Who are True Forex Funds?

True Forex Funds is a proprietary trading firm registered under the legal name TFF International Kft. It was established in October 2021. True Forex Funds has its headquarters in Győr, Hungary, and is being managed by CEO Richard Nagy.

True Forex Funds provides traders with the opportunity to choose between four account types, three two-step evaluations, and a one-step evaluation.

The firm is partnered with a tier-1 liquidity provider that offers the best simulated real market trading conditions as their broker.

True Forex Funds headquarters are located at Móricz Zsigmond rkp. 1/B. fszt. 14, 9022, Győr, Hungary.

Funding Program Options

True Forex Funds provides its traders with four unique funding program options:

- Standard Offer

- Quick Funding

- Timeless Funding

- One-phase Funding

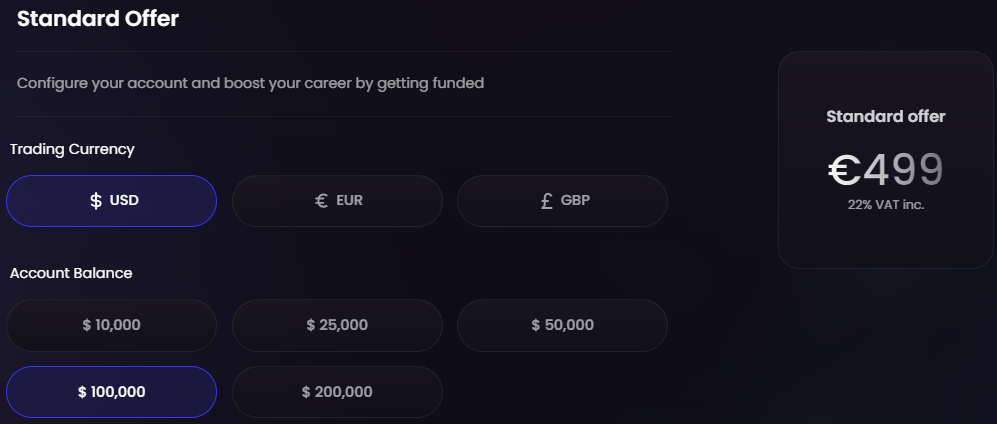

Standard Offer

True Forex Funds Standard Offer is designed to identify profitable traders who can efficiently and profitably manage risk. The evaluation program offers traders the opportunity to manage account sizes ranging from $5,000 up to $200,000 and trade with a leverage of up to 1:100. Traders can also choose their account funding currency between USD, EUR, and GBP.

Evaluation phase one requires a trader to attain an 8% profit target without exceeding their 5% maximum daily loss or 10% maximum loss rules. There are time limitations in place. Phase one requires you to reach the profit target within 30 calendar days. Moreover, you are expected to trade for a minimum of 5 calendar days in order to proceed to phase two.

Evaluation phase two requires a trader to reach a 5% profit target without exceeding their 5% maximum daily loss or 10% maximum loss rules. Phase two has a longer time period as you are expected to reach the profit target within 60 calendar days and trade for a minimum of 5 calendar days in order to proceed to a funded account.

Once both evaluation phases are successfully completed, you will receive a funded account. There are no minimum withdrawal requirements but you do have to respect the 5% maximum daily loss and 10% maximum loss rules. Your initial payout is 14 calendar days from the day you place your first trade on your funded account. All subsequent withdrawals will be processed bi-weekly. Based on the profit made on the funded account, you will be eligible for an 80% profit split.

Standard Offer Scaling Plan

The Standard Offer also has a scaling plan. If a trader demonstrates profitability over the last three months with an average return of 8% over the three months and completes at least three successful withdrawals, then they can scale their account to the next available size. The account increase will be equal to 25% of the initial account size.

Example:

After 3 Months: A $50,000 account increases to $62,500.

After the Next 3 Months: A $62,500 account increases to $75,000.

After the Next 3 Months: A $75,000 account increases to $87,500.

