Who Is FunderPro?

CEO Gary Mullen founded FunderPro, a proprietary trading firm under the legal name FunderPro Ltd, in February 2023. FunderPro gives traders the opportunity to choose between three accounting types, two two-step evaluations or a one step evaluation. They are in partnership with ThinkMarket as their broker.

FunderPro has its headquarters at 30/1, Kenilworth court, Sir Augustus Bartolo Street, Ta’Xbiex XBX1093, Malta.

Funding Program Options

FunderPro offers three unique funding program to its traders

- Regular Evaluation

- Swing Evaluation

- Fast Track

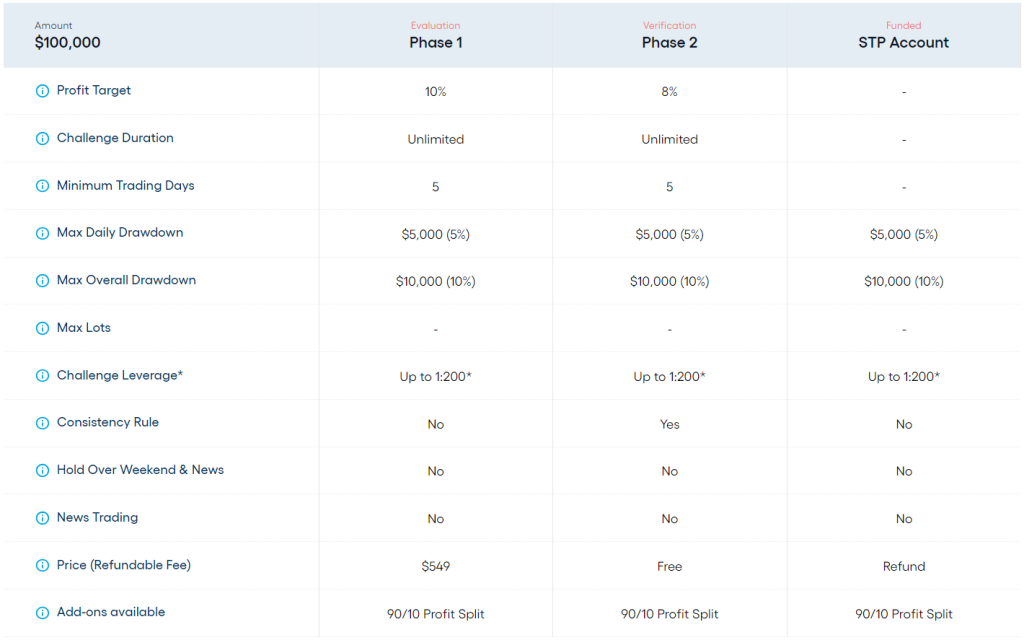

Regular Evaluation:

For FunderPro’s Regular Evaluation, traders have the opportunity to manage account sizes between the range of $25,000 up to $200,000. The aim of this program is to identify talented traders who can profitably and efficiently manage risks throughout the duration of the two-step evaluation. The Regular Evaluation allows traders to trade with a leverage of up to 1:2000.

Phase one of the evaluation requires traders to reach a target profit of 10% without surpassing the 5% maximum daily loss or the 10% maximum loss rule. There is no time limitation on the maximum trading day requirements for phase one. However, you are required to trade a minimum of five trading days in order to proceed to phase two.

Evaluation phase two requires a trader to acquire a profit target of 8% without surpassing a 5% maximum daily loss or a 10% maximum loss. There is also no time limitation on the maximum trading day requirements in phase two. However, you are required to trade a minimum of five trading days in order to proceed to a funded account.

After both evaluation phases are successfully completed, you will receive a funded account with a minimum withdrawal amount of $100. However the 5% maximum daily loss and the 10% maximum loss rule must be respected. If profit is generated, you can receive your first payout on day one and make all other subsequent withdrawals on a daily on-demand basis. Profit split is usually about 80% to 90% based on the profit made on the funded account.

