Trading Account

Tickmill offers three trading account types for CFD trading, these trading accounts are, The Pro account, the VIP account, and the Classic account. The Pro and VIP accounts support raw spreads.

Raw Spread

The raw spread sets itself apart from other retail investor accounts on the platform due to its low entry and deposit requirements. It is distinguished by its minimum lot size of 0.01, a minimum deposit requirement of 100 US dollars, a minimum floating spread starting from 0.0 points, and a commission set at $3 per side per 100,000 traded. The raw spread is classified into two account types, Pro account and VIP account.

Pro account and VIP account share a variety of similarities such as;

- A floating spread from 0.0 pips

- Base currencies in USD, EUR, GBP, PLN, CHF, and ZAR

- Islamic and Demo account option

- A maximum leverage of 1:30

The differences include;

- The Pro account offers a commission of $2 per side, per lot, whereas the VIP account has a commission of $1 per side, per lot.

- The Pro account has a minimum deposit amount of $100, whereas for the VIP account, minimum deposit is not applicable.

- The Pro account doesn’t have a minimum balance, whereas the VIP account has a minimum balance of $50,000

Classic Account

The Classic account features

- A minimum deposit of 100 US dollars

- A minimum floating spread from 1.6 pips

- Base currencies in USD, EUR, GBP, PLN, CHF, and ZAR

- Demo account and Islamic account options available

- A maximum leverage of 1:30

Tickmill Classic account also offers no commission per side per lot, along with no deposit and withdrawal fees.

Before opening an account with Tickmill, clients have the opportunity to explore its terms, features, and platform functionality by utilizing a demo account. Demo accounts and Islamic accounts are offered by all Tickmill account types, and all Islamic accounts are swap-free. Plus, you can manage your demo account along with a live trading account.

Commission And Fees

Tickmill has a below average spread on instruments across various asset classes and fixed commissions relative to other trading platforms. However, Tickmilll Europe Ltd and Tickmill UK Ltd impose a moderate inactivity fee for dormant accounts. However, the broker does not levy any charges for deposit or withdrawal.

Tickmill also offers swap fees. Swap fee is the cost or credit associated with holding a position overnight due to fluctuating interest rates. Swap fees can either be swap long (cost of holding a buy position open overnight) or swap short (cost of holding a sell position overnight).

Commission

Tickmill commission rate is lower than the industry average rate of $3 per side. Traders opting for a Pro account are subjected to a $2 per side commission for executing a full-sized position of 100,000 units. The Classic account has no commission fee, whereas the VIP account has a set commission of $1 per standard lot. This below average fees makes tickmill suitable for high frequency trading.

Fees

Tickmill does not impose handling fees on deposit and withdrawals; however, third-party banking fees may apply. An inactivity fee of 10 euro is applicable to accounts with no activity recorded for one calendar year.

Tickmill fees are fairly competitive. The combination of low spreads, particularly on commodities and indices, along with low fixed commissions, is particularly suited for high-frequency and high-volume trading strategies, such as scalping. These trading conditions facilitate frequent entry and exit from large-scale positions, enabling traders to capitalize on short-term market movement efficiently.

INVESTMENT OPTIONS

Tickmill Europe Union offers a signal provider service of the MetaQuotes community, seamlessly integrated within the MT4 and MT5 platforms. This feature allows traders to subscribe to signals from experienced traders, automatically replicating their trades in real-time on their own accounts.

Tickmill offers various options for passive investors, including

- Pelican Trading is a simplified copy trading platform designed for mobile devices, offering users the ability to replicate the trades of signal providers. It provides an intuitive interface for users to easily follow and execute trades from experienced traders.

- The MyFxBook AutoTrader is an analytical platform that integrates Tickmill‘s technology, allowing users to copy signals from experienced traders. To utilize this feature, users need to link their trading account with Tickmill to their user account registered on the MyFxBook website. Once linked, users can set risk level limits and begin copying signals.

- The copy trading platform service integrated in MT4/MT5 allows users to replicate trades. To get started, users need to register on the MQL5 website and make a deposit. They can then link their user account on the MetaTrader platform, typically through the “Signals” tab. Once linked, users can browse and subscribe to the traders whose trades they wish to copy, paying the applicable subscription fee.

