Who is AquaFunded?

AquaFunded under the legal name AQUA FUNDED FZCO is a proprietary trading firm that was incorporated on October 9th, 2023, and is currently under the management of CEO Jason Blax. AquaFunded has two unique account types traders can choose from, a two-step evaluation and a one-step evaluation. They are in partnership with ThinkMarkets as their broker.

AquaFunded is a proprietary firm based in Dubai, United Arab Emirates, with its headquarters situated at Premises Number 001 – 35882, IFZA Business Park, DDitsbai, United Arab Emirates.

Funding Program Options

AquaFunded offers traders two unique funding program options:

- Two-phase Evaluation

- One-phase Evaluation

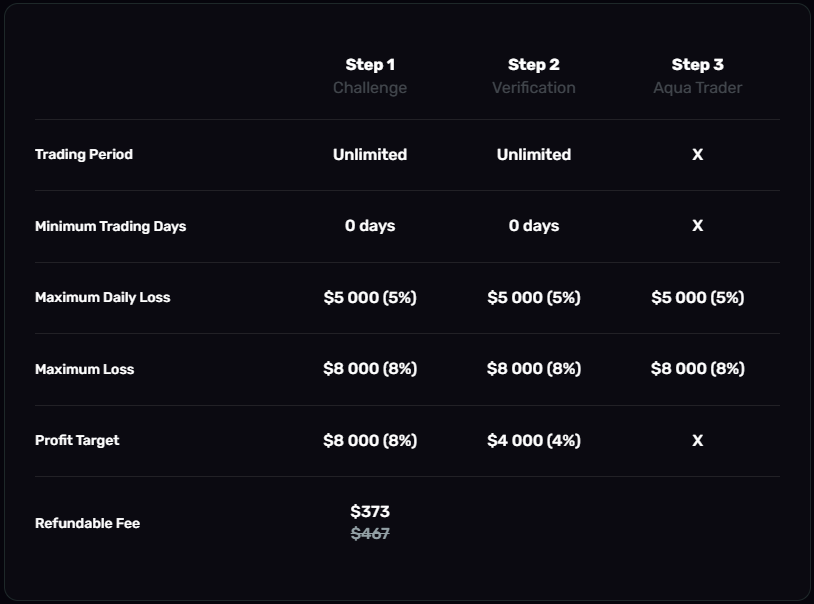

Two-phase Evaluation

AquaFunded‘s Two-phase Evaluation offers traders a chance to manage accounts ranging from $10,000 to $200,000. The goal is to determine talented traders who demonstrate profitability and risk management skills throughout the two-step evaluation period. The Two-step Evaluation allows you to trade with up to 1:100 leverage.

During Evaluation phase one, traders are required to achieve a profit target of 8% without exceeding their 5% maximum daily loss or 8% maximum loss rule. Notably, there are no minimum or maximum trading day requirements during phase one, however, to proceed to phase two, you must obtain the required profit target (8%) without breaching the maximum daily or maximum loss limit rule.

During Evaluation phase two, traders are required to achieve a profit target of 4% without exceeding their 5% maximum daily loss or 8% maximum loss rule. Notably, there are no minimum or maximum trading day requirements during phase two, however, to proceed to funded status, you must obtain the required profit target (4%) without breaching the maximum daily or maximum loss limit.

By concluding both evaluation phases, you will receive funded account that has no minimum withdrawal requirements. However, you are obligated to respect the 5% maximum daily loss and 8% maximum loss rule. Your initial payout is 14 calendar days from the day you place your first position on your funded account while other subsequent withdrawals can be submitted bi-weekly. Based on the profit made on the funded account you are eligible for a profit split of 90%.

Two-phase Evaluation Scaling Plan

The Two-phase Evaluation has a scaling plan. Should a trader exhibit profitability in the last three months with an average return of 12% over the three months, or have an average return of 4% each month, such a trader will become eligible for an account size increase equal to 30% of the initial account size.

Example:

After 3 Months: A qualified $80,000 account increases to $104,000.

After the Next 3 Months: A qualified $104,000 account increases to $128,000.

After the Next 3 Months: A qualified $128,000 account increases to $152,000.

Two-phase Evaluation Trading Rules & Objectives

- Profit Target: There is a designated profit percentage traders must achieve in order to successfully conclude an evaluation phase, withdraw earnings, or scale their trading account. For Phase One there is an 8% profit target, while Phase Two has a profit target of 4%. Funded accounts do not have any specified profit targets.

- Maximum Daily Loss: The maximum daily loss limit on all account sizes is 5%.

