Looking to kickstart your trading journey and gain access to funding? Dive into the world of proprietary trading firms, where funded traders are made through one-step evaluation challenges. This streamlined process simplifies the path to securing funding and trading capital, allowing talented individuals to showcase their trading skills and hit profit targets with ease. Curious to know which prop firms offer this exciting opportunity? Let’s explore and make informed trading decisions!

What is a Proprietary Trading Firm?

A proprietary trading firm, or prop firm is a company, allowing traders to trade with the firm’s capital. These firms offer funding programs that allow traders to trade with a funded account. The importance of trading skills, strategies, and risk management cannot be overstated in prop trading. One phase prop firms have a straightforward evaluation process that involves only one evaluation phase challenge. During this single phase challenge, traders are evaluated based on their trading performance, risk management abilities, and trading style. Successful completion of this phase challenge allows traders to gain access to a funded trading account.

What Does One Phase Prop Firm Mean?

A one-phase prop firm refers to a proprietary trading firm that offers a single, streamlined evaluation process for traders seeking funding. This evaluation typically includes the trading performance of a simulated account with specific rules and risk parameters. Upon meeting profit targets and demonstrating sound risk management practices, traders can begin trading with the prop firm‘s capital.

In comparison to two-phase prop firms, one-phase prop firms offer a faster and more straightforward evaluation process. While the two step evaluation process require traders to pass two distinct evaluation phases to receive funding, one-phase prop firms only allow traders demand a single evaluation phase.

Characteristics of One-Phase Prop Firms

Key characteristics of one-phase prop firms include:

Tighter drawdown and risk management requirements

Shorter evaluation times

Potentially higher costs

Greater flexibility in risk parameter customization

Immediate access to funding upon completion of the evaluation

Benefits of One Step Evaluation Challenge

Some prop firms offer a streamlined process called the one-step evaluation challenge, which allows traders to access funded trading accounts with just a single evaluation phase. This approach is faster and more efficient than multi-step evaluations, enabling traders to start trading with the firm live account in a shorter time frame.

During the evaluation period, which typically lasts from a few days to a few weeks, traders must demonstrate their skills using a demo or trial account while following specific, risk parameters and management rules and guidelines set by the prop trading firm. These risk parameters and rules cover areas such as profit targets, risk management abilities, and trading rules. Upon completion of the evaluation, traders become eligible for funding and can start trading with a funded account.

One-step evaluation prop firms provide traders with essential tools and resources for informed trading decisions including advanced trading platforms, comprehensive risk management tools, and access to various markets. These resources support traders in refining their skills, risk tolerance, implementing effective strategies, and remaining competitive in the ever-changing trading landscape.

Unlike traditional prop trading firms, one-step evaluation prop firms share the risk of trading with traders by claiming only a portion of the profits generated, rather than the entire trading account. However, these prop firms typically allocate a larger portion of the profits to themselves compared to their counterparts.

One-Step Evaluation Prop Trading Firms

Here is a list of Prop Trading Firms offering one step challenges to experienced traders to potentially gain access to funded account. Below are the prop trading firm’s full one step challenges and live account challenge rules.

1. Blue Guardian

Blue Guardian’s Rapid Guardian Challenge is a one-step evaluation program aimed at helping experienced traders obtain funding quickly and efficiently. Here are the key aspects of the challenge:

Profit Target

10% profit target for accounts under $100,000

8% profit target for accounts above $100,000

Profit Split

85% profit share for traders

Time Limits

No time limit for trading

No minimum trading days requirement

Drawdown Limitations

4% daily drawdown limit

6% maximum relative drawdown

Payments

Bi weekly payouts

Account Balances

Available in various amounts ($10,000 to $200,000)

Leverage

1:100 leverage

Traded Assets

Currency pairs, gold, and silver

Trading Rules

Strict compliance with trading rules and risk management policies

Use of expert advisors (EAs) permitted

Trailing stop-loss orders encouraged

Platforms

Multiple platforms supported, including MetaTrader 4 and cTrader

Fees

Refundable fee depending on account size

Free for accounts below $50,000

$87 for accounts between $50,000 and $99,999

$187 for accounts between $100,000 and $199,999

$297 for accounts between $200,000 and $499,999

$497 for accounts equal to or exceeding $500,000

This one-step challenge provides traders with a flexible yet challenging environment to demonstrate their skills and earn significant returns.

2. City Traders Imperium

City Traders Imperium offers a one-step evaluation challenge for traders seeking funding opportunities. Here are the key details of the one-step challenge:

How It Works

Traders need to pass a single challenge by meeting specific profit targets and adhering to risk management rules.

Upon completing the challenge without breaking any rules, traders become eligible for a funded account to trade.

Trading Rules

Profit Target: 10%

Max Daily Loss: 3%

Max Daily Drawdown: 5%

Max Loss: 6%

Profit Sharing

Profit Split: 70% up to 90%

Payouts

Biweekly payouts for traders

Drawdown Limits

Daily Drawdown Limit: 3%

Maximum Drawdown: 5%

Time Limitations

No specific time limit for trading

No minimum trading days requirement

City Traders Imperium’s one-step challenge provides traders with a clear path to showcase their trading skills and potentially secure funding with favorable profit splits and drawdown limits

