Pros

- Free Trial

- Excellent Trustpilot rating of 4.3/5

- The Lux Trader trading platform

- Fast email support

- No time limit on profit target

- Weekend holding allowed

- Profit share 75%

Cons

- 4% maximum relative drawdown and maximum loss limit

- Low leverage 1:1, 1:5, and 1:10

- High minimum trading day requirements

- Limited to one segment of trading

Lux Trading Firm actively supports the success of its traders, empowering them to achieve greater profitability. Traders have the opportunity to trade on accounts with balances of up to $10,000,000. To qualify for funding, one must successfully navigate the distinctive two-step evaluation process. Once accomplished, traders are assigned specific profit targets to enhance their account balance. Upon meeting these targets, they receive a 75% profit split and a subsequent boost in their account balance.

Who are Lux Trading Firm?

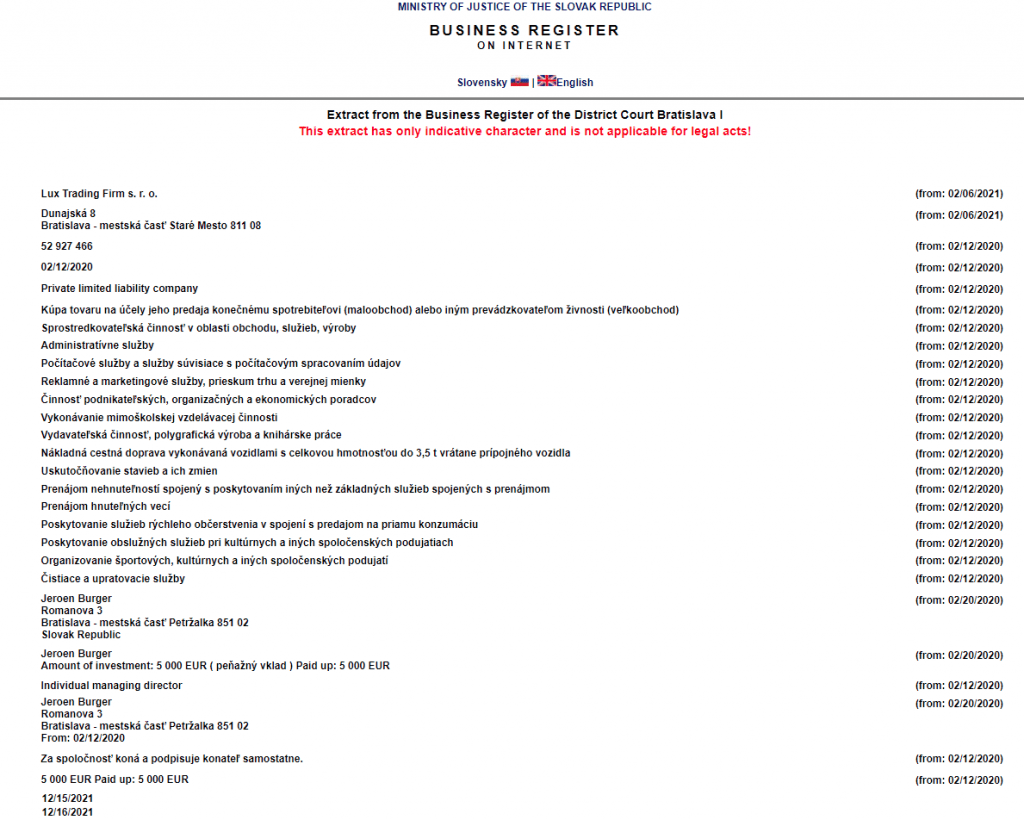

Lux Trading Firm, a proprietary trading company, operates from offices in both London and Slovakia, Bratislava. Traders at Lux Trading Firm have the opportunity to access account balances of up to $10,000,000, facilitated through their affiliation with the reputable broker, After Prime, situated in Australia.

