The Good and Bad about Finotive Funding

Finotive Funding strives to streamline the evaluation process for retail traders, expediting capital growth and enabling the generation of notably higher monthly returns.

Pros

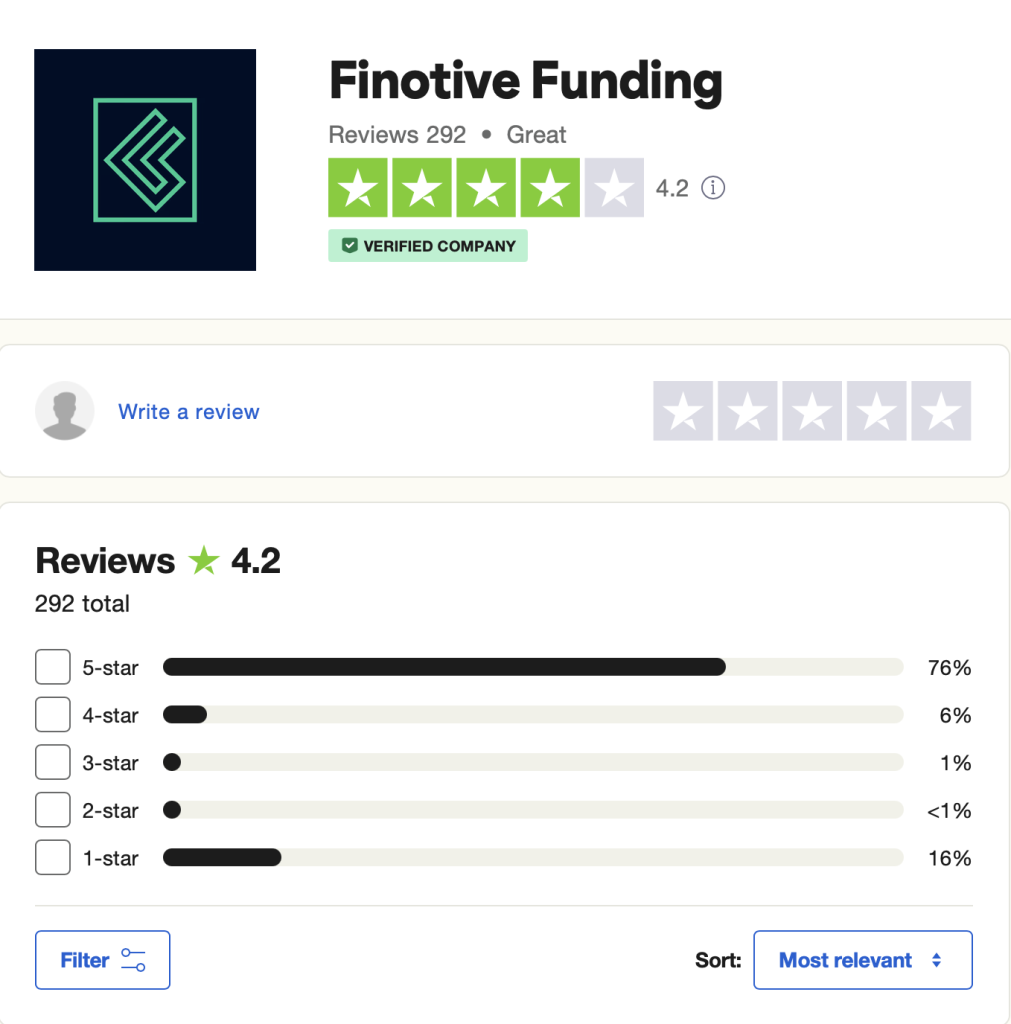

- Excellent Trustpilot rating of 4.3/5

- Three funding program options

- One-time funded account negative balance free redeposit

- Profit split up to 95%

- Unlimited evaluation free retries

- News trading allowed

- Overnight and weekend holding allowed

- Scaling account option up to $3,200,000

- EA’s and bots allowed

- A large variety of trading instruments

- Leverage up to 1:400

Cons

- No free trial

- Reduced 25% profit split if RTP is breached once funded

At Finotive Funding, traders are motivated to excel in their endeavors. The primary expectation from clients revolves around disciplined risk management. The platform facilitates the opportunity to handle account sizes ranging up to $200,000, scalable to a total of $11,410,000, enabling profit splits between 75% to 95%. Achieving this potential involves trading various assets like Forex pairs, commodities, indices, and cryptocurrencies.