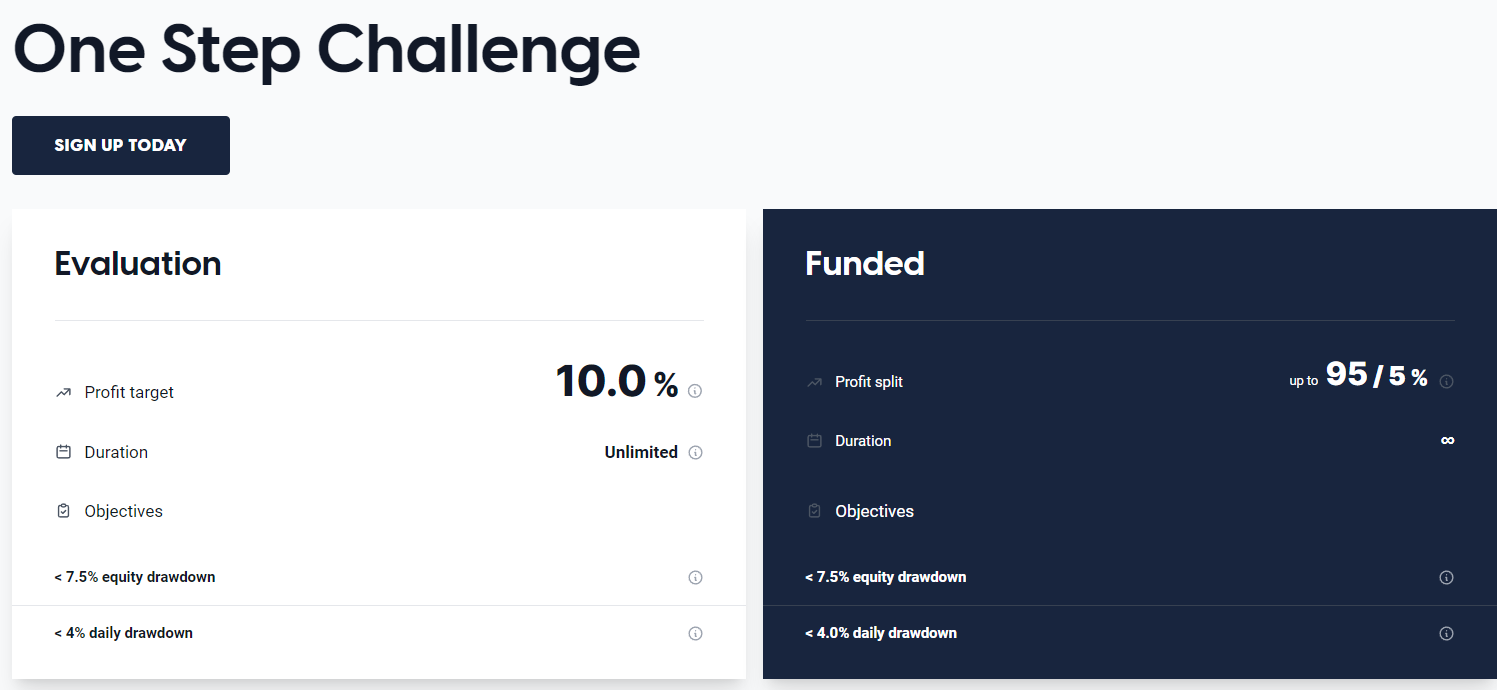

3. Finotive Funding

The Finotive Funding One-Step Challenge is designed to evaluate the skill and discipline of traders looking to earn funding through a single challenge. Below are the key elements of the challenge:

Objectives:

Pass a one-stage evaluation with a 10% profit target

Maintain a maximum daily loss of 4%

Keep a maximum drawdown of 7.5%

Time Limitations:

Unlimited time for completion

No minimum trading days requirement

Profit Share:

70% to 95% profit split upon reaching the profit target

Scaling plans available once profit target met

Payouts:

Biweekly payouts for traders

Leverage:

Up to 1:400 leverage depending on account size

Platforms:

Multiples platforms supported, including MT4 and cTrader

Fees:

Initial fee varies according to account size

Refundable for 2-Step Challenges if the account is in profit on the 30th day of achieving funded status

For detailed information regarding account sizes, funding levels, prices, and other terms, please refer to the official Finotive Funding website.

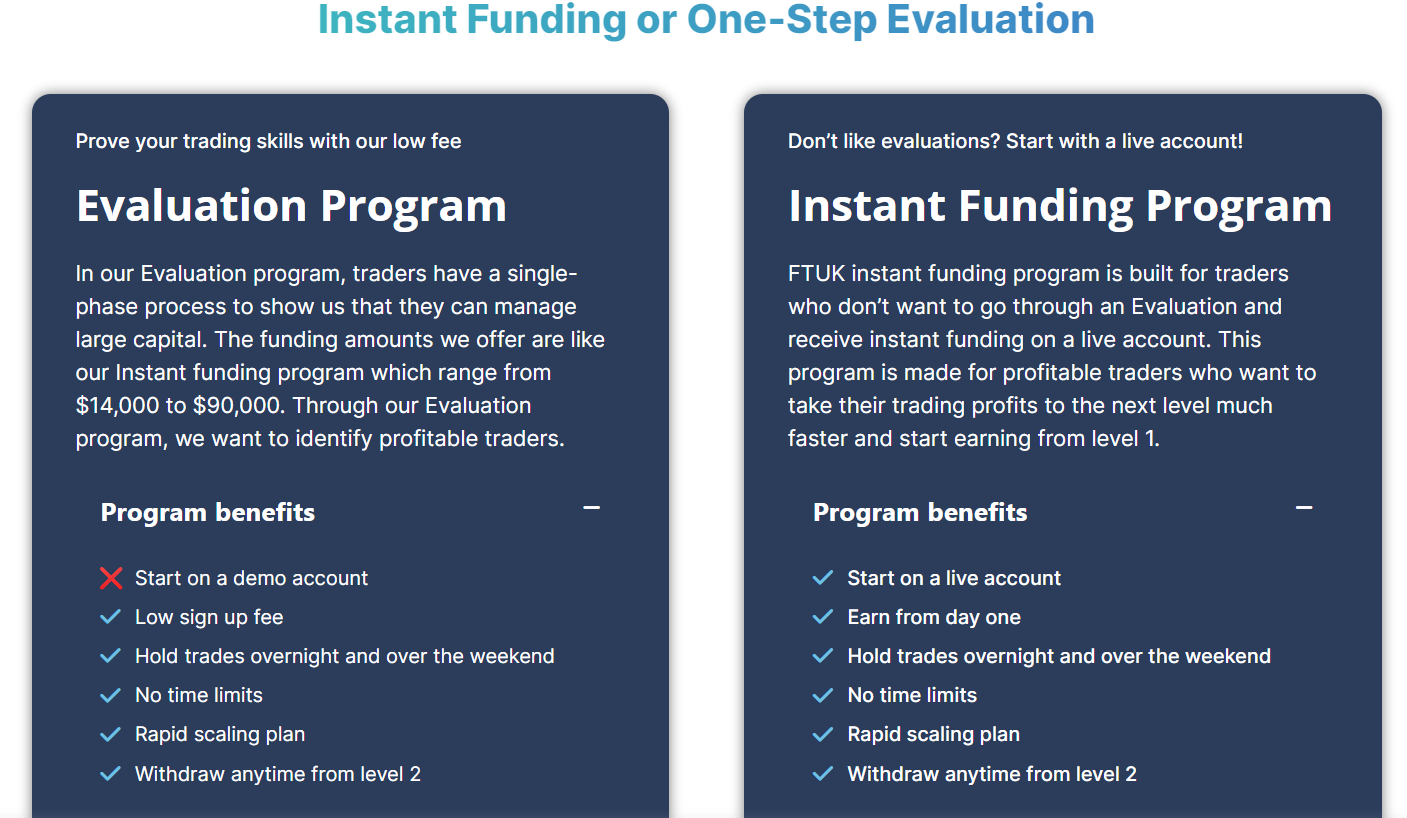

4. FTUK

FTUK offers a one-step evaluation program for traders looking to secure funded trading accounts efficiently. Here are the key details of the FTUK One-Step Challenge:

How It Works

Traders undergo a single-phase evaluation to demonstrate their ability to manage large capital effectively.

