Pros

- Four different funding programs

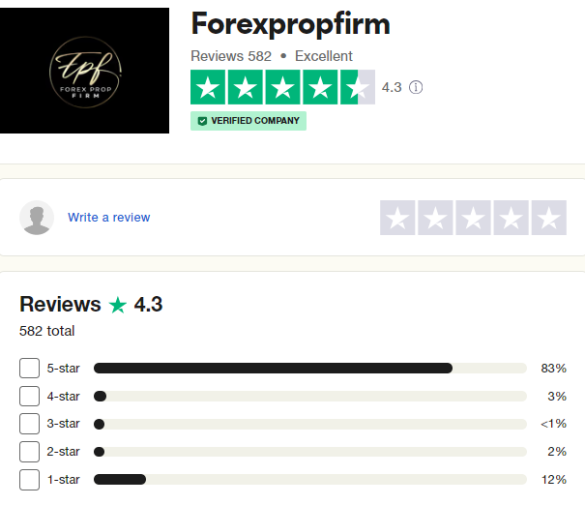

- Excellent Trustpilot rating of 4.3/5

- Excellent support team

- 10% profit split from evaluation phases

- Scaling plan up to $10,000,000 capital

- Profit splits up to 100%

- Bi-weekly payout cycles

- A large variety of trading instruments (forex pairs, commodities, indices, stocks, crypto)

- No maximum trading days on three funding programs

- Overnight trading and holding is allowed

- News trading allowed

Cons

- Leverage up to 1:30

- Withdrawal target of 5% on each funding program

- Maximum trading period for Two-step evaluation program

As a proprietary trading firm, Forex Prop Firm is dedicated to fostering a trader-friendly environment. To cater to diverse needs, they have devised four funding programs accessible to traders globally. These programs provide an opportunity to earn generous profit splits, reaching up to 100%, with the flexibility to manage initial account sizes ranging from $200,000 to scaling up to an impressive $10,000,000. Traders can engage in a variety of assets, including forex pairs, commodities, indices, stocks, and cryptocurrencies to achieve their financial goals.

Who are Forex Prop Firm?

Established in January 2022, Forex Prop Firm operates as a proprietary trading firm under the official business name 9452-8635 Québec Inc. Situated in Montreal, Canada, the firm provides clients the opportunity to trade with accounts ranging from up to $200,000 in capital, with the potential to scale up to an impressive $10,000,000. Leveraging advanced technology, Forex Prop Firm has seamlessly integrated with Eightcap, a broker regulated by ASIC and based in Melbourne, Australia.

The firm’s primary business location is 288 Christin, J5z 4n1, Qc, Canada.

Who is the CEO of Forex Prop Firm?

Jonathan Dufresne serves as the CEO of Forex Prop Firm. Please anticipate additional details about their CEO in upcoming updates. Stay tuned for more information!

Funding program options

Forex Prop Firm offers its traders four different programs to choose from:

- One-step Evaluation

- Two-step Evaluation (No Daily Drawdown during Evaluation)

- No Time Limit Two-step Evaluation

- Instant Funding

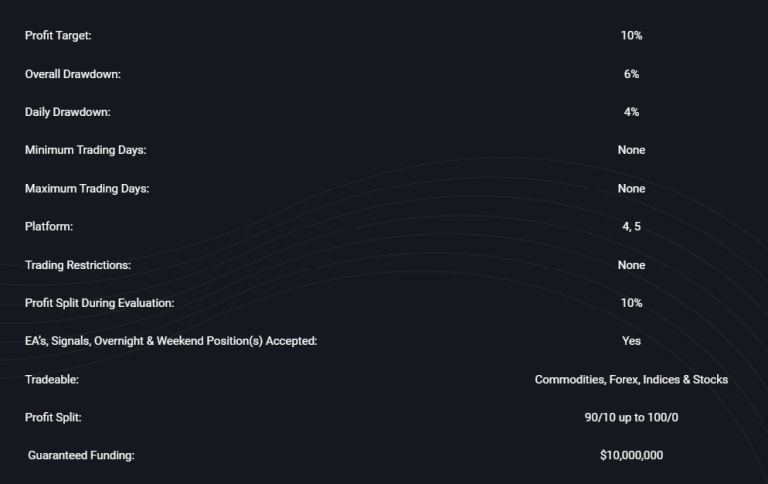

One-step Evaluation

Traders aiming to qualify for Forex Prop Firm’s one-step evaluation program account must fulfill the evaluation requirements without any time constraints. Within this program, they have the opportunity to engage in trading with leverage of up to 1:30.

