The Good and Bad about Bespoke Funding

Bespoke Funding is a proprietary trading firm driven by a fervor for uncovering latent talent within the prop trading sector. They are also fully committed to forging distinctive funding avenues for traders across the globe.

Pros

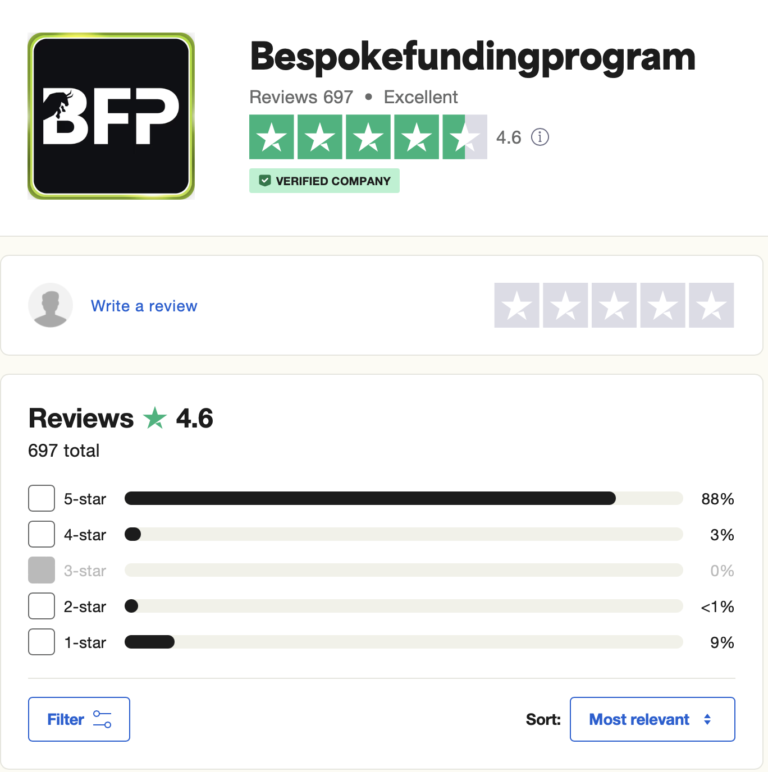

- Excellent Trustpilot rating of 4.4/5

- Two Unique Funding Programs

- Professional Trader Dashboard

- Overnight & Weekend Holding Allowed

- No Minimum Trading Day Requirements with Rapid Challenge

- Scaling Plan

- News Trading Allowed

- Growth Plan Feature

- Bi-weekly payouts

- Leverage up to 1:100

- Auto Close Feature

- First Payout After 14 Days

- Balance-based Drawdown

- A Large Variety of Trading Instruments (Forex Pairs, Commodities, Indices, Cryptocurrencies)

Cons

- Minimum Trading Day Requirements with Classic Challenge

- Initial Maximum Drawdown of 8% on Rapid Challenge

- Lot Size Limit

- No Free Trail

Bespoke Funding is a proprietary trading firm with a mission to unearth hidden talent within the proprietary trading sector. They are dedicated to crafting distinctive create unique funding opportunities and avenues for traders on a global scale. By offering accessible pathways to becoming professional, funded traders who can remotely manage their capital, they empower traders to operate with funding caps of up to $4,000,000 and earn profit splits of up to 80%. This opportunity encompasses trading in forex pairs, commodities, indices, and cryptocurrencies.

Who Is Bespoke Funding?