Who are Finotive Funding?

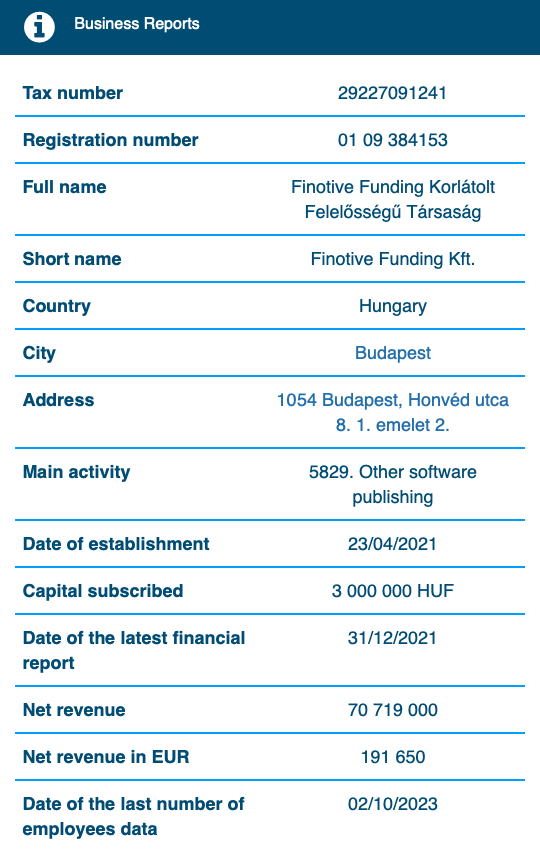

Finotive Funding, established by Oliver Newland on April 23, 2021, embarked on its project long before its official inception. With offices based in Budapest, Hungary, the platform provides traders the opportunity to manage a balance totaling $11,410,000, offering profit splits ranging from 75% to 95%. Additionally, they’ve developed Finotive Markets, their proprietary brokerage, slated for full regulatory compliance by later parts of 2023.

Funding Program Options

Finotive Funding presents traders with a choice among three distinctive funding programs:

- Two-Step Evaluation Program Accounts

- Instant Funding Program Accounts:

- Standard Instant Funding Program Accounts

- Aggressive Instant Funding Program Accounts

- One-Step Evaluation Program Accounts

Two-Step Evaluation Program

Account Size

Leverage

Price (Standard)

Price (Swap-Free)

$2,500

1:100

$50

$60

$5,000

1:100

$75

$100

$10,000

1:200

$100

$150

$25,000

1:200

$150

$200

$50,000

1:400

$300

$400

$100,000

1:400

$500

$625

$200,000

1:400

$950

$1,100

The two-step evaluation program at Finotive Funding is designed to recognize dedicated and skilled traders, rewarding their consistency throughout the dual-phase evaluation period. This evaluation account permits trading with leverage ranging from 1:100 to 1:400, depending on the selected account size.

