Who is Finotive Funding?

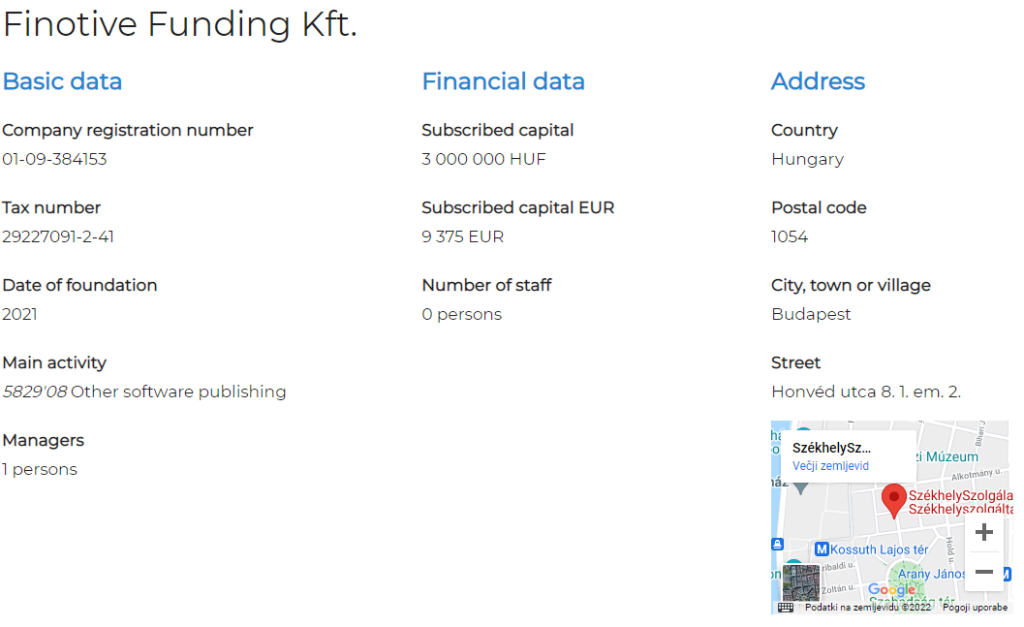

Finotive Funding is a proprietary trading firm registered under the legal name Finotive Group Kft. It was founded on the 23rd of April 2021 and has its headquarters in Budapest, Hungary. Finotive Trading is run and managed by its CEO Oliver Newland.

Traders have the opportunity to choose between five account types, two two-step evaluations, a one-step evaluation, and two instant funding programs.

Finotive Funding’s headquarters is located in Honved utca 8. 1st floor, 1054 Budapest, Hungary.

Funding Program Options

Finotive Funding offers five unique funding program options:

Pro Challenge

Classic Challenge

One-step Challenge

Standard Instant Funding

Aggressive Instant Funding

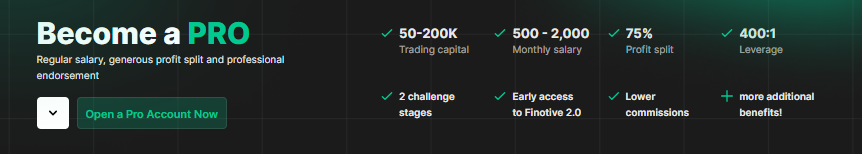

Pro Challenge

Finotive Funding’s Pro Challenge is designed to identify talented traders who possess good risk management skills and can remain profitable. It is a two-step evaluation and provides the opportunity to manage account sizes ranging from $50,000 to $200,000. In addition, the Pro Challenge allows traders to trade with up to 1:400 leverage while being able to choose your account funding between USD, EUR, and GBP.

Here’s how it works.