Standard Offer Trading Rules

- Profit Target: Traders must attain an assigned profit percentage to successfully end an evaluation phase, withdraw earnings, or scale their trading account. The profit target for Phase 1 is set at 8%, whereas Phase 2 requires a profit target of 5% to be met. Funded accounts do not have any specified profit targets.

- Maximum Daily Loss: The maximum loss allowed for a trader to lose in a single trading day without exceeding the account’s limit. The maximum daily loss limit for all account sizes is 5%.

- Maximum Loss: The maximum loss limit for all account sizes is 10%.

- Minimum Trading Days: The minimum duration during which you must engage in trading before successfully concluding an evaluation phase. Both evaluation phases have a minimum trading day requirement of 5 days.

- Maximum Trading Period: The maximum trading duration during which you must achieve your required profit target and conclude your evaluation phase. The evaluation phase one has a maximum trading period of 30 calendar days and 60 calendar days for phase two.

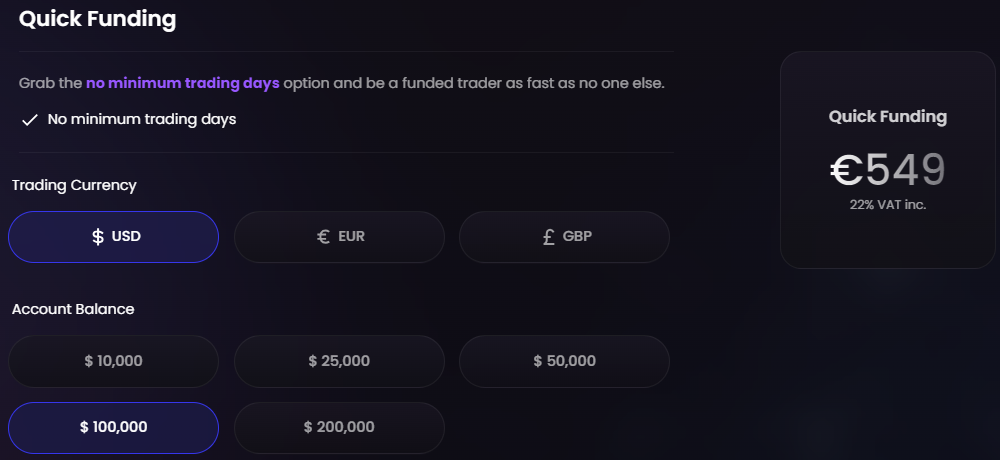

Quick Funding

True Forex Funds Quick Funding is designed to identify talented traders who can be profitable and manage risk throughout the two-step evaluation period. It offers traders the opportunity to manage account sizes ranging from $5,000 up to $200,000 and trade with a leverage of up to 1:100. In addition, you can choose your account funding currency between USD, EUR, and GBP.

Evaluation phase one requires a trader to meet the 8% profit target without exceeding their 5% maximum daily loss or 10% maximum loss rules. Concerning time limitations, note that phase one requires you to reach the profit target within 30 calendar days. However, there is no minimum trading day requirement in order to proceed to phase two.

Evaluation phase two requires a trader to reach a 5% profit target without exceeding their 5% maximum daily loss or 10% maximum loss rules. The time limitation for this phase is higher as you are expected to reach the profit target within 60 calendar days. However, there are no minimum trading day requirements in order to proceed to a funded account.

By concluding both evaluation phases, you will receive a funded account. There are no minimum withdrawal requirements. However, you have to respect the 5% maximum daily loss and 10% maximum loss rules. Your initial payout is 14 calendar days from the day you execute your first trade. All subsequent withdrawals follow the same procedure. Based on the profit made on the funded account, you will be eligible for an 80% profit split.

Quick Funding Scaling Plan

The Quick Funding also has a scaling plan. If a trader demonstrates profitability over the last three months with an average return of 8% over the three months and completes at least three successful withdrawals, then they will become eligible for an account size increase equal to 25% of the initial account size.

