The foreign exchange market, also known as forex or FX, is the world’s largest financial market, with trillions of dollars traded daily. For traders looking to tap into this global market, choosing the best forex broker is crucial. This blog is your one-stop guide to navigating the exciting world of forex trading in 2024.

Whether you’re a seasoned forex trader or a curious beginner, this comprehensive guide will equip you with the knowledge you need to make informed decisions.

We’ll delve into the intricacies of forex trading, from understanding currency pairs (EUR/USD anyone?) to exploring the legalities (yes, forex trading is legal in many jurisdictions, but always check with regulators like the National Futures Association (NFA) or the Australian Securities and Investments Commission (ASIC) to ensure compliance).

We’ll also explore the various features offered by forex brokers, retail traders including forex trading platforms(both web-based and mobile app), trading accounts (tailored to different experience levels), and educational resources.

Understanding factors like trading costs (spreads, commissions, and inactivity fees) and risk management tools (negative balance protection) will be key to navigating the forex market.

But before you jump in, it’s important to understand the risks involved. Forex trading can be volatile, so it’s crucial to start with a well-defined trading strategy and only risk capital you can afford to lose. We’ll explore resources to help you develop your forex trading legal andknowledge and identify reputable online brokers you can trust.

So, whether you’re an aspiring retail trader or a seasoned professional, this blog is your companion on your forex trading journey. Let’s embark on this exciting adventure together and explore the vast potential of the global financial and forex markets!

Understanding Forex Trading

Welcome to the exciting world of forex trading! Here, we’ll break down the basics to get you started:

What is Forex Trading? [What does a forex broker do?]

Forex brokers act as intermediaries, connecting you to the vast interbank market where currencies are traded electronically. They provide user-friendly trading platforms where you can execute forex trades (buying and selling currency pairs like EUR/USD).

In essence, they are your gateway to the global forex market.

Here are some key things forex brokers do:

Provide Trading Platforms: These platforms allow you to place orders, monitor markets, analyze charts, and manage your forex trades.

Offer Different Account Types: Brokers may offer accounts tailored to beginners, experienced traders, or high-volume traders, with varying features and minimum deposits.

Execute Trades: Once you place a trade on your platform, the broker transmits your order to the interbank market for execution.

Hold Your Funds: Forex brokers hold your deposited funds securely in segregated accounts (ideally) to protect your capital.

Provide Customer Support: Reputable brokers offer reliable customer support via phone, email, or live chat to assist you with any queries.

Choosing the right forex broker is crucial for your trading journey. We’ll explore how to select a reliable broker in a later section.

Is Forex Good for Beginning Investors?

Forex trading can be a tempting prospect, but it’s important to be realistic. The market can be volatile, and there are inherent risks involved.

While some beginners find success, forex trading requires discipline, knowledge, and a solid understanding of market dynamics.

It’s not a guaranteed path to riches.

Do I Need a Forex Broker?

Yes, you’ll typically need a forex broker to access the forex market. Forex brokers act as intermediaries, global financial markets connecting you to the interbank market where currencies are traded.

They also have online brokers thatprovide trading platforms for executing your forex trades on. Choosing the right forex broker is crucial, so we’ll delve deeper into that aspect later.

Choosing a Forex Broker

Now that you understand the basics of forex trading, it’s time to find the right partner for your journey: a trusted forex broker.

Choosing the best forex broker depends on your individual needs and your forex trading platform style.

How to Choose the Best Forex Broker?

Forex brokers act as intermediaries, connecting you to the vast interbank market where currencies are traded electronically. They provide user-friendly online trading platforms where you can execute forex trades (buying and selling currency pairs like EUR/USD). Think of them as your gateway to the global forex market.

Here are some key factors to consider when choosing a forex broker:

Regulation: Ensure your chosen broker is regulated by a reputable authority like the National Futures Association (NFA) in the US or the Australian Securities and Investments Commission (ASIC). Regulation helps protect traders and ensures fair practices.

Trading Platform: Forex brokers offer various trading platforms, both web-based and mobile apps. Look for a platform that’s user-friendly, feature-rich (including charting tools and market analysis), and caters to your trading style (beginner-friendly or advanced).

Trading Accounts: Many forex brokers offer different account types tailored to experience levels. Beginner accounts may have lower minimum deposits and educational resources, while advanced accounts might offer higher leverage (use with caution!) and access to additional features.

Trading Costs: Forex brokers typically charge spreads (the difference between the buy and sell price of a currency pair) and commissions on trades. Compare these fees across different brokers to find one with competitive rates that suit your trading volume. Beware of hidden fees like inactivity fees.