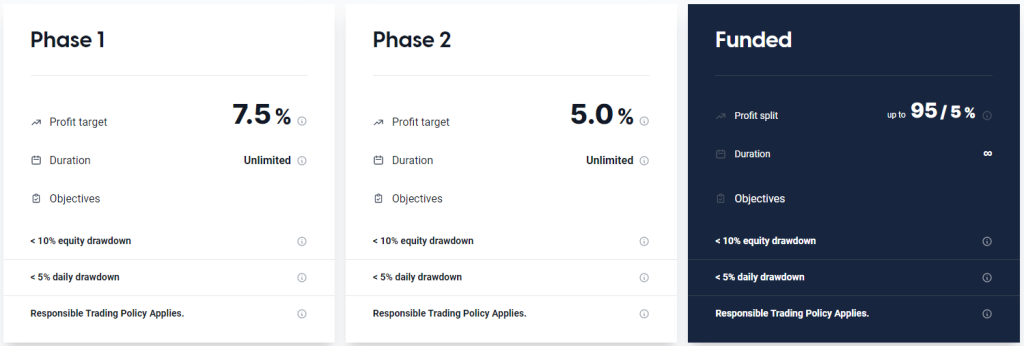

Evaluation phase one sets a profit target of 7.5% for traders to meet while not exceeding their 5% maximum daily loss or 10% maximum loss rules. There are no minimum or maximum trading day requirements for phase one. Therefore, all you are required to do is meet the profit target and maximum loss rules to proceed to the next stage.

For evaluation phase two, the profit target of 5% must be met without exceeding their 5% maximum daily loss or 10% maximum loss rules. Just like phase one, there are no time limitations and you are only required to meet the specified requirements.

Once both phases are successfully completed, you will receive a funded account. There are no minimum withdrawal requirements but you must respect the 5% maximum daily loss and 10% maximum loss rules. Your profit split starts at 75% but can go up to 95% depending on how much profit you make on your account and you are entitled to a monthly salary that’s 1% of your account size. Plus, you can receive payment soon after your first trade. Then subsequent withdrawals are done on a weekly basis.

Note that you have to meet the quarterly profit target of 5% to qualify for the Pro Account for the next 3-month period. If you do not achieve the quarterly profit target, you still get to keep your account but it will be downgraded from Pro to a standard Classic Account.

Pro Challenge Scaling Plan

Where a trader hits a specific profit target, they can scale their account to the next available account size.

For example, the profit target for the $50,000 funded account is 8%.

Week 1: Generate a profit of 5%

Week 2: Generate a profit of 6%

That brings the total generated profit to 11% placing well above the required 8% profit target. However, if you scale your account, you would be required to forfeit your profits.

But it is possible to withdraw the 3% additional profit first before putting in a request to scale your account.

Pro Challenge Trading Rules

- Profit Target: It is necessary to achieve the designated profit percentage in order to successfully conclude the evaluation stage, get a funded account, withdraw earnings, or scale their trading account. For phase one, the profit target is set at 7.5% while phase 2 has a profit target of 5%. Plus, there is a quarterly profit target of 5%.

- Maximum Daily Loss: The maximum daily loss limit on all account sizes is 5%.

- Maximum Loss: The maximum loss limit on all account sizes is 10%.

- Consistency Rule: Finotive Funding mandates its clients to maintain uniformity and consistency in important aspects of trading such as risk management, position sizes, losses, gains, and more. This means that the account results should not show significant differences in their characteristics.

Classic Challenge

Finotive Funding’s Classic Challenge is designed to identify talented traders who possess good risk management skills and can remain profitable. It is a two-step evaluation and provides the opportunity to manage account sizes ranging from $2,500 to $200,000. In addition, the Classic Challenge allows traders to trade with up to 1:400 leverage while being able to choose your account funding between USD, EUR, and GBP.

Here’s how it works.

Evaluation phase one sets a profit target of 7.5% for traders to meet while not exceeding their 5% maximum daily loss or 10% maximum loss rules. There are no minimum or maximum trading day requirements for phase one. Therefore, all you are required to do is meet the profit target and maximum loss rules to proceed to the next stage.