Tickmill Partnership

Tickmill offers the following partnership programs

- Introducing Broker Program. This standard program enables partners to attract referrals through various means. Partners receive rewards of up to $10 per each standard lot traded by a referral on the Classic account and $3 on the Raw account. Additionally, new clients receive a 5% discount on fees through this program.

- Tickmill Prime is specially designed for corporate traders. Through this program, the broker provides technological solutions for aggregating and processing orders, along with institutional connections to facilitate liquidity generation. Additionally, Tickmill provides server capacities, bridges, and other essential infrastructure under partnership conditions, catering to the unique requirements of corporate entities.

- MAM Manger is a tool that enables traders to execute multiple orders on trusted accounts. Partners interested in utilizing this instrument must meet specific requirements, including maintaining a minimum capital of $5,000 and ensuring the availability of two investor accounts with a combined total of at least $50,000.

- Tickmill European Union offers a Portfolio Management program that allows traders to invest funds in investment portfolios managed by a team of professional managers from the broker. This service is tailored for larger investors with accounts starting from 50,000 euro, providing them with access to diversified investment opportunities and professional management expertise,

- White Label Program enables partners to transfer platform and technology to create their own brand. Partners are charged a fee of $5 per million, with no minimum fee requirement.

Tradable Instruments

Tickmill provides a variety of trading instruments such as currency pairs, commodities, share CFDs, ETFs, stock indices, cryptocurrencies, bonds, and futures and options trading.

Contract of Difference (CFDs) are employed to speculate on the price movement of the underlying asset, without physical ownership or delivery. A significant advantage of trading CFDs is the ability for traders to swiftly enter and exit the market, enabling them to capture even the smallest fluctuations in the derivative’s price.

Tickmill UK Ltd allows trades on expected changes in underlying volatility levels in the future.

Several valuable tools are available on the brokers website for signal discovery and the creation of personalized trading strategies.

- Autocharist is a versatile technical analysis tool that enables traders to efficiently filter out price noise, rapidly identify price levels and patterns, scan the market, anticipate the most probable scenarios, and assess volatility levels.

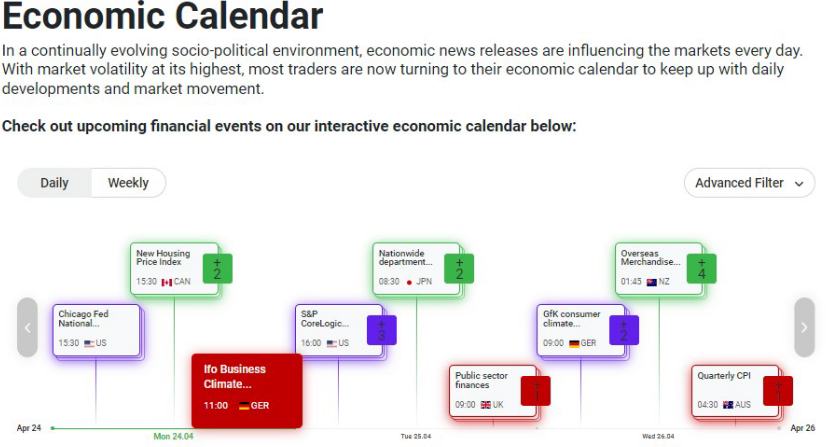

- Economic Calendar displays a list of upcoming news events that could impact asset prices. Users have the option to sort the news by importance and by the country from which they originate.

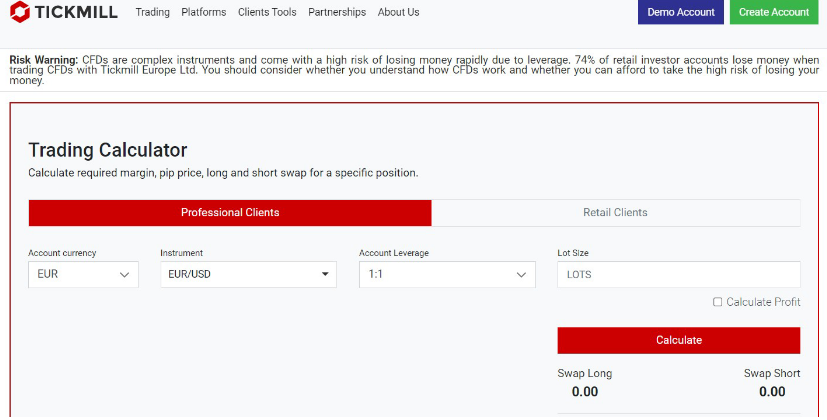

- The Trading Calculator on the platform enables traders to automatically calculate pip value, swap, and margin by inputting data such as asset, position volume, leverage, and account currency. Additionally, the Currency Converter facilitates the conversion of one currency to another using the current exchange rate.

