The Good and Bad about City Traders Imperium

Originally conceived as an aspiration to establish a trading “Empire,” City Traders Imperium, or CTI for short, has since evolved into its central mission. The core vision revolves around empowering traders to attain personal freedom and fulfillment in their lives.

Pros

- Excellent Trustpilot rating of 4.8/5

- One-step evaluation, two-step evaluation, and direct funding programs

- Free Trial

- One-time free retake (Day trading challenge)

- Weekly withdrawals on all funding programs

- Funding up to $4,000,000

- Scaleable profit split up to 100% on all funding programs

- Aggressive scaling program (Instant funding & Direct funding accounts)

- Unlimited time to pass the challenge (Instant funding accounts)

- No maximum daily loss rule (Instant funding accounts)

- CTI propitiatory Risk Manager Tool

- Good education for traders

- News trading is allowed

Cons

- Low 1:10 leverage (Instant funding & Direct funding accounts)

- Mandatory stop-loss rule

CTI fosters an environment where traders, irrespective of their backgrounds, are motivated to attain financial independence. Their foremost requirement from clients is unwavering discipline and a commitment to sustained, long-term performance. CTI offers traders the opportunity to manage substantial capital, with the potential to earn profit splits of up to 100%. These achievements are made possible through trading in Forex pairs, gold, and indices.

Who are City Traders Imperium?

CTI is a UK-based proprietary trading firm located in London. It provides traders with three distinct funding programs: day trading, instant funding, and direct funding. The instant funding program is a one-step evaluation process, while direct funding enables traders to bypass the evaluation phase and begin earning immediately. Meanwhile, the day trading funding program involves a two-step evaluation process. Each of these funding programs includes unique scaling plans, allowing traders to access capital of up to $2,000,000 per account. CTI utilizes MetaTrader 5 as the trading platform and partners with a tier-1 liquidity provider to offer traders a realistic market experience with top-notch trading conditions.

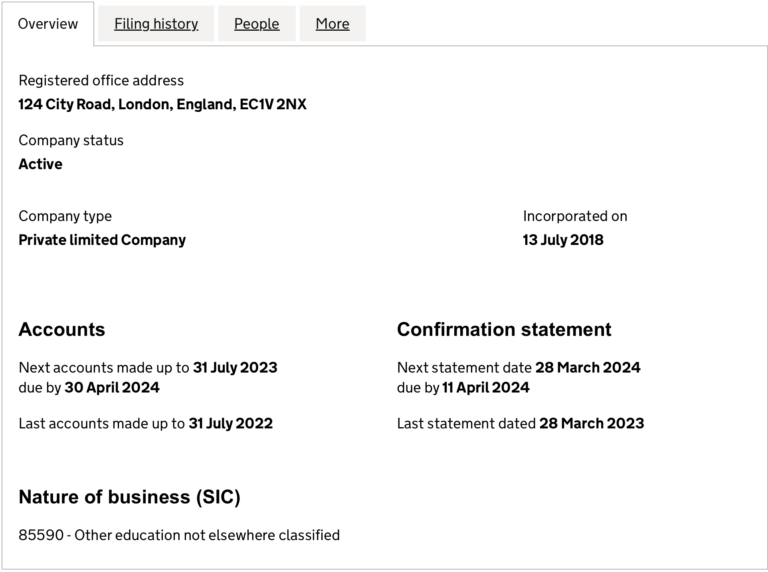

CTI is a registered UK company headquartered in London, as confirmed by Companies House records.

The company was officially incorporated on July 13, 2018, with Daniel Bautista as the founder.

Funding Programs

CTI provides traders with a selection of three distinct programs to consider:

- Day trading funding program accounts (a two-step challenge)

- Instant funding program accounts (a one-step challenge)

- Direct funding program accounts

Day Trading Funding

Day Trading Funding Phases:

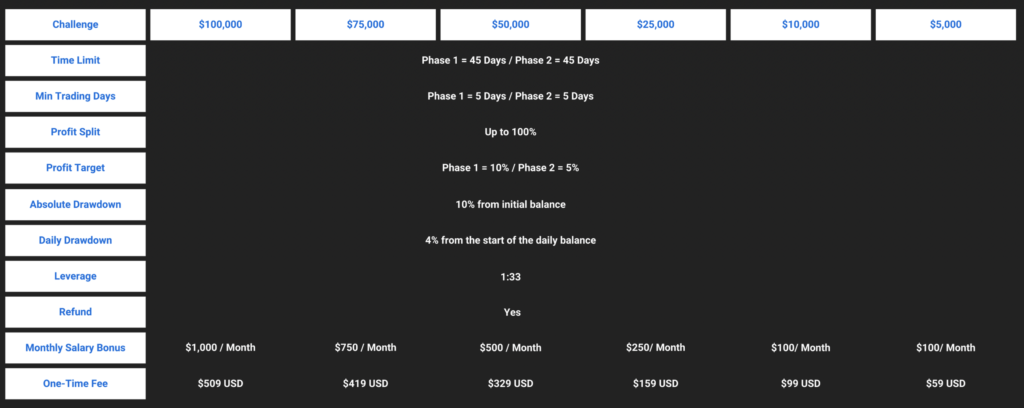

The CTI day trading funding program account is designed to recognize committed and skilled traders who maintain consistency in a two-phase evaluation period. In this evaluation program account, traders can utilize 1:33 leverage.

During evaluation phase one, traders must achieve a profit target of 10% without exceeding the 4% maximum daily loss or 10% maximum loss rules. This goal should be met within 45 calendar days from the date of placing the first position in the evaluation account. Additionally, traders need to engage in a minimum of five trading days to advance to phase two.

In evaluation phase two, traders again aim to reach a profit target, this time at 5%, while adhering to the 4% maximum daily loss and 10% maximum loss rules. The same 45-day time frame from the initial position placement applies, and a minimum of five trading days is required to progress to a funded account.

Upon successful completion of both evaluation phases, traders receive a funded account without profit targets. The only requirements are to maintain the 4% maximum daily loss and 10% maximum loss rules. Traders commence with an 80% profit split on the initial 10%. Upon qualifying for the growth plan, profit splits increase further, reaching up to 90% for a tier 1 growth plan and up to 100% for a tier 2 growth plan. Additionally, funded traders have the opportunity to receive monthly salary bonuses, ranging from $100 to $1,000, depending on the account size they are trading.

Day Trading Funding Scaling Plan:

The day trading funding program accounts at CTI also feature a scaling plan. To qualify, traders must achieve a profit target of 10% or more within a four-month period, where at least two out of the four months were profitable. During this time, they must also process a minimum of two withdrawals, and their account balance must remain positive at the end of the fourth month. Successful traders will receive an account increase equivalent to 30% of the original account balance.

Here’s an example to illustrate the scaling plan:

- After 4 months: If you have a $50,000 account, your account balance will increase to $65,000.

- After the next 4 months: The balance of $65,000 will increase to $80,000.

- After the subsequent 4 months: The balance of $80,000 will increase to $95,000.

- And so on…

Traders in the day trading funding program accounts can trade a variety of instruments, including forex pairs, commodities, and indices.

Day Trading Funding Rules:

Profit target: This is a specific percentage of profit that a trader must achieve before completing an evaluation phase, making profit withdrawals, or scaling their account. Phase 1 has a profit target of 10%, while Phase 2 requires a profit target of 5%. Funded accounts, once achieved, have no profit targets.

Maximum daily loss: This is the maximum allowable daily loss a trader can incur before their account is considered in violation. For all account sizes, the maximum daily loss is set at 4%.

Maximum loss: This represents the overall maximum loss a trader can reach before their account is violated. Similar to maximum daily loss, all account sizes share the same maximum loss limit, which is 10%.

Minimum trading days: These are the minimum number of trading days that must be completed before a trader can finish an evaluation phase or request a withdrawal. Both Phase 1 and Phase 2 have a minimum trading day requirement of five days.

Maximum trading days: This is the maximum number of trading days allowed to reach a specific profit target or withdrawal goal within an evaluation phase. For both Phase 1 and Phase 2, this maximum trading day period is set at 45 days.

No weekend holding: Traders are prohibited from holding open positions during weekends.

Third-party copy trading risk: If traders plan to use copy trading services, they should be aware that using a third-party copy trading service may expose them to the risk of having the same trading strategy as other traders. This could potentially result in denial of a funded account or withdrawal if it exceeds the maximum capital allocation rule.

Third-party EA risk: Similarly, when using a third-party EA (Expert Advisor), traders should consider that others might also be using the same trading strategy. This could lead to denial of a funded account or withdrawal if it exceeds the maximum capital allocation rule.