Customer Support: Reliable and responsive customer support is crucial. Look for a broker offering 24/5 or even 24/7 support via phone, email, or live chat, especially if you’re a beginner.

Additional Considerations: Forex brokers may offer educational resources, market insights, and even trading signals (use these with caution and develop your own trading strategies). Some brokers cater to high-volume traders with special programs and competitive fees.

What fees should you be aware of when choosing a forex broker? [Trading fees]

Understanding best forex brokers andbroker fees is essential. Here’s a breakdown of the most common ones:

Spreads: The difference between the buy and sell price of a currency pair. This is typically the most significant cost associated with forex trading. Look for brokers with competitive spreads that suit your trading style.

Commissions: Some brokers charge commissions per trade on top of the spread. Compare commission structures across brokers to find one that aligns with your trading volume.

Swap Fees: Overnight fees charged for holding open positions over rollover (typically overnight). These can be especially relevant for swing traders and long-term position holders.

Inactivity Fees: Some brokers charge fees for accounts that haven’t been used for a certain period. Be mindful of these if you’re a casual trader.

How do we review brokers?

We use a comprehensive approach to reviewing forex brokers. We consider factors like:

Regulation: Do they hold licenses with reputable authorities like the NFA or ASIC?

Trading Platform: Is the platform user-friendly, feature-rich, and suitable for beginners or advanced traders?

Account Types: Do they offer a variety of accounts with different minimum deposits, features, and leverage options?

Trading Costs: Are their spreads, commissions, and other fees competitive?

Customer Support: Do they offer reliable and responsive support via phone, email, or live chat?

Educational Resources: Do they provide helpful learning materials and market analysis tools?

Mobile Trading Capabilities: Is their mobile trading platform user-friendly and functional?

We also analyze user reviews and feedback to our data points get a well-rounded picture of customer support and each broker’s strengths and weaknesses.

What to avoid when choosing a forex broker?

There are some red flags to watch out for when choosing a forex broker:

Unrealistic promises of guaranteed profits: Forex trading involves inherent risks, and no broker can guarantee success.

Unregulated brokers: Only trade with brokers licensed by reputable authorities.

High-pressure sales tactics: A legitimate broker won’t pressure you to deposit funds immediately.

Hidden fees: Make sure you understand all the costs associated with trading before opening an account.

By following these tips and conducting your research, you can choose a reliable forex broker that meets your needs and helps you navigate the exciting world of forex trading. Remember, seek independent advice before investing, and never risk more than you can afford to lose. In the

Best Forex Brokers for 2024

In 2024, several top forex brokers have stood out for their exceptional services, competitive fees, and commitment to providing a comprehensive trading experience. Here are some of the best forex brokers for 2024 based on the information gathered from various sources:

1. IG – Interactive Brokers

Overview: IG is recognized for being a great overall broker, particularly catering to professional traders.

Strengths: Offers the best web-based trading platform, extensive educational resources, and a solid reputation in the forex trading community.

Features: Provides a user-friendly platform, live training sessions, tutorials, interactive seminars, webinars, and a demo account with $20,000 in virtual funds for beginners.

Reputation: IG has a solid reputation in the industry, backed by thousands of five-star reviews and over 45 years of experience serving a global clientele.

2. OANDA

Overview: OANDA secures the top position as the premier U.S.-regulated forex broker, offering consistently lower spreads and a range of elite trading platforms.

Strengths: Known for tight spreads with no commission fees, loyalty programs for high-volume traders, and a comprehensive suite of trading tools.

Features: Standard account spreads are typically 18.5% less than the industry average, with OANDA consistently maintaining lower spreads across major currency pairs.

Loyalty Program: OANDA’s Elite Trader program offers rebates for high-volume traders, making it attractive for those with significant trading volumes.

3. Forex.com

Overview: Forex.com is recognized as the lowest spread forex broker, providing competitive pricing and a wide selection of currency pairs.

Strengths: Offers tight spreads, a user-friendly platform, and extensive educational resources for traders of all levels.

Features: Provides a range of currency pairs, tools, and a loyalty program for traders with high volumes.

Spreads: Maintains lower spreads compared to industry averages, making it an attractive choice for cost-conscious traders.