Example:

After 3 Months: A $50,000 account increases to $62,500.

After the Next 3 Months: A $62,500 account increases to $75,000.

After the Next 3 Months: A $75,000 account increases to $87,500.

Quick Funding Trading Rules & Objectives

- Profit Target: Traders must attain an assigned profit percentage to successfully end an evaluation phase, withdraw earnings, or scale their trading account. The profit target for Phase 1 is set at 8%, whereas Phase 2 requires a profit target of 5% to be met. Funded accounts do not have any specified profit targets.

- Maximum Daily Loss: The maximum loss allowed for a trader to lose in a single trading day without exceeding the account’s limit. All account sizes are subject to a maximum daily loss limit of 5%.

- Maximum Loss: The maximum overall loss limit permitted for a trader to lose without surpassing the account’s threshold. All account sizes are subject to a maximum loss of 10%.

- Maximum Trading Period: The maximum trading duration during which you must achieve your required profit target and conclude your evaluation phase. The evaluation phase one has a maximum trading period of 30 calendar days and 60 calendar days for phase two.

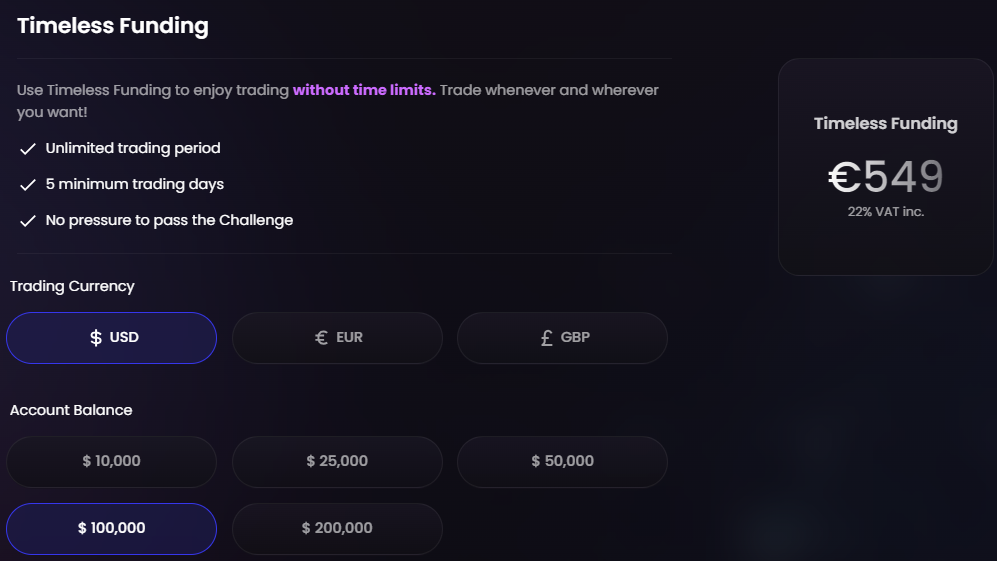

Timeless Funding

True Forex Funds Timeless Funding is designed to identify talented traders who can be profitable and manage risk throughout the two-step evaluation period. It offers traders the opportunity to manage account sizes ranging from $5,000 up to $200,000 and trade with a leverage of up to 1:100. In addition, you can choose your account funding currency between USD, EUR, and GBP.

Evaluation phase one requires a trader to attain an 8% profit target without exceeding their 5% maximum daily loss or 10% maximum loss rules. There is no maximum trading day requirement during phase one. However, you are expected to trade for a minimum of 5 trading days in order to proceed to phase two.

Evaluation phase two requires a trader to reach a 5% profit target without exceeding their 5% maximum daily loss or 10% maximum loss rules. There is also no maximum trading day requirement as well. However, you are expected to trade for a minimum of 5 trading days in order to proceed.