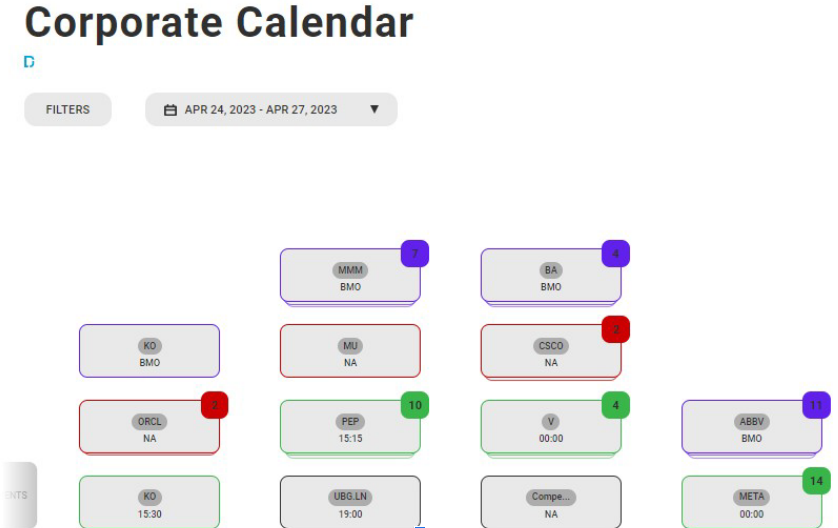

- Corporate Calendar is a vital tool used by stock traders employing fundamental strategies. It provides information on corporate events.

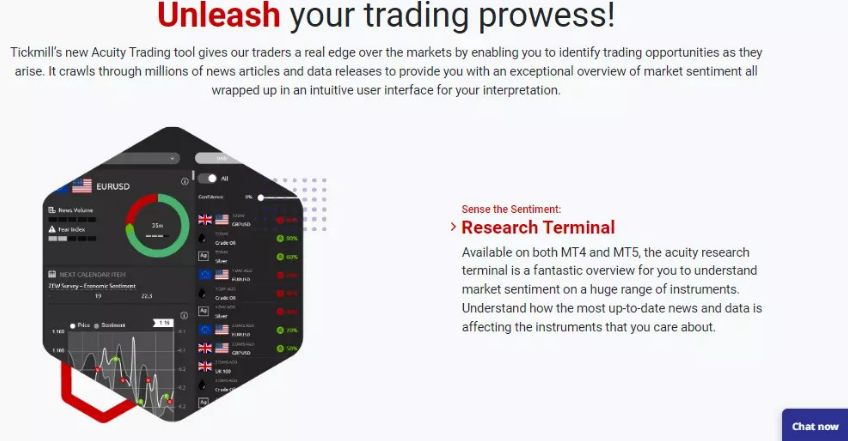

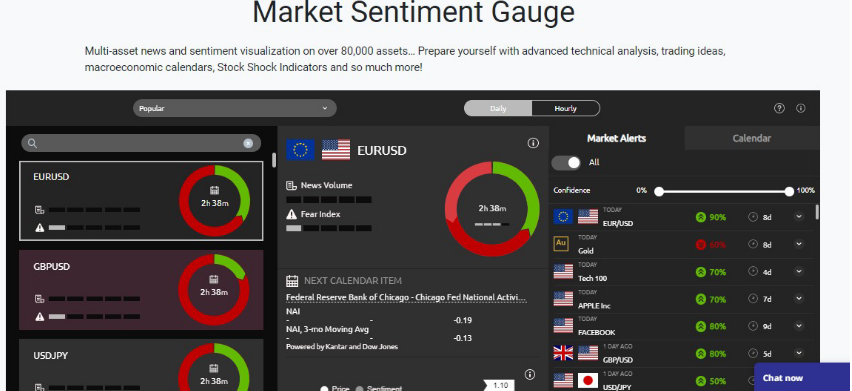

- The Acuity Trading tool uses artificial intelligence to aggregate news and data, providing insights into market sentiments and its impact on the assets of interest to traders.