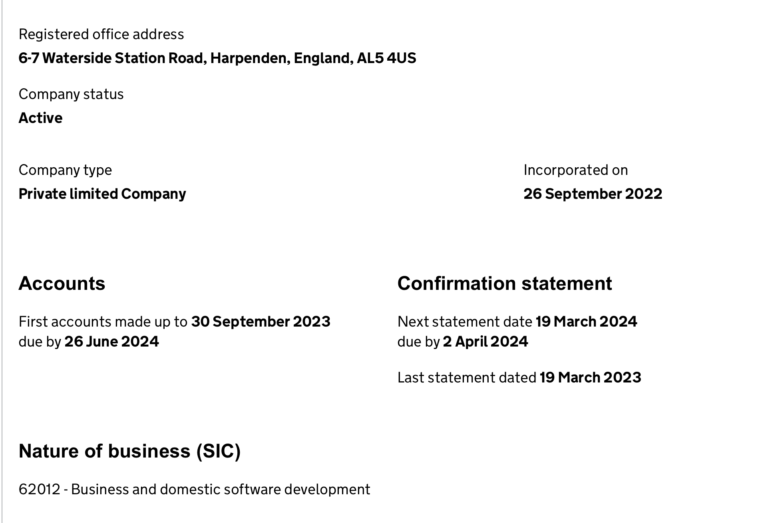

Bespoke Funding is a proprietary trading firm that was officially incorporated on September 26, 2022. They provide traders with the opportunity to opt for either the Classic or the Rapid two-step evaluation programs. The firm operates from its offices in London and extends the possibility for traders to manage account balances of up to $400,000 while offering profit splits of up to 80%. Bespoke Funding has established partnerships with Eightcap and ThinkMarkets to serve as their brokerage providers.

Bespoke Funding’s headquarters are situated at Gemma House, Lilestone Street, London, England, NW8 8SS.

Who is the CEO of BeSpoke Funding Program?

Lewis Kaler is the founder of the BeSpoke Funding program. His prop company opened later on 22 June 2019. Lewis et al quickly grew this firm by introducing new rules and accounts and they’re really beneficial for traders with little money. You can find him on Twitter.

Youtube Video Review

Funding program options:

Bespoke Funding provides traders with two distinct program options:

- Classic Challenge Accounts

- Rapid Challenge Accounts

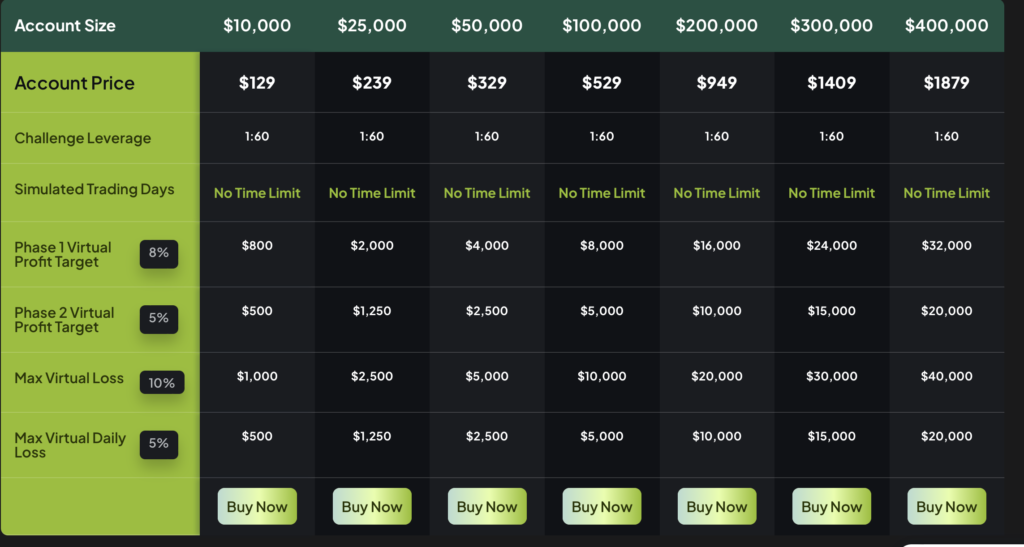

1. Classic Challenge Accounts

The Bespoke Funding Classic Challenge Account is designed to recognize dedicated and skilled traders who consistently perform well in the two-phase evaluation process. This account offers talented traders the opportunity to trade with leverage of up to 1:60 in the prop trading industry.

Account Size

Price

$10,000

$129

$25,000

$239

$50,000

$329

$100,000

$529

$200,000

$949

$300,000

$1,409

$400,000

$1,879

In the Bespoke Funding Classic Challenge Account, the evaluation process consists of two phases. Phase one requires traders to achieve a profit target of 8%, while adhering to the maximum daily loss of 5% and maximum loss of 10% rules. There’s no specific time limit to complete phase one, but you must engage in a minimum of 3 trading days to proceed to phase two.

Phase two of the evaluation mandates traders to reach a profit target of 5%, while also adhering to the 5% maximum daily loss and 10% maximum loss rules. Like phase one, there’s no specific time limit, but you must trade for a minimum of 3 trading days to qualify for a funded account.

Upon successful completion of both evaluation phases, traders receive a funded account with no profit targets. The primary requirements are to maintain a maximum daily loss of 5% and a maximum loss of 10%. The initial payout is processed 14 calendar days after your first trade on the funded account. Subsequent withdrawals can be requested bi-weekly, and the profit split is 80% based on the earnings from your funded account.

