The Good and Bad about Global Forex Funds

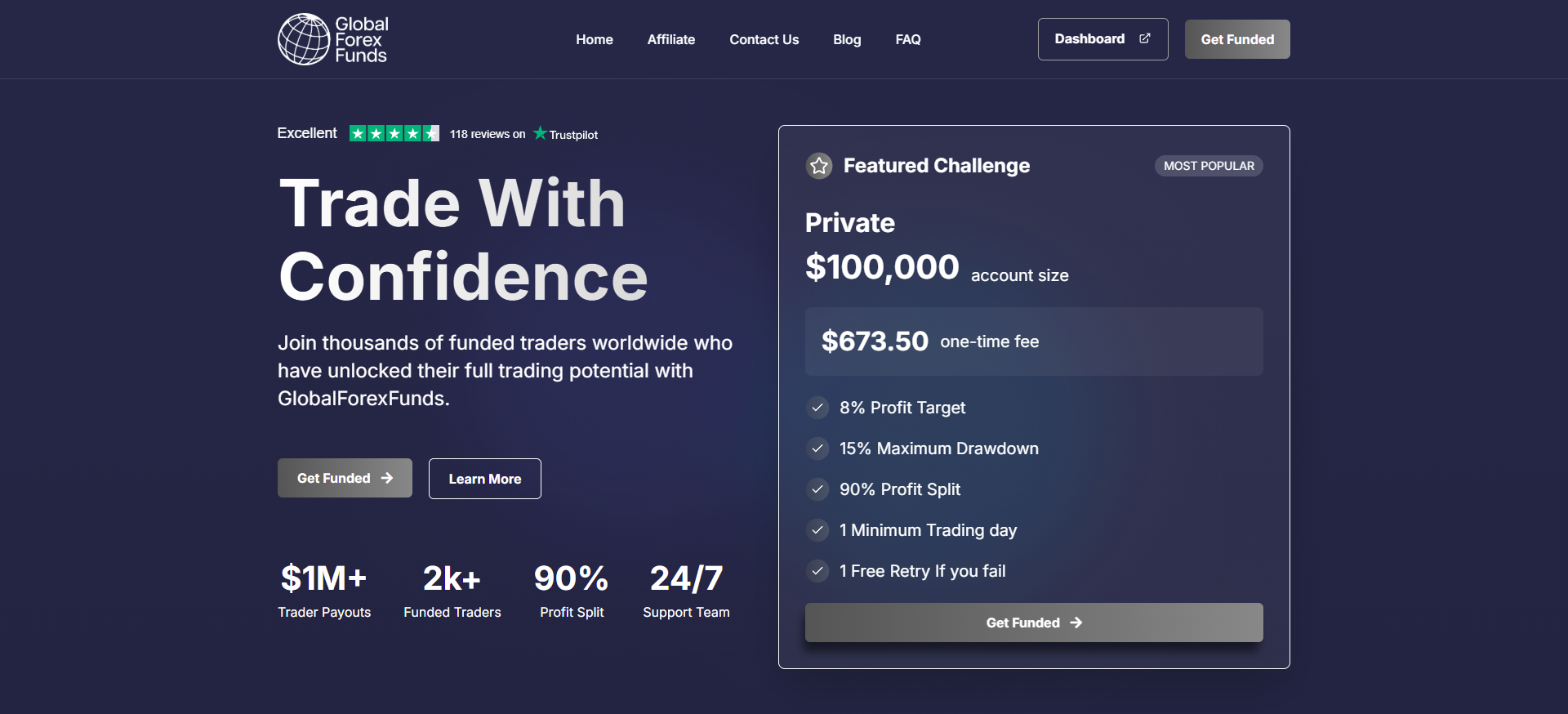

Traders who successfully complete the Global Forex Funds challenge are rewarded with a fully funded account, with access to account sizes of up to $400,000. All trading is conducted remotely, giving you full flexibility and control over your strategies. While the challenge requires discipline and consistent performance, Global Forex Funds supports you with 24/7 assistance and a clear, transparent set of rules to help you achieve success.