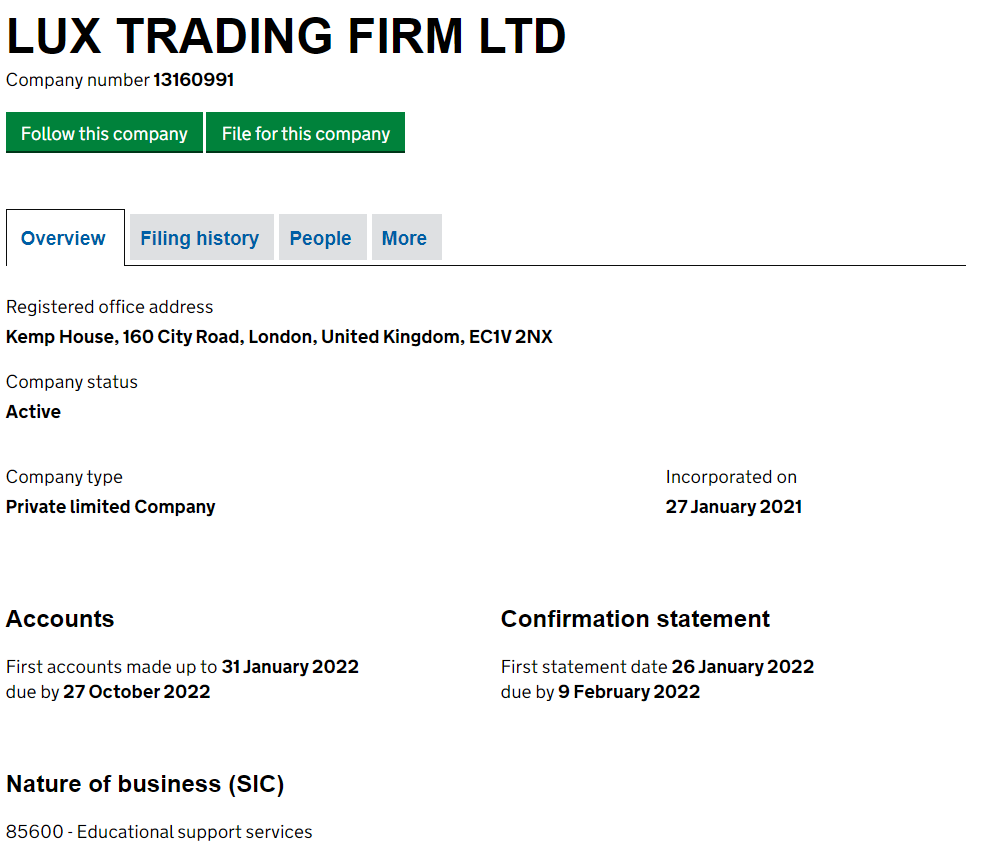

As a registered entity in the United Kingdom, Lux Trading Firm operates under the name Lux Trading Firm Ltd, holding the company number 131609991.

Lux Trading Firm Ltd was incorporated on the 27th of January 2021 and is registered under Kemp House, 160 City Road EC1V 2NX London, UK.

They also have one more registered company, Lux Trading Firm s. r. o at Dunajská 8, Bratislava, Slovakia. Lux Trading Firm s. r. o. The company was registered on 12 February 2020.

