The Good and Bad about FidelCrest

Fidelcrest extends an invitation to regular traders to undertake their verification challenge. Successfully passing this challenge empowers traders to oversee capital of up to $1,000,000 from any location across the globel.

Pros

- Excellent Trustpilot rating 4.7/5

- Unlimited evaluation free retries

- Multiple add-on options

- Own trading tech - Fidelcrest Markets - 0 commissions and raw spreads

- Multilingual Customer support

- Overnight holding and news trading allowed

- Leverage up to 1:200

- Up to 2,000,000 capital

Cons

- 15% up to 20% profit targets on Aggressive accounts

Fidelcrest motivates traders to excel in their careers by providing the opportunity to generate increased profits through trading with balances of up to $2,000,000. To attain funded status, traders must successfully navigate their 2-step trading challenge. Upon accomplishing this, traders enjoy the benefits of profit splits ranging from 80% to 90% on their earnings.

Who Are FidelCrest

Fidelcrest, established in 2018 by a group of forex traders and professionals, is a proprietary trading firm. Headquartered in Nicosia, Cyprus, and with its IT department based in Tallinn, Estonia, the company provides traders the opportunity to operate with capital of up to $2,000,000. Traders can also partner with Fidelcrest Markets as their brokerage platform

Video Review

Funding Programs

Fidelcrest provides traders with a selection of two distinct programs:

-

- Micro Trader Evaluation Program Accounts

- Normal Micro Trader Evaluation Program Accounts

- Aggressive Micro Trader Evaluation Program Accounts

-

- Micro Trader Evaluation Program Accounts

-

-

Pro Trader Evaluation Program Accounts

- Normal Pro Trader Evaluation Program Accounts

- Aggressive Pro Trader Evaluation Program Accounts

-

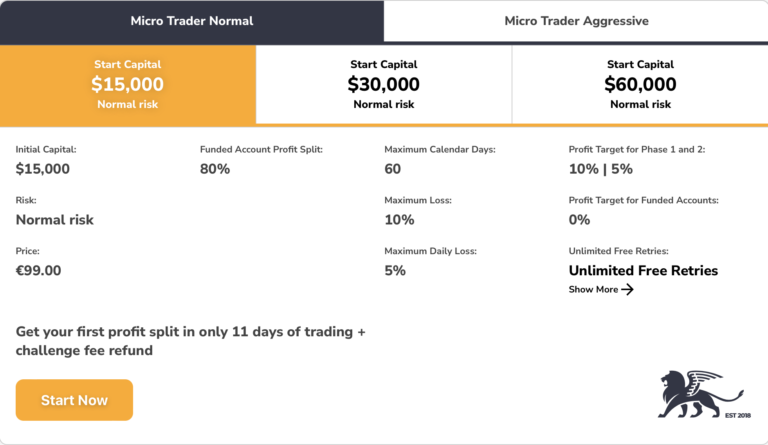

Micro Trader Normal Evaluation

Fidelcrest’s Normal Micro Trader Evaluation Program Account is designed to identify dedicated and skilled traders. These traders are rewarded for their consistent performance during the two-phase evaluation period. This evaluation program account provides the opportunity to trade with leverage of up to 1:200.

Account Size

Price

$15,000

€99

$30,000

€199

$60,000

€299

Micro Trader Normal Evaluation Phases

Evaluation Phase One mandates traders to attain a profit target of 10% without exceeding the 5% maximum daily loss or 10% maximum loss thresholds. The profit target must be reached within 60 calendar days from the initiation of the first position on the evaluation account. No minimum trading day requirements are necessary to progress to evaluation phase two.

Evaluation Phase Two necessitates traders to achieve a profit target of 5% while adhering to the 5% maximum daily loss or 10% maximum loss rules. The profit target must be attained within 60 calendar days from the commencement of the first position on the evaluation account. No minimum trading day prerequisites are essential to move on to a funded account.