Two-Step Evaluation Program Phases:

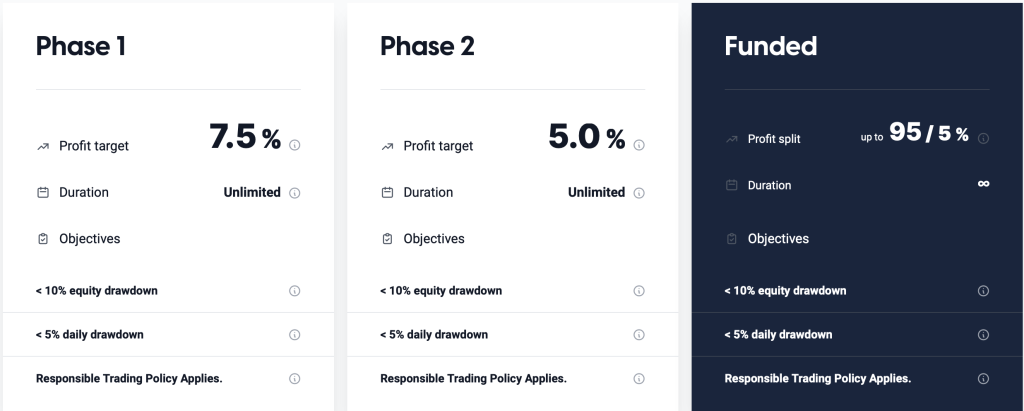

During the evaluation’s first phase at Finotive Funding, traders aim to achieve a 7.5% profit target while adhering to the 5% maximum daily loss and 10% maximum loss regulations. There are no specific constraints on the number of trading days during this phase. Advancing to phase two necessitates meeting the 7.5% profit target without breaching the daily or maximum loss limits.

Phase two requires reaching a 5% profit target while maintaining the 5% maximum daily loss and 10% maximum loss thresholds, without specific constraints on trading days. Progressing to a funded account entails hitting the 5% profit target without violating the daily or maximum loss restrictions.

Upon successful completion of both evaluation phases, traders receive a funded account without profit targets. Instead, they must abide by the 5% maximum daily loss and 10% maximum loss rules. The initial payout doesn’t have a time restriction; traders can request their first withdrawal once they’re profitable in their funded account. Subsequent payouts operate on a weekly basis. Profit splits range from 75% to 95% based on the profits generated in the funded account.

The two-step evaluation program also includes a scaling plan, requiring traders to achieve specific profit targets based on their funded account scaling phase. The detailed spreadsheet for funded challenge account scaling phases is available for reference.

Two-Step Evaluation Program Scaling Plan:

The two-step evaluation funding program accounts feature a scaling plan detailed in the provided spreadsheet. Eligibility for scaling your account hinges solely on reaching the profit target specified for your particular two-step evaluation funding account phase. Once this profit target is attained, account scaling becomes possible. However, it’s important to note that if you choose to scale your account, profit withdrawals are not allowed.

For instance:

Let’s consider a $100,000 account with an 8% profit target.

Week 1: Achieve 4% profit.

Week 2: Gain 7% more, totaling 11% profits.

Having surpassed the 8% profit target by 3%, you can initially withdraw this excess 3% profit. Subsequently, you may request to scale your account with the remaining 8% profit required for scaling.

Trading instruments available for the two-step evaluation program accounts encompass forex pairs, commodities, indices, and cryptocurrencies.

Two-Step Evaluation Program Rules:

The profit target represents the specific percentage of profit that a trader must achieve to conclude an evaluation phase, withdraw profits, or scale their account. Phase 1 entails a profit target of 7.5%, while Phase 2 requires a profit target of 5%. Funded accounts, however, have no specified profit targets.

Maximum daily loss refers to the maximum daily loss a trader can incur before the account is affected. Across all account sizes, the maximum daily loss limit is set at 5%. Similarly, the maximum loss defines the overall maximum loss a trader can incur before the account is impacted, with all account sizes capped at a maximum loss limit of 10%.

The policy against a “gambling mentality” prohibits traders from engaging in trading practices associated with an “all-or-nothing” mindset. Violating this rule can hinder progress from evaluation to funded status, lead to refusal of profit withdrawals, or prevent account scaling. Specific situations considered as signs of reckless trading include:

- Risking 100% or more of the maximum loss limits in open trades (e.g., open trades totaling 5% risk if the trader’s maximum daily loss is 5%).