- Advanced trading tools for MT4 and MT5 offers a comprehensive kit consisting of built-in apps and indicators. These tools feature new feeds, market sentiment analysis, hidden orders detection, correlation matrices, and a variety of other functionalities aimed at enhancing traders capabilities and decision making processes.

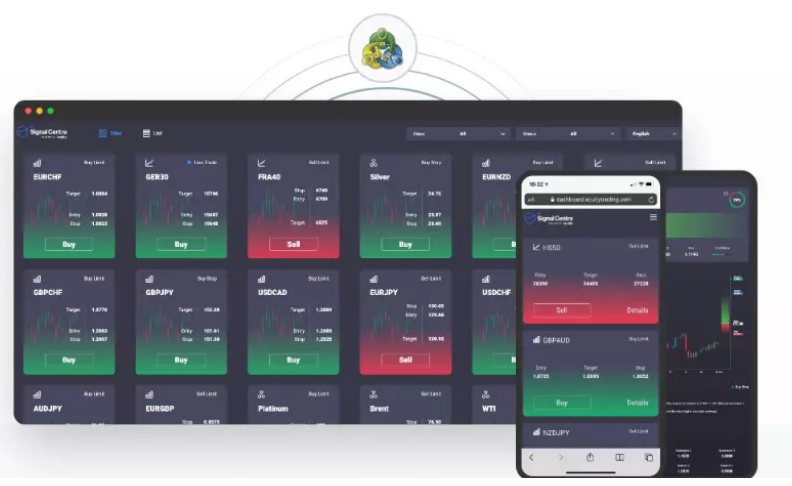

- Signal center is an AI based tool that provides position opening signals along with approximate levels, as well as suggested levels for take profit and stop loss. This tool aids traders in identifying potential entry and exit points.

- Market Sentiment Indicator assists traders in making informed decisions by understanding the broader sentiment trends influencing asset prices.

Deposit And Withdrawal

Typically Tickmill processes all payments, including deposit and withdrawals within a single business day, however, some transactions may take up to 8 business days to reflect in your bank account. Additionally, Tickmill covers banking fees on deposits via bank wire above $5000, providing additional convenience and cost saving for larger transactions. Tickmill does not charge any deposit or withdrawal fees, but there are fees of payment systems and an inactivity fee.

Tickmill deposit methods include Credit/Debit card, Wire transfer, Skrill, Neteller, Przelewy24, Sofort, Rapid, and Paypal.

Tickmill withdrawal methods include Credit/Debit card, Wire transfer, Skrill, Neteller, Przelewy24, Sofort, Rapid, and Paypal. The minimum withdrawal amount is $2.

TRADING PLATFORMS

MetaTrader 5 Desktop

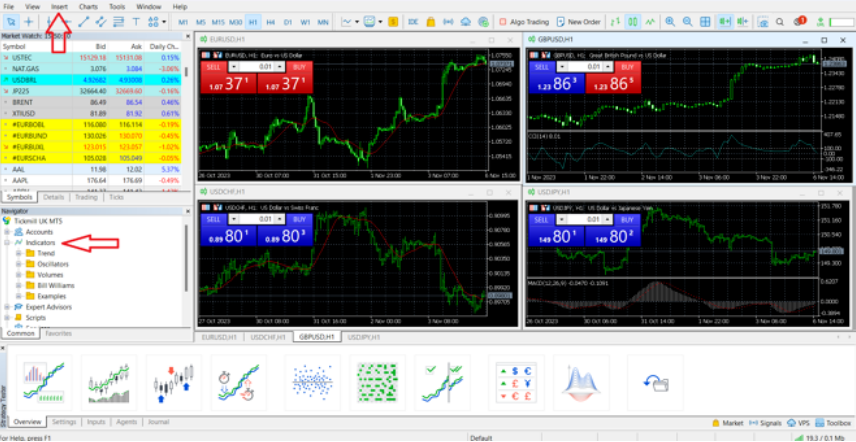

This trading platform features a familiar layout, with the watch list and screen navigator tools situated on the left-hand side, the chart screen on the right hand side, and the strategy tester and other account information pans located at the bottom. Additionally, a panel of available settings can be found at the top of the interface. Arrows on the image highlight where users can access all available technical indicators and drawing tools, facilitating efficient analysis and trading activities.