- Maximum Loss: The maximum loss limit for all account sizes is 8%.

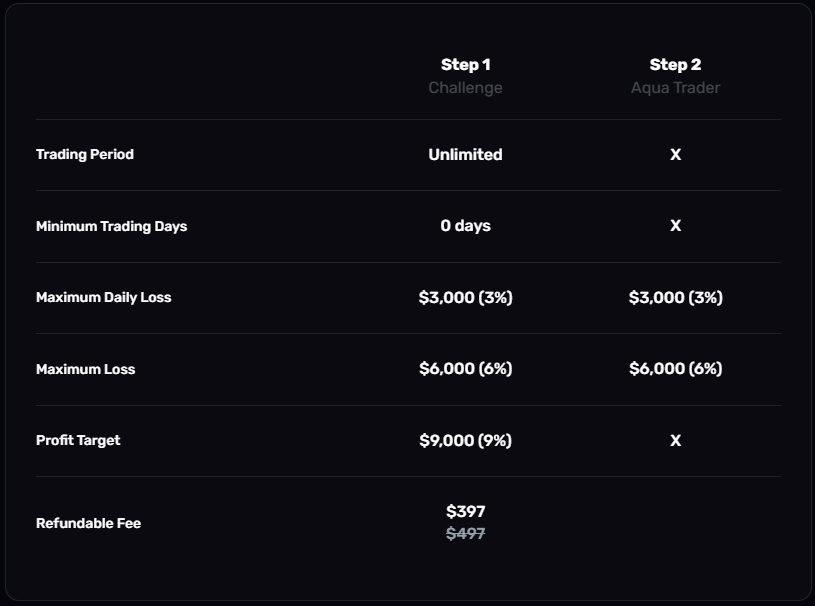

One-phase Evaluation

AquaFunded’s One-phase Evaluation offers traders the chance to manage accounts ranging from $10,000 to $200,000. The goal is to determine talented traders who demonstrate profitability and risk management skills throughout a one-step evaluation period. The One-step Evaluation allows you to trade with up to 1:100 leverage.

For this Evaluation phase one, traders are required to achieve a profit target of 9% without exceeding their 3% maximum daily loss or 6% maximum trailing loss rule. Notably, there are no minimum or maximum trading day requirements during phase one, however, to proceed to funded status, you must obtain the required profit target (9%) without breaching the maximum daily or maximum loss limit rule.

By concluding the evaluation phases, you will receive a funded account that has no minimum withdrawal requirements. However, you are obligated to respect the 3% maximum daily loss and 6% maximum loss rule. Your initial payout is 14 calendar days from the day you place your first position on your funded account while other subsequent withdrawals can be submitted bi-weekly. Based on the profit made on the funded account you are eligible for a profit split of 90%.

One-phase Evaluation Scaling Plan

The One-phase Evaluation has a scaling plan. Should a trader exhibit profitability in the last three months with an average return of 12% over the three months, or have an average return of 4% each month, such a trader will become eligible for an account size increase equal to 30% of the initial account size.

Example:

After 3 Months: A qualified $80,000 account increases to $104,000.

After the Next 3 Months: A qualified $104,000 account increases to $128,000.

After the Next 3 Months: A qualified $128,000 account increases to $152,000.

One-phase Evaluation Trading Rules & Objectives

- Profit Target: There is a designated profit percentage traders are required to reach in order to successfully conclude an evaluation phase, withdraw earnings, or scale their trading account. This evaluation phase has a profit target of 9%. Funded accounts do not have any specified profit targets.

- Maximum Daily Loss: The maximum daily loss limit a trader is allowed to lose in a single trading day without breaching the account. All account sizes have a maximum daily loss of 3%.

- Maximum Trailing Loss: The difference between the highest achieved account balance and the lowest point of the drawdown determines the maximum trailing loss a trader is allowed to lose without breaching the account. All account sizes have a maximum trailing loss of 6%.

What Makes AquaFunded Different From Other Prop Firms?

AquaFunded‘s two unique account types have set it aside from other industry-leading prop firms. These account types include a two-step evaluation and a one-step evaluation.

AquaFunded’s Two-phase Evaluation consists of two evaluation phases that traders are required to complete in order to become qualified for payouts. For Phase One, the profit target is set at 8%, and 4% for Phase Two, with a 5% maximum daily and 8% maximum loss rule. Additionally, there are no minimum or maximum trading day requirements during both evaluation phases. The Two-phase evaluation has a unique scaling plan that allows Traders to manage larger account sizes. The Two-phase evaluation stands out from many funding programs within the industry primarily because it offers an unlimited trading period, no minimum trading day requirements, a first withdrawal after only 14 calendar days, and a starting profit split of 90%.

