The Good and Bad about The Funded Trader

The Funded Trader was founded by the same individuals behind The Forex League and VVS Academy. They established this proprietary trading firm to offer their community precisely the solutions they needed.

Pros

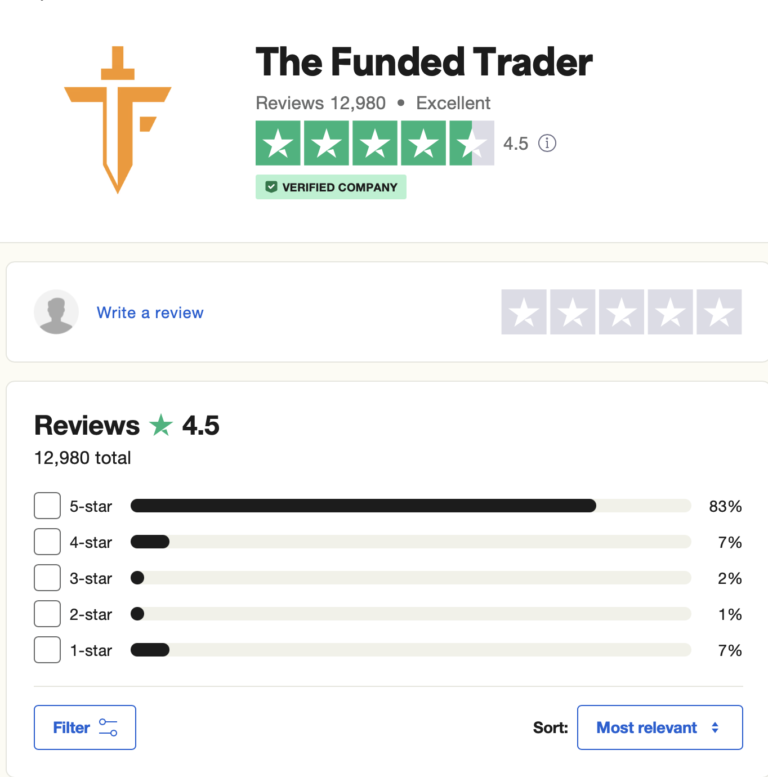

- Over 16k Trustpilot reviews with an excellent score of 4.4/5

- Balance-based Drawdown on Rapid & Dragon Challenge

- Profit Share of 75% up to 95% (Depending on Challenge)

- News trading allowed on Swing Accounts

- Overnight and weekend holding allowed

- Five different funding program options

- Leverage up to 1:200

- Free Trial

- A Large Variety of Trading Instruments (Forex Pairs, Commodities, Indices, Cryptocurrencies)

Cons

- Minimum Trading Day Requirements on Standard & Royal Challenge

- Standard & Royal Challenge have Equity-based Drawdown

- Initial Maximum Drawdown of 8% on Rapid Challenge

- Trailing Drawdown on Knight Challenge

The Funded Trader is actively seeking passionate and seasoned traders and brokers who can demonstrate their skills in navigating unpredictable market conditions and achieve success with the firm’s capital. Traders have the opportunity to manage account sizes of up to $1,500,000 and can earn profit splits as high as 90%. This is possible through trading various assets, including forex pairs, commodities, indices, and cryptocurrencies.

Who Is The Funded Trader?

The Funded Trader is a proprietary trading firm that was established on May 12, 2021. While their office is located in the United States, they provide traders with the opportunity to access capital of up to $1,500,000 and offer profit splits as high as 90%. The firm has established partnerships with brokers such as Eightcap and Purple Trading Seychelles.

The Funded Trader’s headquarters are situated at 14001 W HWY 29, Suite 102, Liberty Hill, TX 78642.

