The Good and Bad about FTMO

Upon successful completion of the evaluation course, traders are granted a position within the FTMO Proprietary Trading firm. This allows them to remotely manage an FTMO account with a balance of up to 200,000 USD. Although this journey may come with its own set of challenges, FTMO provides comprehensive educational resources, account analysis, and performance coaching to assist traders in their quest for financial independence.

Pros

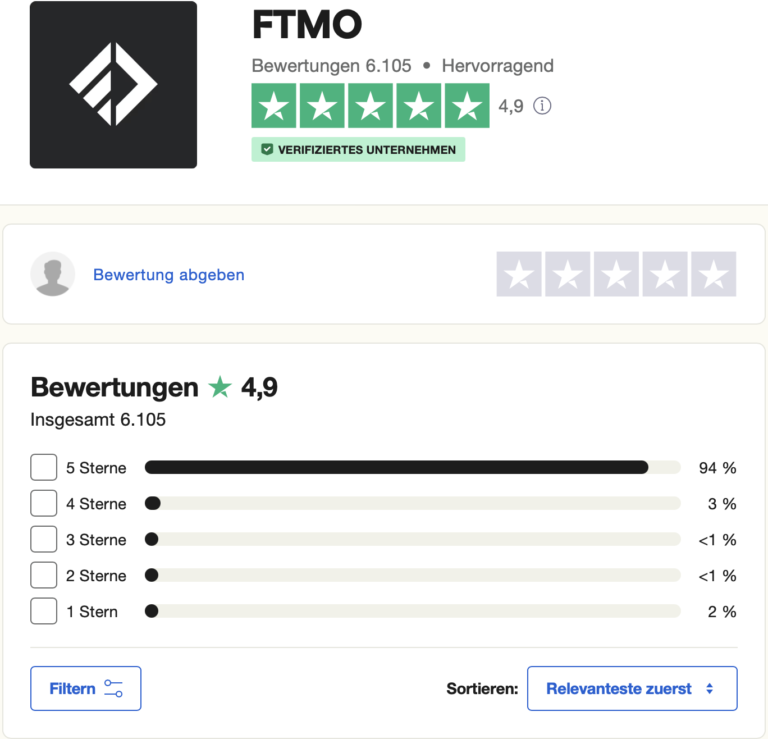

- Over 5k Trustpilot reviews with an excellent score of 4.8/5

- First Payout After 14 Days after that Bi-weekly

- Overnight & Weekend Holding Allowed

- Trading Psychologist for Traders

- Profit Share of 80% up to 90%

- Balance-based Drawdown

- Unlimited trading period

- Swap-free Accounts

- Bi-weekly payouts

- Leverage 1:100

- Scaling Plan

- Free Trial

- A Large Variety of Trading Instruments (Forex Pairs, Commodities, Indices, Stocks, Cryptocurrencies)

- USD, GBP, EUR, CZK, CAD, AUD, & CHF Account Currencies

Cons

- 5% Maximum daily equity-based drawdown

- Trading during high-impact news events is restricted. Trades cannot be opened 2 minutes before or after the event.

- 4 Minimum trading days

- Higher Prices

FTMO is a place where traders can thrive. They are looking for disciplined people who know how to manage risk and focus on being consistent over the long term. At FTMO, you could have the opportunity to manage accounts as large as $2,000,000 and keep up to 90% of the profits you make. This applies to a wide range of assets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies. It’s an exciting chance to earn substantial income while trading the markets you love.

Who Is FTMO?