Upon passing both evaluation phases, you will receive a funded account. There are no minimum withdrawal requirements but you are to respect the 5% maximum daily loss and 10% maximum loss rules. You can process your first payout 14 calendar days from the day you place your first trade. All subsequent withdrawals follow the same process. Based on the profit made on the funded account, you will be eligible for an 80% profit split.

Timeless Funding Scaling Plan

The Timeless Funding also has a scaling plan. If a trader demonstrates profitability over the last three months with an average return of 8% over the three months and completes at least three successful withdrawals, then they will become eligible for an account size increase equal to 25% of the initial account size.

Example:

After 3 Months: A $50,000 account increases to $62,500.

After the Next 3 Months: A $62,500 account increases to $75,000.

After the Next 3 Months: A $75,000 account increases to $87,500.

Timeless Funding Trading Rules & Objectives

- Profit Target: Traders must attain an assigned profit percentage to successfully end an evaluation phase, withdraw earnings, or scale their trading account. The profit target for Phase 1 is set at 8%, whereas Phase 2 requires a profit target of 5% to be met. Funded accounts do not have any specified profit targets.

- Maximum Daily Loss: The maximum loss allowed for a trader to lose in a single trading day without exceeding the account’s limit. The maximum daily loss limit on all account sizes is 5%.

- Maximum Loss: The maximum overall loss limit permitted for a trader to lose without surpassing the account’s threshold. The maximum loss limit on all account sizes is 10%.

- Maximum Trading Period: The maximum trading duration during which you must achieve your required profit target and conclude your evaluation phase. Both evaluation phases have a minimum trading day requirement of 5 days.

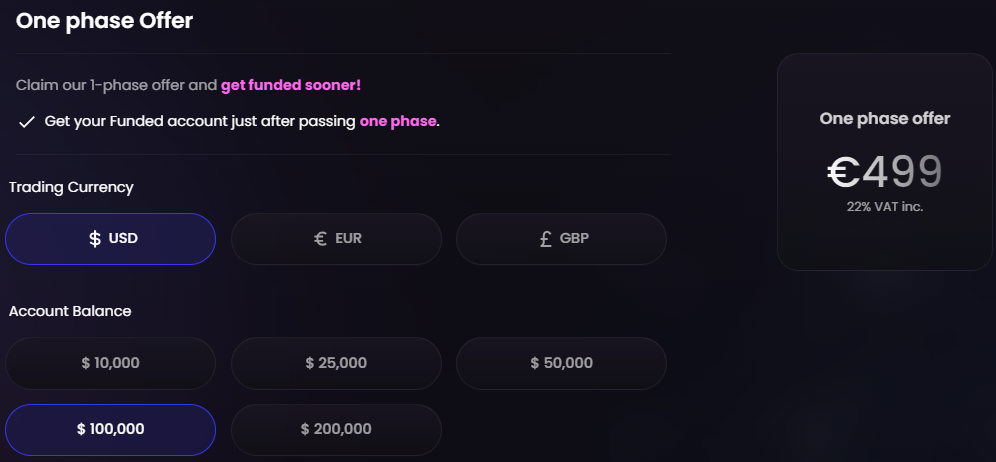

One-phase Funding

True Forex Funds One-phase Funding is designed to identify talented traders who can be profitable and manage risk throughout the two-step evaluation period. It offers traders the opportunity to manage account sizes ranging from $5,000 up to $200,000 and trade with a leverage of up to 1:30. In addition, you can choose your account funding currency between USD, EUR, and GBP.

Evaluation phase one requires a trader to hit the 10% profit target without exceeding their 3% maximum daily loss or 6% maximum loss rules. Although there is no maximum trading day requirement during phase one, you are expected to trade for a minimum of 5 trading days to proceed to phase two.

Evaluation phase two requires a trader to reach a 5% profit target without exceeding their 5% maximum daily loss or 10% maximum loss rules. Concerning time limitations, there are no maximum trading day requirements for phase two. However, you are expected to trade for a minimum of 5 trading days in order to proceed.