- Risking 50% or more of the maximum loss limits in a single trade or across multiple trades on the same trading instrument (e.g., risking 2.5% on a single position if the trader’s maximum daily loss is 5%).

- Consistent trading without defined stop-losses. While an occasional trade without a stop-loss is acceptable, repeated lack of stop-loss use and high trade volume without protection raises concerns due to unpredictable network and hardware issues.

- Third-party copy trading risk highlights that using a third-party copy trading service might expose traders to identical trading strategies used by other traders. Overusing such services may breach the maximum capital allocation rule, resulting in denial of funded accounts or withdrawal requests.

- Third-party EA risk signifies that employing a third-party EA might subject traders to identical trading strategies utilized by other traders. Overuse of third-party EAs can breach the maximum capital allocation rule, potentially leading to denial of funded accounts or withdrawal requests.

Standard Instant Funding Program

Account Size

Price (Standard)

Price (Standard Swap-Free)

Price (Standard Limiteless)

$2,500

$95

$120

$120

$5,000

$190

$240

$230

$10,000

$335

$420

$410

$25,000

$525

$625

$630

$50,000

$1,055

$1,200

$1,270

$100,000

$2,100

$2,300

$2,520

The Finotive Funding standard instant funding program account offers traders the opportunity to bypass the evaluation phase entirely and commence earning from the outset. Traders need to ensure they do not exceed the 5% maximum daily and 8% maximum loss limits. Profit splits range from 55% to 75%, contingent upon the trading profits generated, while leveraging a 1:100 ratio.

Standard Instant Funding Program Scaling Plan:

The standard instant funding program accounts at Finotive Funding feature a scaling plan, as illustrated in the provided spreadsheet. To qualify for scaling your account, the sole requirement is to achieve the profit target specified for your particular instant funding account phase. Upon reaching this profit target, scaling your account becomes viable. However, it’s important to note that if you opt to scale your account, profit withdrawals are not allowed.

For instance:

Consider a $100,000 account with an 8% profit target.

Week 1: Achieve 4% profit.

Week 2: Gain 7%, totaling 11% profits.

Having surpassed the 8% profit target by 3%, you can initially withdraw this excess 3% profit. Subsequently, you may request to scale your account with the remaining 8% profit required for scaling.

The trading instruments available for the standard instant funding program accounts encompass forex pairs, commodities, indices, and cryptocurrencies.

Standard Instant Funding Program Rules:

The maximum daily loss signifies the highest permissible loss a trader can incur within a day before the account is impacted. Across all account sizes, the maximum daily loss is capped at 5%. Similarly, the maximum loss denotes the overall highest acceptable loss a trader can reach before affecting the account, set at 8% for all account sizes.

Maximum trading days refer to the designated timeframe within which a specific profit target or withdrawal target must be attained. For standard instant funding program accounts, the maximum trading day period is set at 90 days.

The guideline against a “gambling mentality” prohibits traders from engaging in trading practices linked to an “all-or-nothing” approach. Violation of this rule can impede progression from evaluation to funded status, result in refusal of profit withdrawals, or hinder the scaling of funded accounts. Indications of reckless trading or gambling include:

- Risking 100% or more of the maximum loss limits in open trades (e.g., open trades totaling 5% risk if the trader’s maximum daily loss is 5%).

- Risking 50% or more of the maximum loss limits in a single trade or across multiple trades on the same trading instrument (e.g., risking 2.5% on a single position if the trader’s maximum daily loss is 5%).

- Consistent trading without predefined stop-losses. While occasional trades without a stop-loss are acceptable, repeated absence of stop-loss use and high trade volume without protection raise concerns due to unpredictable network and hardware issues.

- Third-party copy trading risk cautions users intending to use copy trading services, highlighting the potential risk of being denied a funded account or withdrawal if they exceed the maximum capital allocation rule by adopting identical trading strategies as other users of the same service.