Upon successful completion of both evaluation phases, traders are granted a funded account devoid of profit targets. The sole requirements are to adhere to the 5% maximum daily loss and 10% maximum loss rules. The initial payout is accessible ten calendar days after the first position is placed on the funded account, contingent on specific criteria being met. During this timeframe, traders are obliged to trade for a minimum of 10 calendar days and achieve profitability in order to initiate the first withdrawal request. Profit sharing stands at 80% based on the profits accrued in the funded account.

Micro Trader Normal Evaluation Scaling Plan

At present, Normal Micro Trader Evaluation Program Accounts do not come with an available scaling plan

Guidelines for the Normal Micro Trader Evaluation Program Account

- Profit Target: This represents a specific percentage of profit that traders must achieve before completing an evaluation phase, making profit withdrawals, or scaling their accounts. Phase 1 requires a profit target of 10%, while Phase 2 sets a profit target of 5%. Funded accounts are exempt from profit targets.

- Maximum Daily Loss: This is the maximum allowable loss a trader can incur in a single day before the account is considered in violation. All account sizes have a maximum daily loss limit of 5%.

- Maximum Loss: This indicates the overall maximum loss a trader can experience before the account is considered in violation. A maximum loss limit of 10% applies to all account sizes.

- Maximum Trading Days: This defines the maximum timeframe within which traders are expected to achieve a specific profit target or withdrawal objective. Both Phase 1 and Phase 2 encompass a maximum trading period of 60 calendar days.

-

No Martingale Allowed: Traders are prohibited from utilizing any form of martingale strategy during trading.

- Risk Desk Team: This team evaluates whether a trader’s trading strategy aligns with the prop firm’s criteria. If the strategy is deemed ineligible, traders receive a refund on their evaluation account.

- Third-Party Copy Trading Risk: When employing third-party copy trading services, be aware that others may be utilizing the same strategy. Consequently, you risk potential denial of a funded account/withdrawal if you exceed the maximum capital allocation rule

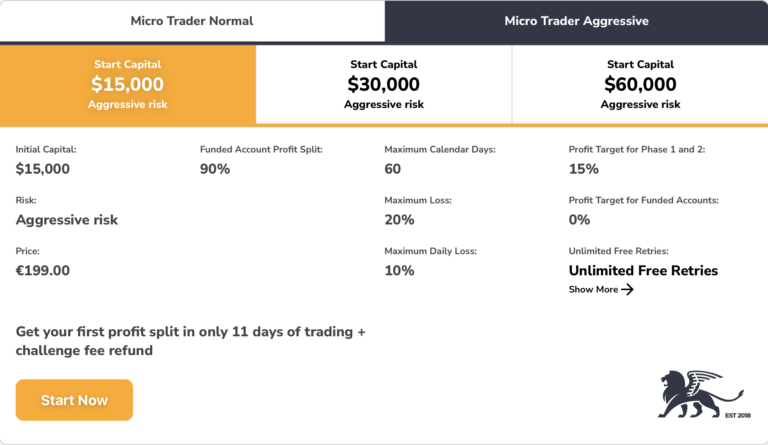

Aggressive Micro Trader Evaluation

Account Size

Price

$15,000

€199

$30,000

€299

$60,000

€399

Aggressive Micro Trader Evaluation Phases

Evaluation phase one mandates traders to attain a profit target of 15%, while ensuring they do not exceed the 10% maximum daily loss or 20% maximum loss thresholds. The profit target must be achieved within 60 calendar days from the initiation of the first position on the evaluation account. There are no minimum trading day requirements to progress to evaluation phase two.

Evaluation phase two requires traders to reach a profit target of 15%, while abiding by the 10% maximum daily loss or 20% maximum loss rules. Similar to phase one, the profit target must be hit within 60 calendar days from the commencement of the first position on the evaluation account. No minimum trading day prerequisites are necessary to move on to a funded account.

Upon successfully completing both evaluation phases, traders are granted a funded account devoid of profit targets. The sole requirements are to adhere to the 10% maximum daily loss and 20% maximum loss rules. The initial payout is accessible ten calendar days after the first position is placed on the funded account, subject to specific criteria. During this timeframe, traders are obligated to trade for a minimum of 10 calendar days while achieving profitability in order to initiate the first withdrawal request. Profit sharing stands at 90% based on the profits generated in the funded account.