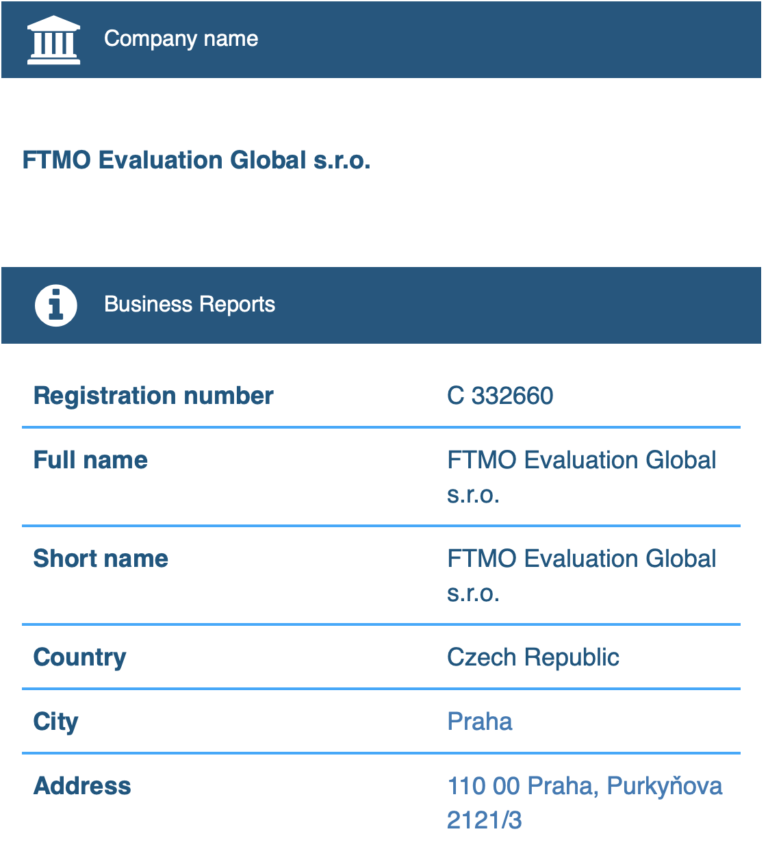

FTMO is a proprietary trading firm incorporated in September 2015. Their headquarters are situated in Prague, Czech Republic, and they provide traders with access to capital up to $2,000,000 in balance with profit splits of up to 90%. They have established a partnership with a tier-1 liquidity provider, ensuring that traders experience the best simulated real market trading conditions through their broker.

Their headquarters are located at Opletalova 1417/25 110 00 Prague, Czech Republic.

Video Review

FTMO's Evaluation Programs

FTMO provides traders with the option to select from two distinct two-phase evaluation funding programs:

- Evaluation Program Accounts

- Aggressive Evaluation Program Accounts

Normal Evaluation Program Accounts

FTMO’s Normal Evaluation Program Accounts are designed to recognize disciplined and skilled traders, rewarding them for their consistency throughout the two-phase evaluation period. Traders using the Normal Evaluation Program Account can trade with leverage of 1:100 and have the flexibility to choose their account funding currency from a selection that includes USD, GBP, EUR, CZK, CAD, AUD, and CHF.

Account Size

Price

$10,000

€155

$25,000

€250

$50,000

€345

$100,000

€540

$200,000

€1,080

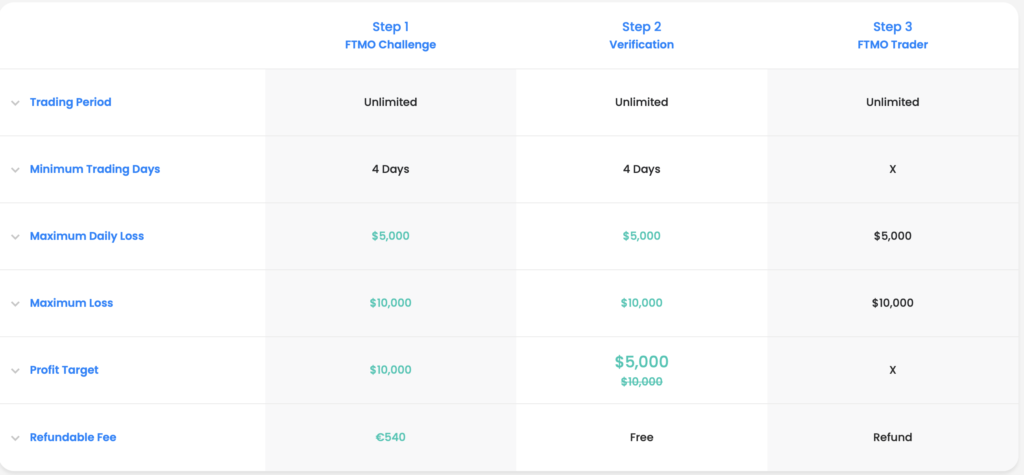

The FTMO Evaluation Phase One necessitates that a trader achieves a profit target of 10%, while adhering to the 5% maximum daily loss or 10% maximum loss rules. There are no specific maximum trading day requirements during Phase One, but traders must engage in a minimum of four trading days to advance to Phase Two.