Upon completion of the challenge, traders become eligible for funded accounts ranging from $14,000 to $90,000.

Trading Rules

Profit Target: 10%

Max Daily Loss: 4%

Max Daily Drawdown: 6%

Max Overall Drawdown: 8%

Profit Sharing

Profit Split: 80% to traders

Profit share increases with higher trading levels

Payouts

Biweekly profit payouts for successful traders

Time Limitations

No specific time limit for completing the challenge

No minimum trading days requirement

Additional Information

Leverage: Up to 1:100 leverage provided

Account Scaling: The funding amount increases by 400% upon hitting the first milestone and doubles for subsequent milestones.

Maximum Funding: Traders can scale up to $5,760,000 per account and hold up to three active accounts simultaneously.

The FTUK One-Step Challenge offers traders a clear path to showcase their trading skills and potentially access significant funding opportunities with favorable profit splits and drawdown limits.

5. FundedNext

FTUK offers a one-step evaluation program for traders looking to secure funded trading accounts efficiently. Here are the key details of the FTUK One-Step Challenge:

How It Works

Traders undergo a single-phase evaluation to demonstrate their ability to manage large capital effectively.

Upon completion of the challenge, traders become eligible for funded accounts ranging from $14,000 to $90,000.

Trading Rules

Profit Target: 10%

Max Daily Loss: 4%

Max Daily Drawdown: 6%

Max Overall Drawdown: 8%

Profit Sharing

Profit Split: 80% to traders

Profit share increases with higher trading levels

Payouts

Bi weekly profit payouts for successful traders

Time Limitations

No specific time limit for completing the challenge

No minimum trading days requirement

Additional Information

Leverage: Up to 1:100 leverage provided

Account Scaling: Funding amount increases by 400% upon hitting the first milestone and doubles for subsequent milestones.

Maximum Funding: Traders can scale up to $5,760,000 per account and hold up to three active accounts simultaneously.

The FTUK One-Step Challenge offers traders a clear path to showcase their trading skills and potentially access significant funding opportunities with favorable profit splits and drawdown limits.