Aggressive Micro Trader Evaluation Scaling Plan

At present, Aggressive Micro Trader Evaluation Program Accounts do not include an available scaling plan.

Aggressive Micro Trader Evaluation Rules

- Profit Target: This represents a specific percentage of profit that traders must achieve before completing an evaluation phase, making profit withdrawals, or scaling their accounts. Phase 1 requires a profit target of 15%, while Phase 2 also entails a profit target of 15%. Funded accounts do not have profit targets.

- Maximum Daily Loss: This signifies the maximum allowable loss a trader can incur on a daily basis before the account is considered in violation. All account sizes have a maximum daily loss limit of 10%.

- Maximum Loss: This defines the overall maximum loss a trader can experience before the account is deemed in violation. A maximum loss limit of 20% applies to all account sizes.

- Maximum Trading Days: This denotes the maximum timeframe within which traders are expected to achieve a specific profit target or withdrawal objective. Both Phase 1 and Phase 2 encompass a maximum trading period of 60 calendar days

- No Martingale Allowed: Traders are prohibited from utilizing any form of martingale strategy during trading.

- Risk Desk Team: This team evaluates whether a trader’s trading strategy aligns with the prop firm’s criteria. If the strategy is deemed ineligible, traders receive a refund on their evaluation account.

- Third-Party Copy Trading Risk: When employing third-party copy trading services, be aware that others may be utilizing the same strategy. Consequently, you risk potential denial of a funded account/withdrawal if you exceed the maximum capital allocation rule.

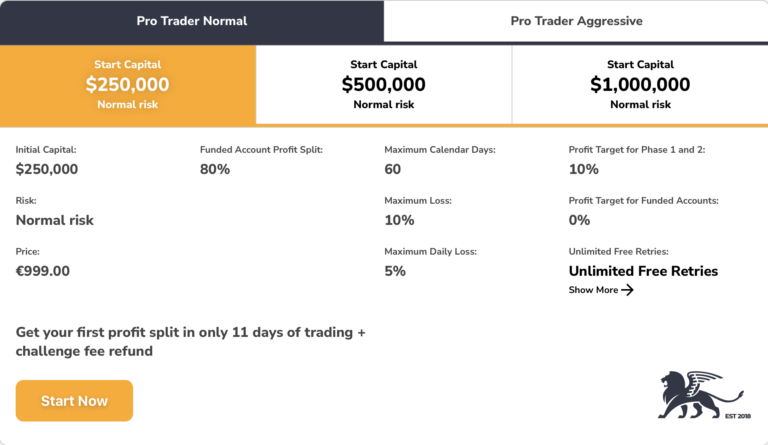

Pro Trader Normal Evaluation

Fidelcrest’s Normal Pro Trader Evaluation Program Account is designed to recognize dedicated and skilled traders, rewarding them for their consistent performance throughout the two-phase evaluation period. This evaluation program account provides the opportunity to trade with leverage of up to 1:200

Account Size

Price

$250,000

€999

$500,000

€1,899

$1,000,000

€2,999

Pro Trader Normal Evaluation Phases

Evaluation phase one mandates traders to achieve a profit target of 10%, while ensuring they do not exceed the 5% maximum daily loss or 10% maximum loss thresholds. The profit target must be reached within 60 calendar days from the day the first position is placed on the evaluation account. There are no minimum trading day requirements to proceed to evaluation phase two.

Evaluation phase two necessitates traders to reach a profit target of 10%, while adhering to the 5% maximum daily loss or 10% maximum loss rules. The profit target must be hit within 60 calendar days from the initiation of the first position on the evaluation account. There are no minimum trading day prerequisites to progress to a funded account.

Upon successfully completing both evaluation phases, traders are granted a funded account without profit targets. The only requirement is to respect the 5% maximum daily loss and 10% maximum loss rules. The initial payout is available ten calendar days after placing the first position on the funded account, provided certain criteria are met. During this period, traders must trade for a minimum of 10 calendar days while also achieving profitability to request the first withdrawal. Profit sharing is set at 80% based on the profit generated in the funded account.