For evaluation phase two, the profit target of 5% must be met without exceeding their 5% maximum daily loss or 10% maximum loss rules. Just like phase one, there are no time limitations and you are only required to meet the specified requirements.

Once both phases are successfully completed, you will receive a funded account. There are no minimum withdrawal requirements but you must respect the 5% maximum daily loss and 10% maximum loss rules. Your profit split starts at 75% but can go up to 95% depending on how much profit you make on your account. Plus, you can receive payment soon after your first trade. Then subsequent withdrawals are done on a weekly basis.

Classic Challenge Scaling Plan

The Classic Challenge also has a scaling plan. When a trader hits a specific profit target, they can scale their account to the next available account size.

For example, the profit target for the $2,500 funded account is 8%.

Week 1: Generate a profit of 5%

Week 2: Generate a profit of 6%

That brings the total generated profit to 11% placing well above the required 8% profit target. However, if you scale your account, you would be required to forfeit your profits.

But it is possible to withdraw the 3% additional profit first before putting in a request to scale your account.

Classic Challenge Trading Rules

- Profit Target: It is necessary to achieve the designated profit percentage in order to successfully conclude the evaluation stage, get a funded account, withdraw earnings, or scale their trading account. For phase one, the profit target is set at 7.5% while phase 2 has a profit target of 5%. There are no profit targets for funded accounts.

- Maximum Daily Loss: The maximum daily loss limit on all account sizes is 5%.

- Maximum Loss: The maximum loss limit on all account sizes is 10%.

One-step Challenge

Finotive Funding’s One-step Challenge is designed to identify talented traders who possess good risk management skills and can remain profitable. It is a two-step evaluation and provides the opportunity to manage account sizes ranging from $2,500 to $200,000. In addition, the one-step Challenge allows traders to trade with up to 1:400 leverage while being able to choose your account funding between USD, EUR, and GBP.

Here’s how it works.

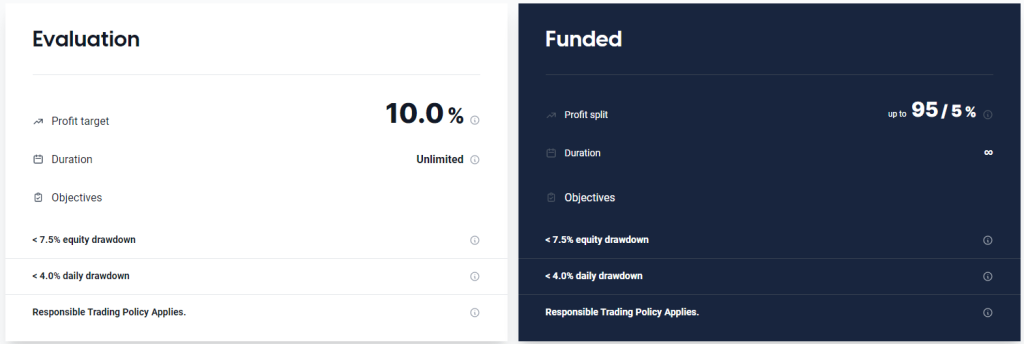

Evaluation phase one sets a profit target of 10% for traders to meet while not exceeding their 4% maximum daily loss or 7.5% maximum loss rules. There are no minimum or maximum trading day requirements for phase one. Therefore, all you are required to do is meet the profit target and maximum loss rules to proceed to the next stage.

Once the evaluation phase is completed, you will receive a funded account. There are no minimum withdrawal requirements but you must respect the 4% maximum daily loss and 7.5% maximum loss rules. Your profit split starts at 75% but can go up to 95% depending on how much profit you make on your account. Plus, you can receive payment soon after your first trade. Then subsequent withdrawals are done on a weekly basis.

One-Step Challenge Scaling Plan

Where a trader hits a specific profit target, they can scale their account to the next available account size.