By concluding both evaluation phases, you are rewarded a funded account that has no minimum withdrawal requirements. Your only obligation is to respect the 5% maximum daily loss and 10% maximum loss rules. You can process your first payout 14 calendar days from the day you place your first trade on your funded account. All subsequent withdrawals can be processed bi-weekly. Based on the profit made on the funded account, you will be eligible for an 80% profit split.

One-phase Funding Scaling Plan

The One-phase Funding also has a scaling plan. If a trader demonstrates profitability over the last three months with an average return of 8% over the three months and completes at least three successful withdrawals, then they will become eligible for an account size increase equal to 25% of the initial account size.

Example:

After 3 Months: A $50,000 account increases to $62,500.

After the Next 3 Months: A $62,500 account increases to $75,000.

After the Next 3 Months: A $75,000 account increases to $87,500.

One-phase Funding Trading Rules & Objectives

- Profit Target: Traders must attain an assigned profit percentage to successfully end an evaluation phase, withdraw earnings, or scale their trading account. The profit target for the evaluation phase is set at 10%. Funded accounts do not have any specified profit targets.

- Maximum Daily Loss: The maximum loss allowed for a trader to lose in a single trading day without exceeding the account’s limit. All account sizes are subject to a maximum daily loss limit of 3%.

- Maximum Loss: The maximum overall loss limit permitted for a trader to lose without surpassing the account’s threshold. All account sizes are subject to a maximum loss of 6%.

- Minimum Trading Days: The minimum duration during which you must engage in trading before successfully concluding an evaluation phase. The evaluation phases have a minimum trading day requirement of 5 days.

- Maximum Trading Period: The maximum trading duration during which you must achieve your required profit target and conclude your evaluation phase. The evaluation phase has a maximum trading period of 30 calendar days.

What Makes True Forex Funds Different From Other Prop Firms?

True Forex Funds differ from the majority of industry-leading prop firms mainly due to the fact that it provides four distinct options for traders. There are four account types: three two-step evaluations and a one-step evaluation.

True Forex Funds’ Standard Offer requires traders to conclude two evaluation phases successfully before becoming eligible for an account.

True Forex Funds’ Quick Funding is a two-step evaluation that requires traders to conclude two evaluation phases successfully before becoming eligible for payouts.

True Forex Funds’ Timeless Funding is a two-step evaluation that requires traders to conclude two evaluation phases successfully before becoming eligible for payouts.

True Forex Funds’ One-phase Funding is a one-step evaluation that requires traders to conclude one evaluation phase successfully before becoming eligible for payouts.

All funding programs have scaling plans. This enables traders to consistently grow their portfolio and enjoy more rewards for trading if they are profitable. All withdrawals are also processed bi-weekly.

In summary, True Forex Funds differs from other industry-leading prop firms by providing four unique account types: three two-step evaluations and a one-step evaluation. The different funding options means that there is something for everybody regardless of your skill level and trading needs. Although there are time limitations for most of the funding programs, it isn’t excessively restrictive. During the evaluation period, you can still get an idea of what the prop firm offers and test your skills as well.

Is Getting True Forex Funds Capital Realistic?

Before trading with a prop firm, it is important to access its features and trading requirements to determine if it aligns with your trading style and needs. It is also necessary to compare its offerings with that of other prop trading firms before making a decision. If a prop firm provides an attractive profit split but sets high trading costs and commissions, it reduces the possibility of growing your account exponentially. Time constraints are also an important factor to consider.

Flexibility in trading is essential because it takes the burden off an already stressful process. Moreover, the more time you have to trade, the easier it is to acquaint yourself with the trading rules of the firm.

Receiving capital from the Standard Offer is feasible mainly due to its modest profit targets (8% in phase one and 5% in phase two) coupled with average maximum loss rules (5% maximum daily and 10% maximum loss). It is essential to note that phase one has a maximum of 30 calendar days and 60 calendar days for phase two. There is also a minimum trading day requirement of 5 calendar days. When both evaluation phases are completed successfully, traders can enjoy a profit split of 80%.