Video Review

The Funded Trader provides traders with four program options to choose from:

- Standard challenge accounts

- Standard regular challenge accounts

- Standard swing challenge accounts

- Rapid challenge accounts

- Rapid regular challenge accounts

- Rapid swing challenge accounts

- Royal challenge accounts

- Knight challenge accounts

Standard Challenge Program

Account Size

Price

$5,000

$65

$10,000

$129

$25,000

$199

$50,000

$299

$100,000

$499

$200,000

$939

$300,000

$1,409

$400,000

$1,879

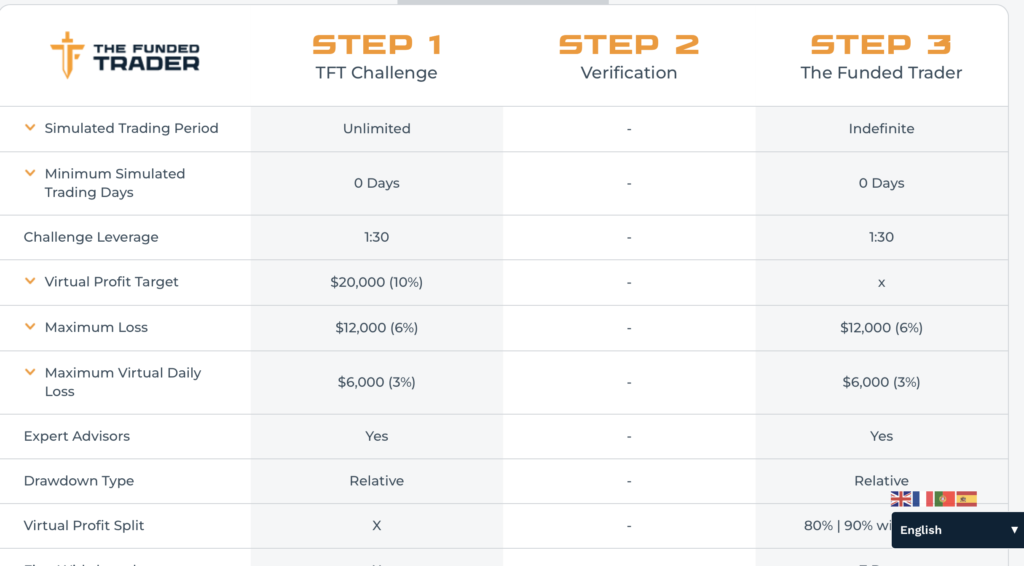

The Funded Trader’s standard challenge account is designed to identify committed and skilled traders and brokers who demonstrate consistency in a two-phase evaluation period. The regular evaluation program account allows for 1:200 leverage during the evaluation stages and 1:100 once funded. In contrast, swing evaluation programs offer 1:60 leverage during the evaluation stages and 1:30 once funded. One key difference is that swing accounts permit holding trades over weekends, while regular accounts require trade closure.

For evaluation phase one, traders must achieve a 10% profit target without exceeding a 5% maximum daily loss or violating the 10% maximum loss rules. There are no specific maximum trading day requirements during phase one, but traders must complete a minimum of three trading days to progress to phase two.

Evaluation phase two requires traders to attain a 5% profit target while adhering to a 5% maximum daily loss and 10% maximum loss rules. Similar to phase one, there are no maximum trading day restrictions, but a minimum of three trading days is necessary to advance to a funded account.

Upon successfully completing both evaluation phases, day traders are granted a funded account with no profit targets. Instead, they must adhere to the 5% maximum daily loss, 10% maximum loss, and lot size limit rules. The first payout occurs 21 calendar days from the day traders place their initial position on the funded account. Subsequent payouts are scheduled on a bi-weekly basis. Profit splits range from 80% to 90% based on the profit fee generated from the funded account.

Add-on options for The Funded Trader’sStandard challenge accounts

- Additional Drawdown

- EA’s Enabled

Standard challenge account scaling plan

The scaling plan for Standard challenge accounts involves reaching a profit target of 6% or more within a three-month period, with two out of the three months being profitable. Traders who achieve this goal will see their account balance increase by 25% of the original account balance.

Here’s an example of how the scaling plan works:

- Initial account balance: $200,000

- After 3 months: Account balance increases to $250,000.

- After the next 3 months: Balance of $250,000 increases to $300,000.

- After the subsequent 3 months: Balance of $300,000 increases to $350,000.

- And so on…

Traders participating in Standard challenge accounts have the opportunity to trade a variety of instruments, including forex pairs, commodities, indices, and cryptocurrencies.

The rules for Standard challenge accounts are as follows:

Profit Targets: Traders must achieve specific profit percentages before completing evaluation phases, making withdrawals, or scaling their accounts. Phase 1 has a profit target of 10%, while Phase 2 has a profit target of 5%. Funded accounts have no profit targets.