For example, the profit target for the $50,000 funded account is 8%.

Week 1: Generate a profit of 5%

Week 2: Generate a profit of 6%

That brings the total generated profit to 11% placing well above the required 8% profit target. However, if you scale your account, you would be required to forfeit your profits.

But it is possible to withdraw the 3% additional profit first before putting in a request to scale your account.

One-Step Challenge Trading Rules

- Profit Target: It is necessary to achieve the designated profit percentage in order to successfully conclude the evaluation stage, get a funded account, withdraw earnings, or scale their trading account. For phase one, the profit target is set at 7.5% while phase 2 has a profit target of 5%. Plus, there is a quarterly profit target of 5%.

- Maximum Daily Loss: The maximum daily loss limit on all account sizes is 5%.

- Maximum Loss: The maximum loss limit on all account sizes is 7.5%.

Standard Instant Funding

Finotive Funding’s Standard Instant Funding is designed to identify talented traders who possess good skills and can remain profitable. It is a two-step evaluation and provides the opportunity to manage account sizes ranging from $2,500 to $100,000. In addition, Standard Instant Funding allows traders to trade with up to 1:100 leverage while being able to choose your account funding between USD, EUR, and GBP.

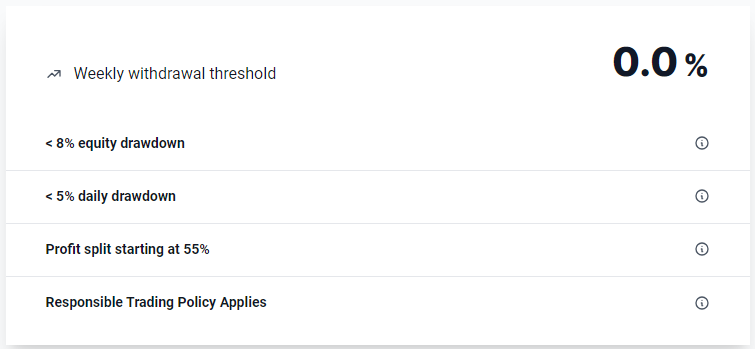

Purchasing Standard Instant Funding gives you access to a funded account without going through the evaluation phases present in other funding options. There are no minimum withdrawal requirements but you must respect the 5% maximum daily loss and 8% maximum loss rules. Your profit split starts at 55% but can go up to 75% depending on how much profit you make on your account. Plus, you can receive payment soon after your first trade. Then subsequent withdrawals are done on a weekly basis.

Standard Instant Funding Scaling Plan

Where a trader hits a specific profit target, they can scale their account to the next available account size.

For example, the profit target for the $50,000 funded account is 8%.

Week 1: Generate a profit of 5%

Week 2: Generate a profit of 6%

That brings the total generated profit to 11% placing well above the required 8% profit target. However, if you scale your account, you would be required to forfeit your profits.

But it is possible to withdraw the 3% additional profit first before putting in a request to scale your account.

Standard Instant Funding Trading Rules

- Maximum Daily Loss: The maximum daily loss limit on all account sizes is 5%.

- Maximum Loss: The maximum loss limit on all account sizes is 8%.

- Stop-loss Required: It is necessary for a trader to place a stop loss on each position before initiating a trade.

- Risk Rule: It is necessary to limit the total risk on all open positions to a specific percentage. Standard Instant Funding has a total risk limit of 2.5% of the previous day’s closing balance.

Aggressive Instant Funding

Finotive Funding’s Aggressive Instant Funding is designed to identify talented traders who possess good skills and can remain profitable. It is a two-step evaluation and provides the opportunity to manage account sizes ranging from $2,500 to $100,000. In addition, Aggressive Instant Funding allows traders to trade with up to 1:100 leverage while being able to choose your account funding between USD, EUR, and GBP.