Account Size

Price

$25,000

$209

$50,000

$319

$100,000

$549

$200,000

$999

During the evaluation phase, traders are required to achieve a 10% profit target, adhering to the 4% maximum daily and 6% overall drawdown limit rules. This evaluation period comes with the flexibility of no specific minimum or maximum trading day requirements, allowing traders to operate at their preferred pace without time constraints.

Upon successful completion of the evaluation phase, traders are granted a funded account. To request a withdrawal, they must meet a 5% profit target threshold while respecting the 4% maximum daily and 6% overall drawdown limit rules. The first payout can be requested 30 calendar days after placing the first trade on the funded account, coupled with generating a profit of 5% or more.

Starting with a 90% profit split, traders can scale up to 100% participation in the scaling plan. Upon eligibility for the first payout, traders receive a bonus equivalent to 10% of the profit generated during the evaluation period. Subsequent withdrawals can be requested bi-weekly on the 1st and 16th of each month, provided a profit of 5% or more has been achieved.

One-step evaluation program account rules

- The profit target represents a designated percentage of profit that traders must achieve to conclude an evaluation phase, withdraw profits, or scale their account. In this context, the profit target is set at 10%. For funded accounts, a 5% withdrawal profit target is applicable.

- The maximum daily loss refers to the highest allowable loss a trader can incur within a single day before the account is considered violated. For all account sizes, a uniform maximum daily loss limit of 4% is enforced.

- The maximum loss denotes the highest cumulative loss a trader can experience before the account is deemed violated. Across all account sizes, a standardized maximum loss limit of 6% is maintained.

- Engaging in third-party copy trading involves considering the risk associated with potential duplication of trading strategies. When utilizing a copy trading service, it’s important to be aware that other traders may already be employing the exact same strategy. This duplication introduces the risk that, by utilizing such a third-party service, you could face the possibility of being denied a funded account or withdrawal if you surpass the maximum capital allocation rule.

- Engaging with a third-party EA involves considering the risk associated with potential replication of trading strategies. When utilizing a third-party EA, it’s crucial to be aware that other traders may already be employing the exact same strategy. This duplication introduces the risk that, by using such a third-party EA, you could potentially face denial of a funded account or withdrawal if you exceed the maximum capital allocation rule.

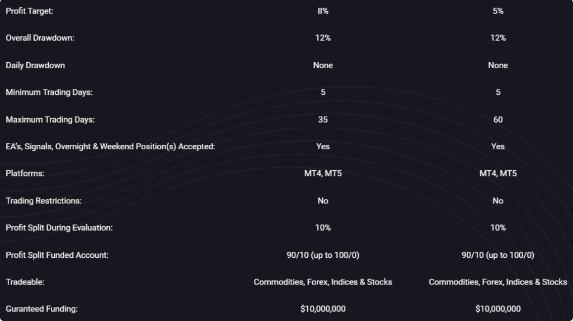

Two-step Evaluation (No Daily Drawdown during Evaluation)

The primary objective of Forex Prop Firm’s two-step evaluation program account is to recognize disciplined and skilled traders, rewarding them for their consistency within the defined two-step evaluation period. Traders operating in the two-step evaluation program account have the flexibility to trade with leverage of up to 1:30. It’s important to note that there are no daily drawdown rules imposed when utilizing the two-step evaluation program account.

Account Size

Monthly Bonus (Hot Seat Status)

$25,000

$189

$50,000

$289

$100,000

$499

$200,000

$979

The first step of the evaluation process necessitates traders to achieve an 8% profit target while staying within the 12% maximum loss rule. This profit target must be met within 35 calendar days from the initiation of the first position on the evaluation account. Additionally, there is a requirement of a minimum of five trading days to progress to step two.

Moving to the second evaluation step, traders must attain a 5% profit target while adhering to the 12% maximum loss rule. This target needs to be reached within 60 calendar days from the placement of the first position on the evaluation account. Similar to step one, there is a prerequisite of a minimum of five trading days to advance to funded status.

Upon successful completion of both evaluation steps, traders are granted a funded account with a 5% profit target threshold for withdrawal requests. Compliance with the 5% maximum daily and 10% maximum loss rules is mandatory. The first payout can be requested 30 calendar days after initiating the first trade on the funded account and generating a profit of 5% or more.

Starting with a 90% profit split, traders can scale up to 100% through participation in the scaling plan. Upon eligibility for the first payout, traders receive a bonus equivalent to 10% of the profit generated during both evaluation steps. Subsequent withdrawals can be requested bi-weekly on the 1st and 16th of each month, provided a profit of 5% or more has been achieved. Eligibility is contingent on meeting the specified profit criteria.