Pro Trader Normal Evaluation Scaling Plan

Currently, there is no available scaling plan for Normal Pro Trader Evaluation Program Accounts

Pro Trader Normal Evaluation Rules

-

Profit Target: The profit target is a specific percentage of profit that traders must achieve before completing an evaluation phase, withdrawing profits, or scaling their account. Phase 1 entails a profit target of 10%, and Phase 2 also involves a profit target of 10%. Funded accounts do not have profit targets.

-

Maximum Daily Loss: This refers to the maximum loss a trader can incur in a single day before the account is considered in violation. All account sizes have a maximum daily loss limit of 5%.

-

Maximum Loss: This indicates the maximum overall loss a trader can experience before the account is considered in violation. A maximum loss limit of 10% applies to all account sizes.

-

Maximum Trading Days: This represents the maximum period within which traders are required to achieve a specific profit target or withdrawal objective. Both Phase 1 and Phase 2 encompass a maximum trading period of 60 calendar days.

-

No Martingale Allowed: Traders are prohibited from using any form of martingale strategy during trading.

-

Risk Desk Team: This team assesses whether a trader’s trading strategy aligns with the prop firm’s criteria. If the strategy is deemed ineligible, traders receive a refund on their evaluation account.

-

Third-Party Copy Trading Risk: If you plan to use copy trading services, consider that other traders might already be using the same strategy through a third-party copy trading service. This increases the risk of being denied a funded account or withdrawal if you exceed the maximum capital allocation rule.

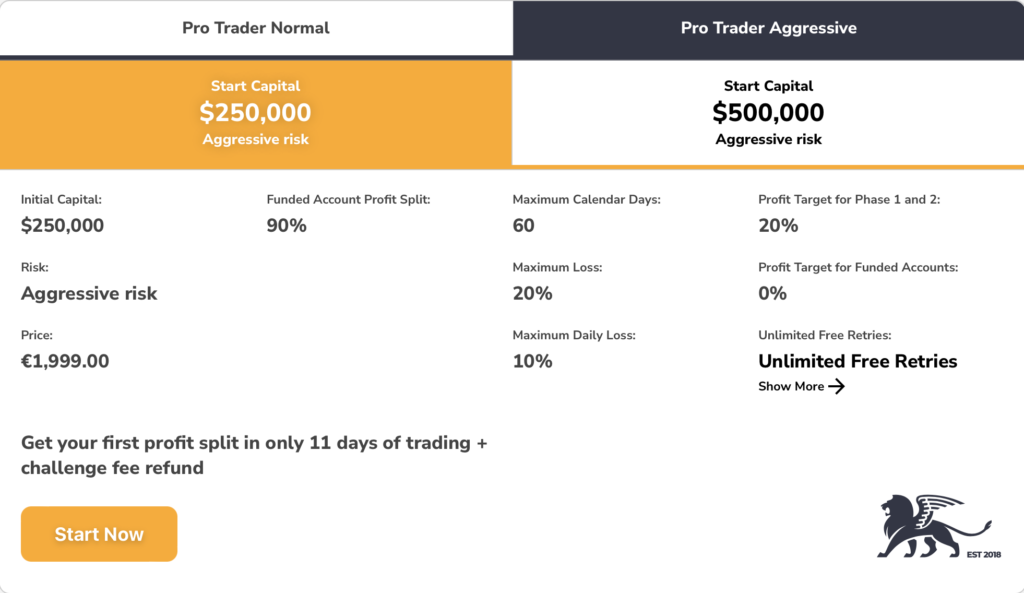

Pro Trader Aggressive Evaluation

Fidelcrest’s Aggressive Pro Trader Evaluation Program Account is designed to recognize dedicated and skilled traders, rewarding them for their consistent performance throughout the two-phase evaluation period. This evaluation program account provides the opportunity to trade with leverage of up to 1:200

Account Size

Price

$250,000

€1,999

$500,000

€3,499

Pro Trader Aggressive Evaluation Phases

Evaluation phase one necessitates traders to achieve a profit target of 20%, while ensuring they do not exceed the 10% maximum daily loss or 20% maximum loss thresholds. The profit target must be attained within 60 calendar days from the day the first position is placed on the evaluation account. There are no minimum trading day requirements to progress to evaluation phase two.