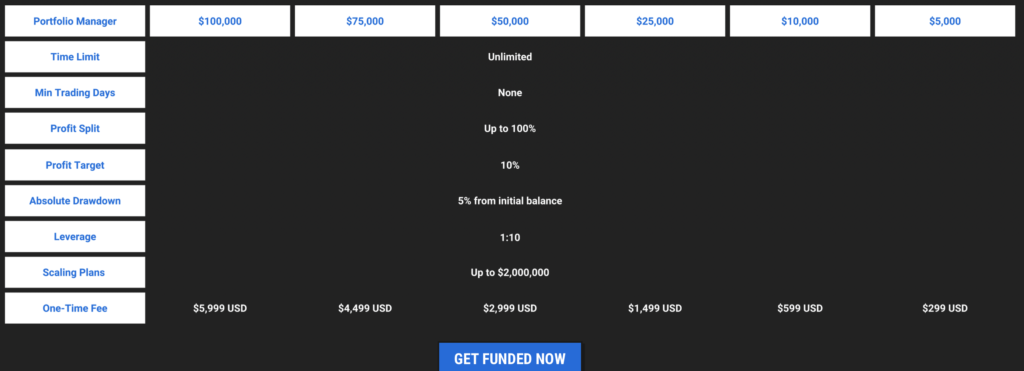

Instant Funding Program

Instant Funding Program Phases:

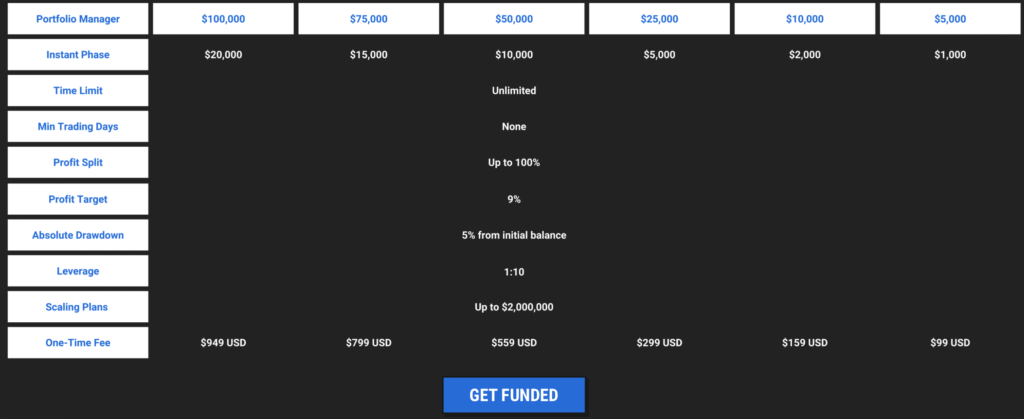

Standard Evaluation Funding Program Account: CTI’s standard evaluation funding program account offers traders flexibility in meeting evaluation requirements, with no time limitations and the ability to trade with 1:10 leverage.

Evaluation Phase: During the evaluation phase, traders aim to achieve a profit target of 9% without exceeding a 5% maximum loss limit. There is no specific time limit for this phase, allowing traders to work towards their profit target at their own pace. Traders must also adhere to the requirement of setting a stop loss on every position they open.

Funded Account: Upon successful completion of the evaluation phase, traders are rewarded with a funded account. In this phase, there are no profit targets to meet, but traders must still observe a 5% maximum loss rule. Similar to the evaluation phase, setting stop losses on all positions is mandatory. Traders can request payouts on a weekly basis, and these withdrawals do not impact the account’s growth. Funded traders can earn profit splits ranging from 50% to 100%, depending on the profits generated.

Instant Funding Program Scaling Plan:

Instant Funding Program Accounts: CTI’s instant funding program accounts also come with a scaling plan, which is detailed in the spreadsheet provided. To become eligible for scaling your account, you need to achieve a profit target of 10%. Once you reach this profit target, you are eligible to scale up your account. Importantly, withdrawing your profits will not hinder your account’s ability to scale up. Your account becomes eligible for scaling when your total profits reach the 10% profit target.

Example: Let’s illustrate this with an example. Suppose the profit target for this account type is 10%. In the first week, you gain 4.2% and decide to withdraw your profits. In the second week, you gain an additional 5.8% and also withdraw those profits. At this point, your total profits have reached 10%, making you eligible for a scale-up, as you’ve met the 10% profit target.

Trading Instruments: Traders using the instant funding program account have the opportunity to trade forex pairs, commodities, and indices.