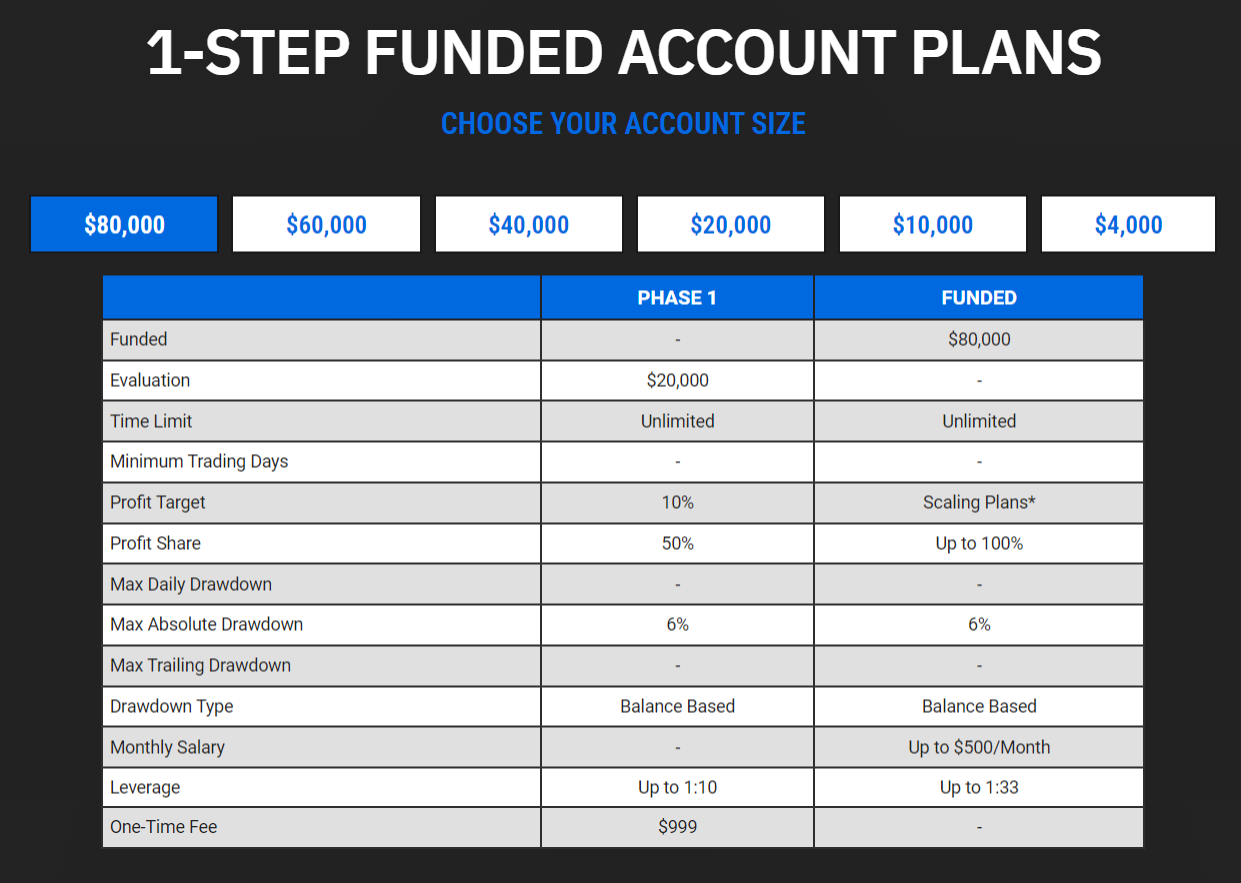

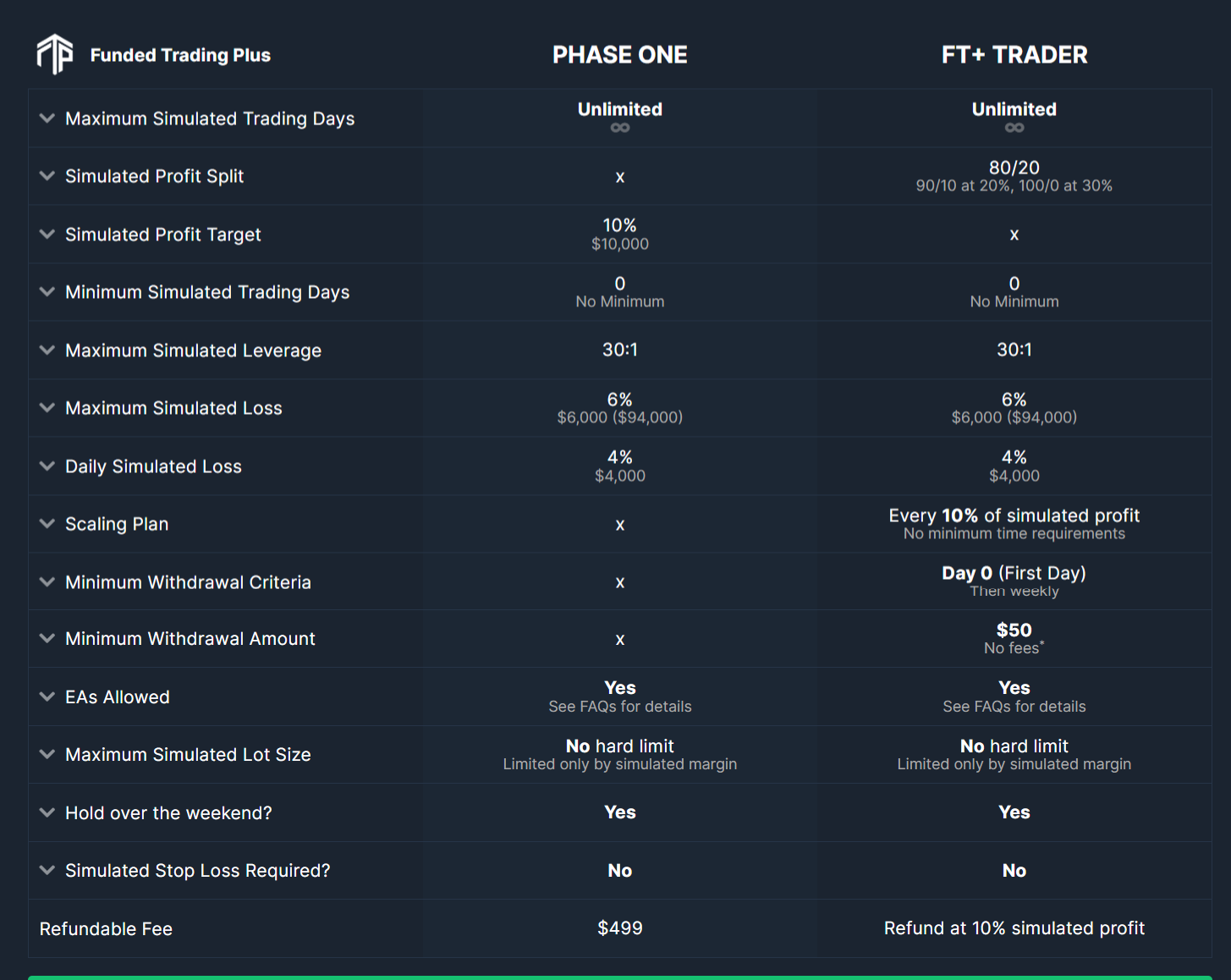

6. Funded Trading Plus

Funded Trading Plus offers a one-step evaluation program for traders looking to secure funded trading accounts. Here are the key details of the Funded Trading Plus One-Step Challenge:

How It Works

Traders undergo a single-phase evaluation to demonstrate their ability to manage large capital effectively.

Upon successful completion of the challenge, traders become eligible for funded accounts starting at $5,000.

Trading Rules

Profit Target: 10%

Max Daily Loss: 3%

Max Daily Drawdown: 4%

Max Overall Drawdown: 6%

Profit Sharing

Profit Split: 90% to traders

Payouts

Monthly profit payouts for traders

Time Limitations

No specific time limit for completing the challenge

No minimum trading days requirement

Additional Information

Leverage: Up to 1:30 leverage provided

Account Scaling: The account size increases by $25,000 every three months until reaching a total of $1,500,000.

The Funded Trading Plus One-Step Challenge offers traders a clear path to showcase their trading skills and potentially access significant funding opportunities with favorable profit splits and drawdown limits.

7. Goat Funded Trader

Goat Funded Trader (GFT) offers a one-step evaluation program for traders looking to secure funded accounts. Here are the key details of the Goat Funded Trader One-Step Challenge:

How It Works

Traders undergo a single-phase evaluation criteria to demonstrate their ability to manage large capital effectively.

Upon completion of the challenge, traders become eligible for funded accounts starting at $15,000.

Trading Rules

Profit Target: 10%

Max Daily Loss: 3%

Max Daily Drawdown limits: 4%

Max Overall Drawdown: 6%

Profit Sharing

Profit Split: 90% to traders

Payouts

Monthly profit payouts for successful traders

Time Limitations

No specific time limit for completing the challenge

No minimum trading days requirement

Additional Information

Leverage: Up to 1:100 leverage provided

Account Scaling: The account size increases based on the selected package, with options for $15,000, $50,000, and $100,000.

The Goat Funded Trader One-Step Challenge offers traders a clear path to showcase their trading skills and potentially access significant funding opportunities with favorable profit splits and drawdown limits.