Two-step evaluation program account rules

- The profit target represents a defined percentage of profit that traders must achieve to conclude an evaluation phase, withdraw profits, or scale their account. In Phase 1, the profit target is set at 8%, while Phase 2 requires a profit target of 5%. For funded accounts, a 5% withdrawal profit target is applicable.

- The maximum daily loss signifies the highest allowable loss a trader can incur on a daily basis before the account is considered violated. Notably, there is no maximum daily loss rule applicable during both evaluation steps. However, once traders attain funded status, all account sizes are subject to a maximum daily loss limit of 5%.

- The maximum loss refers to the highest cumulative loss a trader can incur overall before the account is deemed violated. Throughout both evaluation steps, all account sizes are subject to a maximum loss limit of 12%. However, upon reaching funded status, the maximum loss for all account sizes is reduced to 10%.

- The minimum trading days represent the mandatory duration during which trading must occur before completing an evaluation phase or requesting a withdrawal. For both phases, a prerequisite of a minimum of 5 trading days exists. Conversely, when operating with a funded account, there are no minimum trading day requirements.

- The maximum trading days denote the stipulated period within which traders must achieve a specific profit target or withdrawal target. Phase 1 has a maximum period of 35 trading days, while Phase 2 has a maximum period of 60 trading days.

- Engaging in third-party copy trading involves considering the risk associated with potential replication of trading strategies. When utilizing a third-party copy trading service, it’s essential to be aware that other traders may already be employing precisely the same trading strategy. This duplication introduces the risk that, by using such a third-party service, you could face the possibility of being denied a funded account or withdrawal if you surpass the maximum capital allocation rule.

- Engaging with a third-party EA involves considering the risk associated with potential replication of trading strategies. When utilizing a third-party EA, it’s important to be aware that other traders may already be employing precisely the same trading strategy. This similarity introduces the risk that, by using such a third-party EA, you could potentially face denial of a funded account or withdrawal if you exceed the maximum capital allocation rule.

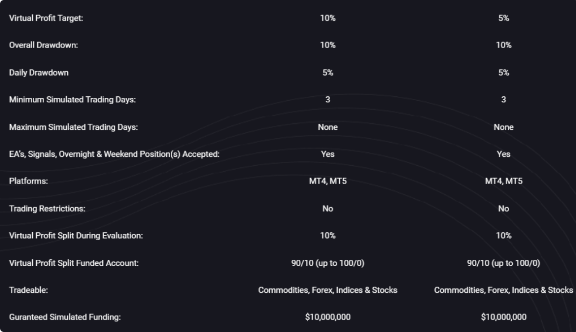

No Time Limit Two-step Evaluation

Forex Prop Firm’s two-step evaluation program with no time limit is designed to recognize disciplined and skilled traders, rewarding them for their consistency in an unrestricted two-step evaluation period. This unique program allows traders to operate with up to 1:30 leverage

Account Size

Price

$25,000

$209

$50,000

$319

$100,000

$549

$200,000

$999

In the initial phase of the evaluation process, traders are required to achieve a 10% profit target while adhering to the 5% maximum daily loss and 10% maximum loss rules. Notably, there are no specific time limitations or maximum trading day requirements during this first step. However, a minimum of three trading days is necessary to progress to the second step.

Moving to the second evaluation phase, traders must attain a 5% profit target while maintaining the 5% maximum daily loss and 10% maximum loss rules. Similar to the first phase, there are no specific time limitations or maximum trading day requirements during this step. Nevertheless, a minimum of three trading days is mandatory to advance to funded status.

Upon successfully completing both evaluation steps, traders earn a funded account, featuring a 5% profit target threshold for withdrawal requests. Adherence to the 5% maximum daily loss and 10% maximum loss rules is mandatory. The first payout can be requested 30 calendar days after initiating the first trade on the funded account and generating a profit of 5% or more.

Starting with a 90% profit split, traders can scale up to 100% through participation in the scaling plan. Upon eligibility for the first payout, traders receive a bonus equivalent to 10% of the profit generated during both evaluation steps. Subsequent withdrawals can be requested bi-weekly on the 1st and 16th of each month, provided a profit of 5% or more has been achieved. Eligibility is contingent on meeting the specified profit criteria.

No time limit two-step evaluation program account rules

- The profit target represents a designated percentage of profit that traders must achieve to conclude an evaluation phase, withdraw profits, or scale their account. In Phase 1, the profit target is set at 10%, while Phase 2 requires a profit target of 5%. For funded accounts, a 5% withdrawal profit target is applicable.