Evaluation phase two requires traders to reach a profit target of 20%, while abiding by the 10% maximum daily loss or 20% maximum loss rules. The profit target must be hit within 60 calendar days from the initiation of the first position on the evaluation account. There are no minimum trading day prerequisites to move on to a funded account.

Upon successfully completing both evaluation phases, traders are granted a funded account without profit targets. The only requirement is to adhere to the 10% maximum daily loss and 20% maximum loss rules. The initial payout is accessible ten calendar days after the first position is placed on the funded account, provided certain criteria are met. During this period, traders must trade for a minimum of 10 calendar days while also achieving profitability to request the first withdrawal. Profit sharing stands at 90% based on the profit generated in the funded account.

Pro Trader Aggressive Evaluation Scaling Plan

At present, Aggressive Pro Trader Evaluation Program Accounts do not include an available scaling plan.

Pro Trader Aggressive Evaluation Rules

-

Profit Target: The profit target represents a specific percentage of profit that traders are required to achieve before completing an evaluation phase, withdrawing profits, or scaling their account. Phase 1 entails a profit target of 20%, and Phase 2 also involves a profit target of 20%. Funded accounts do not have profit targets.

-

Maximum Daily Loss: This indicates the maximum allowable loss a trader can incur on a daily basis before the account is considered in violation. All account sizes have a maximum daily loss limit of 10%.

-

Maximum Loss: This signifies the maximum overall loss a trader can experience before the account is deemed in violation. A maximum loss limit of 20% applies to all account sizes.

-

Maximum Trading Days: This represents the maximum period within which traders are required to achieve a specific profit target or withdrawal objective. Both Phase 1 and Phase 2 encompass a maximum trading period of 60 calendar days.

-

No Martingale Allowed: Traders are prohibited from using any form of martingale strategy during trading

-

Risk Desk Team: This team evaluates whether a trader’s trading strategy aligns with the prop firm’s criteria. If the strategy is deemed ineligible, traders receive a refund on their evaluation account.

- Third-Party Copy Trading Risk: If you intend to use copy trading services, be aware that other traders might already be using the same strategy through a third-party copy trading service. This increases the risk of being denied a funded account or withdrawal if you exceed the maximum capital allocation rule

Additional enhancements offered when acquiring an evaluation program

-

Add Insurance: Obtain a second account for free if you do not pass your first Challenge phase. (Applicable to all account sizes and types) – (+30% on the one-time fee)

-

Double Your Capital: Secure a second account for free after achieving profit with your funded account. – (+50% on the one-time fee)

-

Double Your Leverage: Gain the opportunity to work with up to 1:200 leverage, enabling you to manage significantly larger position sizes. (Applicable to all account sizes and types) – (+20% on the one-time fee)

-

Unlimited Retry: Enjoy the chance for unlimited retries on your evaluation phases if you conclude your trading period in profit. (Complimentary for all account sizes and types)

Furthermore, you will have the option to select one of the following two complimentary add-ons:

- Enjoy an unrestricted trading period throughout both evaluation phases.

- Benefit from a maximum trading duration of 60 calendar days, with the added advantage of a complimentary retry if drawdown remains under 2%.

What sets Fidelcrest apart from other proprietary trading firms?

Fidelcrest distinguishes itself from the majority of top-tier prop firms through its clear-cut trading regulations. Traders under Fidelcrest’s umbrella can engage in trading activities during news releases, maintain positions overnight, and even trade over the weekends.