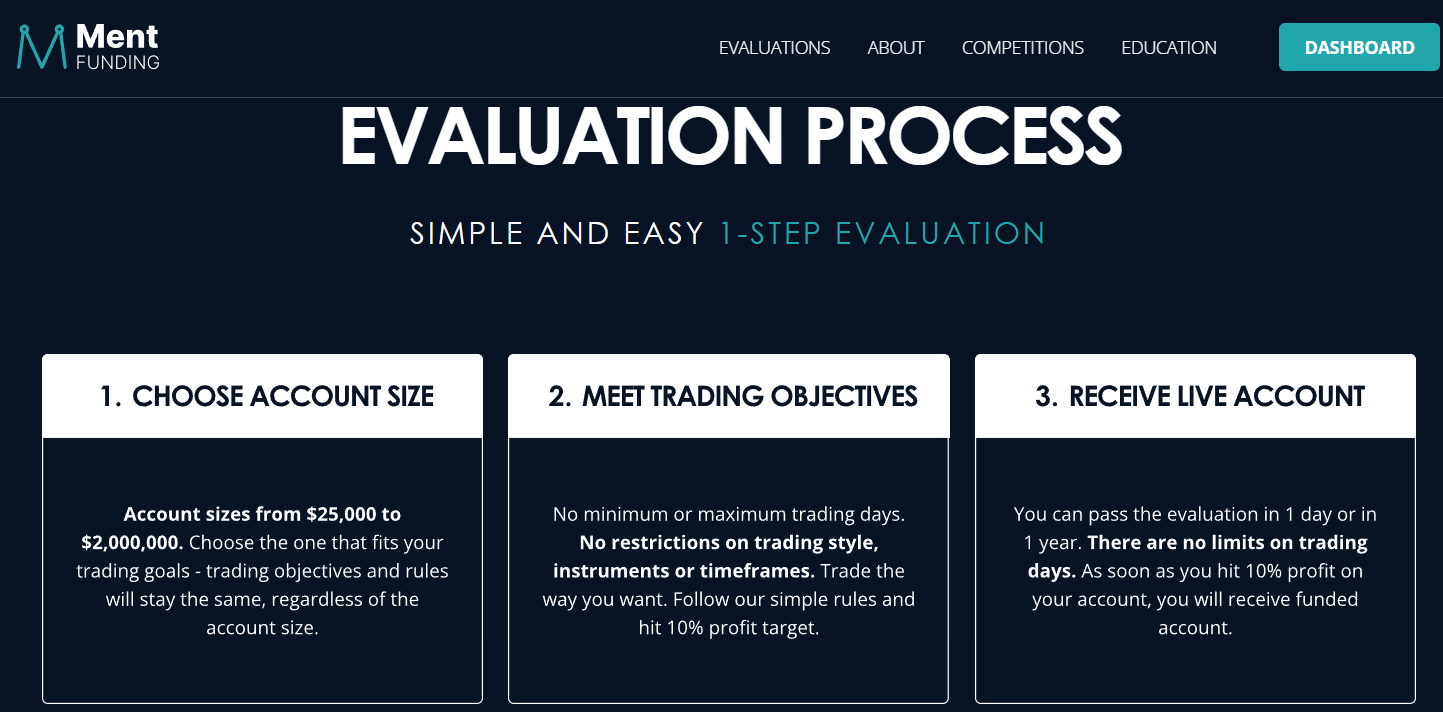

8. Ment Funding

Ment Funding provides a one-step evaluation program for traders aiming to secure funded trading accounts. Here are the key details of the Ment Funding One-Step Challenge:

How It Works

Traders undergo a single-phase evaluation to showcase their trading skills and discipline.

Completion of the challenge grants traders eligibility for funded accounts starting at $25,000.

Trading Rules

Profit Target: 10%

Max Daily Loss: 5%

Max Overall Loss: 6%

Profit Sharing

Profit Split: 75% to traders

Payouts

Payouts available after three days of trading and subsequently on a monthly basis

Time Limitations

No specific time limit for completing the challenge

No minimum trading days requirement

The Ment Funding One-Step Challenge offers traders an opportunity to demonstrate their own trading style and risk management abilities, and potentially access funded accounts with favorable profit splits and risk management rules.