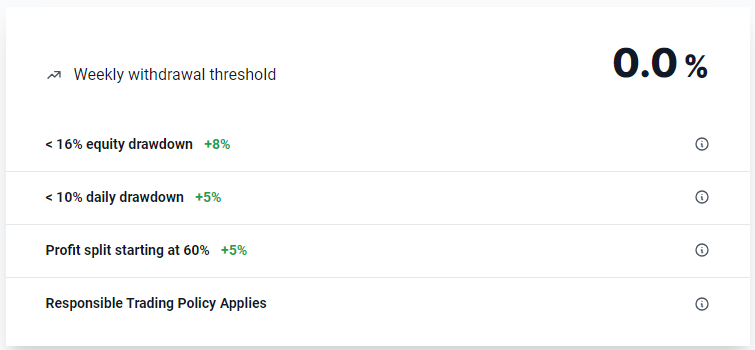

Purchasing the Aggressive Instant Funding program gives you access to a funded account. There are no minimum withdrawal requirements but you must respect the 10% maximum daily loss and 16% maximum loss rules. Your profit split starts at 60% but can go up to 75% depending on how much profit you make on your account. Plus, you can receive payment soon after your first trade. Then subsequent withdrawals are done on a weekly basis.

Aggressive Instant Funding Scaling Plan

Aggressive Instant Funding also has a scaling plan. Where a trader hits a specific profit target, they can scale their account to the next available account size.

For example, the profit target for the $50,000 funded account is 8%.

Week 1: Generate a profit of 5%

Week 2: Generate a profit of 6%

That brings the total generated profit to 11% placing well above the required 8% profit target. However, if you scale your account, you would be required to forfeit your profits.

But it is possible to withdraw the 3% additional profit first before putting in a request to scale your account.

Aggressive Instant Funding Trading Rules

- Maximum Daily Loss: The maximum daily loss limit on all account sizes is 10%.

- Maximum Loss: The maximum loss limit on all account sizes is 16%.

- Stop-loss Required: It is necessary for a trader to place a stop loss on each position before initiating a trade.

- Risk Rule: It is necessary to limit the total risk on all open positions to a specific percentage. Aggressive Instant Funding has a total risk limit of 5% of the previous day’s closing balance.

What Sets Finotive Funding Apart from Other Prop Firms?

Finotive Funding sets itself apart from other major prop trading firms with its unique offerings and convenient environment for trading. It offers five different account types: two two-step evaluation, a one-step evaluation, and two instant funding programs.

Finotive Funding’s Pro Challenge requires traders to successfully complete two phases before receiving a funded account. The profit target for phase one is 7.5% and 5% in phase two with a 5% maximum daily and 10% maximum loss rules. One special feature of the Pro Challenge program is that it offers traders a monthly salary that’s 1% of the initial account balance, giving them greater reward for their efforts.

Finotive Funding’s Classic Challenge requires traders to successfully complete two phases before receiving a funded account. The profit target for phase one is 7.5% and 5% in phase two with a 5% maximum daily and 10% maximum loss rules.

Finotive Funding One-step Challenge requires traders to only complete a single evaluation phase. The profit target is 10% with a 4% maximum daily and 7.5% maximum loss rules.

The Standard Instant Funding program grants direct access to a funded account. Although traders do not go through any evaluation phase, they are still obligated to respect the 5% maximum daily loss and 8% maximum loss rules.

Finotive Funding’s Aggressive Instant Funding program also gives direct access to a funded account. However, there is a 10% maximum daily loss and 16% maximum loss rules. Finotive Funding instant funding accounts also have a total risk limit of 5% of the previous day’s closing balance.

All funding programs have a unique scaling plan that allows traders to manage greater account sizes. In addition, all funding programs have no time limitations. This makes it easier to acquaint yourself with the platform and it also takes away some of the stress of trading. You can also redraw immediately after making your first profit on your funded account and subsequent payout is done weekly.