Add-ons for FunderPro’s Regular Evaluation:

- 90% Profit split

Regular Evaluation Scaling Plan:

Regular Evaluation also has a scaling plan. There is a 50% of the account size if the trader has been profitable in the last three months with an average return of 10%. There is a profit split increase to 90% when the trader scales their Regular Evaluation for the first time.

For example:

After 3 months: a qualified $50,000 account increases to $75,000.

After the next 3 months: a qualified $75,000 account increases to $112,500.

After the next 3 months: a qualified $112,500 account increases to $169,000.

And so on……

Regular Evaluation Trading Rules and Objectives:

- Profit Target: Traders are expected to achieve designated profit targets in order to successfully conclude an evaluation phase, withdraw earnings, or scale their trading account. The set target profit for phase one is at 10% while phase two has its set profit target at 8%. Funded accounts have no specified profit target set on them.

- Maximum Daily Loss: This is the maximum amount that can be lost in a single trading day without violating the account. There is a maximum of 5% daily loss on all account sizes.

- Minimum Trading Days: Traders have to trade for at least 5 days to successfully complete the evaluation phases.

- No Weekend Holding: Traders are banned from holding trades during the weekends, this means that all trading should cease after the market closes on Friday.

- No News Trading: Opening or closing trades on the specified commodity is not allowed within 2-minutes before and after the announcement of the particular news.

- Consistency Rule: This commands traders to maintain consistency in various such as position size, risk management, losses, gains and so on. This suggests that account results should not show a noticeable difference in their characteristics. The profits earned on your best day should not surpass 60% of your total profit( this applies only to phase 2).

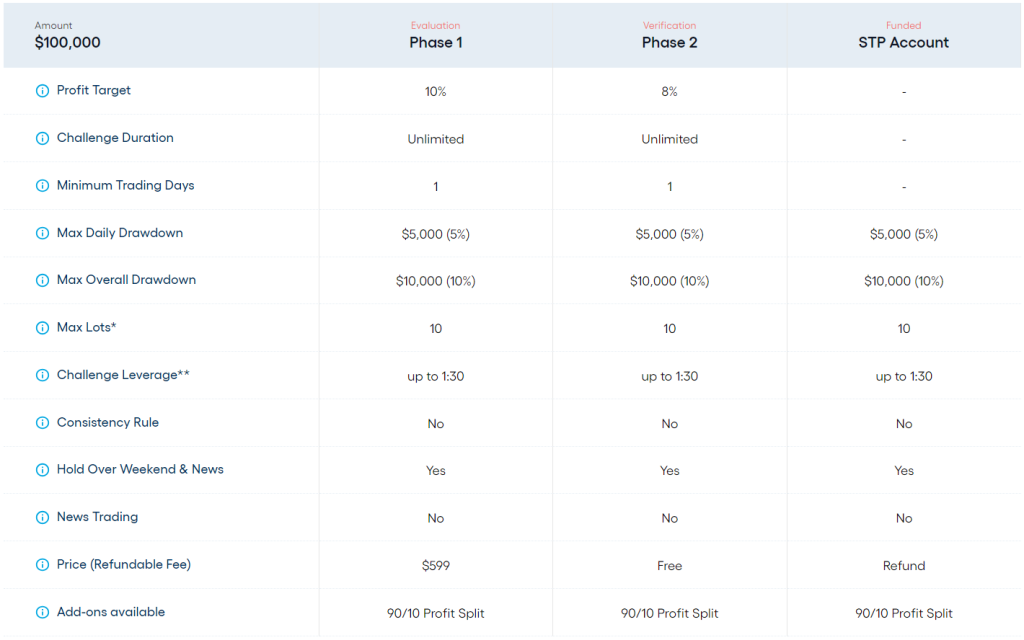

Swing Evaluation:

FunderPro’s Swing Evaluation allows traders to manage account sizes ranging from $25,000 up to $200,000. The evaluation is used to identify traders who can efficiently manage risk throughout the two step evaluation period whilst still being profitable. The Swing Evaluation allows trading with up to 1:30 leverage.

