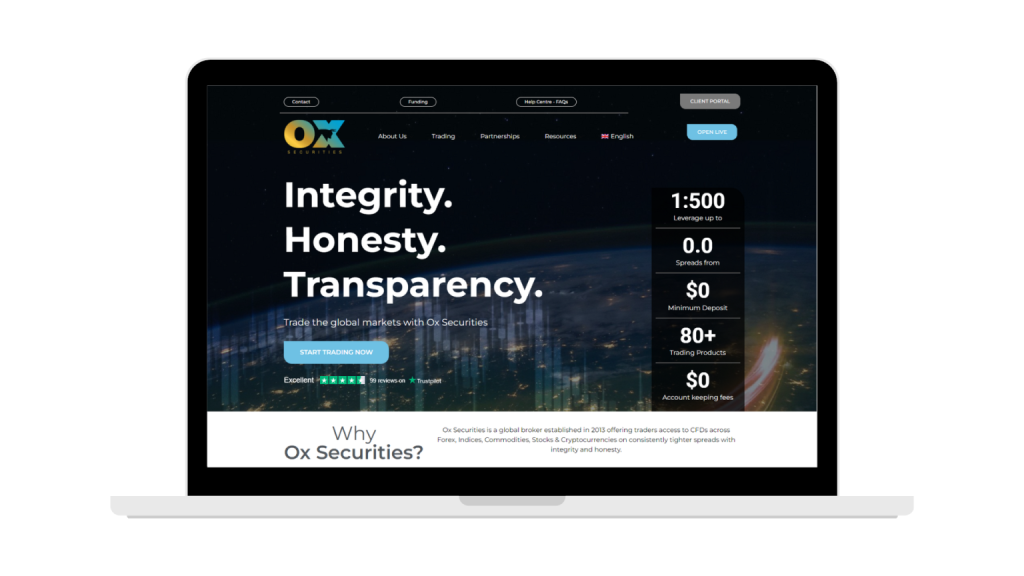

Which Broker Does Lux Trading Firm Use?

The firm partners with Ox securities as their broker.

The company is a renowned one and has been in the trading industry since 2013. It partners with prop firms like Lux Trading Firm to give traders access to the world’s tradable market, such as foreign exchange pairs, CFDs, commodities, and indices. The company houses virtues of integrity, honesty and transparency while making sure that their customers have the best technology and an excellent customer support service through various platforms and devices.

Lux Trading Firm allows its traders to trade on a platform known as The Lux Trader or MetaTrader 5.

Trading Instruments

Lux Trading Firm provides a number of trading instruments for traders to work with including forex pairs, commodities and indices, with 1:30 ratio leverage depending on the trading instrument used.

Education

Lux Trading Firm does have an extensive blog section for its community. There you can learn more about trading strategy and how to trade forex pairs.

Lux Trading Firm also provides a free trial option to its growing community of traders. So before you make any financial commitment, you can familiarize themselves with the prop firm and its trading rules while trading with the company.

Lux Trading Firm also provides up-to-date trading dashboards to keep track of their trading progress, which is necessary at the evaluation phase and for managing funded accounts.

Trustpilot Feedback

Trustpilot is a website used for gathering the comments and opinions of traders working with the company. The feedback enables the prospective traders to know how well the prop firm is doing and the overall experience of traders on the platform.

Lux Trading Firm has received impressive ratings of 4.4 out of 5 from a substantial pool of 587 reviews. 81% of these reviews awarded the trading firm the highest rating of 5 stars.

Lux Trading Firm traders recommend it as one of the most reliable prop firms because of its impeccable layout, easy-to-use interface, and clear policies.

You can find reviews of other prop firms on TrustPilot and make comparisons.

Customer Support

Traders can reach Lux Trading Firm customer representatives through their email at sales@luxtradingfirm.com. You can also learn more about the prop firm and have your immediate questions answered by using the FAQ page or by checking any of their social media pages.

Is Lux Trading Firm Legit?

Lux Trading Firm is one of the best prop firms and has made a name for itself as one of the most reliable prop firms. It affords its traders the opportunity to choose between two funding programs, a two-step evaluation and a one-step evaluation.

It further caters to the needs of a diverse range of individuals with different trading styles by providing features, such as an unlimited and no minimum trading day period to this effect. It is an excellent decision for traders with good trading strategy wanting to grow in the field and make profit consistently.

The educational resources combined with various financial instruments affords traders the opportunity to profit from different trading and investment opportunities.

For more information to enhance trading success you can visit our website and read comprehensive reviews of forex proprietary trading firms and get the latest prop firm news by visting our website