Receiving capital from Quick Funding is feasible mainly due to its realistic profit targets (8% in phase one and 5% in phase two) coupled with average maximum loss rules (5% maximum daily and 10% maximum loss). It is essential to note that phase one has a maximum of 30 calendar days and 60 calendar days for phase two. There are no minimum trading day requirements. When both evaluation phases are completed successfully, traders can enjoy a profit split of 80%.

Receiving capital from Timeless Funding is feasible mainly due to its below-average profit targets (8% in phase one and 5% in phase two) coupled with average maximum loss rules (5% maximum daily and 10% maximum loss). It is essential to note that there are no maximum trading day requirements, however, there is a minimum trading day requirement of 5 calendar days. When both evaluation phases are completed successfully, traders can enjoy a profit split of 80%.

Receiving capital from One-phase Funding is feasible mainly due to its average profit target of 10% coupled with average maximum loss rules (3% maximum daily and 6% maximum loss). It is essential to note that there is a maximum of 30 calendar days, with a minimum trading day requirement of 5 calendar days. When both evaluation phases are completed successfully, traders can enjoy a profit split of 80%.

For these reasons, True Forex Funds is a prop firm that comes highly recommended since it provides four unique funding programs to choose from, three two-step evaluations and a one-step evaluation. It provides realistic trading objectives and conditions for receiving a funded trading account and subsequent payouts.

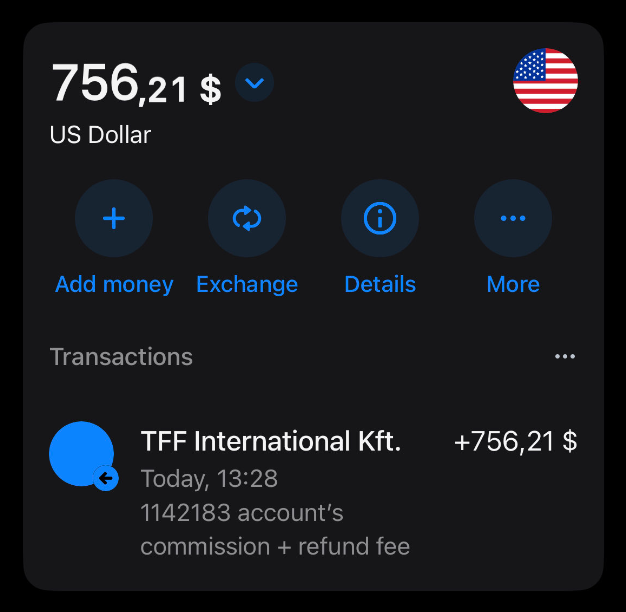

Payment Proof

True Forex Funds is a prop firm established in October 2021. Yet they boast a sizable community of traders who have received funded accounts.

You can find payment proof regarding True Forex Funds on numerous websites. One excellent place where you can find such information, is Trustpilot where their traders share their experience while working with the company and their opinion on the payment process. Additional payment proof of True Forex Funds can be found on their YouTube and Discord channels, where the prop firm posts payout certificates of their traders.

Education

True Forex Funds offers its community a comprehensive Blog of educational resources. Content on the True Forex Funds website is be divided into the following categories:

- Company News: Latest company news and updates.

- Forex Trading: Educational articles about forex trading in general.

- Fundamentals: Educational articles covering the fundamental aspects of trading.

- Market Analysis: Educational market analyses.

- Psychology: Educational articles discussing the psychology in trading.

- Technicals: Educational articles about the technical aspects of trading.

- Testimonials: Educational interviews of the most successful traders.

True Forex Funds also provides traders with a well-designed trader dashboard. This makes it easier to execute risk management strategies and manage your progress through the real-time statistics it provides.