For evaluation phase one, you are to meet a profit target of 10% without exceeding their 5% maximum daily loss or a 10% maximum loss rule. With regards to time limitation, there is no minimum or maximum trading day requirement. However the 10% profit target is required to be met without breaching the maximum daily or maximum loss limit rules set.

Evaluation phase two requires traders to hit a profit target of 8% traders without exceeding their 5% maximum daily loss or 10% maximum loss rule. With regards to time limitations, there is no maximum or minimum trading day requirement.

Completing both evaluation phases means a funded account will be awarded to you with the minimum withdrawal amount of $100. The 5% maximum daily loss and 10% maximum loss rule must be obeyed. The first withdrawal can be made on the first day if you manage to generate a profit while other subsequent withdrawals can be done on daily on-demand bases. Profit splits can be 80% up to 90% based on how profitable you are.

Add-ons for FunderPro’s Swing Evaluation:

- 90% Profit Split

Swing Evaluation Scaling Plan:

A trader who is profitable in the last three months with an average of 10% average return over the course of the three months is qualified for an account size increase equivalent to 50% of the account size. There is an increase in the profit split to 90% after the trader scales their Swing Evaluation for the first time.

For example :

After 3 months: a qualified $50,000 account increases to $75,000.

After the next 3 months : a qualified $75,000 account increase to $112,500

After the next three months : a qualified $112,500 account increase to $169,750

And so on….

Swing Evaluation Trading Rules and Objectives:

- Profit Target: There are designated profit targets traders are expected to achieve to successfully conclude the evaluation phase, withdraw earnings, and scale their trading account. The set target profit for phase one is at 10% while phase two has its set profit target at 8%. Funded accounts have no specified profit target set on them.

- Maximum Daily Loss: A trader is allowed a maximum loss limit, that is the maximum amount that can be lost in a single trading day without violating the account. There is a maximum of 5% daily loss on all account sizes.

- Maximum Loss: A trader is allowed a maximum loss limit, that is the maximum amount that is permitted to be lost overall without violating the account. There is a maximum of 10% maximum loss on all account sizes.

- No News Trading: Trading is prohibited during high impact news releases. This means that conducting new trades or terminating active trades on the specified commodity is not allowed within 2-minutes before and after the announcement of the particular news.

- Lot Size Limit: In most cases lot size limits are set based on the original account balance of your trading account. For instance the lot size limitations for different accounts can be as follows:

An account size of $25,000 will have a lot size limitation of 2.5 lots

An account size of $50,000 will have a lot size limitation of 5 lots

An account size of $100,000 will have a lot size limitation of 10 lots

An account size of $150,000 will have a lot size limitation of 15 lots

An account size of $200,000 will have a lot size limitation of 20 lots

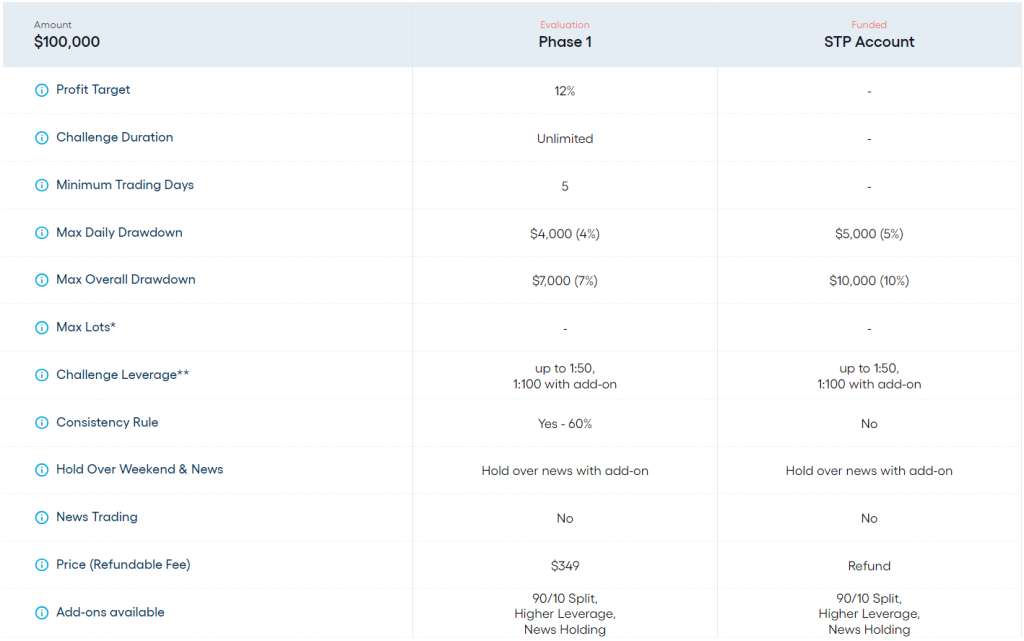

Fast Track

FunderPro’s Fast Track gives room for traders to manage account sizes ranging from $25,000 up to $1,000,000. The aim of this program is to identify talented traders who can profitably and efficiently manage risks throughout the duration of the one-step evaluation period. The Fast Track allows traders to trade with a leverage of up to 1:100

The evaluation phase for Fast Track has a profit target of 12% traders are required to reach while not surpassing their 4% maximum daily loss or 7% maximum loss rule. With regards to time limitation, there is no maximum trading day requirement, but traders are expected to trade in a minimum of 5 trading days in order to move on to a funded account.

Add-ons for FunderPro’s Fast Track:

- Double Leverage of 1:100

- 90% Profit Split

- Allowed News Holding

Fast Track Scaling Plan:

Fast Track also has a scaling plan. A trader is considered for an account size increase equal to 50% of the account size if the trader has been profitable in the last three months with an average return of 10%. There is a profit split increase to 90% when the trader scales their Fast Track for the first time.

For example:

After 3 months: a qualified $50,000 account increases to $75,000.

After the next 3 months : a qualified $75,000 account increase to $112,500

After the next three months : a qualified $112,500 account increase to $169,750

And so on….

Fast Track Trading Rules:

- Profit Target: There is a designated profit percentage traders are expected to achieve in order to successfully conclude an evaluation phase, withdraw earnings or scale their trading account. The set target profit for the evaluation phase is at 12%. Funded accounts have no specified profit target set on them.

- Maximum Daily Loss: A trader is allowed a maximum loss limit, that is the maximum amount that can be lost in a single trading day without violating the account. There is a maximum of 4% daily loss during the evaluation and 5% on funded accounts, this applies to all account sizes.

- Maximum Loss: A trader is allowed a maximum loss limit, that is the maximum amount that is permitted to be lost overall without violating the account. There is a maximum of 7% maximum loss during evaluation period and 10% once funded on all account sizes

- No News Trading: Trading is prohibited during high- impact news releases. This means that conducting new trades or terminating active trades on the specified commodity is not allowed within 2-minutes before and after the announcement of the particular news,

- Consistency Rule: This commands traders to maintain balance in various areas such as position size, risk management, losses, gains and so on. This suggests that account results should not show a noticeable difference in their characteristics. The profits earned on your best day should not surpass 60% of your total profit( applies to this evaluation).

What Sets FunderPro Apart From Other Prop Firms

FunderPro set themselves apart from other industry-leading prop firms due to the distinct account types they offer, which includes a two two-step evaluation and a one step evaluation. In addition to this they also provide an extensive number of favorable features such as unlimited trading periods, a first day withdrawal feature, on demand future payout and multiple add-on features.

The Regular Evaluation offers a unique scaling plan that allows traders to manage larger account sizes. The profit target is 10% in phase one and 8% in phase two, with a 5% maximum daily and 10% maximum loss rules. Plus, traders are expected to trade for at least 5 days and meet the designated profit targets to qualify for a funded account. Regular Evaluation stands out from other funding programs in the industry mainly as it offers an unlimited trading period, a first day withdrawal feature, on demand future payout and multiple add-on features.