- The maximum daily loss signifies the highest allowable loss a trader can incur on a daily basis before the account is considered violated. For all account sizes, a uniform maximum daily loss limit of 5% is enforced.

- The maximum loss refers to the highest cumulative loss a trader can incur overall before the account is deemed violated. Across all account sizes, a standardized maximum loss limit of 10% is maintained.

- The minimum trading days represent the obligatory duration during which trading must occur before completing an evaluation phase or requesting a withdrawal. In both phases, there is a requirement of a minimum of 3 trading days. Conversely, when operating with a funded account, there are no minimum trading day requirements.

- Engaging in third-party copy trading involves considering the risk associated with potential duplication of trading strategies. When utilizing a third-party copy trading service, it’s important to be aware that other traders may already be employing precisely the same trading strategy. This replication introduces the risk that, by using such a third-party service, you could potentially face denial of a funded account or withdrawal if you exceed the maximum capital allocation rule.

- Engaging with a third-party EA involves considering the risk associated with potential replication of trading strategies. When utilizing a third-party EA, it’s important to be aware that other traders may already be employing precisely the same trading strategy. This similarity introduces the risk that, by using such a third-party EA, you could potentially face denial of a funded account or withdrawal if you exceed the maximum capital allocation rule.

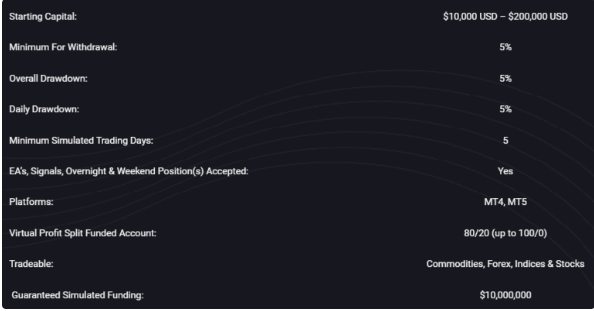

Instant Funding

Forex Prop Firm’s instant funding program account is tailored for proficient traders, allowing them to bypass the evaluation phase and commence earning from the outset. Traders in this program need to focus solely on not exceeding the 5% maximum daily loss and 5% overall drawdown limit rule. They stand to receive profit splits ranging from 80% up to 100%, contingent on the profits generated, while trading with leverage of up to 1:30.

Furthermore, traders should note a five minimum trading day requirement and a 5% profit target before becoming eligible to request their first withdrawal. Following the initial payout, traders can subsequently request withdrawals on a bi-weekly basis, occurring on the 1st and 16th of each month. It’s essential to be mindful that eligibility for withdrawals is contingent on generating a profit of 5% or more.

Account Size

Price

$10,000

$500

$25,000

$1,250

$50,000

$2,500

$100,000

$5,000

$200,000

$10,000

Instant funding program account rules

- The profit target represents a specified percentage of profit that traders must achieve to conclude an evaluation phase, withdraw profits, or scale their account. For instant funding accounts, there is a 5% withdrawal profit target in place.

- The maximum daily loss denotes the highest allowable loss a trader can incur on a daily basis before the account is considered violated. For all account sizes, a standardized maximum daily loss limit of 5% is maintained.

- The maximum loss refers to the highest cumulative loss a trader can reach overall before the account is deemed violated. Across all account sizes, there is a uniform maximum loss limit of 5%.

- The minimum trading days represent the obligatory duration during which trading must occur before completing an evaluation phase or requesting a withdrawal. For instant funding accounts, traders must fulfill a minimum trading requirement of 5 trading days to become eligible for their first payout.

- Participating in third-party copy trading carries a risk wherein, if you choose to utilize copy trading services, it’s crucial to consider that others may already be employing the exact same trading strategy through the third-party service. Engaging in a third-party copy trading service could potentially lead to the risk of being denied a funded account or withdrawal if you exceed the maximum capital allocation rule.

Engaging with a third-party EA involves considering the risk that, when using such an EA, other traders may already be employing the exact same trading strategy. Utilizing a third-party EA potentially exposes you to the risk of being denied a funded account or withdrawal if you surpass the maximum capital allocation rule.

What makes Forex Prop Firm different from other prop firms?

Forex Prop Firm stands out from the majority of industry-leading prop firms by providing a selection of four distinct funding programs: One-step evaluation, two-step evaluation, no time limit two-step evaluation, and instant funding. The firm also emphasizes clear and uncomplicated trading rules, enabling traders to engage in news releases, hold overnight positions, and trade over weekends. Additionally, participants are rewarded with a 10% profit split from their demo phases.