When compared to other prop firms, Fidelcrest’s Micro Trader evaluation program account introduces a unique two-phase evaluation structure. This entails completing two distinct phases before becoming eligible for payouts. Phase one necessitates achieving a 10% profit target, while phase two demands a 5% profit target for normal risk accounts, and an ambitious 15% for aggressive risk accounts. In the case of normal risk accounts, a 5% maximum daily loss limit and a 10% maximum loss limit in both evaluation phases, as well as after achieving funded status, apply. Conversely, aggressive risk accounts adhere to a 10% maximum daily loss limit and a 20% maximum loss limit in both evaluation phases and funded status. Notably, neither normal risk nor aggressive risk accounts impose any minimum trading day prerequisites during either evaluation phase. Moreover, Micro Trader evaluation program accounts offered by Fidelcrest lack an available scaling plan. In comparison to other prominent prop firms in the industry, Fidelcrest’s trading goals align within the industry average.

Is Fetting Fidelcrest Capital Realistic?

Assessing the feasibility of obtaining capital from Fidelcrest is a critical step when evaluating prop firms that align with your forex trading strategy. While a company may offer an attractive profit split on a generously funded account, it’s important to analyze and reviews whether their trading requirements are attainable. If a firm demands exceptionally high monthly profits with minimal drawdowns, the chances of success can be significantly diminished.

The Micro Trader evaluation program accounts offer a realistic pathway to securing capital. This is primarily due to their flexibility in offering both normal and aggressive risk account options. Normal risk accounts come with moderate profit targets (10% in phase one and 5% in phase two) and reasonable maximum loss restrictions (5% maximum daily loss and 10% maximum loss in both evaluation phases). In contrast, aggressive risk accounts present higher profit targets (15% in both phases) alongside slightly more elevated maximum loss rules (10% maximum daily loss and 20% maximum loss in both evaluation phases).

Similarly, the Pro Trader evaluation program accounts offer a realistic avenue for obtaining capital. Like the Micro Trader program, they provide the choice between normal and aggressive risk account types. Normal risk accounts feature moderate profit targets (10% in both phases) and reasonable maximum loss constraints (5% maximum daily loss and 10% maximum loss in both evaluation phases). Meanwhile, aggressive risk accounts boast higher profit targets (20% in both phases) and somewhat elevated maximum loss regulations (10% maximum daily loss and 20% maximum loss in both evaluation phases).

In light of these considerations, Fidelcrest emerges as a promising option for securing funding. Their evaluation program accounts offer realistic trading objectives and conditions, enhancing the likelihood of receiving payouts in line with your trading performance.