Its Fast Track program is another well-designed evaluation phase tailored towards traders who are already skilled enough to instantly become funded traders. The evaluation phase for Fast Track has a profit target of 12% traders are required to reach while not surpassing their 4% maximum daily loss or 7% maximum loss rule. There are no maximum day requirements but you are still expected to trade for at least 5 days.

Is Getting FunderPro Capital Realistic?

Evaluating the attainment of trading requirements is necessary when considering a proprietary trading firm that aligns with your trading goals.

While a prop firm may seem attractive with a high percentage profit split on funded accounts, its feasibility decreases over time if they require a substantial monthly gain with minimal maximum drawdown percentage, significantly reducing the likelihood of success. Examining time restrictions is also crucial and lastly it is also important to educate yourself on the trading rules required during evaluation process and ensuing funding stages to avoid the risk of breaching trading account terms.

Receiving capital from Regular Evaluation is possible due to its slightly above average profit targets (10% in phase one and 8% in phase two) accompanied with its average maximum loss rule (5% maximum daily and 10% maximum loss). There is no maximum trading day but there is a minimum requirement of 5 trading days. Upon completing both evaluation phases, consistent and profitable traders are eligible for a payout of 80% up to 90%.

Receiving capital from Swing Evaluation is possible due to its slightly above average profit targets ( 10% in phase one and 8% in phase two) accompanied with its average maximum loss rule (5% maximum daily and 10% maximum loss). There is no maximum trading day requirement which offers flexibility. This gives traders enough wiggle room to acquaint themselves with the platform during the evaluation process and also test their trading skills. In addition, funds can be secured swiftly without time restraints. Upon successful completion of both evaluation phases, consistent and profitable traders are eligible for a payout of 80% up to 90%.

Receiving capital from Fast Track is possible due to its slightly above average profit target of 12% accompanied with its average maximum loss rules (4% maximum daily and 7% maximum loss which becomes 5% maximum daily and 10% maximum loss on funded accounts). There is no maximum trading day requirement but a minimum requirement of 5 trading days. Upon the successful completion of the evaluation phase, participants are eligible for a payout of 80% up to 90%.

Considering all these features, FunderPro stands out among other prop firms and is highly recommended for its realistic trading objectives, modest profit targets and conditions required for qualifying for payouts.

Payment Proof

After successfully completing any of the three programs, the Regular Evaluation, Swing Evaluation or Fast track and reaching the funded status, traders are eligible to receive their first payout on the first trading day if they manage to generate a profit. After the first payout traders are qualified to receive other subsequent payout on a daily on-demand basis. Profit splits can be 80% up to 90% based on the profit made on the funded account.

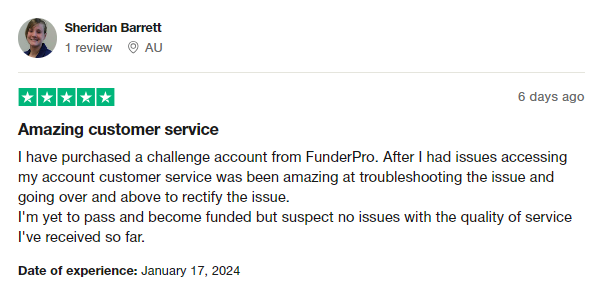

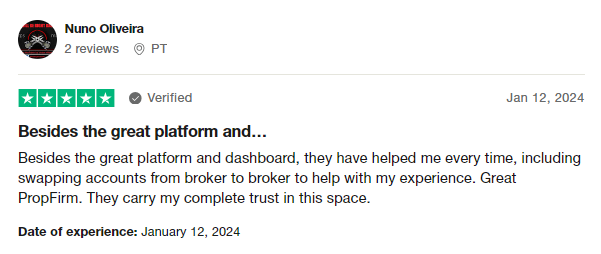

FunderPro payment proof can be found on a number of websites, such websites include TrustPilot. TrustPilot is a reliable platform allowing traders to share their honest opinion of companies in the proprietary trading firm industry. So, it wouldn’t be difficult to find payment proof from funded traders on FunderPro.