Finotive Funding is a prop firm that stands out from the rest due to its unique account type, realistic profit and risk trading requirements. It also gives profitable traders more room to grow with its scaling options.

Is Getting Finotive Funding Capital Realistic?

Before trading with a prop firm, it is important to access its features and trading requirements to determine if it aligns with your trading style and needs. If a company provides an attractive profit split but sets high trading costs and commissions, it reduces the possibility of growing your account exponentially. Time constraints are also an important factor to consider.

Flexibility in trading is essential because it takes the burden off an already stressful process. Moreover, the more time you have to trade, the easier it is to acquaint yourself with the trading rules of the firm.

Getting capital from Finotive Funding is realistic because

Receiving capital from the Pro Challenge is realistic due to its average profit targets (7.5% in phase one and 5% in phase two) coupled with modest maximum loss rules (5% maximum daily and 10% maximum loss). It is important to note that upon receiving a funded account, traders instantly enjoy a profit split of 75% that can go up to 95% depending on how profitable you are. You also get a monthly allowance that’s 1% of the initial account balance.

Receiving capital from the Classic Challenge is realistic due to its average profit targets (7.5% in phase one and 5% in phase two) coupled with modest maximum loss rules (5% maximum daily and 10% maximum loss). It is important to note that upon receiving an account, traders instantly enjoy a profit split of 75% that can go up to 95% depending on how profitable you are.

Receiving capital from the One-step Challenge is realistic due to its average profit target of 10% coupled with modest maximum loss rules (4% maximum daily and 7.5% maximum loss). It is important to note that upon receiving a trading account, traders instantly enjoy a profit split of 75% that can go up to 95% depending on how profitable you are.

Receiving capital from Standard Instant Funding is realistic mainly due to the fact that there are no profit requirements coupled with average maximum loss rules (5% maximum daily and 8% maximum loss). It is important to note that upon receiving an account, traders instantly enjoy a profit split of 55% that can go up to 75% depending on how profitable you are.

Receiving capital from Aggressive Instant Funding is realistic mainly due to the fact that there are no profit requirements coupled with average maximum loss rules (10% maximum daily and 16% maximum loss). It is important to note that upon receiving a trading account, traders instantly enjoy a profit split of 60% that can go up to 75% depending on how profitable you are.

It is also important to remember that there are no time limitations on all funding programs. Plus, traders are given the opportunity to scale and grow their portfolio if they meet the necessary profit targets.

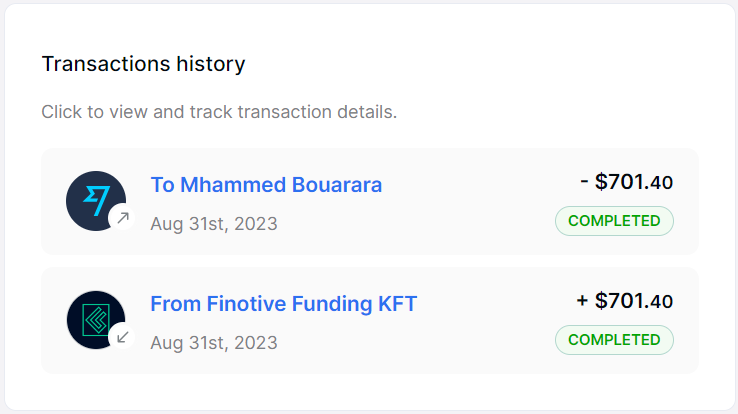

Payment Proof

Finotive Funding is a proprietary trading firm that was incorporated in April 2021. Yet it has succeeded in garnering a large community of successful funded traders.

Regardless of the funding program you choose, it is possible to receive payout right from the first day of trading. However, subsequent payouts occur on a weekly basis. The ability to scale your account and enjoy increased profit split gives funded traders the opportunity to make more profit.

