The Good and Bad about MyFundedFX

MyFundedFX evaluates the potential of their traders by requiring them to pass a one-step or two-step evaluation challenge. During this process, traders are provided with a demo account that contains virtual funds for trading, and their performance is closely monitored.

Pros

- Excellent Trustpilot rating of 4.7/5

- Unlimited trading period to complete evaluation phases

- 80% profit splits

- Maximum balance of up to $1,500,000

- Overnight and weekend holding allowed

- Bi-weekly payouts

- Scaling account option

- News trading allowed

- A large variety of trading instruments

- Leverage up to 1:100

Cons

- No Free Trial

- Trailing drawdown on one-step challenge accounts

- Lot size limitations

Pros

- Excellent Trustpilot rating of 4.7/5

- Unlimited trading period to complete evaluation phases

- 80% profit splits

- Maximum balance of up to $1,500,000

- Overnight and weekend holding allowed

- Bi-weekly payouts

- Scaling account option

- News trading allowed

- A large variety of trading instruments

- Leverage up to 1:100

Cons

- No Free Trial

- Trailing drawdown on one-step challenge accounts

- Lot size limitations

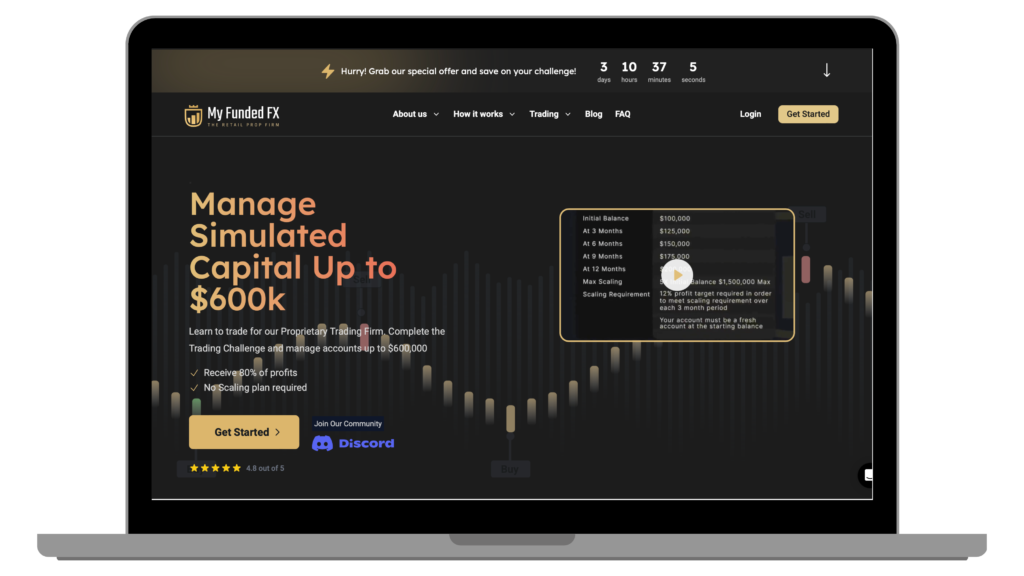

MyFundedFX offers traders challenge programs that allow them to trade without risking their own capital. Profitable traders are rewarded with a payment based on a specific percentage of the profits they generate, and they have no liability on the firm’s capital. Traders have the opportunity to manage account sizes of up to $300,000 and can earn profit splits of 80%. They can achieve these results by trading a variety of instruments, including forex pairs, commodities, indices, and cryptocurrencies.

Who is MyFundedFX?

MyFundedFX is a proprietary trading firm that was incorporated in June 2022. The firm is based in the United States, with its office located at 100 Crescent Court Suite 700, Dallas, TX 75201. MyFundedFX offers traders the opportunity to merge their accounts up to $300,000 and provides a scaling plan to further increase their account balance. The firm has partnerships with Eightcap and ThinkMarkets, serving as their brokers.

Funding Program Options

MyFundedFX provides traders with three different program options to choose from:

- One-step evaluation challenge accounts.

- Normal two-step evaluation challenge accounts.

- Pro two-step evaluation challenge accounts.

One-Step Evaluation

Account Size

Price

$5,000

$50

$10,000

$100

$25,000

$200

$100,000

$500

$200,000

$950

$300,000

$1,399

Account Size

Price

$5,000

$50

$10,000

$100

$25,000

$200

$100,000

$500

$200,000

$950

$300,000

$1,399

The one-step evaluation challenge account at MyFundedFX demands that traders achieve a profit target of 10% while ensuring they do not exceed the 4% maximum daily loss and 6% maximum trailing loss limits. There are no minimum trading day requirements, and traders have an unlimited time period to meet the profit target.