Pros

- 2,000+ funded traders worldwide with a growing reputation

- Fast bi-weekly payouts with quick processing times

- Overnight and weekend positions allowed

- 24/7 customer support

- Profit split up to 90%

- Generous daily and maximum drawdown limits

- No restrictions on news trading

- Leverage up to 1:100

- Clear, transparent rules with no hidden fees or commissions

- Multiple trading platforms supported, including Platform 5 and TradeLocker

Cons

- 5% maximum daily drawdown limit

- Minimum of 7 trading days required for the Economy Challenge

- No free trial account available

Global Forex Funds is a funding program designed for traders who value discipline, risk management, and consistent results. They provide the opportunity to trade funded accounts with up to $400,000 in capital and keep up to 90% of the profits. With realistic profit targets, industry-leading drawdown limits, and access to professional platforms like Platform 5 and TradeLocker, Global Forex Funds empowers traders to perform at their best in the global financial markets.

Who Is Global Forex Funds?

Global Forex Funds is a proprietary trading program that empowers traders by providing access to simulated capital of up to $400,000 with profit splits of up to 90%. Designed for traders across forex, commodities, indices, and more, Global Forex Funds operates worldwide and supports thousands of traders in a transparent, trader-friendly environment. With industry-leading conditions, multiple professional platforms, and flexible trading rules, the program delivers an accessible and rewarding path for traders of all experience levels.

Their headquarters are based in Limassol, Cyprus.

Global Forex Funds Trading Challenges

Global Forex Funds provides a selection of structured challenge options designed to suit various trading styles, skill levels, and account sizes. Traders can choose from multiple plans, with funding amounts ranging from $5,000 to $400,000.

- Economy $50K

- Economy $100K

- Economy $200K

- Private $100K

- Other custom funding options

Supported Trading Assets & Account Options

Global Forex Funds gives traders access to a wide range of financial instruments through professional platforms like Platform 5 and TradeLocker. These typically include major, minor, and exotic forex pairs, along with indices, commodities, and more all with institutional-grade execution, tight spreads, and deep liquidity.

Challenge Account Sizes & Fees

Account Size

One Time Fee

$50,000

$329

$100,000

$449

$200,000

$799

The Global Forex Funds Evaluation Process is designed to identify skilled, disciplined traders while offering fair trading conditions and accessible funding.

In the Private Challenge, traders aim to reach a profit target of 8%, while adhering to a 5% daily loss limit and a 15% overall drawdown limit. This stage requires just one minimum trading day and has no strict time limit, allowing traders to progress at their own pace.

Upon passing the challenge, traders receive a funded account with up to 90% profit split. While there are no additional profit targets during the funded stage, drawdown limits still apply to support consistent risk management.

Global Forex Funds processes payouts on a bi-weekly basis, with fast withdrawals supported through various payment methods to help traders access their earnings quickly.

Account Growth Opportunities at Global Forex Funds

Global Forex Funds is committed to rewarding disciplined, consistent traders through its performance based funding model. While no formal scaling plan is currently outlined, traders who demonstrate strong, sustainable results can maintain long term access to trading capital with profit splits of up to 90%.

The program supports trader growth by minimizing restrictions, offering flexible trading conditions, and maintaining a transparent rule set. Leverage options vary by challenge type, with up to 1:100 leverage available on select plans such as the Private Challenge.

Funded traders can access professional platforms like Platform 5 and TradeLocker, with instrument offerings that typically include forex pairs, indices, commodities, and more. Global Forex Funds continues to evolve its features and funding models to meet the demands of modern traders around the world.