Instant Funding Program Rules:

Profit Target: The profit target refers to a specific percentage of profit that a trader needs to achieve before they can complete an evaluation phase, withdraw their profits, or consider scaling their account. In the case of the evaluation phase, the profit target is set at 9%.

Maximum Loss: The maximum loss represents the highest allowable level of loss that a trader can reach before their account is considered in violation. It’s important to note that all account sizes have a maximum loss limit of 5%.

Stop-Loss Required: This requirement means that traders must set a stop-loss on every position they open before initiating a trade. This risk management practice helps protect the trader from excessive losses.

Third-Party Copy Trading Risk: Traders should be aware that using third-party copy trading services may expose them to the risk of adopting the exact same trading strategy as other users of the same service. Consequently, if a trader exceeds the maximum capital allocation rule by using such services, they may face challenges in obtaining a funded account or processing withdrawals.

Third-Party EA Risk: Similarly, utilizing third-party EAs (Expert Advisors) carries the risk of employing a trading strategy that is already being used by other traders. This may impact a trader’s eligibility for a funded account or withdrawal if they exceed the maximum capital allocation rule by relying on third-party EAs.

Direct Funding Program

CTI’s Direct Funding Program account provides traders with the opportunity to bypass the evaluation phase entirely and commence trading immediately. Traders can earn profit splits ranging from 70% to 100%, depending on their trading performance. This account offers 1:10 leverage, and it’s worth noting that there are no restrictions regarding minimum or maximum trading durations.

The Direct Funding Program accounts at CTI also include a scaling plan, as outlined in the provided spreadsheet. To qualify for scaling your account, you simply need to achieve a profit target of 10%. You can scale your account once this profit target is reached. An additional advantage is that your weekly withdrawals will not impact your ability to scale your account. Your account becomes eligible for scaling once your total profits reach the 10% profit target.

Example:

The profit target for this account type is 10%.

Week 1: You gain 4.2% and withdraw your profits.

Week 2: You gain 5.8% and withdraw your profits.

Your total profits have now reached 10%, making you eligible for a scale-up since you’ve met the 10% profit target.

Trading instruments available for the Direct Funding Program account include forex pairs, commodities, and indices.

Direct Funding Program Rules:

Maximum Loss: The maximum loss a trader can incur overall before the account is in violation. All account sizes have a maximum loss limit of 5%.

Stop-Loss Required: Traders are obligated to set a stop-loss on every trade position before opening a trade.

Third-Party Copy Trading Risk: When considering third-party copy trading services, be aware that other day traders may already be using the same trading strategy. Using such services can potentially lead to denial of a funded account or withdrawal if you surpass the maximum capital allocation rule.

Third-Party EA (Expert Advisor) Risk: If you plan to use a third-party EA, be mindful that other traders might also be using the same EA and trading strategy. Using third-party EAs carries the risk of being denied a funded account or withdrawal if you exceed the maximum capital allocation rule.

Is Getting City Traders Imperium Capital Realistic?

It’s crucial to assess the feasibility of trading requirements when evaluating proprietary firms that align with your forex markets trading style. For instance, a company offering a generous profit split on a well-funded account might seem attractive, but if they demand exceptionally high monthly gains with minimal drawdown limits, your chances of success could be minimal.

Obtaining capital through CTI’s day trading programs is generally realistic. These programs set reasonable profit targets (10% in phase one and 5% in phase two) along with moderate maximum loss rules (4% maximum daily and 10% maximum loss).

Similarly, gaining capital through CTI’s instant funding programs is feasible. These programs follow a straightforward one-step evaluation process. Day traders need to achieve a 9% profit target over an unlimited time period before they can begin earning on a weekly basis.

Furthermore, CTI’s direct funding program offers a realistic path to capital. With no evaluation phases, traders can start earning from the outset. There’s no specific profit target to reach, and withdrawals can be requested on a weekly basis.

Considering these factors, CTI stands out as an excellent choice for securing funding. With three distinct funding programs that feature realistic trading objectives and the flexibility to receive weekly payouts, it offers a strong opportunity for traders.

Payment Proof

CTI, or City Traders Imperium, was officially incorporated on the 13th of July, 2018. Traders participating in any of CTI’s funding programs have the flexibility to request withdrawals on a weekly basis, and it’s advisable to allow up to seven days for the withdrawal payment to be processed.

When withdrawing funds, traders have three options:

- Withdraw the entire amount.