Another source of payment proof can be found in the Discord channel and YouTube channel for FunderPro where payout certificates and interviews of the most successful traders can be found in abundance. Examples of Payment proof and Payout certificates can be seen in the images below

Education

FunderPro does supply its community with educational content on its blog allowing traders to grow their skills and maintain steady profit growth. The blog posts provide information on forex pairs, commodities, indices, and other trading instruments.

Furthermore, FunderPro offers a free trial period to its community, ensuring its members are able get themselves used to its platform and trading rules while having an experience of what it’s like to trade with the company.

Finally, FunderPro also equips traders with a detailed and organized dashboard, making risk management easier to handle with the live statistics of trading objectives.

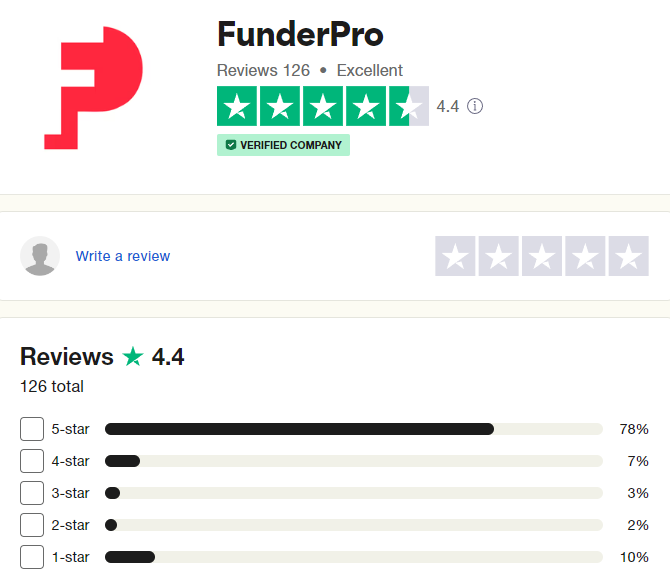

Trustpilot Feedback

FunderPro received an excellent score and Trustpilot based on ratings from the community.

On Trustpilot, the FunderPro community has left many positive comments about the prop firm. They gave it an impressive 4.4 out of 5 rating in a poll of 126 reviews. A remarkable 78% of these reviews gave FunderPro 5 stars.

FunderPro’s clients haven’t stopped commending them for their outstanding platform and dashboard, emphasizing the firm’s support and guidance. The firm was also commended for easing account transactions between brokers, enhancing users’ experience, and supporting their trading journey. Clients have ranked FunderPro as a great proprietary trading company.

Customer Support

To address issues while crypto trading, you can reach out to customer service support through their live chat or via email at support@FunderPro.com. You can also chat with customer care on their Discord and Telegram channels.

Conclusion

To sum it up, FunderPro is a reputable and reliable proprietary trading firm that allows traders to choose between three funding programs, a two two-step evaluation and a one-step evaluation.

To those seeking a prop firm with remarkable trading conditions that cater to a wide range of individuals with various trading styles, FunderPro Ltd is the right choice. You can receive trading capital of up to $200,000 and expand your options with different trading instruments.

With their selection of trading programs, unlimited trading period, no minimum trading day requirements( part of Swing Evaluation), a first day withdrawal feature on profits made on funded accounts, on-demand future payouts and multiple add-on feature, FunderPro is considered an excellent choice for traders seeking a prop firm with a well developed trading scheme and to earn profits on a consistent basis.

For additional insights to boost your trading success, please explore our website where you can find in-depth reviews of forex proprietary trading firms. Stay updated on the latest news from prop firms by visiting our site.