Upon successfully completing the one-step evaluation challenge, traders receive a funded account with no profit targets. They are only required to adhere to the 4% maximum daily loss and 6% maximum trailing loss rules. The initial profit split is 80% based on profits earned 14 calendar days after the first position is placed on the funded account. Subsequent payouts are made on a bi-weekly basis.

One Step Evaluation Scaling Plan

The one-step evaluation challenge accounts at MyFundedFX also feature a scaling plan. To be eligible for scaling, traders must achieve profitability within a three-month period, maintaining an average return of 12% or more over that time frame. Successful traders will receive an account increase of 25% of their original account balance, up to a maximum balance of $1,500,000.

For example:

- After 3 months: If you have a $200,000 account, your account balance will increase to $250,000.

- After the next 3 months: The balance of $250,000 increases to $300,000.

- After the subsequent 3 months: The balance of $300,000 increases to $350,000.

- And so on…

Traders in the one-step evaluation challenge accounts can trade a variety of instruments, including forex pairs, commodities, indices, and cryptocurrencies.

One-Step Evaluation Rules

Profit Target: Traders must achieve a specific percentage of profit before completing the evaluation phase, withdrawing profits, or scaling their account. The profit target for the evaluation period is 10%, while the funded account has no profit targets.

Maximum Daily Loss: This represents the maximum loss a trader can incur on a daily basis before violating the account rules. All account sizes have a maximum daily loss of 4%.

Maximum Trailing Drawdown: Maximum trailing drawdown is the highest account balance achieved minus the maximum drawdown. All account sizes have a maximum trailing drawdown of 6%.

Lot Size Limit: Traders are required to adhere to specified lot sizes for different trading instruments, often based on the initial account balance of the proprietary firm account.

Third-Party Copy Trading Risk: If you plan to use copy trading services, be aware that using a third-party copy trading service may involve other traders employing the same trading strategy. This could potentially lead to denial of a funded account or withdrawal if you exceed the maximum capital allocation rule.

Third-Party EA Risk: Similarly, if you intend to use an Expert Advisor (EA) developed by a third party, there may be other traders using the same EA and strategy. Using a third-party EA carries the risk of being denied a funded account or withdrawal if you exceed the maximum capital allocation rule.

Normal Two Step Challenge

MyFundedFX’s normal two-step evaluation challenge account is designed to recognize traders who demonstrate consistency and discipline throughout a two-phase evaluation period. Traders are rewarded for their performance in this program, and they can trade with leverage of up to 1:100.

Account Size

Price

$5,000

$50

$10,000

$100

$25,000

$200

$100,000

$500

$200,000

$950

$300,000

$1,399

Account Size

Price

$5,000

$50

$10,000

$100

$25,000

$200

$100,000

$500

$200,000

$950

$300,000

$1,399

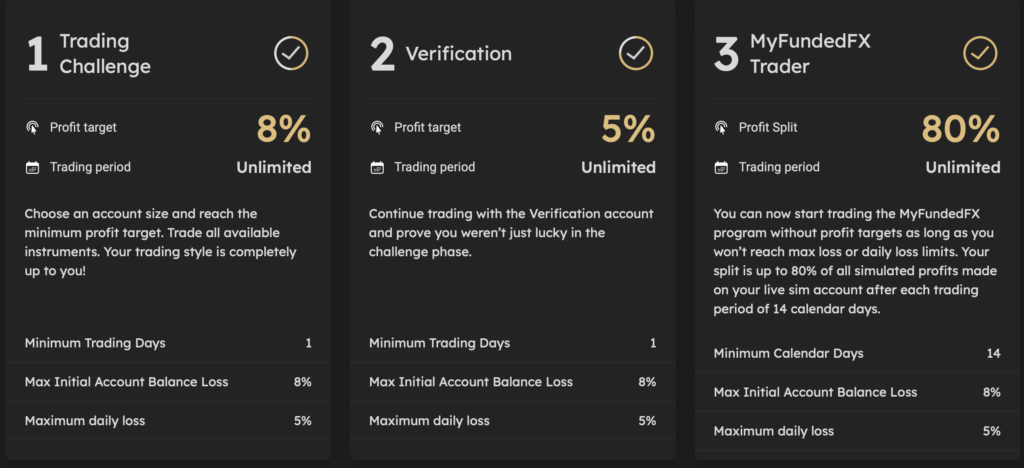

To successfully complete the normal two-step evaluation challenge account at MyFundedFX, traders must meet specific targets in each of the two evaluation phases. In phase one, traders are required to achieve a profit target of 8% while ensuring they do not exceed a 5% maximum daily loss or an 8% maximum loss. There are no minimum trading day requirements during this phase.