Maximum Daily Loss: The maximum loss a trader can incur in a single trading day before the account is considered in violation is 5%. This applies to all account sizes.

Maximum Loss: The maximum cumulative loss a trader can reach before the account is in violation is 10%. This also applies to all account sizes.

Minimum Trading Days: Traders are required to trade for a minimum number of days before completing an evaluation phase or requesting a withdrawal. Both Phase 1 and Phase 2 have a minimum trading day requirement of 3 days. Funded accounts have no minimum trading day requirements for payouts.

Lot Size Limit: Traders must adhere to specified lot sizes for specific trading instruments. These lot sizes are typically determined based on the initial account balance of the prop firm account. This rule applies only to funded accounts.

No Martingale Allowed: Traders are prohibited from using martingale strategies while trading.

Third-Party Copy Trading Risk: If traders intend to use copy trading services, they should be aware that using a third-party copy trading service may involve other traders using the same trading strategy. There is a risk of being denied a funded account or withdrawal if this exceeds the maximum capital allocation rule.

No EAs Allowed: Traders are not allowed to use any type of EA (Expert Advisor) services, except for expert advisors for copying purposes.

Rapid Challenge Program

Account Size

Price

$5,000

$79

$10,000

$129

$25,000

$229

$50,000

$399

$100,000

$499

$200,000

$899

The objective of the Rapid challenge account at The Funded Trader is to identify dedicated and skilled traders who exhibit consistent performance during the two-phase evaluation period. In the regular evaluation program account, traders can operate with a leverage of 1:100. Conversely, in the swing evaluation programs, traders can utilize a 1:30 leverage. The primary distinction lies in swing accounts having the flexibility to maintain trades over weekends, whereas regular accounts necessitate closing trades.

In the first evaluation phase, traders are tasked with achieving an 8% profit target while ensuring they do not exceed a 5% maximum daily loss or breach the 8% maximum fee loss limits. This profit objective should be met within 35 calendar days from the initiation of their evaluation account. Importantly, there are no minimum trading day requirements to advance to phase two.

Moving on to the second evaluation phase, traders are expected to reach a 5% profit target while staying within the bounds of a 5% maximum daily loss and the 8% maximum loss thresholds. Traders are required to attain this profit target within 60 calendar days from the inception of their evaluation account, and again, there are no minimum trading day prerequisites to progress to a funded account.

Upon successfully completing both evaluation phases, traders earn a funded account where profit targets are eliminated. Instead, traders must adhere to regulations regarding a 5% maximum daily loss, an 8% maximum loss, and lot size limits. The initial payout is disbursed 14 calendar days after initiating the first position in the funded account, followed by subsequent bi-weekly payouts. Detailed information on the withdrawal schedule and profit split percentages can be found in the spreadsheet provided below.

Payout Number

Profit Split

1st Payout

80%

2nd Payout

85%

3rd Payout

90%

4th Payout

80%

Starting from the fourth payout and continuing thereafter, the profit split stands at 80%.

Scaling in the Rapid challenge accounts operates with a unique approach. To scale your account, you must achieve a profit target of 10% or more within a single profit split period. With each withdrawal that surpasses 10% of your initial account balance, you will receive an account increase of 10%.

For example:

Account Size

Profit Split

Scaled Account Size

$100,000

10%+

$110,000

$110,000

10%+

$120,000

$120,000

10%+

$130,000

$130,000

10%+

$140,000

In the case of standard challenge accounts, day traders have the opportunity to engage with a variety of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies.

Rapid Challenge Account Rules:

Profit Target: A specific percentage of profit that a trader must achieve before advancing through evaluation phases, withdrawing profits, or scaling their account. Phase 1 requires an 8% profit target, while phase 2 sets a 5% profit target. Funded accounts have no profit targets.

Maximum Daily Loss: The highest allowable daily trading loss before the account is considered in violation. All account sizes share a maximum daily loss limit of 5%.

Maximum Loss: The overall maximum loss a trader can incur before the account is considered in violation. All account sizes have a maximum loss limit of 8%.