In comparison to other prop firms, Forex Prop Firm’s one-step evaluation program necessitates the completion of a single phase before becoming eligible for payouts. The program sets a profit target of 10%, with a 4% maximum daily loss and 6% maximum drawdown rules. Notably, the absence of minimum or maximum trading day requirements in their one-step evaluation programs distinguishes Forex Prop Firm, allowing traders the flexibility to progress at their own pace. However, a 5% profit generation is required to qualify for withdrawal.

The two-step evaluation program at Forex Prop Firm involves a two-phase evaluation challenge where traders must complete both phases for payout eligibility. In phase one, the profit target is 8%, and in phase two, it is 5%, with a 12% maximum drawdown rule. Upon reaching funded status, traders need to adhere to a 5% maximum daily loss and 10% maximum drawdown rules. Notably, unlike other industry-leading prop firms, Forex Prop Firm’s two-step evaluation programs lack a daily drawdown rule, allowing traders to concentrate solely on the maximum drawdown rule. Similar to the one-step program, a 5% profit target must be achieved for withdrawal eligibility.

Example of comparison between Forex Prop Firm & True Forex Funds

Trading Objectives

Forex Prop Firm

True Forex Funds (Standard)

Phase 1 Profit Target

8%

8%

Phase 2 Profit Target

5%

5%

Maximum Daily Loss

None (5% once funded)

5%

Maximum Loss

12% (10% once funded)

10%

Minimum Trading Days

5 Calendar Days

5 Calendar Days

Maximum Trading Period

Phase 1: 35 Calendar Days Phase 2: 60 Calendar Days

Phase 1: 30 Calendar Days Phase 2: 60 Calendar Days

Profit Split

90% up to 100%

80%

Example of comparison between Forex Prop Firm & E8 Funding

Trading Objectives

Forex Prop Firm

E8 Funding (Normal)

Phase 1 Profit Target

8%

8%

Phase 2 Profit Target

5%

5%

Maximum Daily Loss

None (5% once funded)

5%

Maximum Loss

12% (10% once funded)

8% (Scaleable up to 14%)

Minimum Trading Days

5 Calendar Days

No Minimum Trading Days

Maximum Trading Period

Phase 1: 35 Calendar Days Phase 2: 60 Calendar Days

Phase 1: Unlimited Phase 2: Unlimited

Profit Split

90% up to 100%

80%

Example of comparison between Forex Prop Firm & FTMO

Trading Objectives

Forex Prop Firm

FTMO

Phase 1 Profit Target

8%

10%

Phase 2 Profit Target

5%

5%

Maximum Daily Loss

None (5% once funded)

5%

Maximum Loss

12% (10% once funded)

10%

Minimum Trading Days

5 Calendar Days

4 Calendar Days

Maximum Trading Period

Phase 1: 35 Calendar Days Phase 2: 60 Calendar Days

Phase 1: Unlimited Phase 2: Unlimited

Profit Split

90% up to 100%

80% up to 90%

Forex Prop Firm’s no time limit two-step evaluation program is a comprehensive two-phase process mandating traders to successfully navigate both phases for payout eligibility. In phase one, a 10% profit target is set, followed by a 5% profit target in phase two. Both phases adhere to the 5% maximum daily loss and 10% maximum drawdown rules.

Distinguishing itself from other industry-leading prop firms, Forex Prop Firm imposes no maximum trading day requirements for the no time limit two-step evaluation program accounts. This approach allows traders the flexibility to advance at their preferred pace. However, a prerequisite for withdrawal eligibility is the generation of a 5% profit.