In phase two, traders must reach a profit target of 5% while also maintaining a 5% maximum daily loss and an 8% maximum loss. Like in phase one, there are no minimum trading day requirements.

Upon successfully completing both evaluation phases, traders are rewarded with a funded account where they are no longer required to meet profit targets. Instead, they must adhere to the 5% maximum daily loss and 8% maximum loss rules. The initial profit split is 80% of the profits made within 14 calendar days after the first position was opened in the funded account. Subsequent payouts are made on a bi-weekly basis.

Normal Two-Step Challenge Scaling Plan

For traders pursuing the normal two-step evaluation challenge accounts at MyFundedFX, there is also a scaling plan available. To become eligible for scaling, traders must achieve profitability within a three-month period, maintaining an average return of 12% profit or more over this duration. Upon meeting this requirement, traders will receive an account increase of 25% of their original account balance, up to a maximum balance of $1,500,000.

Here’s an example to illustrate how the scaling works:

- Initial account balance: $200,000

- After 3 months: The account balance increases to $250,000.

- After the next 3 months: The balance of $250,000 increases to $300,000.

- After the subsequent 3 months: The balance of $300,000 increases to $350,000.

- And so on…

Trading instruments available for normal two-step evaluation challenge accounts include forex pairs, commodities, indices, and cryptocurrencies.

Normal Two-Step Challenge Rules

Profit Target: Traders must achieve an 8% profit target in the first evaluation phase and a 5% profit target in the second phase. Funded accounts have no profit targets.

Maximum Daily Loss: The maximum daily loss allowed for all account sizes is 5%.

Maximum Loss: Traders should not exceed an 8% maximum loss, which applies to all account sizes.

Lot Size Limit: Traders are required to adhere to specified lot sizes for specific trading instruments, often based on the initial account balance of the prop firm account.

Third-Party Copy Trading Risk: Traders intending to use copy trading services should be aware that using a third-party copy trading service may expose them to other traders using the same strategy. This can potentially result in being denied a funded account or withdrawal if exceeding the maximum capital allocation rule.

Third-Party EA Risk: If traders plan to use an EA (Expert Advisor), they should consider that other traders might already be using the same EA and strategy. Using a third-party EA may lead to the risk of being denied a funded account or withdrawal if exceeding the maximum capital allocation rule.

Pro Two Step Evaluation Challenge

MyFundedFX’s professional two-step evaluation challenge account is designed to recognize traders who demonstrate consistency and discipline throughout the two-phase evaluation process. Traders who opt for this evaluation program can trade with a leverage of 1:50.

Account Size

Price

$5,000

$70

$10,000

$135

$25,000

$250

$50,000

$375

$100,000

$575

$200,000

$1,100

$300,000

$1,600

Account Size

Price

$5,000

$70

$10,000

$135

$25,000

$250

$50,000

$375

$100,000

$575

$200,000

$1,100

$300,000

$1,600

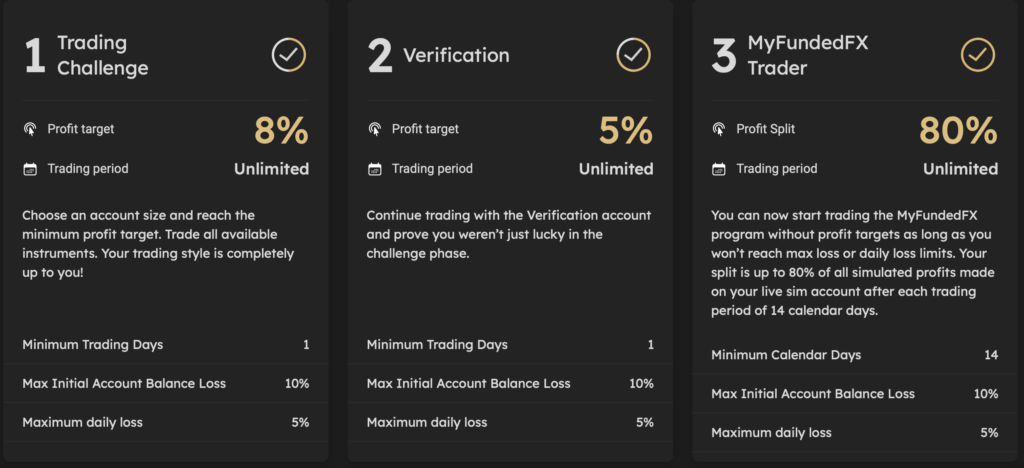

During the first evaluation phase, a trader is expected to achieve an 8% profit target while adhering to the 5% maximum daily loss or 10% maximum loss rules. There are no specific minimum trading day requirements during this phase, and traders can trade without time limitations.