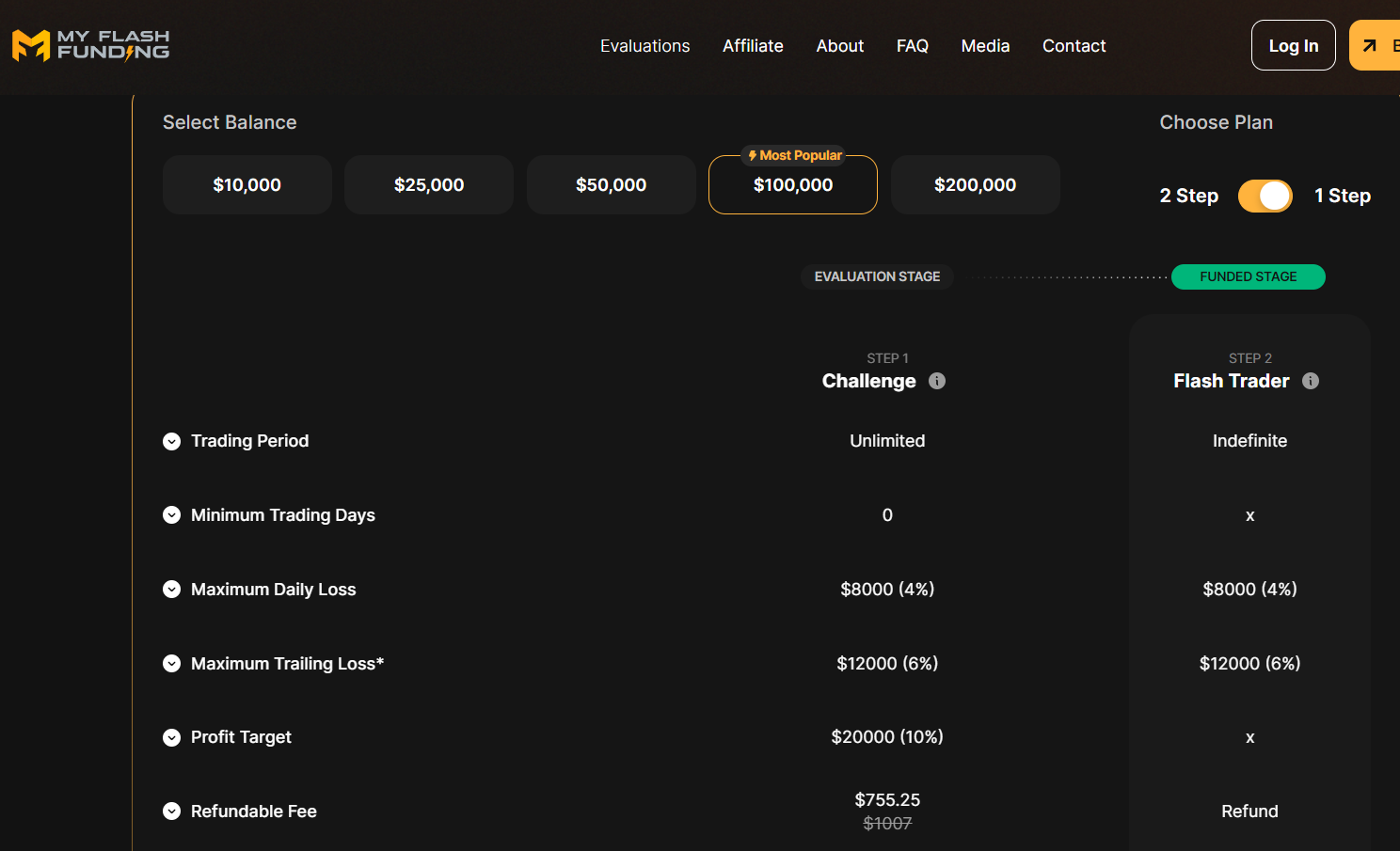

9. MyFlashFunding

MyFlashFunding offers a one-step evaluation program for traders seeking funded trading accounts. Here are the key details of the MyFlashFunding One-Step Challenge:

How It Works

Traders undergo a single-phase evaluation process with stable conditions until completion.

Traders can start managing a demo account with up to $300,000 within 24 hours based on their experience.

Minimum trading days required: 1 day, allowing for completion in at least 1 day.

No limit on the maximum number of trading days, providing flexibility and freedom.

Trading Rules

Profit Target: 10% of the simulated gain

Max Daily Loss: $200

Max Overall Drawdown (trailing): $300

Profit Sharing

Simulated Gain Split: 80%

Live Account Profit Split: Not specified in search results

Payouts

Monthly payouts for successful traders

Time Limitations

No specific trading time limit for completing the challenge

Minimum trading days: 1 day

The MyFlashFunding One-Step Challenge offers traders an opportunity to demonstrate their trading skills and potentially access funded accounts with favorable profit splits and risk management rules.

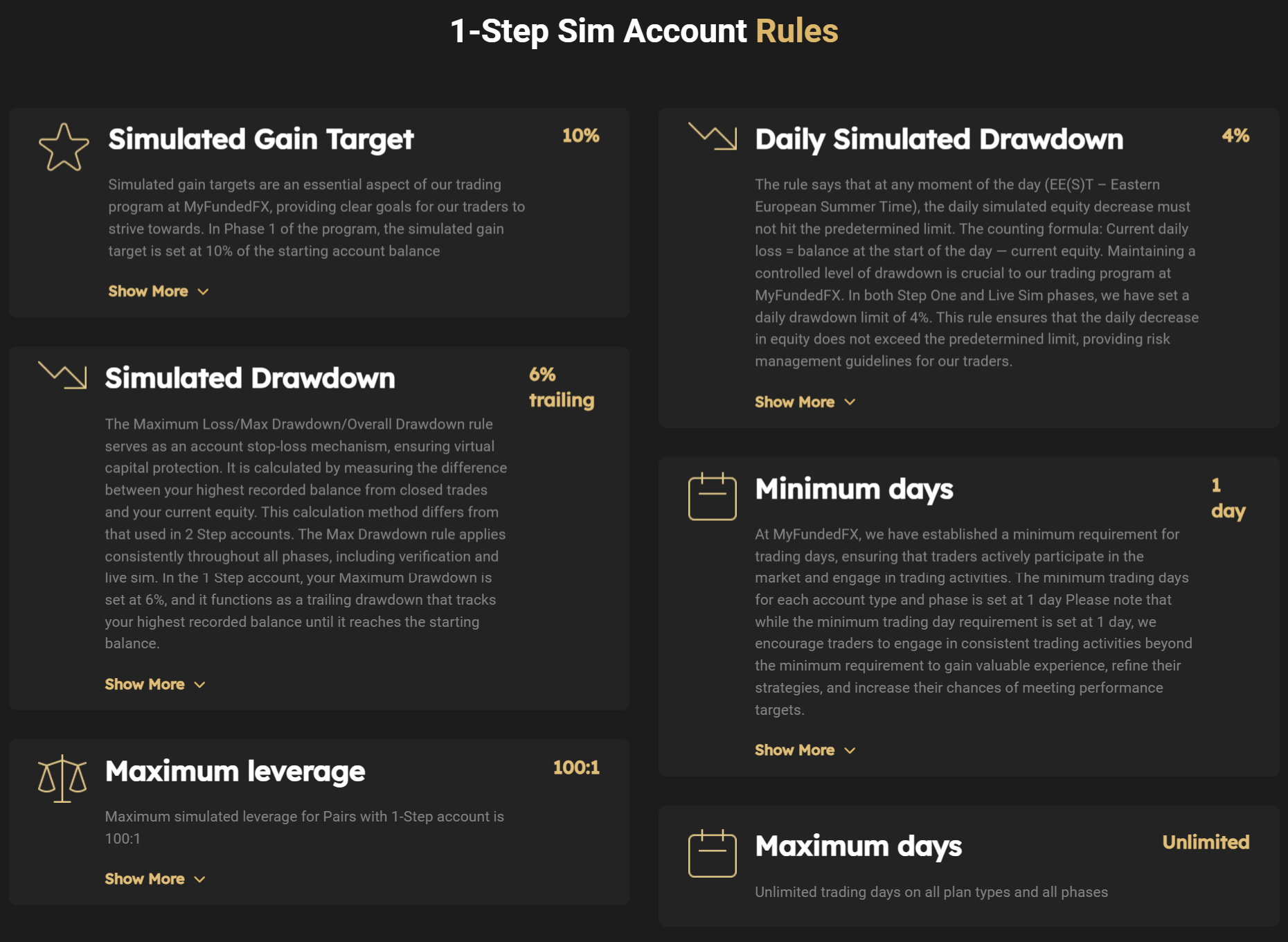

10. MyFundedFX

MyFundedFX offers single phase account challenge for traders aiming to secure funded trading accounts. Here are the key details of the MyFundedFX One-Step Challenge:’

How It Works

Traders undergo a single-phase evaluation process with stable conditions throughout.

Traders can start managing a demo account with up to $300,000 within 24 hours based on their experience.

Minimum trading days required: 1 day, allowing for completion in at least 1 day.

No limit on the maximum number of trading days, providing flexibility.