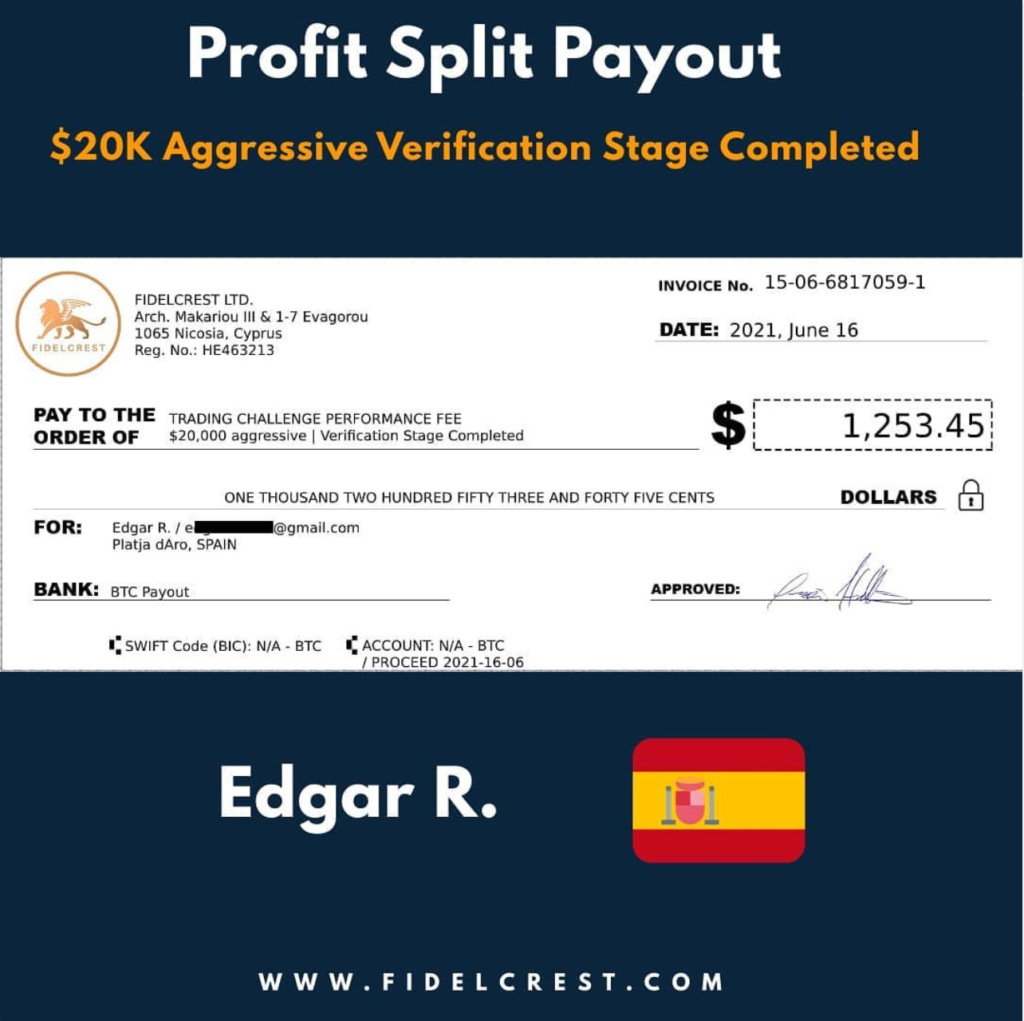

Payment Proof

Fidelcrest was established in 2018 and achieved official incorporation in 2020. For evidence of successful payments made to traders, you can explore multiple sources:

-

YouTube Channel: Fidelcrest maintains a YouTube channel where they may share payment proof and updates related to their traders’ success stories. You can visit their YouTube channel to access this information.

-

News Section: On their official website, Fidelcrest likely has a dedicated trading News or Blog section. Here, they often post announcements, company news, and payment proof to showcase their traders’ achievements. You can navigate to their website to find this section.

-

Instagram Account: Fidelcrest also manages an Instagram account under the username “Fidelcrestgroup.” This account may feature payment proof and other relevant updates. You can access this Instagram account by clicking on the provided link.

By exploring these platforms, you can gain valuable insights into the successful payment history and achievements of Fidelcrest traders.