The FTMO Evaluation Phase Two entails a trader achieving a profit target of 5%, while also adhering to the 5% maximum daily loss or 10% maximum loss rules. Similar to Phase One, there are no set maximum trading day requirements during Phase Two, but traders must participate for a minimum of four trading days to proceed to a funded account.

Upon successfully completing both evaluation phases, traders are awarded a funded account with no specific profit targets. They are only required to abide by the 5% maximum daily loss and 10% maximum loss rules. By default, the first payout is scheduled for 30 calendar days from the day the trader places their first position on their funded account. However, traders have the option to request a payout on demand after just 14 calendar days from the day they place their first position on their funded account. Profit splits for traders on their funded account range from 80% up to 90%, based on the profits they generate.

Normal evaluation program account scaling plan

In the Normal Evaluation Program Accounts, there is a scaling plan in place. Traders are required to achieve a profit target of 10% or more within a four-month period, during which two out of the four months must be profitable, with one of them being the fourth month. Upon meeting this requirement, traders receive an account increase equivalent to 25% of the original account balance.

For instance, if a trader has a $200,000 account:

- After 4 months: The account balance increases to $250,000.

- After the subsequent 4 months: The balance of $250,000 increases to $300,000.

- Following another 4 months: The balance of $300,000 increases to $350,000.

- And so on…

In the Normal Evaluation Program Accounts, traders have the flexibility to trade various instruments, including forex pairs, commodities, indices, stocks, bonds, and cryptocurrencies.

Normal evaluation program account scaling plan

Profit target is a specific percentage of profit money that traders must achieve before they can progress in an evaluation phase, withdraw profits, or scale their account. Phase 1 requires a profit target of 10%, phase 2 requires a profit target of 5%, and funded accounts have no profit targets.

Maximum daily loss is the maximum loss a trader can incur within a single trading day before the account is invalidated. The maximum daily loss for all account sizes is 5%.

Maximum loss is the maximum cumulative loss a trader can incur overall before the account is invalidated. The maximum loss for all account sizes is 10%.

Minimum trading days represent the minimum number of days a trader is required to actively trade before completing an evaluation phase or requesting a withdrawal. Both evaluation phases have a minimum trading day requirement of 4 days, while funded accounts have no minimum trading day requirements for debit.

Weekend holding is allowed if traders select a broker that supports it; otherwise, it may be restricted.

No news trading means traders are prohibited from executing trades during high-impact news releases. Trading activity is restricted within 2 minutes before and after the release of news events in normal funded evaluation program accounts.

Third-party copy trading risk acknowledges that if traders intend to utilize copy trading services, they should be aware that others may already be using the same strategy via the service. This could potentially lead to denial of a funded account or withdrawal if the trader exceeds the maximum capital allocation rule.

Third-party EA risk highlights that using a third-party Expert Advisor (EA) carries the risk that other traders might be employing the same EA with an identical trading strategies. This could result in denial of a funded account or withdrawal if the trader surpasses the maximum capital allocation rule.

Aggressive Evaluation Program Accounts

FTMO Aggressive evaluation program accounts are designed to discover disciplined and skilled traders who can consistently perform well during the two-phase evaluation process. These accounts offer traders the opportunity to trade with 1:100 leverage, just like the normal evaluation accounts. and provide a choice of account funding in various currencies, including USD, GBP, EUR, CZK, CAD, AUD, and CHF.