Maximum Trading Days: The maximum time frame within which a trader must reach a specific profit target or withdrawal target. Phase 1 has a maximum of 35 trading days, while phase 2 allows up to 60 trading days.

Lot Size Limit: Traders must adhere to specified lot sizes for different trading instruments, often determined by the initial account balance of the proprietary firm account. This applies only to funded accounts.

No Martingale Allowed: Traders are prohibited from utilizing martingale strategies during trading.

No Weekend Holding: Traders are not permitted to keep open positions during the weekends.

Third-Party Copy Trading Risk: Using third-party copy trading services carries a risk that other traders may employ the same strategy. This can impact a trader’s eligibility for a funded account or withdrawal if it exceeds the maximum capital allocation rule.

No EAs Allowed: Traders are restricted from using EA (Expert Advisor) services, with an exception for expert advisors used for copying purposes.

Royal Challenge Program

Account Size

Price

$50,000

$289

$100,000

$489

$200,000

$939

$200,000

$1,399

$400,000

$1,869

The Funded Trader’s Royal Challenge account aims to identify dedicated and skilled traders who are rewarded for their consistency in a two-phase evaluation period. The evaluation program account allows you to trade with 1:200 leverage.

In Phase One of the evaluation, a trader must achieve a profit target of 8% without exceeding the maximum daily loss of 5% or the maximum loss of 10%. You are required to reach your profit target within 35 calendar days from the day you open your first position in your evaluation account. Additionally, you must complete a minimum of five trading days to proceed to Phase Two.

In Phase Two of the evaluation, a trader must reach a profit target of 5% without exceeding the maximum daily loss of 5% or the maximum loss of 10%. You are required to reach your profit target within 60 calendar days from the day you open your first position in your evaluation account. You must also complete a minimum of five trading days to become eligible for a funded account.

By successfully completing both evaluation phases, you will be awarded a funded account with no profit targets. You are only required to adhere to the 5% maximum daily loss, 10% maximum loss, and lot size limit rules. Your first payout will be issued 30 calendar days from the day you open your first position in your funded account. Please note that after receiving your first payout, all subsequent payouts will be based on a bi-weekly schedule. Your profit split will range from 80% to 90% based on the profits generated in your funded account.

The scaling plan for Royal Challenge accounts operates as follows: To qualify for an account increase, traders need to achieve a profit target of 6% or more within a three-month period, with at least two of those three months being profitable. Upon meeting this requirement, traders will receive a 25% account balance increase.

Here’s an example to illustrate the scaling plan:

- After 3 months: If you have a $200,000 account, your account balance will increase to $250,000.

- After the next 3 months: The balance of $250,000 will increase to $300,000.

- After another 3 months: The balance of $300,000 will increase to $350,000.

- And so forth…

The trading instruments available for Royal Challenge accounts include forex pairs, commodities, indices, and cryptocurrencies.

Here are the rules for the Royal Challenge account:

Profit Target: Traders must achieve a specific profit percentage before completing an evaluation phase, withdrawing profits, or scaling their account. Phase 1 has a profit target of 8%, while Phase 2 has a profit target of 5%. Funded accounts have no profit targets.

Maximum Daily Loss: Traders are subject to a maximum daily loss, which is the most significant loss allowed on a daily basis before the account is violated. This limit is set at 5% for all account sizes.

Maximum Loss: There is a maximum allowable loss for traders, representing the maximum cumulative loss before the account is violated. This maximum loss is set at 10% for all account sizes.

Minimum Trading Days: Traders must trade for a minimum period before they can complete an evaluation phase or request a withdrawal. Both Phase 1 and Phase 2 have a minimum trading day requirement of 5 days. Funded accounts do not have a minimum trading day requirement before becoming eligible for payouts.

Maximum Trading Days: There is a maximum period within which traders must achieve a specific profit target or withdrawal target. Phase 1 has a maximum of 35 trading days, while Phase 2 has a maximum of 60 trading days.

No Martingale Allowed: Traders are prohibited from using any martingale strategy while trading.

Third-Party Copy Trading Risk: If traders intend to use copy trading services, they should be aware that using a third-party copy trading service may involve other traders using the same strategy. This could potentially lead to being denied a funded account or withdrawal if it exceeds the maximum capital allocation rule.