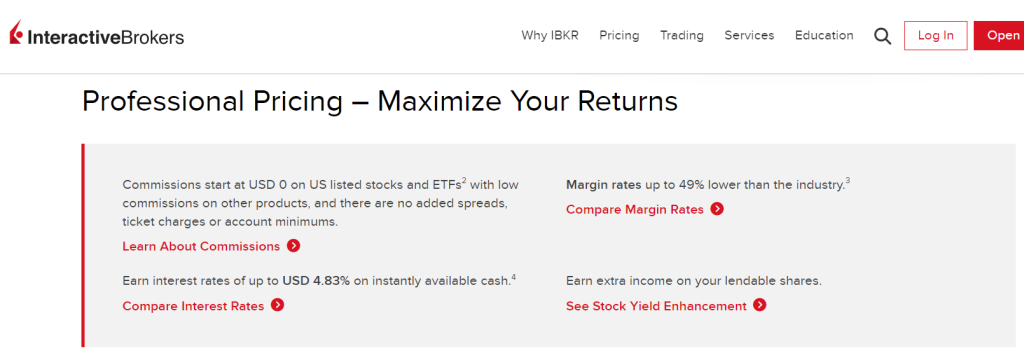

4. Interactive Brokers

Overview: Interactive Brokers is known for its best broker commission rates, making it a preferred choice for traders looking to optimize their trading costs.

Strengths: Offers competitive commission rates, a wide range of trading tools, and a robust trading platform.

Features: Provides a variety of trading options, tools for advanced traders, and a focus on cost-effective trading solutions.

Commission Rates: Interactive Brokers stands out for its competitive commission rates, making it appealing for traders seeking cost-efficient trading options.

These brokers have been selected based on the reputation, services, fees, and overall trading experience they offer to traders in 2024 derivatives and forex markets below. Whether you are a beginner or a seasoned trader, choosing a reputable forex broker is crucial for success in the dynamic world of currency trading.

Getting Started with Forex Trading

Now that you’ve grasped the basics and chosen a reliable forex broker, it’s time to explore how to get started with forex trading. Here’s a roadmap to guide your initial steps:

Can I Start Trading Forex with a Small Amount of Money?

Yes, forex trading can be accessible with a relatively small initial investment compared to other asset classes.

Many forex brokers offer minimum deposits suitable for beginners, allowing you to start small and gradually build your experience and capital.

However, remember, forex trading involves inherent risks, so it’s crucial to only risk what you can afford to lose.

How Much Money Do I Need to Begin Forex Trading?

The initial investment you need for forex trading depends on your risk tolerance and trading goals.

Beginners are recommended to start small, with their initial investments and a deposit that allows them to learn the ropes without risking a significant amount of capital.

As your trading experience grows, you can gradually increase your investment size.

Here’s a general guideline:

Micro Accounts: Some brokers offer micro accounts with minimum deposits as low as $50 or $100. These are ideal for getting a feel for the market without risking a lot.

Mini Accounts: Mini accounts typically have minimum deposits ranging from $250 to $$$1000. These are a good option for beginners who want to test their strategies with a slightly larger investment.

Standard Accounts: Standard accounts often require minimum deposits of $1000 or more. These are suitable for traders with some experience and a higher risk tolerance.

Remember, this is just a starting point. Always consider your financial situation and risk tolerance before investing in forex trading.

How Do I Start Trading Forex?

Once you’ve chosen a forex broker and funded your account, you’re ready to take your first steps:

Familiarize Yourself with the Trading Platform: Spend time exploring your chosen broker’s trading platform. Learn how to navigate the interface, place orders, use charting tools, and access market analysis features. Most brokers offer demo accounts with virtual funds so you can practice without risking real money.

Develop a Trading Strategy: Forex trading is not about random guessing. Develop a trading strategy based on technical analysis (chart patterns, indicators) or fundamental analysis (economic data, news events). Backtest your strategy on historical data to assess its effectiveness before deploying it with real capital.

Start Small and Manage Your Risk: As a beginner, it’s wise to start with small trade sizes. Use risk management techniques like stop-loss orders to limit your potential losses on each trade. Remember, consistency and discipline are key to success in forex trading.

What Types of Assets Can I Trade?

The primary asset class in forex trading is currency pairs. Forex brokers typically offer a variety of major, minor, and exotic currency pairs to trade.

Major pairs like EUR/USD and USD/JPY are the most liquid and widely traded.

Minor pairs involve less common currencies and may have slightly wider spreads.

Exotic forex pairs often involve currencies from emerging markets and can be more volatile.

Some forex brokers may have only trading forex pairs but also offer trading in other asset classes like contracts for difference (CFDs) on commodities, indices, and stocks. However, these instruments can be more complex and carry higher risks.

It’s best to focus on currency pairs until you gain experience in forex trading.

Choosing the right currency pair to trade forex in depends on your risk tolerance, trading style, and market preferences.

For beginners, major currency pairs are often recommended due to their higher liquidity and tighter spreads. You can explore the different currency pairs offered by your chosen forex broker [link to the section “Which forex broker offers the most currency pairs?”].