Account Size

Price

$10,000

€155

$25,000

€250

$50,000

€345

$100,000

€540

$200,000

€1,080

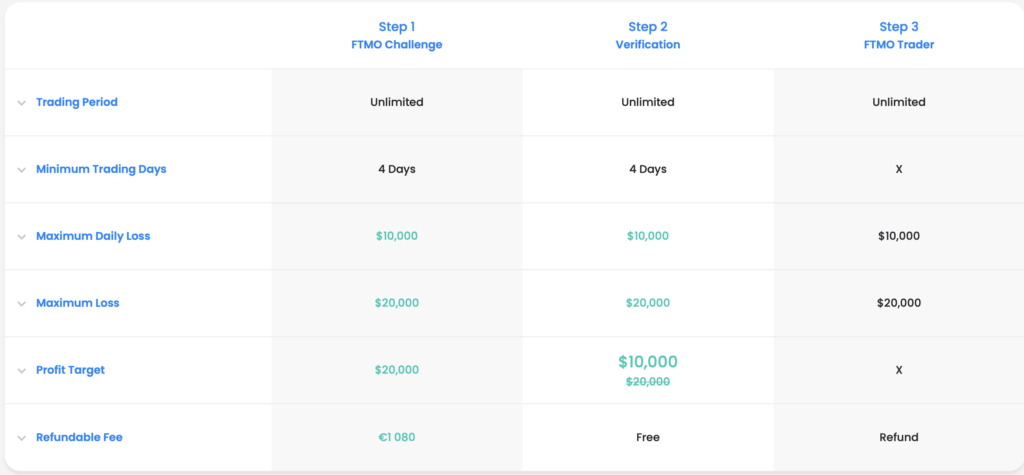

In the Aggressive evaluation program accounts, Phase 1 requires traders to achieve a profit target of 20% without exceeding the maximum daily loss of 10% or the maximum loss of 20%. There is no specific maximum trading day requirement during Phase 1, but traders must complete a minimum of four trading days to proceed to Phase 2.

Phase 2 of the Aggressive evaluation program necessitates traders to reach a profit target of 10% while adhering to the maximum daily loss of 10% and the maximum loss of 20%. There is no specific maximum trading day requirement during Phase 2, but traders must complete a minimum of five trading days to be eligible for a funded account.

Upon successful completion of both evaluation phases, traders are granted a funded account where they are not subjected to profit targets. Instead, they must adhere to the maximum daily loss of 10% and the maximum loss of 20% fee. By default, the first payout from the funded account is scheduled for 30 calendar days from the day the first position is placed. However, Traders have the option to request a payout on demand after only 14 calendar days from the day the first position is placed on the funded account. Profit splits on funded accounts range from 80% up to 90%, depending on the profits generated.

Aggressive evaluation program account scaling plan

In the Aggressive evaluation program accounts, there is a scaling plan options that traders can take advantage of. To be eligible for the scaling plan, traders are required to achieve a profit target of 10% or more within a four-month period. This period should include two profitable months, with one of them being the fourth month. Upon meeting these criteria, traders will receive an account increase of 25% of the original account balance.

Here’s an example to illustrate how the scaling plan works:

- After 4 months: If you have a $100,000 account, your account balance will increase to $125,000.

- After the next 4 months: The balance of $125,000 increases to $150,000.

- After the next 4 months: The balance of $150,000 increases to $175,000.

- And so on…

Trading strategies and instruments for the Aggressive evaluation program accounts include forex pairs, commodities, indices, stocks, bonds, and cryptocurrencies. This provides traders with a diverse range of assets to trade and showcase their skills during the evaluation phases.

Aggressive evaluation program account rules

- Profit Target:

- Phase 1: 20%

- Phase 2: 10%

- Funded Accounts: No profit targets

Maximum Daily Loss:

- All Account Sizes: 10%

Maximum Loss:

- All Account Sizes: 20%

Minimum Trading Days:

- Phase 1 and Phase 2: Minimum of 4 trading days

- Funded Accounts: No minimum trading days required before eligibility for payouts

Third-Party Copy Trading Risk:

- If you plan to use copy trading services, be aware that others might use the same strategy. Using third-party copy trading may affect your chances of getting funded or withdrawing funds if you exceed the maximum capital allocation rule.

Third-Party EA Risk:

- If you intend to use a third-party EA (Expert Advisor), keep in mind that others might use the same strategy. Using a third-party EA may affect your eligibility for a funded account or withdrawal if you exceed the maximum capital allocation rule.

options

Is getting FTMO capital realistic

When exploring prop firms industry that align with your forex trading style options, it’s crucial to assess the attainability of their trading requirements. While a firm offering a generous profit split on a well-funded account may sound enticing, the feasibility of achieving high monthly gains with minimal drawdowns could be challenging.