Classic challenge account scaling plan:

In Bespoke Funding’s Classic Challenge Accounts, traders have access to a scaling plan. To qualify for an account increase, you must achieve a payout of 8% or more within a four-month period, with at least three out of the four months being profitable. If these conditions are met, your account balance will be increased by 40% of the original account balance.

Here’s an example to illustrate this scaling plan:

After 4 months: If you initially had a $200,000 account, your account balance will increase to $280,000.

After the next 4 months: The balance of $280,000 increases to $360,000.

After another 4 months: The balance of $360,000 increases to $440,000.

This plan allows traders to potentially grow their account balances significantly over time.

The trading instruments available for Classic Challenge Accounts include forex pairs, commodities, indices, and cryptocurrencies.

Classic Challenge Account Rules:

In Bespoke Funding’s trading programs, there are specific rules and requirements that traders need to adhere to:

Profit Targets:

Phase 1 requires a profit target of 8%.

Phase 2 has a profit target of 5%.

Funded accounts have no profit targets.

Maximum Daily Loss:

All account sizes have a maximum daily loss limit of 5%.

Maximum Loss:

All account sizes have a maximum loss limit of 10%.

Minimum Trading Days:

Both evaluation phases require a minimum trading day requirement of 3 days.

Lot Size Limit:

Traders are required to follow specified lot sizes for trading instruments based on their account size. Here are the maximum lots allowed for different account sizes:

$10,000 – 4 lots

$25,000 – 10 lots

$50,000 – 20 lots

$100,000 – 40 lots

$200,000 – 80 lots

$300,000 – 120 lots

$400,000 – 160 lots

No Martingale Allowed:

Traders are prohibited from using any martingale trading strategy.

Third-Party Copy Trading Risk:

If you intend to use copy trading services, be aware that using a third-party copy trading service may lead to a denial of a funded account or withdrawal if it exceeds the maximum capital allocation rule.

Third-Party EA Risk:

If you plan to use a third-party EA, understand that using it may result in a denial of a funded account or withdrawal if it exceeds the maximum capital allocation rule.

These rules and requirements are essential for maintaining a disciplined and controlled trading environment providing traders within Bespoke Funding’s programs. Traders should adhere to these guidelines to achieve success and qualify for funded accounts.

How is Max Daily Loss calculated for Classic challenge?

The balance based daily drawdown loss limitation for the 2-step Classic challenge is calculated according to the following: – Example of balance based drawdowns daily – Using your $1050,000 balance based profit you can use this to build your buffer to get back to the 5% mark.

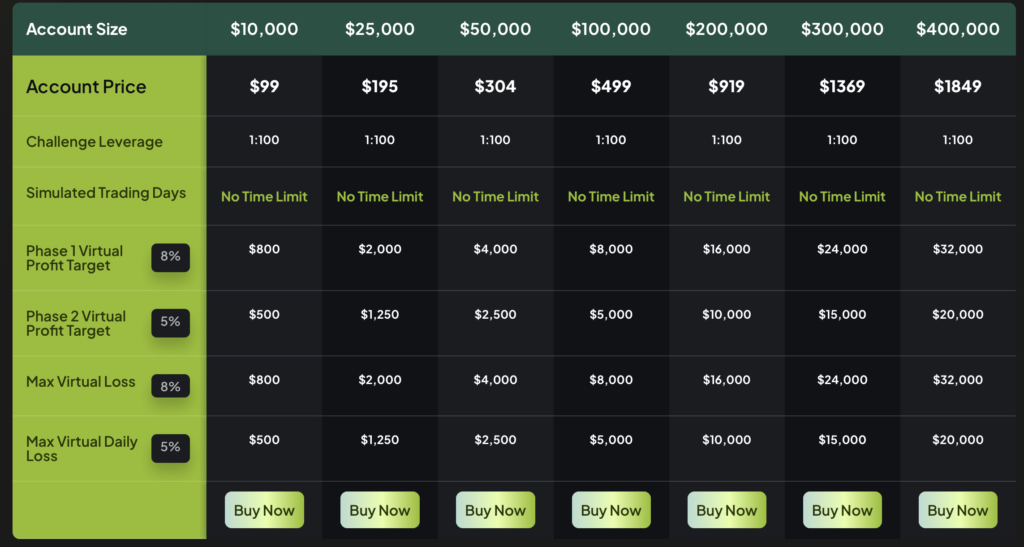

2. Rapid Challenge Accounts

The Bespoke Funding rapid challenge account is designed to recognize dedicated and skilled traders who consistently perform well during the two-phase evaluation period. Traders who choose this challenge account have the opportunity to trade with leverage of up to 1:100.