Trading Rules & Risk Parameters at Global Forex Funds

Profit Targets

The Private Challenge requires a profit target of 8% to pass. Once funded, traders are no longer required to meet fixed profit targets and can focus on consistent, disciplined trading.Maximum Daily Loss

A 5% daily loss limit is enforced across most account types to promote sound risk management practices.Maximum Drawdown

For the Private Challenge, the maximum drawdown is 15%, offering greater flexibility than many industry competitors.Minimum Trading Days

The Private Challenge requires just 1 minimum trading day, enabling skilled traders to qualify quickly. Once funded, there are no minimum trading days required to request profit withdrawals.Weekend Holding

Global Forex Funds allows both overnight and weekend positions, giving traders full control over trade duration.News Trading

News trading is allowed there are no restrictions during scheduled economic events or high impact announcements.Copy Trading Notice

While copy trading tools are not outright banned, strategies must be genuinely unique. Accounts flagged for copying or mirroring other traders’ positions may be reviewed or disqualified.Expert Advisors (EAs)

The use of Expert Advisors is permitted. However, mass shared or mirrored EA strategies that closely replicate other traders’ behavior could lead to account violations or payout denial.

How the Evaluation Process Works at Global Forex Funds

Global Forex Funds uses a streamlined one phase evaluation model designed to identify disciplined traders who can manage risk and achieve realistic profit targets.

The Private Challenge offers up to 1:100 leverage, flexible trading conditions, and access to professional platforms such as Platform 5 and TradeLocker. Traders can access a broad selection of instruments, including forex pairs, indices, and commodities, under clear, trader-friendly rules.

Account Size

Price

$50,000

$329.00

$100,000

$449.00

$200,000

$799.00

Global Forex Funds offers a one-phase evaluation process across its challenge types, designed to reward skilled traders who can meet realistic profit targets while practicing strong risk management.

For example, the Economy Challenge requires a 10% profit target, with a 5% daily loss and 10% overall drawdown limit. Traders must meet a minimum of 7 active trading days to qualify for a funded account.

The Private Challenge lowers the profit target to 8%, allows for a 15% max drawdown, and requires only 1 active trading day offering more flexibility to experienced traders.

Once funded, traders can earn up to 90% of profits, with bi-weekly payouts and fast withdrawals. While no fixed profit targets apply in the funded stage, daily and overall drawdown rules remain to promote long-term consistency and discipline.

Funding Growth Potential at Global Forex Funds

Global Forex Funds may not currently offer a formal account scaling program, but traders who consistently perform well and manage risk effectively can continue to enjoy profit splits of up to 90% and the opportunity to trade larger capital over time.

Access to major forex pairs, indices, commodities, and metals

Leverage of up to 1:100 on select challenges

No restrictions on news trading or weekend holding

Bi-weekly profit withdrawals with a 90% split for top performers

All trading is conducted under realistic market conditions, with support for a broad range of assets including forex, indices, metals, and energy products. Whether you trade EUR/USD, gold, or oil, you’ll benefit from flexible rules, professional-grade platforms, and competitive payout terms.

Global Forex Funds is designed to empower disciplined traders with the tools, capital, and freedom they need to maximize their performance in global markets.

options

Is Securing Capital from Global Forex Funds a Realistic Goal?

When choosing a proprietary trading firm, it’s essential to evaluate whether their profit targets and risk rules are aligned with your trading style. High funding amounts and generous profit splits may sound attractive, but they only matter if the path to funding is achievable and fair.

Global Forex Funds offers multiple evaluation programs including 1-phase, 2-phase, and instant funding options giving traders the flexibility to choose a challenge that fits their skills and risk tolerance.

In the Two-Phase Evaluation, Phase 1 requires traders to reach an 8% profit target within 30 days, while Phase 2 lowers the target to 6% with 60 days to complete. Both phases apply a 5% daily loss limit and a 10% overall drawdown, promoting responsible risk management while maintaining realistic goals.

Unlike firms with confusing or inconsistent challenge tiers, Global Forex Funds defines each challenge clearly, with consistent rules across account sizes within each model. Whether traders choose the Economy, Private, or Two-Phase Challenge, the evaluation conditions remain transparent and structured for success.