Receiving capital through the normal evaluation program accounts is generally realistic. This is primarily due to their moderate profit targets, requiring a 10% profit in phase one and a 5% profit in phase two. Additionally, these accounts come with reasonable maximum loss limits, set at 5% per day and 10% overall.

Even when considering the aggressive evaluation program accounts, achieving capital allocation remains realistic. Despite their higher profit targets of 20% (phase one) and 10% (phase two), these accounts are balanced with more substantial maximum loss thresholds of 10% per day and 20% overall.

Taking all these factors into account, FTMO stands out as an excellent choice for securing funding. This is because both normal and aggressive evaluation program accounts offer realistic trading objectives and conditions to attain payouts.

Payment Proof and Trustworthiness

FTMO is a proprietary trading firm that was established in September 2015. One of the notable features of FTMO is its bi-weekly payout option, allowing traders and brokers to request payouts at regular intervals once they secure funding. Moreover, traders at FTMO enjoy the benefit of having no profit targets to meet when making withdrawals.

To illustrate the success and transparency of FTMO, you can view two examples of payment proof below. The first image showcases a certificate awarded to a trader who successfully completed the evaluation challenge, highlighting the firm’s commitment to rewarding traders and brokers for their achievements. The second image is a withdrawal certificate issued to one of FTMO’s prosperous traders, further emphasizing the trustworthiness and reliability of the firm.

FTMO's Reputation

FTMO has received overwhelmingly positive feedback in their reviews.

On Trustpilot, they have a diverse community of traders and brokers leaving positive feedback, resulting in an impressive score of 4.9 out of 5 from a total of 6,105 reviews. Additionally, FTMO boasts a responsive and dependable support team that is readily available to address any inquiries or uncertainties you may have.

Support

FTMO provides various avenues or options for obtaining information and assistance:

- FAQ Page: FTMO offers a comprehensive FAQ page where you can find answers to common questions.

Email Support: You can contact their support team via email at support@ftmo.com. They are available 24/7 to respond to your queries.

Live Chat: You can use the live chat feature on their website to get real-time assistance.

WhatsApp: FTMO’s support team can be reached via WhatsApp for quick and convenient communication.

Multilingual Support: They offer support in 15 languages, including English, German, Spanish, Portuguese, French, Italian, Czech, Hindi, Filipino, Vietnamese, Slovenian, Serbian, Ukrainian, Turkish, and Russian.

Phone Support: Phone support is available from Monday to Friday, 8 AM to 5 PM CE(S)T, at the following number: +44 2033222983.

This extensive support network ensures that traders can access assistance and information through their preferred method and in their preferred language.

Conclusion

In summary, FTMO is a reputable proprietary trading firm industry that provides traders with the choice of two distinct two-phase evaluation program account types: normal and aggressive. Each account type comes with slightly different trading objectives and rules.

For the normal evaluation programs, traders are required to complete two phases before becoming funded and eligible to earn profit splits. Profit targets of 10% in phase one and 5% in phase two must be achieved, which are realistic trading objectives, considering the 5% maximum daily and 10% maximum loss rules. Traders in normal evaluation programs can earn profit splits ranging from 80% to 90%, and they have the option to scale their accounts. It’s important to note that normal accounts offer 1:100 leverage but do not allow trading during weekends or high-impact news releases.

On the other hand, aggressive evaluation programs also consist of two phases before traders become funded and eligible for profit splits. These programs require profit targets of 20% in phase one and 10% in phase two, which remain realistic due to the 10% maximum daily and 20% maximum loss rules. Traders in aggressive evaluation programs can earn profit splits ranging from 80% to 90% and have the option to scale their accounts. These accounts offer 1:30 leverage and allow trading during weekends and high-impact news releases.

FTMO, established in 2015, offers a straightforward approach with clear rules. Their track record and ongoing success in funding traders globally make them one of the leading proprietary trading firms in the industry. If you’re seeking a prop firm with transparent rules and a solid reputation, FTMO is a highly recommended choice.

If you found this FTMO Review to be informative, you can visit their website here.

You can also discover additional Propfirm reviews here.