AquaFunded’s One-phase Evaluation consists of a single evaluation phase that traders are required to complete in order to become qualified for payouts. The profit target is set at 9%, with a 3% maximum daily and 6% maximum trailing loss rule. Additionally, there are no minimum or maximum trading day requirements during the evaluation phase. The One-phase evaluation has a unique scaling plan that allows traders to manage larger account sizes. The One-phase evaluation stands out from many funding programs within the industry primarily because it offers an unlimited trading period, no minimum trading day requirements, a first withdrawal after only 14 calendar days, and a starting profit split of 90%.

In conclusion, AquaFunded two unique account types have set it aside from other industry-leading firms. These account types include a two-step evaluation and a one-step evaluation. They also offer several features that are deemed favorable, such as an unlimited trading period, no minimum trading day requirements, first payout 14 calendar days after placing your first trade, and a starting profit split of 90%.

Is Getting AquaFunded Capital Realistic?

It is necessary to assess the achievability of trading requirements when considering proprietary trading firms that align with your forex trading style. Opting for a firm that promises a generous profit split on a well-capitalized account might seem appealing. Moreover, it is important to examine time constraints as an unlimited trading period is more favorable as it allows you to trade at your own pace. Lastly, it is crucial to familiarize yourself with all trading rules during the evaluation process and subsequent funding stages to lessen the risk of accidentally violating your trading account terms.

Receiving capital from the Two-phase Evaluation is feasible mainly because it offers relatively modest profit targets (8% in phase one and 4% in phase two) in addition to the average maximum loss rules (5% maximum daily and 8% maximum loss). Coupled with this, there are no minimum or maximum trading day requirements, meaning that funds can be secured swiftly in a day or can proceed at a preferred pace. Furthermore, upon concluding both evaluation phases, participants are eligible for payouts featuring a generous 90% profit split.

Receiving capital from the One-phase Evaluation is feasible mainly because it offers an average profit target of 9% in addition to the average maximum loss rules (3% maximum daily and 6% maximum trailing loss). Coupled with this, there are no minimum or maximum trading day requirements, meaning that funds can be secured swiftly in a day or can proceed at a preferred pace. Furthermore, upon concluding both evaluation phases, participants are eligible for payouts featuring a generous 90% profit split.

For these reasons, AlphaFunded is highly advised since it offers two unique funding programs to choose from a two-step evaluation and a one-step evaluation, which all feature practical trading objectives and conditions for qualifying for payouts.

Payment Proof

AquaFunded incorporated on the 9th of October 2023, is a proprietary trading firm that has built an extensive community of traders who had started working with them even before they were launched. The prop firm amassed an impressive number of 50 funded traders within their first week of going live.

Upon achieving funded status, you will be qualified to receive your initial payout after 14 calendar days. Following your first payout, you can process subsequent payouts bi-weekly. You will be eligible for a generous profit split of 90% which will be based on the profit you generated on the funded account.

Since AquaFunded is a relatively new prop firm, there hasn’t been much said about how their funded traders receive payouts.

Education

AquaFunded doesn’t provide any additional educational content to their community.

Regardless, AquaFunded provides its clients accessibility to a meticulously crafted traders dashboard. This enhances risk management by providing around-the-clock access to their comprehensive statistical trading objectives and real-time updates.