With high-leverage options (up to 1:100), bi-weekly withdrawals, and up to 90% profit splits, Global Forex Funds creates a balanced, attainable environment for traders seeking capital. Those who apply discipline, manage risk, and perform consistently have a real opportunity to secure a funded account.

Is Securing Capital from Global Forex Funds a Realistic Goal?

When choosing a proprietary trading firm that matches your trading style, it’s important to consider whether their profit targets, risk parameters, and rules are realistically achievable. High funding amounts and generous profit splits are only valuable when paired with an evaluation process that supports long-term success.

Global Forex Funds offers a variety of evaluation models tailored to different trading styles, including the Private Challenge, Economy Challenge, and a Two-Phase Evaluation. Their Private Challenge, in particular, features a simplified, single-phase structure requiring just an 8% profit target and offering a generous 15% maximum drawdown — ideal for traders who value flexibility without unnecessary restrictions.

Risk parameters across their challenges are straightforward and built to promote disciplined trading, with consistent rules like a 5% daily loss limit and no restrictions on news trading or weekend positions.

With leverage up to 1:100, transparent funding rules, and profit splits of up to 90%, Global Forex Funds provides a trader-friendly environment where skilled, consistent performers have a genuine opportunity to secure and grow funded capital.

Global Forex Funds’ Industry Reputation

Global Forex Funds has built a strong presence in the proprietary trading industry, earning positive feedback from traders for its transparent rules, competitive profit splits, and reliable payout process.

On Trustpilot, Global Forex Funds maintains a strong TrustScore of approximately 4.7 out of 5, based on over 110 reviews, mostly in the 5-star range. Many users cite the platform’s transparent rules, fast payouts (often within two days), and flexible Instant Funding model as key advantages.

Traders also frequently praise the customer support team for being responsive and dependable, noting consistent support and assistance throughout the funding process.

Note: While overall ratings are very positive, Trustpilot review visibility may be influenced by review-managing tools. For the most balanced perspective, it’s helpful to consider additional independent forums and user feedback.

Support

Global Forex Funds provides traders with multiple support channels to access information and receive assistance

FAQ Page: A comprehensive Frequently Asked Questions section covers a wide range of common topics, helping traders quickly find answers on their own.

Email Support: Reach the support team anytime at support@globalforexfunds.com. Responses are typically prompt, professional, and helpful.

Live Chat: Real time support is available through the live chat feature directly on the Global Forex Funds website.

Telegram: For fast communication and updates, traders can also connect with the team via Telegram.

Multilingual Assistance: Support is available in over 15 languages, including:

English, German, Spanish, Portuguese, French, Italian, Czech

Hindi, Filipino, Vietnamese, Slovenian, Serbian, Ukrainian, Turkish, Russian

Phone Support: Telephone assistance is offered Monday to Friday, from 8 AM to 5 PM CEST/CET (Central European [Summer] Time).

This diverse, multilingual support system ensures traders can get help in their preferred language and through their preferred method whether it’s email, chat, phone, or Telegram making support accessible and dependable.

Conclusion

In conclusion,Global Forex Funds is a respected proprietary trading firm centered around a clear and well-structured two-phase evaluation program that rewards consistent performance and disciplined risk management.

Traders can choose from multiple account sizes, all governed by the same transparent rules regardless of funding level.

To secure funding, participants must meet realistic profit targets in each evaluation phase while adhering to strict daily loss and maximum drawdown limits. Generous timeframes and a minimum number of active trading days ensure the process remains fair and attainable.

Once funded, traders benefit from:

No ongoing profit target requirements

Fast, reliable payout processing

Competitive profit splits of up to 90%

Flexible trading conditions

High leverage (up to 1:100)

No restrictions on news trading or weekend holding

Known for its transparency, trader-first rules, and supportive environment, Global Forex Funds continues to grow its reputation among retail traders worldwide.