Knight Challenge Program

Account Size

Price

$25,000

$189

$50,000

$289

$100,000

$489

$200,000

$939

The Funded Trader Knight Challenge account is designed to recognize dedicated and skilled traders who demonstrate consistency in a single-phase evaluation period. Traders using this evaluation program account can trade with a leverage of 1:30.

During the evaluation phase, traders are required to achieve a profit target of 10% while ensuring they do not exceed a 3% maximum daily loss or a 6% maximum trailing loss. There are no specific minimum or maximum trading day requirements for your evaluation account. The sole requirement for advancement to a funded account is achieving the profit target.

Upon successful completion of the evaluation phase, traders are granted a funded account without profit targets. They are only obligated to adhere to a 3% maximum daily loss and a 6% maximum trailing loss. The initial payout is processed within seven calendar days from the day you open your first position in your funded account. It’s important to note that subsequent payouts are also scheduled on a weekly basis. Profit splits range from 80% to 90%, depending on the profits generated in the funded account.

Knight challenge account scaling plan

The scaling plan for Knight Challenge accounts offers traders an opportunity to increase their account size and profit split. To qualify, traders need to achieve a profit target of 6% or more within a three-month period, with at least two out of the three months being profitable. Successful traders will receive an account increase of 25% of their original account balance.

Additionally, upon scaling their account for the first time, traders will enjoy an enhanced profit split, increasing from 80% to 90%. The daily drawdown limit will also be adjusted, rising from 3% to 4%.

Here’s an example of how this scaling plan works:

- After 3 months: If you initially had a $200,000 account, your account balance will increase to $250,000.

- After the next 3 months: Your balance of $250,000 will further increase to $300,000.

- Subsequently, after another 3 months: Your balance of $300,000 will continue to grow to $350,000.

- This pattern continues for subsequent periods.

Traders using Knight Challenge accounts have the flexibility to trade various instruments, including forex pairs, commodities, indices, and cryptocurrencies.

The rules for the Knight Challenge account are designed to ensure responsible and disciplined trading practices:

-

Profit Target: Traders must achieve a specific profit percentage before advancing in the evaluation phase, withdrawing profits, or scaling their account. The evaluation phase requires reaching a profit target of 10%, while funded accounts have no profit targets.

-

Maximum Daily Loss: There is a daily loss limit that traders cannot exceed before their account is considered in violation. All account sizes have a maximum daily loss of 3%, but this limit increases to 4% once the account is scaled for the first time.

-

Maximum Trailing Drawdown: This parameter defines the maximum drawdown, calculated as the difference between the highest account balance achieved and the maximum drawdown. All account sizes have a maximum trailing drawdown of 6%.

-

No Martingale Allowed: Traders are not permitted to employ martingale strategies while trading.

-

Third-Party Copy Trading Risk: If traders intend to use copy trading services, they should be aware that using a third-party copy trading service may involve other traders employing the same trading strategy. Exceeding the maximum capital allocation rule could result in being denied a funded account or withdrawal.

-

Third-Party EA Risk: If traders intend to use an Expert Advisor (EA), they should keep in mind that other traders might also be using the same EA and trading strategy. Similar to copy trading, exceeding the maximum capital allocation rule while using a third-party EA can lead to denial of a funded account or withdrawal.

Is getting The Funded Trader capital realistic?

When evaluating proprietary trading firms, it’s crucial to assess the realism of their trading requirements, especially in relation to your own forex trading style. Some firms may offer enticing profit splits on well-funded accounts, but if their expectations for high monthly gains come with tight maximum drawdown limits, your chances of success could dwindle.

Here’s a breakdown of the realism of receiving capital from The Funded Trader across their various challenge program accounts:

Standard Challenge Program Accounts: These accounts offer a realistic opportunity to receive funding. They come with average profit targets (10% in phase one and 5% in phase two) and relatively generous maximum loss rules (5% maximum daily and 10% maximum loss).

Rapid Challenge Program Accounts: Receiving capital from the Rapid Challenge program accounts is also realistic. These accounts have relatively low profit targets (8% in phase one and 5% in phase two) and average maximum loss rules (5% maximum daily and 8% maximum loss).