Example of comparison between Forex Prop Firm & Funding Pips

Trading Objectives

Forex Prop Firm

Funding Pips

Phase 1 Profit Target

10%

5%

Phase 2 Profit Target

5%

5%

Maximum Daily Loss

5%

5%

Maximum Loss

10%

10%

Minimum Trading Days

3 Calendar Days

No Minimum Trading Days

No Minimum Trading Days

Phase 1: Unlimited Phase 2: Unlimited

Phase 1: Unlimited Phase 2: Unlimited

Profit Split

90% up to 100%

80% up to 90%

Example of comparison between Forex Prop Firm & Finotive Funding

Trading Objectives

Forex Prop Firm

Finotive Funding

Phase 1 Profit Target

10%

7.5%

Phase 2 Profit Target

5%

5%

Maximum Daily Loss

5%

5%

Maximum Loss

10%

Minimum Trading Days

3 Calendar Days

No Minimum Trading Days

Maximum Trading Period

Phase 1: Unlimited Phase 2: Unlimited

Phase 1: Unlimited Phase 2: Unlimited

Profit Split

90% up to 100%

75% up to 95%

Example of comparison between Forex Prop Firm & FundedNext

Trading Objectives

Forex Prop Firm

Finotive Funding

Phase 1 Profit Target

10%

8%

Phase 2 Profit Target

5%

5%

Maximum Daily Loss

5%

5%

Maximum Loss

10%

10%

Minimum Trading Days

3 Calendar Days

5 Calendar Days

Maximum Trading Period

Phase 1: Unlimited Phase 2: Unlimited

Phase 1: Unlimited Phase 2: Unlimited

Profit Split

90% up to 100%

80% up to 90%

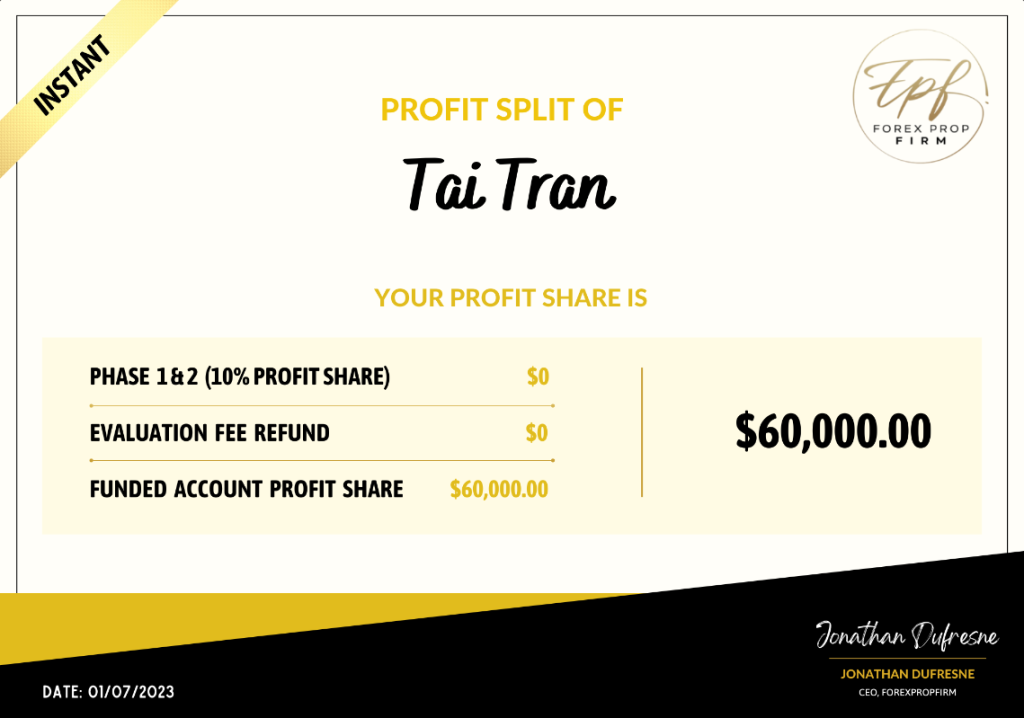

Unlike other prop firms, Forex Prop Firm stands out with its inclusion of instant funding programs, constituting a direct funding approach. These accounts adhere to a 5% maximum daily loss and a 5% maximum drawdown rule, offering traders the flexibility of a 5 minimum calendar day requirement without imposing any maximum trading day restrictions. Notably, these accounts start with profit splits ranging from 80% up to 100%, creating a favorable starting point. However, traders are required to generate a 5% profit before becoming eligible for a withdrawal.

In summary, Forex Prop Firm distinguishes itself from other leading prop firms by providing a diverse range of four funding programs. Their emphasis on straightforward rules makes them an appealing choice for traders. Notably, traders can engage in activities such as trading during news, holding trades overnight, and trading over weekends. Additionally, participants receive a 10% profit split from their demo phases.