How to Choose a Suitable Trading Account?

Many forex brokers offer various trading accounts tailored to different experience levels and trading styles. Here’s a breakdown to help you choose:

Beginner Accounts: These accounts typically have lower minimum deposits, educational resources, and basic trading features. They are ideal for getting started and learning the ropes.

Standard Accounts: These accounts offer a wider range of features, including various currency pairs, leverage options, and more advanced charting tools. They are suitable for traders with some experience who are comfortable with a larger investment.

Advanced Accounts: These accounts cater to experienced traders and often include tight spreads, high leverage (use with caution!), and access to advanced trading tools and platforms.

Consider factors like minimum deposit, trading features, spreads, commissions, and educational resources when choosing your account type.

By following these steps, you can equip yourself with the knowledge and tools needed to get started with

Risk Management

Forex trading, like any financial endeavor, involves inherent risks. Effective risk management is crucial to protecting your capital and ensuring a sustainable trading journey. Here, we explore key concepts to help you mitigate risk:

What is negative balance protection in forex trading?

Negative balance protection is a policy offered by some forex brokers that limits potential losses. With negative balance protection, your account balance cannot fall below zero, even if your trades move against you significantly. This can be beneficial for beginners who are still learning the ropes.

It’s important to note that not all forex brokers offer negative balance protection, and regulations regarding it vary across jurisdictions. Always check with your chosen trade forexbroker to see if they offer this feature.

What is a compensation scheme in forex trading?

A compensation scheme is a safety net offered in some countries to protect the retail clients of forex traders in case their broker becomes insolvent. These schemes typically have limitations on coverage amounts.

Research compensation schemes available in your jurisdiction to understand the level of protection they offer.

Remember, compensation schemes are not a substitute for proper risk management. It’s your responsibility to trade wisely and manage your risk exposure.

How to verify if the broker offers a segregated fund?

Segregated funds are accounts where forex traders and brokers hold client funds separate from their own company funds. This helps protect client funds in case the broker encounters financial difficulties.

Look for a forex broker that segregates client funds to add an extra layer of security to your forex trading accounts and experience.

Verification methods can vary. Some brokers clearly state on their websites if they segregate client funds. You can also check with the broker directly or consult regulatory body websites for information on segregation practices.

How to avoid forex trading scams?

![]()

Unfortunately, forex scams do exist. Here are some red flags to watch out for:

Guaranteed profits: Forex trading involves inherent risks, and no broker can guarantee success.

Unrealistic returns: Promises of extraordinary returns are often too good to be true.

Unregulated brokers: Only trade with brokers licensed by reputable authorities like the National Futures Association (NFA) in the US or the Australian Securities and Investments Commission (ASIC).

High-pressure sales tactics: A legitimate forex broker won’t pressure you to deposit funds immediately.

Hidden fees: Make sure you understand all the costs associated with trading before opening an account.

By following these tips and conducting thorough research, online trading you can minimize the risk of falling victim to a forex trading scam. Always choose a reputable, regulated forex broker with a proven track record.

Remember, seek independent advice before investing and never risk more than you can afford to lose. By implementing effective risk management strategies, you can approach forex trading with greater confidence and protect your hard-earned capital.

Frequently Asked Questions

Which forex broker has the best trading platform?

IG stands out for having a first-class web trading platform, offering a superb educational experience, advanced trader, and great deposit and withdrawal options.

Additionally, OANDA is recognized for providing great trading platforms with outstanding research tools and fast, user-friendly account opening.

Which broker is best for forex trading?

In the United States, Forex.com is highlighted as the best forex broker for 2024, offering an excellent selection of currency pairs, competitive spreads, full liquidity providers and diverse technical research tools. Additionally, Exness is recommended as the best overall forex broker to consider in 2024, providing access to high leverage, full liquidity providers multiple trading platforms, and high-quality research tools.

Is $100 enough to start forex?

Yes, it is possible beginner traders to start forex trading with as little as $100. The forex market has a low barrier to entry, allowing traders to begin with relatively small amounts of capital.

Which forex broker is legal in USA?

Forex trading is legal in the United States, but brokers operating in the U.S. must be registered and comply with regulations set by authorities like the Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA).

Do I need a broker for forex?

Yes, you need a broker to participate in forex trading. Brokers provide access to the foreign exchange market and facilitate trades on behalf of traders. It is essential to choose a reputable and regulated broker to ensure fund safety and compliance with regulations.

For more trading success tips, visit our site. Read detailed reviews of forex proprietary trading firms and stay updated with the latest prop firm news.