Royal Challenge Program Accounts: The Royal Challenge program accounts present a realistic opportunity for funding. They have relatively low profit targets (8% in phase one and 5% in phase two) and average maximum loss rules (5% maximum daily and 10% maximum loss).

Knight Challenge Program Accounts: Receiving capital from the Knight Challenge program accounts is considered realistic. These accounts have an average profit target of 10% with reasonable maximum loss rules (3% maximum daily and 6% maximum trailing loss).

In summary, The Funded Trader offers a range of funding programs with realistic trading objectives and conditions, providing traders with diverse options to pursue funding while aligning with their trading strategies and risk tolerance.

Payment proof

The Funded Trader Traders Feedback

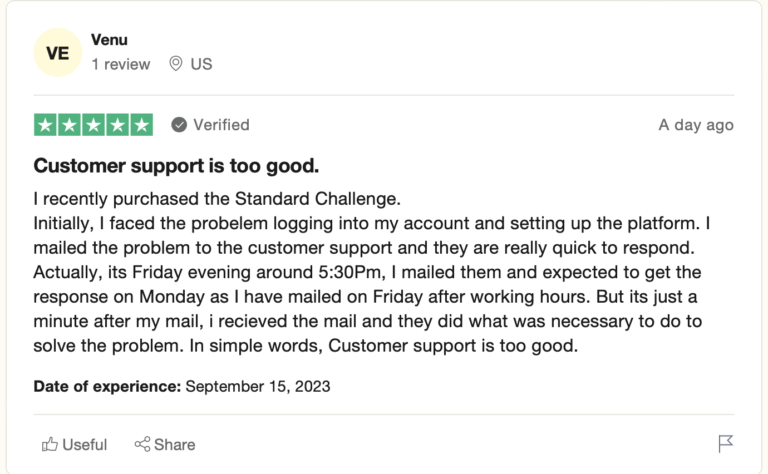

On Trustpilot, The Funded Trader boasts a substantial number of community comments, most of which are highly positive, resulting in an impressive score of 4.5 out of 5 from a total of 12,980 reviews. Additionally, their dedicated support team is readily available to provide you with the information you need.

According to their community, The Funded Trader is known for its understanding and responsive team, which is committed to assisting their clients until they are fully satisfied.

The Funded Trader Support

FAQ Page: You can find answers to common questions on their FAQ page.

Email Support: You can contact their support team directly via email at support@thefundedtraderprogram.com.

Live Chat: They offer live chat support, where you can send them a message, and they will respond to your email.

Discord Channel: You can join their Discord channel, which has various channels dedicated to providing support and assistance for any technical issues or questions you may have.

Conclusion

In summary, The Funded Trader is a reputable proprietary trading firm that provides traders with four distinct funding programs: Standard, Rapid, Royal, and Knight.

The Standard challenge programs are conventional two-phase evaluation challenges, requiring traders to achieve profit targets of 10% in phase one and 5% in phase two. These targets are realistic, considering the 5% maximum daily loss and 10% maximum loss rules. Successful traders in this program can earn profit splits of up to 90% and have the opportunity to scale their accounts.

Similarly, the Rapid challenge programs follow the same two-phase evaluation structure and require profit targets of 8% in phase one and 5% in phase two. The daily loss limit is 5%, and the maximum loss is 8%. Traders in the Rapid program can also earn profit splits of up to 90% and scale their accounts.

Royal challenge programs share the same two-phase evaluation format, with profit targets of 8% in phase one and 5% in phase two. The program adheres to a 5% maximum daily loss and 10% maximum loss rules. Successful participants can receive profit splits of up to 90% and have the option to scale their accounts.

Knight challenge accounts offer a one-step evaluation process, requiring traders to reach a profit target of 10% before becoming funded. The program features a 3% maximum daily loss and a 6% maximum trailing loss rule. Traders in this program can earn profit splits ranging from 80% to 90% and have the opportunity to scale their accounts.

The Funded Trader is an excellent choice for traders seeking a prop firm with clear and reasonable trading rules. Their well-established reputation, along with diverse funding program options, caters to individuals with various trading styles. Considering their offerings, stands as a leading player in the proprietary trading industry.

If you found this The Funded Trader Review to be informative, you can visit their website here.

You can also discover additional Propfirm reviews here.