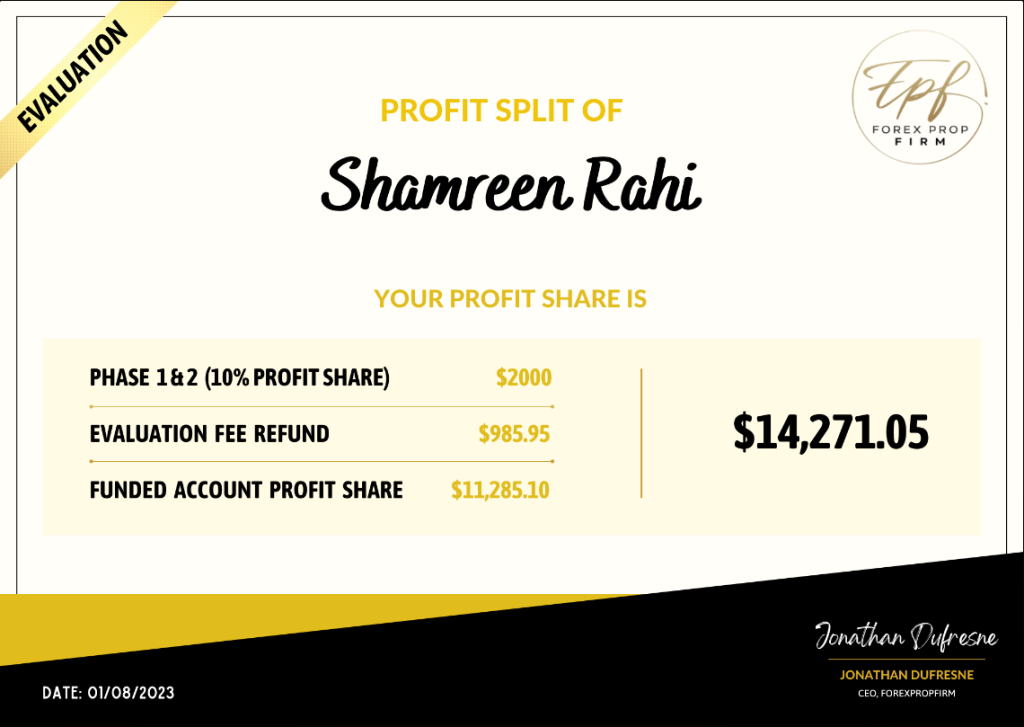

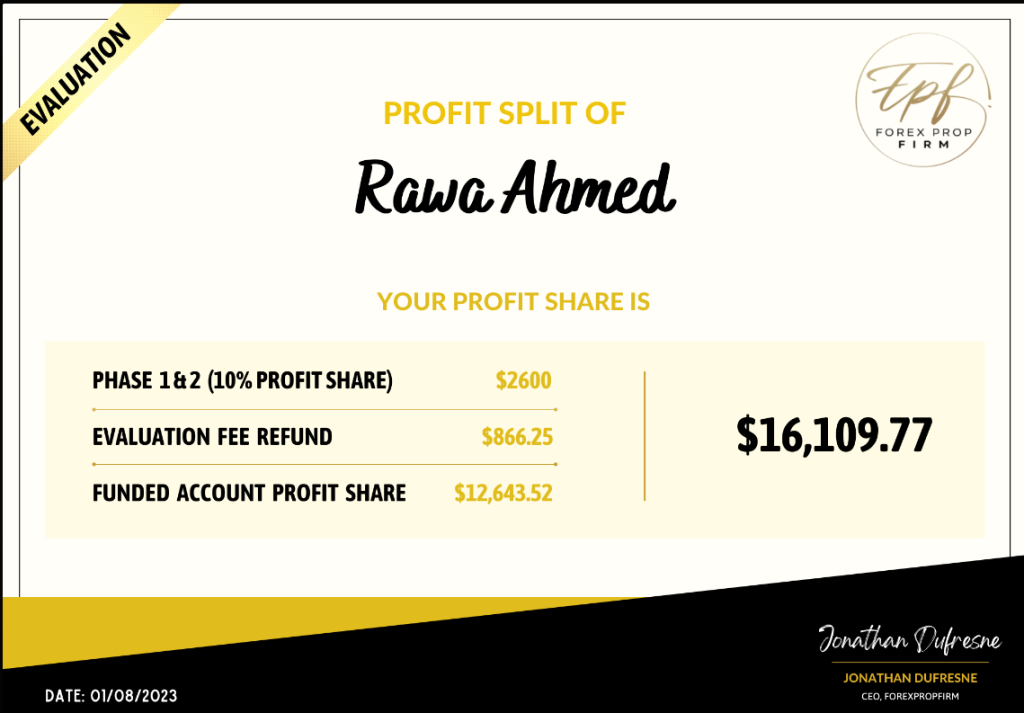

Payment proof

Established in January 2022, Forex Prop Firm is a proprietary trading firm with a notable track record of successful traders, evident in the abundant payment proofs showcasing their ability to generate profits and qualify for profit splits.

Upon achieving funded status through any of the four funding programs offered by Forex Prop Firm, traders become eligible for their initial payout within 30 calendar days. It’s essential to be aware that withdrawal requests can be made on the 1st and 16th of each month, provided traders have generated a minimum profit of 5%. Payouts are structured with a 90% profit split, and traders have the opportunity to increase this percentage up to 100% through participation in Forex Prop Firm’s scaling plan.