The second evaluation phase entails reaching a 5% profit target while maintaining the same 5% maximum daily loss or 10% maximum loss restrictions. Similar to the first phase, there are no minimum trading day requirements, and traders can take as much time as needed to meet the profit target. Successfully completing both evaluation phases grants the trader a funded account.

In the funded account, there are no profit targets to meet. Traders are only required to follow the 5% maximum daily loss and 10% maximum loss rules. Initial profit splits are set at 80%, calculated based on profits made 14 calendar days after the first position was opened on the funded account. Subsequent payouts occur bi-weekly.”

Pro Two Step Evaluation Challenge Scaling Plan

Scaling plans are also available for Pro two-step evaluation challenge accounts. To be eligible for scaling, traders must demonstrate profitability within a three-month period, maintaining an average return of 12% profit or more over this duration. Upon meeting these criteria, traders will receive an account increase of 25% of the original account balance, with a maximum limit of $1,500,000.

For instance:

- After 3 months: If your account starts with $200,000, your account balance will grow to $250,000.

- After the next 3 months: The balance of $250,000 will increase to $300,000.

- Subsequently, after the next 3 months: The balance of $300,000 will further increase to $350,000.

- This pattern continues accordingly.

Traders operating Pro two-step evaluation challenge accounts have access to a range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies

Pro Two Step Evaluation Challenge Rules

Profit targets are specific percentage objectives that traders must achieve to progress through evaluation phases, withdraw profits, or become eligible for account scaling. Phase 1 requires an 8% profit target, while Phase 2 has a 5% profit target. Funded accounts do not have profit targets.

The maximum daily loss represents the highest allowable daily loss before an account is violated. For all account sizes, this limit is set at 5%. Similarly, the maximum loss is the highest allowable overall loss before the account is violated, with all account sizes capped at 10%.

Lot size limits dictate specific lot sizes for various trading instruments, typically determined by the initial account balance of the prop firm account.

Traders using third-party copy trading services should be aware that other traders may be employing the same strategy. This can potentially affect their eligibility for a funded account or withdrawal if they exceed the maximum capital allocation rule.

Similarly, traders using third-party EAs should consider that others may be using the same strategy. This also carries the risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded

Is Getting MyFundedFX Capital Realistic?

Assessing the realism of trading requirements is crucial when selecting a prop firm that aligns with your forex trading style. While a firm offering a high profit split on a well-funded account may seem enticing, it’s essential to consider if they expect unrealistically high monthly gains with low maximum drawdown percentages. Unrealistic requirements can significantly diminish your chances of success.

Receiving capital through the one-step evaluation challenge accounts is generally realistic, as they feature an average profit target of 10% along with reasonable maximum loss rules (4% maximum daily and 6% maximum trailing loss).

The normal two-step evaluation challenge accounts also offer realistic opportunities, given their relatively low profit targets (8% in phase one and 5% in phase two) and slightly below-average maximum loss rules (5% maximum daily and 8% maximum loss).

Likewise, the pro two-step evaluation challenge accounts provide realistic prospects, featuring relatively low profit targets (8% in phase one and 5% in phase two) and average maximum loss rules (5% maximum daily and 10% maximum loss).

Considering these factors, MyFundedFX stands out as an excellent choice for obtaining funding, offering three distinct funding programs with realistic trading objectives and payout conditions.

Payment Proof

MyFundedFX, established in June 2022, has a payout structure that begins with the first payout becoming available 14 calendar days after obtaining a live-funded account. Following this initial payout, traders receive payouts on a bi-weekly basis. To provide further assurance, you can access a substantial collection of payment proof on MyFundedFX’s Discord channel, specifically under the ‘Payout proof’ section.