MetaTrader 5 chart facilitates technical analysis by offering a comprehensive overview of price action behavior, allowing traders access to various analytical tools and chart configuration possibilities.

Tickmill MetaTrader 5 offers the following analytical tools and chart configuration

- Technical indicators. The platform supports a wide array of indicators, including trend-based, volume-based, oscillators etc. Technical indicators are used to determine where the market is likely to head next.

- Drawing tool. They are used to study repeatable price patterns. These tools can also be applied to identify crucial support and resistance levels, as well as potential breakout or breakdown points.

- Timeframes. The platform enables multi timeframe analysis of price action behaviors, allowing traders to assess market dynamics across different time frames simultaneously.

- Chart types include line, area, or candlestick. This diversity of chart types enables traders to examine potential trading opportunities from various perspectives.

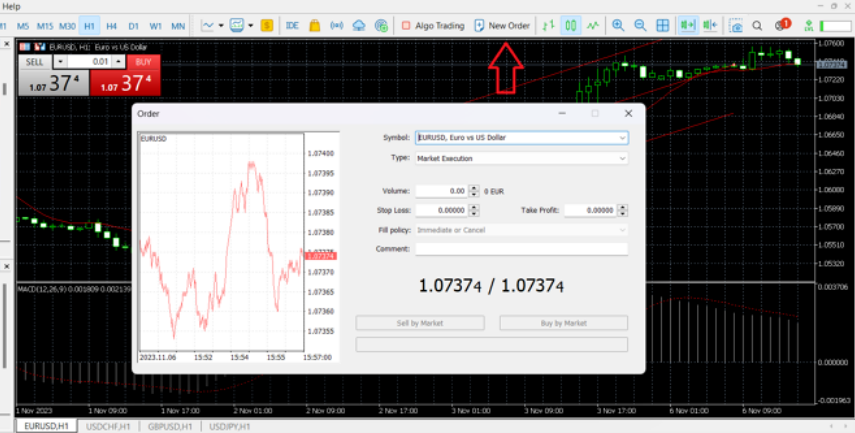

Order

The orders available on the MetaTrader 5 platform includes

- Market Orders are utilized for immediate entry into the market at the best available price. Upon triggering, they ensure volume filling, although there may be disparity between the requested price and the actual price at which the order is executed.

- Limit Orders ensure exact price execution. A limit order will only be filled if the market price reaches the predetermined execution price set by the trader.

- Stop Orders are used to support open positions by defining the maximum potential loss if the market moves against the trader. A stop loss order is positioned at a predetermined price level above or below the current market price. If the market reaches this level and triggers the stop-loss, it automatically converts into a market order and is executed at the best available price.

MetaTrader 5 Mobile App

The MetaTrader 5 mobile app version is easy to use due to its straightforward layout. The app consists of four major components, a watchlist for selected instruments, a chart window, an order placing window, and an account info section. The mobile app allows traders to access the market and their accounts anytime, however, it is not suitable for advanced technical analysis.

Tickmill also offers a range of platforms and tools for futures and options trading.

Tickmill Europe Ltd incorporates ZuluTrade, one of the largest social trading platforms. Clients can link their accounts to ZuluTrade, connecting with thousands of traders worldwide. This service facilitates the sharing of trading ideas and experience, enabling clients to learn from each other and enhance their trading strategies.

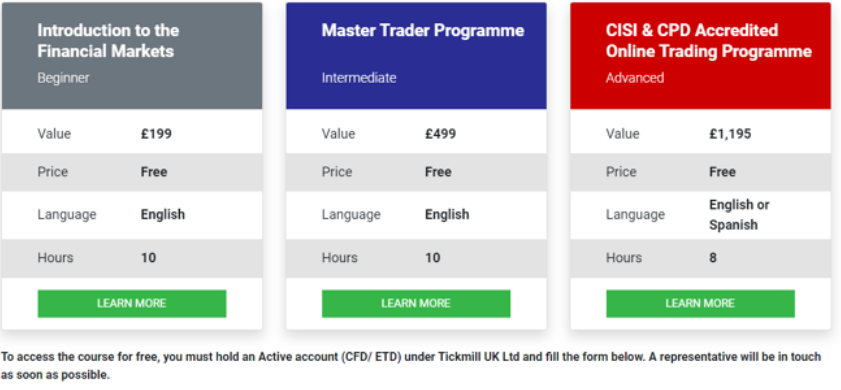

Education

Tickmill offers beginners the chance to develop a comprehensive understanding of essential trading concepts and skills. Moreover, active clients of Tickmill UK Ltd can access accredited trading courses for free.