- Third-party EA risk warns users intending to use an EA, highlighting the potential risk of being denied a funded account or withdrawal if they exceed the maximum capital allocation rule by adopting identical trading strategies as other users of the same EA.

Aggressive Instant Funding Program

Account Size

Price (Aggressive)

Price (Aggressive Swap-Free)

Price (Aggressive Limitless)

$2,500

$165

$210

$200

$5,000

$330

$420

$400

$10,000

$660

$780

$800

$25,000

$1,340

$1,500

$1,610

$50,000

$2,400

$2,600

$2,880

$100,000

$5,280

$5,555

$6,340

The aggressive instant funding program account at Finotive Funding offers traders the opportunity to bypass the evaluation phase entirely and commence earning immediately. Traders need to ensure they do not exceed the 10% maximum daily and 16% maximum loss limits. Profit splits range from 60% to 75%, contingent upon the trading profits generated, while leveraging a 1:100 ratio.

Aggressive Instant Funding Program Scaling Plan:

The aggressive instant funding program accounts at Finotive Funding incorporate a scaling plan detailed in the provided spreadsheet. To qualify for scaling your account, the sole requirement is to achieve the profit target specified for your particular instant funding account phase. Upon reaching this profit target, scaling your account becomes feasible. However, it’s important to note that if you opt to scale your account, profit withdrawals are not allowed.

For instance:

Consider a $100,000 account with a 16% profit target.

Week 1: Achieve 8% profit.

Week 2: Gain 14%, totaling 22% profits.

Having surpassed the 16% profit target by 6%, you can initially withdraw this excess 6% profit. Subsequently, you may request to scale your account with the remaining 16% profit required for scaling.

The trading instruments available for the aggressive instant funding program accounts encompass forex pairs, commodities, indices, and cryptocurrencies.

Aggressive Instant Funding Program Rules:

The maximum daily loss signifies the highest permissible loss a trader can incur within a day before the account is impacted. Across all account sizes, the maximum daily loss is capped at 10%. Similarly, the maximum loss denotes the overall highest acceptable loss a trader can reach before affecting the account, set at 16% for all account sizes.

Maximum trading days represent the designated timeframe within which a specific profit target or withdrawal target must be attained. For aggressive instant funding program accounts, the maximum trading day period is set at 90 days.

The guideline against a “gambling mentality” prohibits traders from engaging in trading practices associated with an “all-or-nothing” approach. Violation of this rule can impede progression from evaluation to funded status, result in refusal of profit withdrawals, or hinder the scaling of funded accounts. Indications of reckless trading or gambling include:

- Risking 100% or more of the maximum loss limits in open trades (e.g., open trades totaling 5% risk if the trader’s maximum daily loss is 5%).

- Risking 50% or more of the maximum loss limits in a single trade or across multiple trades on the same trading instrument (e.g., risking 2.5% on a single position if the trader’s maximum daily loss is 5%).

- Consistent trading without predefined stop-losses. While an occasional trade without a stop-loss is acceptable, repeated absence of stop-loss use and high trade volume without protection raise concerns due to unpredictable network and hardware issues.

- Third-party copy trading risk cautions users intending to use copy trading services, highlighting the potential risk of being denied a funded account or withdrawal if they exceed the maximum capital allocation rule by adopting identical trading strategies as other users of the same service.

- Third-party EA risk warns users intending to use an EA, highlighting the potential risk of being denied a funded account or withdrawal if they exceed the maximum capital allocation rule by adopting identical trading strategies as other users of the same EA.

One-Step Evaluation Program

Account Size

Leverage

Price (Standard)

Price (Swap-Free)

$2,500

1:100

$60

$72

$5,000

1:100

$90

$120

$10,000

1:200

$120

$180

$25,000

1:200

$180

$240

$50,000

1:400

$360

$480

$100,000

1:400

$600

$750

$200,000

1:400

$1,140

$1,320

Finotive Funding’s one-step evaluation program account is designed to recognize dedicated and skilled traders, emphasizing consistency throughout the single-phase evaluation period. Traders within this evaluation program account can leverage trading ratios ranging from 1:100 up to 1:400, contingent upon the chosen account size.