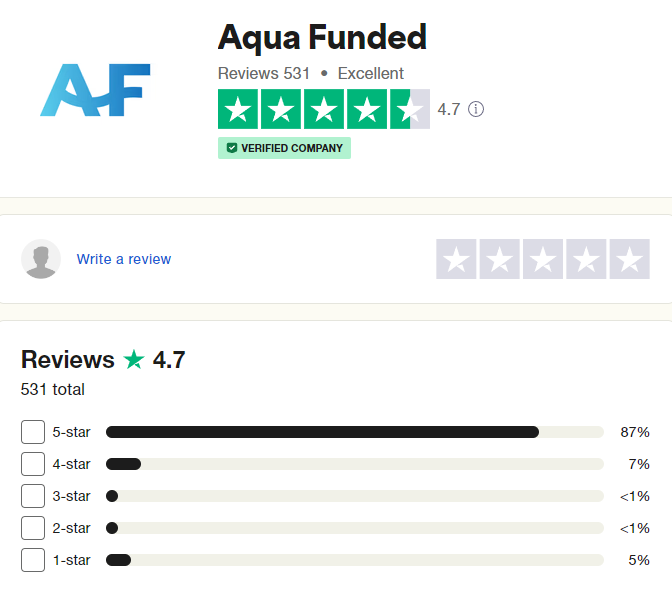

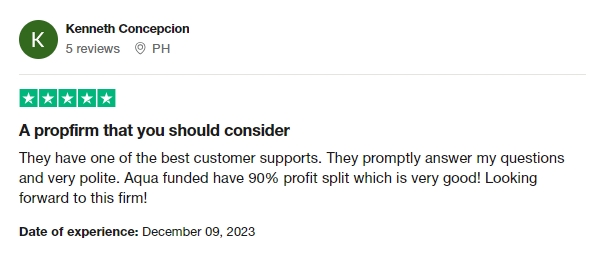

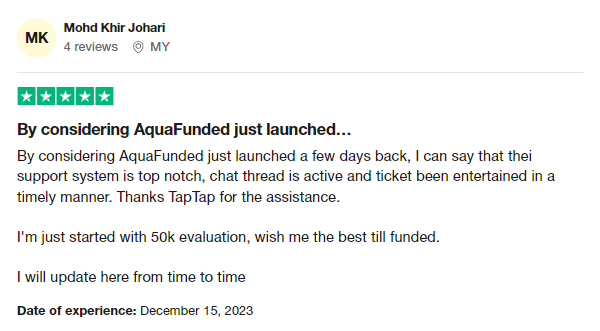

Trustpilot Feedback

AquaFunded has gathered an excellent score on Trustpilot based on their community’s feedback.

On Trustpilot, AquaFunded has a large variety of their community commenting and providing positive feedback regarding their company services. The firm has attained a remarkable rating of 4.7 out of 5 from a substantial pool of 531 reviews, with 87% of these reviews awarding AquaFunded the highest rating of 5 stars.

AquaFunded is applauded for its exceptional customer support, delivering prompt, and courteous responses to inquiries. Community members highlighted the access it gives to different markets and the appealing 90% profit split offered by AquaFunded, expressing optimism and anticipation regarding their experience with the firm.

Despite being a new company, AquaFunded clients have complemented the company’s exceptional customer service and prompt resolution of tickets. They extend gratitude to the support member for their assistance and disclose that they’ve initiated a $50,000 evaluation, expressing optimism for success until funded while promising to provide updates on their progress.

Customer Support

If you have questions or concerns about AquaFunded, you can reach out to customer care through the live chat on the website or via email at support@aquafunded.com. Checking their FAQ page could provide you with quick answers but you could get a more detailed response through their Discord channel.

Conclusion

AquaFunded is a reputable and reliable proprietary trading firm that offers traders the opportunity to choose between two funding programs: the Two-phase evaluation, and the One-phase evaluation.

AquaFunded’s Two-phase Evaluation is an industry-standard two-step evaluation. It requires traders to conclude two evaluation phases before becoming a funded trader and enjoy profit splits of 90%. A profit target of 8% is set in phase one and for phase two 4%, Traders must successfully complete both phases in order to become funded. These are realistic trading objectives, considering you have a 5% maximum daily and 8% maximum loss rules to follow. Concerning time constraints, there are no minimum or maximum trading day requirements during both evaluation phases, this allows ease in trading as traders can process trades at their preferred pace without time pressure.

AquaFunded’s One-phase Evaluation is a One-step evaluation. It requires traders to conclude a single evaluation phase before becoming a funded trader and enjoy profit splits of 90%. A profit target of 9% is set, and traders must complete the evaluation phase in order to become funded. These are realistic trading objectives, considering you have a 3% maximum daily and 6% maximum trailing loss rules to follow. Concerning time limitations, there are no minimum or maximum trading day requirements during the evaluation process, this allows ease in trading as traders can process trades at their preferred pace without time pressure.

To traders looking for a reputable and reliable proprietary trading firm, AquaFunded is highly recommended, as they offer excellent trading conditions that cater to a variety of individuals each with unique trading styles. They provide traders with unique features, such as, realistic trading conditions, unlimited trading period, no minimum trading day requirements, a first withdrawal after only 14 calendar days, and a starting profit split of 90%.

After evaluating everything AquaFunded has to offer to traders worldwide, the prop firm is without a doubt a desirable choice within the prop trading industry.

If you found this AquaFunded Review to be informative, you can visit their website here.

You can also discover additional Propfirm reviews here.