Tickmill offers the following educational materials

Free LSEG Accredited Courses

Tickmill UK Ltd clients have free access to courses provided by the London Stock Exchange Group Academy. This course includes topics on risk management, the intricacies of technical and fundamental analysis, the psychology of trading, and many more.

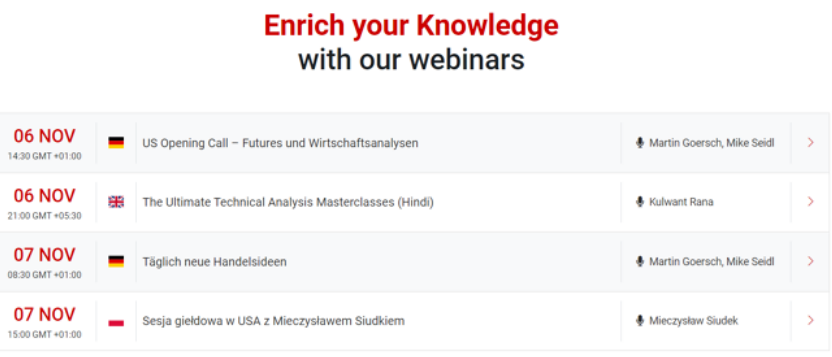

Webinars

Webinars cover a wide array of trading topics, including CFDs, futures, trading fundamentals, technical analysis, trading psychology, and more, providing traders with comprehensive learning opportunities. Additionally, a collection of past webinars is accessible on the broker’s YouTube channel.

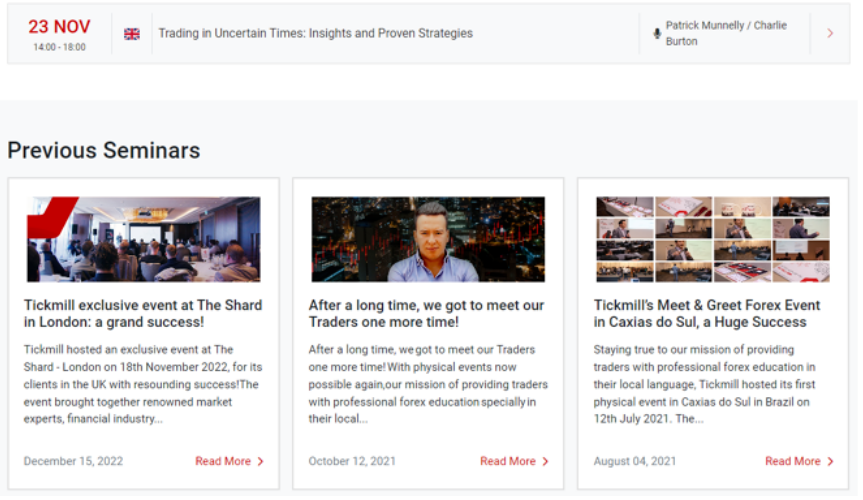

Seminars

Tickmill conducts in-depth seminars that focus on key market drivers and behaviors.

Educational Videos

Tickmill has a substantial collection of beginner friendly educational videos covering various topics such as crypto trading, commodity trading, CFDs, stocks and more. Additionally, MetaTrader also has video tutorials available, catering to traders’ diverse learning needs and preferences.

E-books

Tickmill has created five e-books, which encompasses various topics. This ebook offers highly practical content supported by multiple graphs, charts, and other types of images.

Educational articles

Tickmill’s blog offers a vast array of educational content. These articles focus less on teaching the technical aspects of trading and more on shaping a traders mindset and approach. The aim is to instill a disciplined and strategic approach to trading, emphasizing the importance of risk management, understanding trading costs, and adopting effective trading strategies.