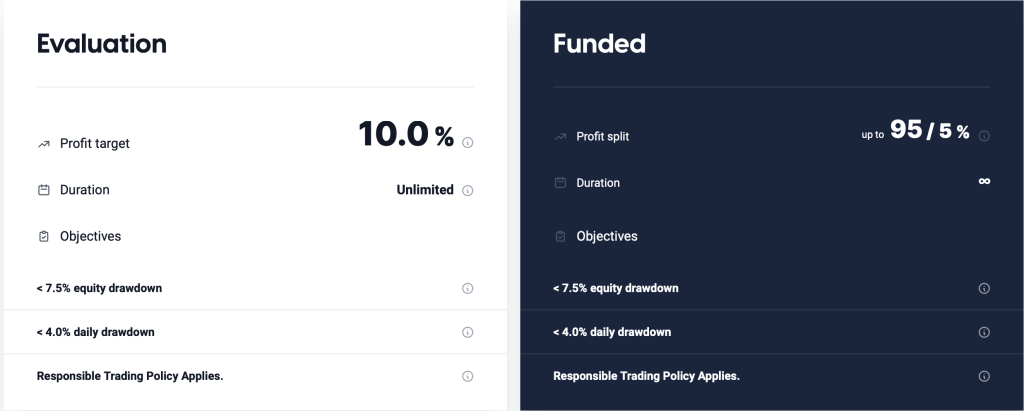

The evaluation phase mandates a trader to achieve a 10% profit target while adhering to a maximum daily loss of 4% or a maximum overall loss of 7.5%. Within the evaluation account, there are no restrictions on the minimum or maximum trading days. Fulfillment of the profit target is the sole requirement to progress to a funded account.

Upon successful completion of the evaluation phase, traders gain access to a funded account without specific profit targets. Instead, they are required to abide by the 4% maximum daily loss or 7.5% maximum loss rules. The first payout has no time constraints, enabling traders to request their initial withdrawal upon attaining profitability in the funded account. Subsequent payouts occur on a weekly basis following the initial withdrawal. Profit splits range from 75% to 95%, contingent upon the profits generated within the funded account.

One-Step Evaluation Program Scaling Plan:

I’m unable to view or access external content or spreadsheets directly. However, I can guide you through how the scaling plan for the one-step evaluation program accounts generally operates if you can provide specific details or criteria from the spreadsheet.

The one-step evaluation funding program accounts feature a scaling plan that is detailed in the spreadsheet provided. Qualifying for account scaling requires reaching a profit target specified for your particular one-step evaluation funding phase. Once this profit target is achieved, eligibility to scale the account is granted. It’s essential to note that scaling the account precludes profit withdrawals.

For instance:

Suppose the profit target for your $100,000 account is 8%.

Week 1: You achieve a 4% gain.

Week 2: You gain 7%, totaling 11% in profits.

Having exceeded the 8% profit target by 3%, you can initially withdraw this surplus 3% profit. Subsequently, you may request to scale your account with the remaining 8% profit required for scaling.

The available trading instruments for the one-step evaluation program accounts encompass forex pairs, commodities, indices, and cryptocurrencies.

One-Step Evaluation Program Rules:

One-step evaluation program account rules

The profit target represents the specific profit percentage a trader must achieve to complete an evaluation phase, request profit withdrawals, or scale their account. This target is set at 10%. Funded accounts, however, do not have profit targets.

Maximum daily loss refers to the highest allowable daily loss before violating the account’s terms. Across all account sizes, the maximum daily loss is set at 4%. Meanwhile, the maximum overall loss a trader can reach without violating their account is 7.5% for all account sizes.