You can find Finotive Funding payment proof on numerous platforms such as Trustpilot. Successful traders in the prop firm also post their payment certificates on the Discord channel and Instagram page of the firm.

Education

On the Finotive Funding website, you can find the MetaTrader 4 and MetaTrader 5 Lot Size calculator designed to help manage risk effectively.

Finotive Funding takes it a step further by offering traders a free trial option. This enables traders to experience the prop firm’s trading conditions and adapt to it, therefore mitigating the possibility of mistakes when they eventually purchase one of the funding programs.

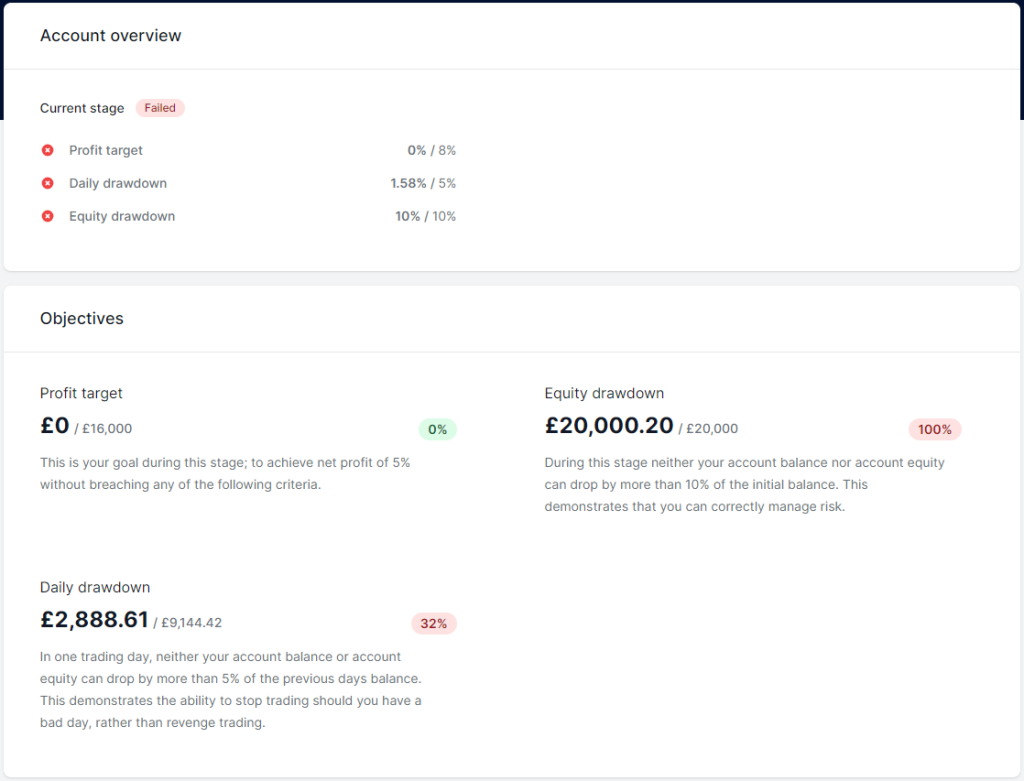

Plus, the prop trading firm grants its funded traders exclusive access to a meticulously designed trader dashboard. It provides real-time updates every minute and extensive statistics with top-notch user experience. The provision of detailed educational materials give Finotive Funding an edge over other prop firms.