Account Size

Price

$10,000

$99

$25,000

$195

$50,000

$304

$100,000

$499

$200,000

$919

$300,000

$1,369

$400,000

$1,829

In the Bespoke Funding rapid challenge account, the first evaluation phase necessitates achieving an 8% profit target without exceeding the 5% maximum daily loss or 8% maximum loss restrictions. Importantly, there are no specific minimum or maximum trading day requirements during this phase. To advance to the second phase, traders need only attain the 8% profit target while adhering to the daily and maximum loss limits.

During the second evaluation phase, traders must reach a 5% profit target without exceeding the 5% maximum daily loss or 8% maximum loss restrictions. Again, there are no minimum or maximum trading day requirements. Achieving the 5% profit target while staying within the loss limits is the key to progressing to a funded account.

Upon successfully completing both evaluation phases, traders receive a funded account with no profit targets. The only rules to observe are the 5% maximum daily loss and 10% maximum loss restrictions. The first payout occurs 14 calendar days after initiating trading on the funded account, with subsequent withdrawals permitted on a bi-weekly basis. Traders are entitled to an 80% profit split based on the earnings generated from their funded account.

Rapid challenge account scaling plan:

This trading account in Bespoke Funding also come with a potential for trader to manage more capital. To qualify for this advantage, traders need to achieve a payout of 8% or more within a four-month period, with at least one trade in three of those four months being profitable. If this criterion is met, traders will receive an account increase equivalent to 40% of their original account balance.

Here’s an example to illustrate the scaling plan:

After 4 months: If you initially had a $200,000 account, your account balance will increase to $280,000.

After the next 4 months: The balance of $280,000 will increase to $360,000.

After another 4 months: The balance of $360,000 will increase to $440,000.

This pattern continues as long as the trader meets the scaling criteria.

Traders utilizing this account can trade a variety of instruments, including forex pairs, commodities, indices, and cryptocurrencies.

Rapid challenge account rules:

Bespoke Funding’s trading requirements and features are designed to ensure a fair and structured trading environment for its traders. Here are the key aspects:

Profit Targets: Traders must achieve specific profit targets to progress through the evaluation phases or to request withdrawals. Phase 1 has a profit target of 8%, while Phase 2 requires a profit target of 5%. Funded accounts have no profit targets.

Daily Loss Limit: All account sizes have a maximum daily loss limit of 5%, which means traders cannot exceed this limit in a single trading day.

Maximum Loss: There is also a maximum loss limit of 8% for all account sizes, ensuring that traders do not reach an excessive overall loss.

Lot Size Limit: Traders are required to follow specified lot sizes based on their initial account balance. The maximum lots available for trading depend on the account size, ranging from 4 lots for a $10,000 account to 160 lots for a $400,000 account.

No Martingale Strategy: Traders are not allowed to use martingale strategies during their trading activities.

Third-Party Copy Trading Risk: Using third-party copy trading platforms or services comes with a risk, as other traders may be employing the same strategy. Exceeding the maximum capital allocation rule in this context could result in denial of a funded account or withdrawal.

Third-Party EA Risk: Similarly, using third-party EAs carries a risk if others are using the same strategy. Exceeding the maximum capital allocation rule in this case may lead to issues with funded accounts or withdrawals.

Special Features: Bespoke Funding provides several special features for traders:

Balance-based drawdown, which is favorable for profitable and swing traders compared to industry-standard equity-based drawdown.

An auto close feature that triggers when traders hit their profit targets during evaluation periods, automatically closing all trades as they qualify for Phase 2 or a funded account.

Instant challenge credentials with all funding programs and challenge phases.

Fast processing of payouts and account resets within 24 hours, allowing traders to resume trading quickly.

These features aim to create a fair and efficient trading environment for Bespoke Funding traders.

Is getting Bespoke Funding capital realistic?

Assessing the realism of trading requirements is crucial when selecting a proprietary trading firm that aligns with your trading style. Prop firms may offer enticing profit splits on well-funded accounts, but if the trading requirements are overly demanding, your chances of success may be limited.

Classic Challenge Accounts: Receiving capital from Bespoke Funding’s Classic Challenge Accounts appears realistic. These accounts have relatively modest profit targets (8% in Phase 1 and 5% in Phase 2) and adhere to average maximum loss rules (5% maximum daily and 10% maximum loss). These requirements are attainable for traders who have developed effective trading strategies.