The rule against a “gambling mentality” aims to prevent traders from engaging in reckless trading practices that might endanger their accounts. Violations of this rule could halt progress from the evaluation phase to funded status, impede profit withdrawal, or restrict the scaling of a funded account. The following scenarios are considered signs of reckless trading or gambling:

- Risking 100% or more of the maximum loss limits in open trades, such as having open trades totaling 5% risk when the maximum daily loss allowed is 5%.

- Risking 50% or more of the maximum loss limits in a single trade or across multiple trades on the same trading instrument. For instance, risking 2.5% on a single position when the maximum daily loss is 5%.

- Engaging in constant trading without implementing set stop-losses. While an occasional trade without a stop-loss may be acceptable, repeated absence of stop-loss use and high trade volume without protection is a concern. Unforeseen network and hardware issues make it beneficial for traders to utilize stop-losses consistently.

- Third-party copy trading risk involves understanding that utilizing a third-party copy trading service may expose traders to similar trading strategies employed by other traders. Using such services may lead to denial of a funded account or withdrawal if it breaches the maximum capital allocation rule.

- Third-party EA risk involves the potential risk of being denied a funded account or withdrawal if using a third-party EA that implements the same trading strategy already in use by other traders, breaching the maximum capital allocation rule.

Is Getting Finotive Funding Capital Realistic?

Understanding the practicality of trading requirements is crucial when assessing prop firms that align with your forex trading style. Opting for a company offering high-profit splits on well-funded accounts might seem appealing. However, if they demand substantial monthly gains with minimal drawdowns, success becomes highly improbable.

Securing capital through two-step evaluation programs tends to be more feasible due to their relatively modest profit targets (7.5% in phase one and 5% in phase two), coupled with reasonable maximum loss regulations (5% daily and 10% overall).

Instant funding programs also present a realistic avenue as direct funding initiatives, allowing immediate earnings without profit target obligations. Traders become eligible to request withdrawals on a weekly basis without the necessity of meeting profit targets.

One-step evaluation programs similarly offer practicality, primarily with an average profit target of 10% and higher-than-average maximum loss parameters (4% daily and 7.5% overall).

Considering these factors, Finotive Funding emerges as a commendable choice for securing funding. Their offering of three distinct funding programs aligns with realistic trading goals and conditions for payout eligibility, providing traders with pragmatic paths to funding.

Finotive Funding Traders Feedback

Finotive Funding boasts a wide array of community feedback on Trustpilot, with an impressive score of 4.2 out of 5 from 292 reviews, indicating a strong positive sentiment.

Support

Finotive Funding offers a comprehensive FAQ section on their website, a responsive support team available via their social media handles, direct email at info@finotivefunding.com, and a convenient live chat feature on their site. These avenues ensure quick access to information and assistance for users.

Conclusion

Ultimately, Finotive Funding stands as a reputable proprietary trading firm, offering traders a choice between three distinctive funding programs: Two-Step Evaluation, Instant Funding, and One-Step Evaluation.

The Two-Step Evaluation programs represent an industry-standard two-phase evaluation challenge necessary before funding and eligibility for profit shares. Finotive Funding requires traders to achieve profit goals of 7.5% in Phase One and 5% in Phase Two before becoming funded. These targets align as realistic trading objectives, given adherence to rules of a maximum 5% daily loss and 10% maximum loss. Through evaluation programs, traders can earn up to 95% profit shares and scale accounts.

Instant Funding programs, as direct funding programs, allow traders to skip the evaluation period and dive straight into trading with a funded account, earning weekly profit shares. Across all instant funding program accounts, there’s a maximum trading day duration of 90 days. With instant funding programs, traders can earn profit shares ranging from 55% to 75% and have the option to scale accounts.

Lastly, One-Step Evaluation programs require completion of a single phase before funding and eligibility for profit shares. Finotive Funding mandates traders to reach a 10% profit target before becoming funded. These objectives appear realistic, considering adherence to rules of a 4% maximum daily loss and 7.5% maximum loss. Through One-Step Evaluation programs, traders can earn up to 95% profit shares and also scale their accounts.