Trading Rules

Profit Target: 10% of the simulated gain

Max Daily Loss: $200

Max Overall Drawdown: $300

Profit Sharing

Simulated Gain Split: 80%

Payouts

Payouts can be requested every 14 calendar days.

The MyFundedFX One-Step Challenge offers traders an opportunity to showcase their trading skills and potentially access funding accounts with favorable profit splits and risk management rules.

11. Surge Trader

SurgeTrader offers a one-step evaluation program for traders seeking funded trading accounts. Here are the key details of the SurgeTrader One-Step Challenge:

How It Works

Traders undergo a single phase evaluation process without preliminary stages.

After selecting an account size, traders begin trading immediately with no waiting periods.

Trading Rules

Profit Target: 10%

Max Daily Loss: 5%

Max Trailing Drawdown: 5%

Profit Sharing

Standard Profit Split: 75%

Increased Profit Split: 90% when adding fee

Payouts

Payout requests can be made once a month.

Time Limitations

No time limit for completing the challenge

No minimum trading days requirement

Additional Information

Leverage: Varies according to instrument, with up to 10:1 for Forex and Metals, 5:1 for Stocks, and 2:1 for Cryptocurrencies

Instruments: Forex, Cryptocurrencies, Metals, Energy, Indices, Shares

News trading: Allowed

Weekend position holding: Prohibited

The SurgeTrader One-Step Challenge offers traders an opportunity to showcase their trading skills and potentially access funded accounts with favorable profit splits and risk management rules.

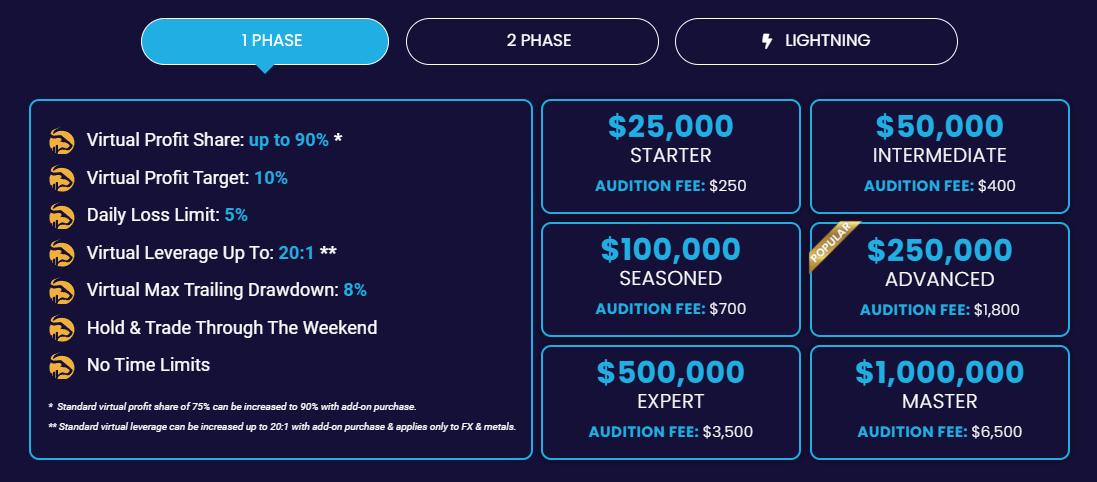

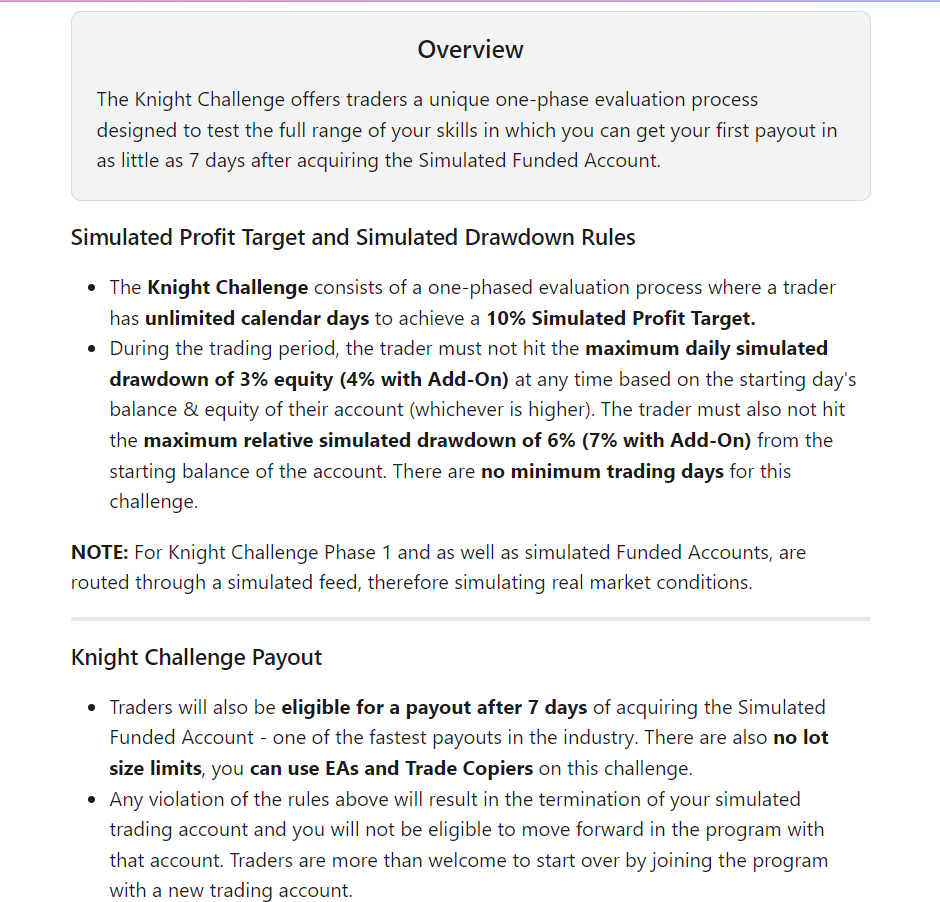

12. The Funded Trader

The Funded Trader provides a single phase challenge for traders aiming to secure funded trading accounts. Funded Trader’s 1-step Knight Challenge Program offers a free trading account, starting with $25000 for $188. Here are the key details of The Funded Trader One-Step Challenge:

How It Works

Traders undergo a single-phase evaluation process without preliminary stages.