For those seeking verification of payment success, numerous instances of profit split certificates are available. Forex Prop Firm’s thriving community frequently shares diverse payment proofs on their Discord and Telegram channels, offering a comprehensive view of the firm’s traders achieving financial success.

You can see some examples of payment proof below:

Traders’ Comments about Forex Prop Firm

Forex Prop Firm has excellent feedback from its community.

Trustpilot hosts a diverse array of community feedback for Forex Prop Firm, with a remarkable overall score of 4.3/5 from 582 reviews. The positive comments underscore the firm’s reputation for delivering outstanding customer support. Forex Prop Firm is widely recognized for its responsive and helpful team, readily providing assistance whether you seek additional information or encounter any challenges while engaging with their services.

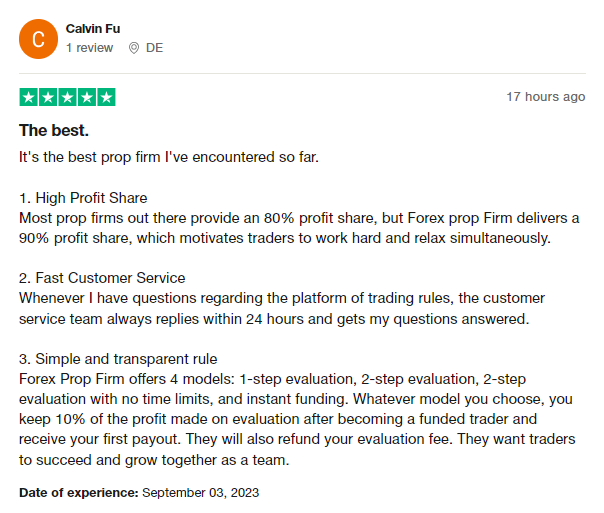

A trader from Forex Prop Firm has shared comprehensive feedback based on his firsthand experience with the platform. He highlights the motivating factor of the 90% profit share, emphasizing that traders can confidently withdraw 90% of the profits they generate. Additionally, he commends the swift and round-the-clock customer service offered by the firm. Lastly, the trader appreciates the simplicity and clarity of Forex Prop Firm’s trading rules across all four funding models, which are crafted to support traders in their journey to success and mutual growth with the company.

Conclusion

Forex Prop Firm is a reputable proprietary trading firm that provides traders with a selection of four distinct funding programs: One-step evaluation, two-step evaluation, no time limit two-step evaluation, and instant funding.

The one-step evaluation program entails completing a single phase to qualify for payouts. Traders need to achieve a 10% profit target without exceeding the 4% maximum daily loss and 6% maximum drawdown rules. Successful participants can earn profit splits ranging from 90% to 100% and have the opportunity to scale their accounts up to $10,000,000. However, a 5% profit target is required while funded to become eligible for withdrawal.

Two-step programs involve a standard two-phase evaluation process where traders must achieve profit targets of 8% in phase one and 5% in phase two to become funded. Notably, there is no maximum daily loss rule during the evaluation phases, only a 12% maximum drawdown rule. Upon reaching funded status, traders must adhere to a 5% maximum daily loss and 10% maximum drawdown rules. The program includes a 5 minimum trading day requirement in each evaluation step, with 35 calendar days for step one and 60 calendar days for step two. Profit splits of 90% to 100% are possible, and accounts can be scaled up to $10,000,000. A 5% profit target is necessary for withdrawal eligibility.

No time limit two-step evaluation programs follow a similar two-phase structure, requiring profit targets of 10% in phase one and 5% in phase two. Traders have an unlimited trading period for both evaluation steps, with a minimum trading day requirement of 3 calendar days in each step. The rules include a 5% maximum daily loss and 10% maximum drawdown. Profit splits range from 90% to 100%, and accounts can be scaled up to $10,000,000. A 5% profit target is required for withdrawal eligibility.

Instant funding programs allow traders to bypass the evaluation period and trade directly with a funded account, without any maximum trading day limitations. Profit splits of 80% to 100% are possible, and accounts can be scaled up to $10,000,000. A 5% profit target is necessary for withdrawal eligibility.

In conclusion, Forex Prop Firm is recommended for individuals seeking a prop firm with transparent trading rules, particularly those comfortable with a profit target on funded accounts. The well-established proprietary trading firm offers favorable conditions with its four diverse funding programs, catering to a wide range of traders with unique styles. Considering the overall offerings, Forex Prop Firm shows promising potential to become one of the leading proprietary trading firms in the industry.