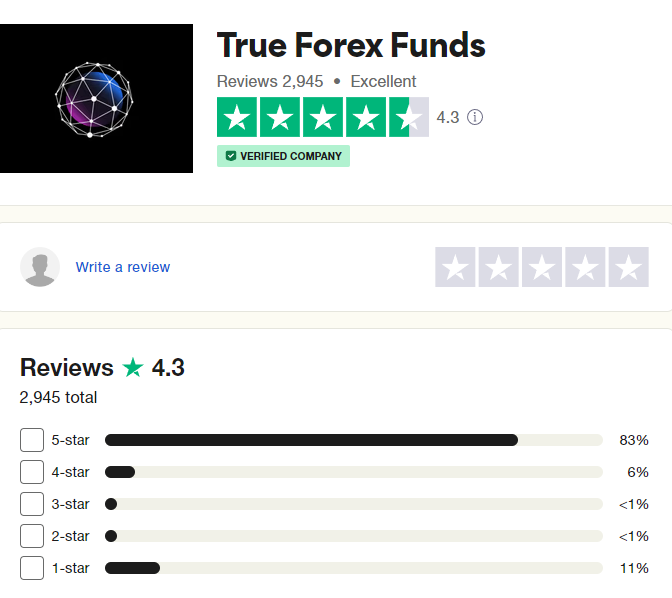

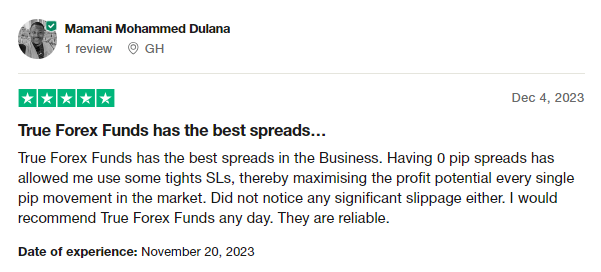

Trustpilot Feedback

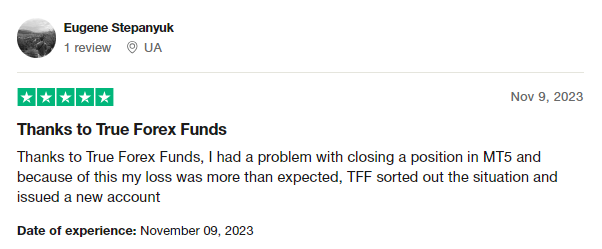

True Forex Funds has garnered an outstanding score on Trustpilot based on their community’s feedback.

On Trustpilot, True Forex Funds has a large number of traders who have reviewed the platform and left positive feedback regarding the company services and offerings. The firm has gathered an impressive rating of 4.3 out of 5 from a substantial pool of 2,945 reviews and 83% of these are 5 star reviews.

Traders appreciate the prop trading firm for having the best spreads in the business, with tight stop-loss orders. The absence of significant slippage is also noted by their clients and they confidently recommend True Forex Funds, emphasizing their reliability.

True Forex Funds customer care has also been praised for their quick responses and hands-on approach to dealing with problems. Their prompt intervention makes it possible to resolve issues in the best way possible and also helps to build trust with their funded traders. The provision of numerous account types is another feature that appeals to traders and places it among other top proprietary trading firms.

Customer Support

If you have questions or concerns about True Forex Funds, you can reach out to customer care through the live chat on the website or via email at support@trueforexfunds.com. Checking their FAQ page could provide you with quick answers but you could get a more detailed response through the Discord channel.

Conclusion

True Forex Funds is a reputable and reliable proprietary trading firm providing traders with an opportunity to choose between four funding programs: the Standard Offer, Quick Funding, and Timeless Funding, which are a two-step evaluation, and One-phase Funding, which is a one-step evaluation.

True Forex Funds is a top-tier prop trading firm. It is suitable for individuals seeking a credible proprietary trading firm that provides a convenient environment for trading and caters to a diverse range of individuals with unique trading styles. The numerous reviews on Trustpilot is a reflection of the trust their existing client base have for the platform and it is a useful indicator of what to expect when you join True Forex Funds

If you found this True Forex Funds Review to be informative, you can visit their website here.

You can also discover additional Propfirm reviews here.