Traders can manage account sizes up to $1,500,000 and receive profit splits up to 90%.

Traders can trade forex pairs, commodities, indices, and cryptocurrencies.

Trading Rules

Profit Target: 10%

Max Daily Loss: $200

Max Daily Drawdown: 4%

Max Overall Drawdown: 6%

Profit Sharing

Profit Split: Up to 90% for traders

Payouts

Weekly withdrawals available

Payouts can be requested every 14 calendar days

Time Limitations

No specific time limit for completing the challenge

No minimum trading days requirement

The Funded Trader One-Step Challenge offers traders an opportunity to showcase their trading skills and potentially access funded traders’ accounts with favorable profit splits and risk management rules.

Pros and Cons of One Step Challenge Vs. Two Step Evaluations

Here is a table comparing the pros and cons of one step evaluation versus two step evaluation challenge for prop trading firms:

| Criteria | One Step Evaluation Challenge | Two Step Evaluation Challenge |

|---|---|---|

| Evaluation Process | Straightforward and efficient | Lengthy and stricter criteria |

| Evaluation Phase | Only one evaluation phase | Two evaluation phases |

| Risk Management | Smaller daily drawdowns and smaller maximum drawdowns | Slightly below-average maximum loss rules |

| Profit Targets | Profit target of 10% during evaluation phase, no profit targets for funded account | Profit targets of 8% in phase one and 5% in phase two |

| Funding Options | Faster access to funding | Better funding options |

| Fees | Higher fees | Lower subscription fees |

| Risk | Higher risk | Lower risk |

| Trading Rules | Tighter drawdown and other slightly tough trading rules | More relaxed trading rules |

| Minimum Trading Days | No minimum trading day requirements | No minimum trading day requirements |

| Proprietary Trading Firms | Attractive to experienced traders | Suitable for traders with smaller budgets who are just starting |

| Account Scaling | Eligible for scaling with an average return of 12% or more over three months | Opportunities for account |

How Do One-Step Evaluation Prop Firms Work?

These prop trading firms offer traders a streamlined route to securing funding and commencing trading with a proprietary trading firm. Here’s a breakdown of the step-by-step process typically followed by prop traders:

Registration and fee payment: Traders looking to participate in the evaluation process must first register with the prop trading firm and pay a registration fee. The fee amount may vary depending on the firm and the size of the evaluation account.

Evaluation period: Upon registration, traders are given a specific period, usually spanning from a few days to several weeks, to showcase their trading skills using a demo or trial account. Throughout this period, traders must abide by the specific rules and guidelines outlined by the prop trading firm.

Trading rules and guidelines: Traders are provided with a set of predefined rules and objectives to follow during the evaluation period. These guidelines may include meeting profit targets, adhering to maximum drawdown limits, and implementing rigorous risk management protocols.

Evaluation criteria: The prop trading firm evaluates the trader’s performance based on various factors during the evaluation period. Meeting specific criteria, such as achieving profit targets, demonstrating effective money management practices, and maintaining consistent performance, is crucial for success.

Funding offer: Traders who meet the evaluation criteria may receive a funding offer from the prop trading firm. The funding amount typically corresponds to the trader’s performance during the evaluation period, taking into account factors like profitability, risk management, and overall trading skills.

Trading with funding: Once funded, traders must adhere to certain parameters and guidelines set by the prop trading firm. These parameters may include restrictions on position sizes, specific risk management rules, and other trading guidelines. In return for providing funding, the prop trading firm typically retains a share of the trader’s profits, usually ranging from 20% to 50%, based on the firm’s policies and the funding amount provided.

Key Factors When Finding The Best Prop Trading Firm

Searching for the perfect one-step evaluation prop firm? Follow these steps to ensure you make the right choice:

Assess trading conditions and rules: Examine the trading conditions and rules of each prop firm carefully. Consider factors like profit targets, drawdown limits, and compatibility with your trading style. Starting with lower profit targets and gradually increasing them might be wise. Also, check if the prop firm allows the usage of expert advisors for automated trading.

Explore funding options and profit splits: Look for prop firms offering competitive funding options and favorable profit splits. Evaluate the initial investment size and potential for profit growth. Some firms may provide a higher profit share percentage or offer larger funded account sizes, which can significantly impact your trading journey.

Understand the evaluation process: Get familiar with the evaluation process of each prop firm. Some may require traders to trade successfully in a simulated account, meeting specific rules and risk parameters, before progressing to a funded account. Take note of the evaluation period duration, ensuring you have enough time to pass the challenge successfully.

Compare subscription fees: Consider the subscription fees associated with each one-step evaluation prop firm. Evaluate these fees in relation to your budget and financial capabilities. While some firms may charge higher fees compared to two-step evaluations, assess the value provided and whether the fees are justified for the services offered.

Evaluate risk management requirements: Thoroughly review the risk management requirements imposed by each prop firm. Some may have stricter rules, such as smaller daily drawdown and maximum drawdown limits. Ensure you have the necessary discipline, risk management skills, and trading strategies to meet these requirements effectively.

Check reputation and customer support: Research the reputation and customer support of the prop firms you’re considering. Look for reviews and testimonials from other traders to gauge the quality of their services and responsiveness to customer needs. A reliable and supportive customer support system is crucial for an optimal trading experience.

Frequently Asked Questions

Are Forex prop firms worth it?

Joining a Forex prop firm can be worth it for traders looking to showcase their skills and potentially gain access to more trading capital. However, it is important to weigh the costs and benefits and do research on the specific firm before joining.

Prop firms are legitimate companies that offer traders access to capital, training, and technology to trade financial instruments with the firm’s money. Prop firms typically operate on a profit-sharing model, where traders receive a percentage of the profits they generate.

However, profit sharing can also mean that a portion of the trading profits will go to the prop firm, reducing the overall earnings compared to trading with your own capital. It is important to carefully review the terms and conditions before joining a prop firm.

How much capital can funded traders receive at one step prop firms?

Typically the fund size of these accounts varies according to trading status, location and agreements.

Are prop firms trustworthy?

Almost certainly. Prop companies seek professionals to trade. However, the exception exists. A recent case in the United States was My Forex Fund that faced prosecution by the Federal Trade Commission at its fall meeting. Earlier this year they said that they had blocked a trader from passing their examinations.

A Quick Look at One Phase Prop Firms

Proprietary Trading Firm

One-Step Evaluation

✅

❌

❌

At our website you get the most comprehensive forex proprietary trading firms reviews which are mentioned above.