- Withdraw a partial amount.

- Keep the funds in the account as an additional buffer against drawdown.

It’s worth noting that withdrawals will initially be refunded to the source from which the payment was made (e.g., debit/credit card). Once the withdrawal amount exceeds the payment amount, traders have the option to request withdrawals using the following methods:

- PayPal.

- Transferwise.

- Revolut.

- Cryptocurrency.

To gain confidence in CTI’s payout process, you can refer to their YouTube channel, where they conduct interviews with their funded traders. Additionally, on their Discord channel, there is a dedicated section named “payout-proof” where certificates are displayed as rewards for individuals who have successfully completed the Evaluation or Portfolio Manager processes. This provides tangible evidence of traders’ achievements with CTI.

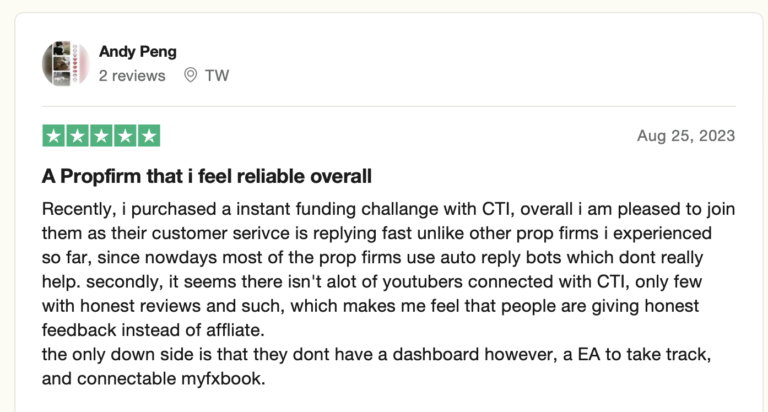

City Traders Imperium Traders Feedback

This positive sentiment is a testament to CTI’s reputation and the value it provides to its trading community.

City Traders Imperium (CTI) has received exceptional feedback on Trustpilot, with a remarkable score of 4.8 out of 5 based on 922 reviews. This high rating, coupled with the fact that they engage with all reviews, demonstrates CTI’s commitment to transparency and customer satisfaction. Additionally, their responsive support team further enhances the positive trading experience for their clients.

City Traders Imperium (CTI) provides valuable educational resources and clear trading rules and guidelines that encourage their clients to improve their risk management skills. This focus on risk management is essential for traders to enhance their overall trading proficiency and make informed decisions in the financial markets.

Support

CTI provides a FAQ page where you can find answers to common questions and information you may be looking for.

For direct support, you can reach out to their team through various channels:

Email: Contact them at ctisupport@citytradersimperium.com for inquiries and assistance.

Live Chat: CTI offers an active live chat support feature where you can send them a message and receive a response via email.

Social Media: You can also reach out to them through their social media channels for support.

Additionally, they have a Discord channel with a dedicated Support channel where you can seek assistance with any support or technical issues you encounter.

I hope this information is helpful. If you have any more specific requests or need further assistance, please feel free to let me know.

Conclusion

In summary, CTI is a reputable prop trading firm that provides traders with a choice of three distinct funding programs: Day Trading (two-step), Instant Funding (one-step), and Direct Funding programs.

For Day Trading programs, traders must complete a two-phase evaluation challenge before becoming funded and eligible for weekly profit splits. CTI sets realistic profit targets of 10% in phase one and 5% in phase two, along with a 4% maximum daily loss and 10% maximum loss rule. This program offers profit splits of up to 100%, and traders can scale their accounts.

Standard programs, including the one-step evaluation account, require traders to achieve a 9% profit target within an unlimited time frame before earning weekly profits through Instant Funding programs. Profit splits start at 50% and can increase to 100% through scaling.

Direct Funding programs allow traders to skip the evaluation phase and trade funded accounts immediately. There are no time restrictions, but traders must adhere to maximum loss limits, required stop-loss, stop-loss risk per position, and rules related to third-party copy trading and EAs. Profit splits begin at 70% and can reach 100% with scaling.

CTI is recommended for traders seeking a prop firm with clear and straightforward trading rules. They have a strong reputation and offer favorable conditions for a diverse range of traders. Considering all that CTI provides, they are undoubtedly one of the leading firms in the industry.

If you found this City Trades Imperium Review to be informative, you can visit their website here.

You can also discover additional Propfirm reviews here.