Rapid Challenge Accounts: Bespoke Funding’s Rapid Challenge Accounts also present realistic opportunities. They feature profit targets that are similar to the Classic Challenge Accounts (8% in Phase 1 and 5% in Phase 2) and slightly below-average maximum loss rules (5% maximum daily and 8% maximum loss). These requirements are reasonable for traders seeking funded opportunities.

In summary, Bespoke Funding provides two distinct funding programs, both of which offer realistic trading objectives and conditions for receiving payouts. Traders can choose the program that best suits their trading style and capabilities, increasing their chances of success within a fair and balanced trading environment.

Payment proof:

Bespoke Funding was officially established on September 26, 2022. Traders who participate in Bespoke Funding’s Classic and Rapid challenge accounts can initiate their first withdrawal after a 14-calendar-day period. Subsequent payouts are processed on a bi-weekly basis. It’s important to note that once a trader is funded through either of these two funding programs, there are no profit targets to meet in order to request a payout.

If you’re looking for examples of payment proof from Bespoke Funding, you can often find such evidence on their Discord channel, specifically in the “Payout Proof” section. Here, you can view real-life examples of successful traders who have received payouts from , providing assurance of the firm’s commitment to funding traders and distributing profits.

Bespoke Funding Traders Feedback:

This positive feedback is a good indicator of the firm’s credibility and the value it provides to traders. Let’s check what the transparency report tells us.

Bespoke Funding’s Trustpilot score of 4.6/5 based on 697 reviews is a strong indicator of their positive reputation and customer satisfaction. Having a reliable customer service team available through live chat is also a valuable feature for traders, as it ensures that they can receive timely assistance and information when needed. This combination of positive reviews and accessible support adds to the firm’s credibility and attractiveness to traders.

Their community praises their support team for their fast response time. However, despite that, a member of their community also mentioned that they offer excellent trading conditions with their Eightcap broker.

The fact that Bespoke Funding’s support team was willing to assist a trader who was experiencing personal issues speaks to their commitment to their clients’ well-being and success. This kind of personalized and caring approach is indeed a positive trait for a proprietary trading firm, as it creates a supportive and empathetic environment for traders. It’s always reassuring to hear that a firm values its clients beyond just their trading activities, and this can foster a strong and trusting relationship between traders and the company.

Support:

Bespoke Funding seems to provide multiple channels of support and information for their traders, including a FAQ page, email support support@bespokefundingprogram.com , and live chat support. This accessibility to assistance and resources can be valuable for traders, especially when they have questions or need clarification on various aspects of the funding programs or trading rules. It’s essential for traders to have easy access to support to ensure a smooth and successful trading experience.

Conclusion:

Bespoke Funding is a not the best prop firm but it is a reputable proprietary trading firm that offers traders the choice between two distinct funding programs: the Classic Challenge and the Rapid Challenge accounts. They are serious traders not scammers.

Classic Challenge Accounts are industry-standard two-phase evaluation challenges that must be completed before becoming funded and eligible to earn profit splits. Bespoke Funding requires traders to achieve profit targets of 8% in Phase one and 5% in Phase two, which are realistic trading objectives considering the 5% maximum daily and 10% maximum loss rules. With Classic Challenge Accounts, traders can earn 80% profit splits while also having the opportunity to scale their accounts.

On the other hand, Rapid Challenge Accounts are also industry-standard two-phase evaluation challenges that must be completed before becoming a funded trader and eligible to earn profit splits. Bespoke Funding requires traders to reach profit targets of 8% in Phase one and 5% in Phase two, which are realistic trading objectives considering the 5% maximum daily and 8% maximum loss rules. With Rapid Challenge Accounts, traders can earn 80% profit splits while also having the opportunity to scale their accounts.

I would recommend Bespoke Funding to anyone seeking a prop firm with straightforward trading rules. It’s important to note that they have lot size limitations, and the martingale trading strategy is prohibited. After considering all that Bespoke Funding has to offer, they are certainly one of the industry-leading prop firms.

If you found this Bespoke Funding Review to be informative, you can visit their website here.

You can also discover additional Propfirm reviews here.

FAQs

How much does the bespoke funding program payout?

Get 20% profit – Trade Up To $3,000,000 Total Capital Trade Funding Accounts upto $2 million. Complete this 1-phase review to see if you are a suitable financial institution for the size you want.

What broker does bespoke funding use?

We have integrated our risk management technologies into MT4 and MT5. This trading platform along with pricing and implementation are supplied by Think Markets broker. Tell me your best trader product? You could sell the products on Think Markets.