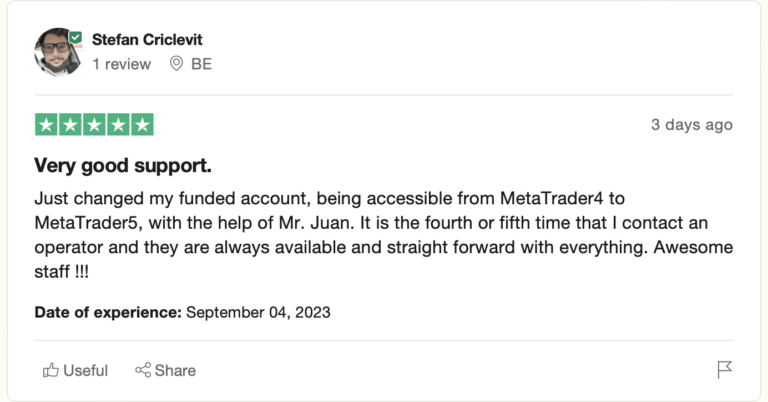

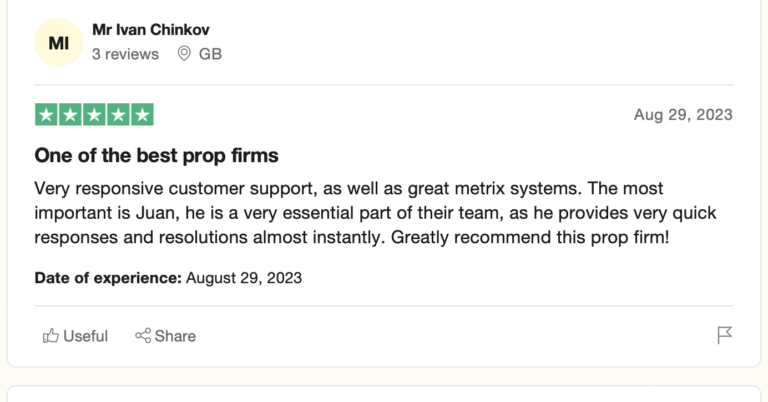

FidelCrest Traders Feedback

Fidelcrest has excellent feedback from their reviews.

Fidelcrest enjoys a positive reputation on Trustpilot, with numerous positive comments from their community. They currently maintain an impressive rating of 4.7 out of 5 based on 1124 reviews. This high rating reflects the satisfaction and positive experiences of many individuals who have interacted with Fidelcrest´s services.

Furthermore, Fidelcrest boasts a dependable support team that is readily available to address any inquiries or concerns you may have. Whether you seek information about their proprietary trading firm, trading rules and objectives, or encounter any issues, their support team is dedicated to providing you with the assistance and guidance you require. This commitment to customer support ensures that traders have access to the necessary resources and information for a successful trading experience with Fidelcrest.

Fidelcrest’s community has consistently praised their exceptional customer support service. Members of their community have highlighted the prompt and highly helpful assistance provided by Fidelcrest’s support team, regardless of the nature of the issue at hand. This positive feedback underscores the company’s commitment to delivering excellent customer service and ensuring that traders have a smooth and supportive experience while working with Fidelcrest.

Support

Fidelcrest offers multiple avenues for accessing information and support:

-

FAQ Page: Fidelcrest provides a comprehensive FAQ page where you can find answers to common questions and gather information about the firm.

-

Email Support: You can contact their management support team directly via email at support@fidlecrest.com for inquiries or assistance.

-

Social Media: They are active on social media platforms, making it possible to reach out and engage with them through these channels.

-

Live Chat Support: Fidelcrest offers live chat support, available 24/5 during the weekdays from Monday to Friday. This real-time chat support can assist you with immediate queries and concerns.

These support options demonstrate Fidelcrest’s commitment to providing accessible and responsive assistance management to their traders and clients.

Conclusion

In conclusion, Fidelcrest is a reputable proprietary trading firm that provides traders with two distinct funding programs: Micro Trader and Pro Trader. Each program consists of a two-phase evaluation challenge that must be completed before traders become eligible for funding and profit splits. Traders can choose between normal and aggressive risk account types within these programs, each with varying profit targets and maximum loss rules.

For Micro Trader evaluation programs, normal risk accounts have profit targets of 10% in phase one and 5% in phase two, along with a 5% maximum daily loss and a maximum loss of 10%. Aggressive risk accounts target 15% profits in both phases, with a 10% maximum daily loss and a maximum loss of 20%. Traders can earn profit splits ranging from 80% to 90% based on their chosen risk type.

Similarly, Pro Trader evaluation programs offer normal risk accounts with 10% profit targets in both phases, a 5% maximum daily loss, and a maximum loss of 10%. Aggressive risk accounts aim for 20% profits in both phases, with a 10% maximum daily loss and a maximum loss of 20%. Profit splits for Pro Trader accounts vary from 80% to 90% based on the chosen risk type.

Fidelcrest is an excellent choice for traders seeking a prop firm with clear and straightforward trading rules. They cater to a diverse range of individuals with unique trading styles and have established themselves as one of the industry’s better proprietary trading firms. The information in this review was last updated on September 07, 2023.

If you found our review of Fidelcrest’s proprietary trading firm layout informative and helpful, please let us know. We would also appreciate hearing your thoughts on whether Fidelcrest offers the trading instruments you’re interested in. Thank you for reading!