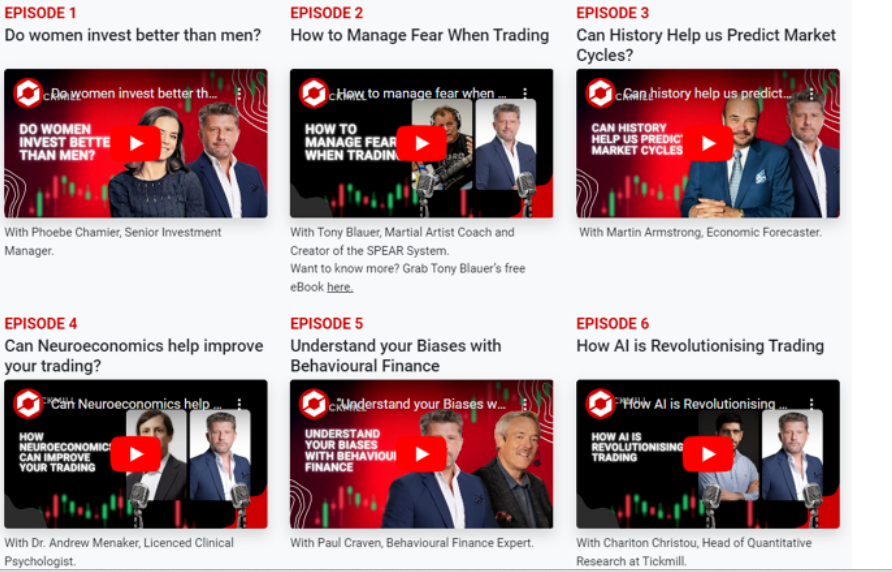

Podcast

Tickmill’s video podcast called T-SHOW blends entertainment with finance, diving into topics like investment, trading, and personal growth. Tickmill’s proprietary ‘Bright Minds’ podcast offers a broader and more abstract overview of important trading and investing topics, providing listeners with insightful discussions and perspectives from industry experts.

Forex Glossary

Tickmill’s forex glossary contains descriptions of some of the most popular and widely used trading terms and concepts, providing traders with a comprehensive reference to enhance their understanding of the forex.

Tickmill‘s educational content helps clients to make well informed trading decisions, thus improving the overall trading experience.

Customer Support

Customer support at Tickmill is available 5 days a week, excluding Saturdays and Sundays from 7:00 to 16:00 GMT. The support service can be contacted via phone numbers found on the website, email, online chart at the broker’s website, and using the feedback form.

Conclusion

Tickmill UK Ltd stands out as a well balanced broker with extensive services and offerings easily comparable to the best trading platforms. It caters to traders through its offerings in CFDs and ETDs (futures and options) trading. Moreover, Tickmill UK Ltd is protected by Cyprus Securities, the Financial Services Authority of Seychelles and Dubai Financial Services Authority. In addition, client funds are protected by the Financial Services Compensation Scheme in the event that the company becomes insolvent. Tickmill also offers negative balance protection. This is for traders who are losing money rapidly as it prevents trading losses from exceeding the account balance for traders.

The broker offers three trading account types for CFD trading, the Pro and VIP account which support raw spreads, and the Classic account. The classic and pro accounts require a minimum deposit of $100, whereas for the VIP accounts minimum deposit is not applicable. Tickmill also offers demo and Islamic account options. Plus, you can manage your demo account along with your live trading account. For both new and experienced traders, there is an educational section where you can learn the basics of technical and fundamental analysis

Tickmill UK Ltd provides a variety of trading instruments such as currency pairs, commodities, share CFDs, ETFs, stock indices, cryptocurrencies, bonds, and futures and options trading.

The broker also has one of the most competitive pricing mechanisms due to its below average spread rates and fixed commissions, moreover, they do not impose charges on any deposit and withdrawal. Clients of Tickmill have access to a wide range of trading instruments such as CFDs, futures, and options.

Tickmill offers two trading platforms that provide traders a range of order and charting types.

Payments are processed fairly quickly, however transaction time may vary. Tickmill does not charge handling fees on any deposit and withdrawal, although third-party banking fees may apply. This approach ensures that traders can efficiently manage their funds without incurring unnecessary trading costs.

Therefore, Tickmill is a desirable option for both professional traders and beginners when considering trading platforms to further your trading career.

If you found this Tickmill Review to be informative, you can visit their website here.

You can also discover additional reviews here.