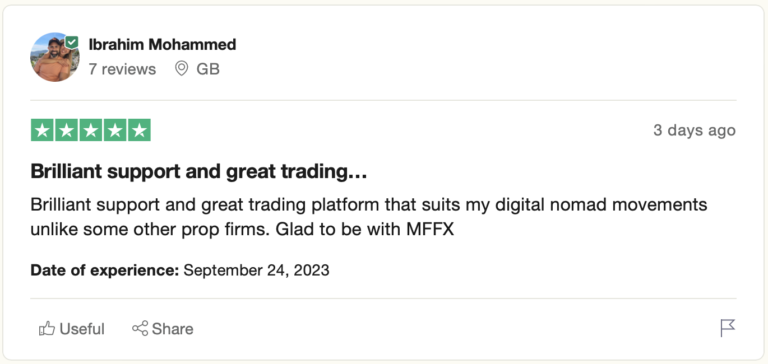

MyFundedFX Traders Feedback

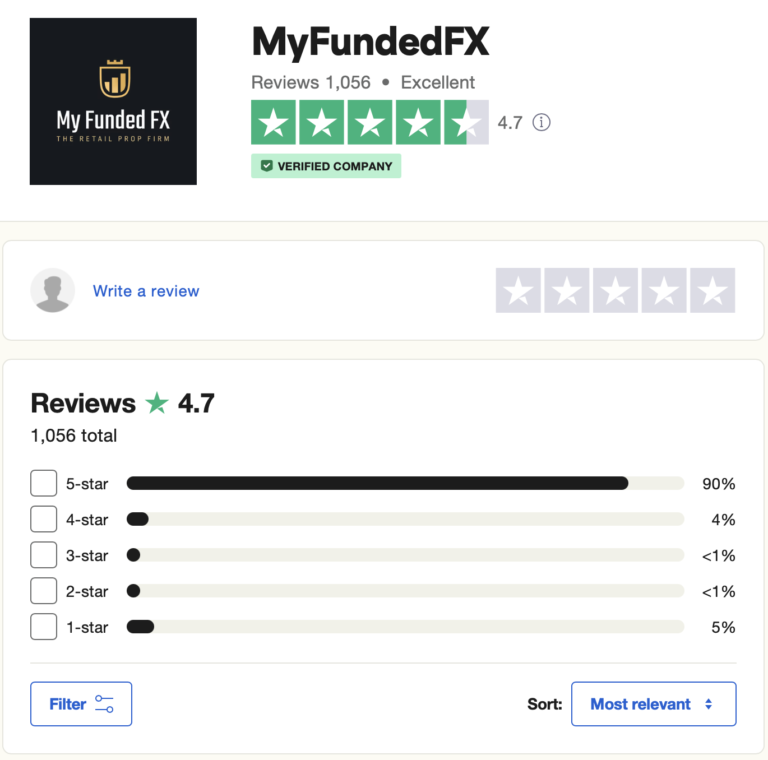

MyFundedFX has garnered exceptional feedback from user reviews

On Trustpilot, MyFundedFX has received a high level of community feedback, with a strong rating of 4.7/5 from a total of 1,056 reviews.

Support

MyFundedFX offers a comprehensive support system to assist traders with any inquiries or issues. You can visit their FAQ page for answers to common questions. Additionally, their customer support team can be reached via email at support@Myfundedfx.com. For more immediate assistance, you can utilize their efficient live chat support, where their team will promptly address any concerns or provide general information about their proprietary trading services.

Conclusion

In summary, MyFundedFX stands as a reputable proprietary trading firm, offering traders a choice among three distinct funding programs: one-step challenge accounts and two two-step challenge accounts. Furthermore, they provide traders with relatively lenient trading regulations and an unrestricted trading timeframe, allowing for overnight and weekend trades, as well as trading during news releases.

One-step evaluation challenge accounts necessitate the completion of a single phase before achieving funding eligibility and the ability to earn profit shares. MyFundedFX mandates that traders attain a 10% profit target before becoming funded. These requirements are realistic given the 4% maximum daily drawdown and 6% maximum trailing drawdown rules in place. With one-step evaluation programs, traders can secure 80% profit shares, with opportunities for account scaling.

The normal two-step evaluation challenge adheres to industry standards, comprising two phases that must be completed to achieve funding and profit-sharing eligibility. MyFundedFX sets profit targets at 8% in phase one and 5% in phase two, which are attainable goals considering the 5% maximum daily and 8% maximum loss rules that traders must follow. Normal two-step evaluation challenge accounts offer 80% profit shares and the potential for account scaling.

Similarly, the pro two-step evaluation challenge aligns with industry norms, featuring two phases that traders must complete to attain funding and profit-sharing eligibility. MyFundedFX sets profit targets at 8% in phase one and 5% in phase two, which are realistic goals given the 5% maximum daily and 10% maximum loss rules that traders must adhere to. Pro two-step evaluation challenge accounts offer 80% profit shares and opportunities for account scaling.

I would recommend MyFundedFX to traders seeking a reputable proprietary trading firm with clear and straightforward rules and trading objectives. They provide favorable conditions for a diverse range of traders with unique trading strategies. After evaluating all that MyFundedFX has to offer, it is evident that they are one of the top proprietary trading firms in the industry.

If you found this MyFundedFX Review to be informative, you can visit their website here.

You can also discover additional Propfirm reviews here.