Trustpilot Feedback

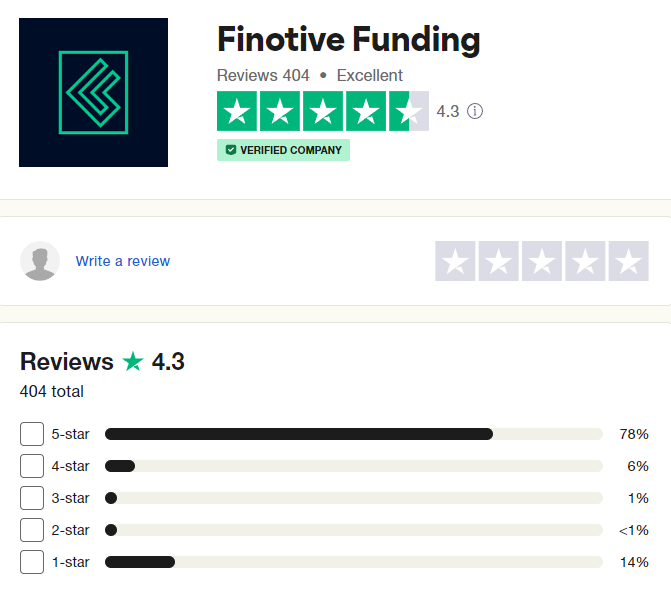

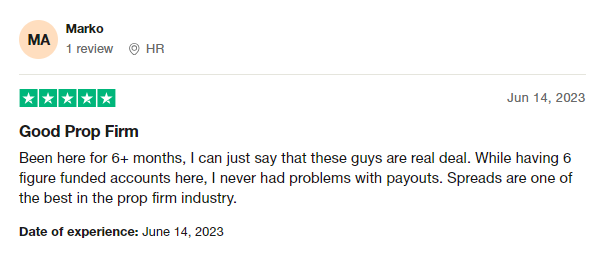

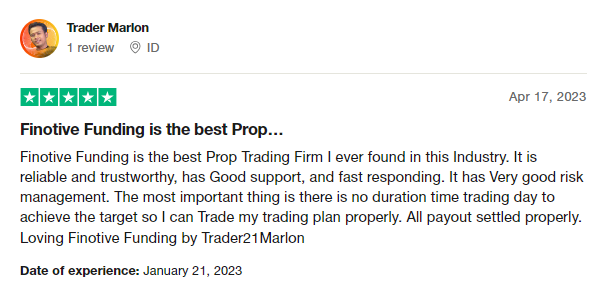

Finotive Funding has an impressive score on Trustpilot based on their community’s feedback. From a pool of 404 reviews, the prop firm has achieved an overall rating of 4.3 out of 5 most of which are 5 star reviews.

Clients praise the firm for its smooth payout process and for offering some of the best spreads in the prop firm industry.

The firm is also commended for its systematic approach to risk management while allowing traders to execute their strategies effectively. The reviews Finotive Funding has gotten so far, points to its credibility and trustworthiness as a prop firm.

Customer Support

You can reach out to the prop firm through their 24/7 live chat feature or email at support@finotivefunding.com.

The platform also has a Discord and Telegram link where you can reach out to customer care or other traders on the platform.

Conclusion

Finotive Funding has built a reputation for itself as a trustworthy and credible platform. It has succeeded in amassing a large community for itself based on its unique offerings and the convenience it offers traders.

The Pro Challenge and Classic Challenge are two-step evaluation programs. Traders must meet the profit percentage and maximum loss rules for both challenges to receive a funded account. The primary difference is that the Pro Challenge comes with a monthly salary that’s 1% of the initial account balance.

Finotive Funding’s One-step challenge requires traders to only complete a single evaluation phase to become eligible for a funded account. Traders must hit a profit percentage of 10% to be successful and enjoy an advantageous 75% profit split that can rise to 95%.

The Standard Instant Funding and Aggressive Instant Funding programs are both instant funding accounts. Traders can start earning immediately and enjoy a profit split as high as 75%.

The lack of time limitations on all funding programs is essential to traders who want to move at their own pace and figure things out along the way. The availability of different account types also provides a variety of options to choose from which can be attractive to professional traders.

All in all, Finotive Funding is a platform that delivers on its promises and a reliable prop firm where traders can grow their trading career.

If you found this Finotive Funding Review to be informative, you can visit their website here.

You can also discover additional Propfirm reviews here.