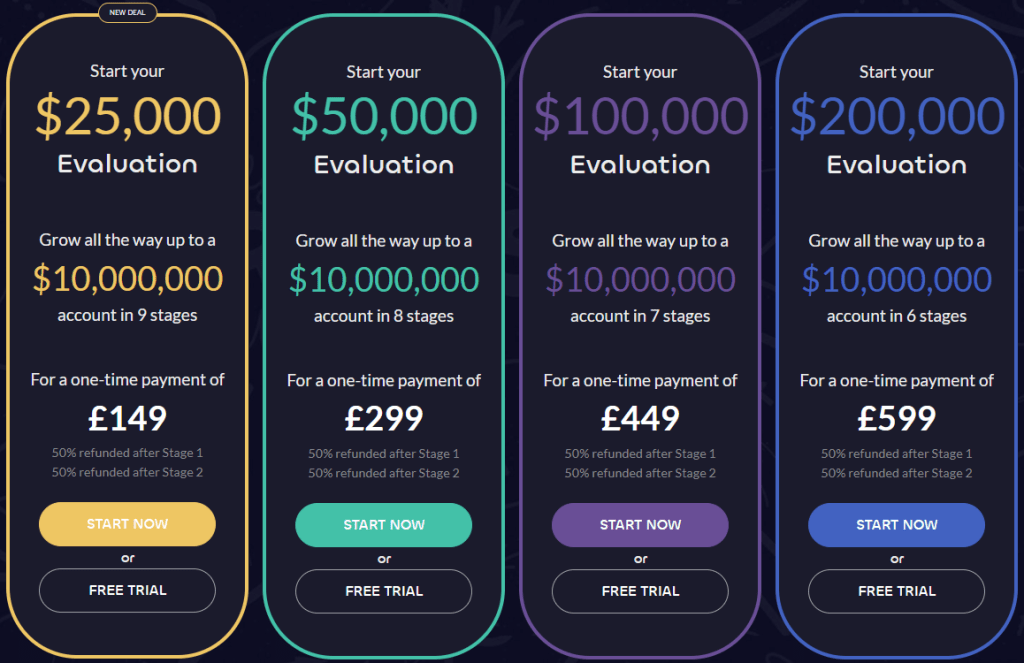

Funding program options

Lux Trading Firm offers its traders two different programs to choose from:

- Two-step evaluation program

- One-step evaluation program

Two-step evaluation program accounts

Lux Trading Firm’s evaluation program accounts are designed to identify and reward consistent and talented traders who demonstrate proficiency throughout a unique two-phase evaluation process. Traders in the evaluation program account have the opportunity to trade with up to 1:10 leverage.

During Phase One, known as the Evaluation stage, traders are required to achieve a 6% profit target while adhering to a maximum loss of 5%. There are no specific time limitations for hitting the profit target, but a minimum trading period of 29 calendar days (or 15 calendar days for swing traders) is mandatory to progress to Phase Two. Successful completion of the Evaluation stage also makes traders eligible for a 50% refund of their initial one-time fee.

Moving on to Phase Two, referred to as the Advanced stage, traders must attain a 4% profit target without exceeding the 5% maximum loss rule. Similar to the Evaluation stage, there are no specific time constraints during the Advanced stage. Successful completion of this stage makes traders eligible for a second 50% refund of their initial one-time fee.

Upon successful completion of both Evaluation and Advanced stages, traders are rewarded with a live funded account, also known as the Professional account. In this phase, there are no profit target requirements for withdrawals, and traders only need to adhere to the 4% maximum loss rule. The first payout is scheduled 30 calendar days from the day the first position is placed on the funded account, with a profit split of 75% based on the profits generated. Subsequent payouts occur monthly, maintaining a 75% profit split based on the profits earned on the funded account. It’s important to note that all future payouts are subject to this monthly schedule.

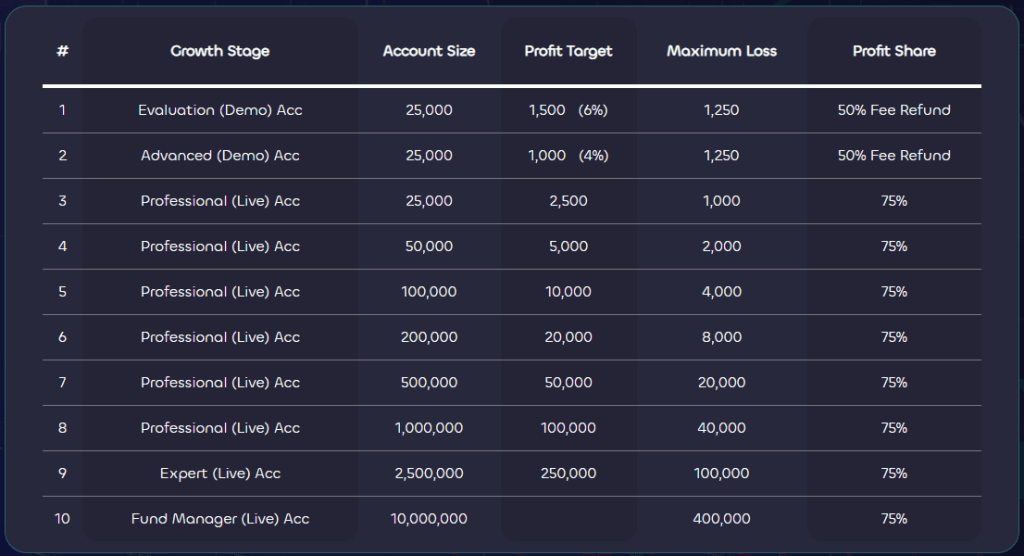

Two-step evaluation program account scaling plan

The two-step evaluation program accounts at Lux Trading Firm also incorporate a scaling plan. Traders are mandated to achieve a profit target of 10% to advance their account to the next growth stage, with the potential to scale up to a maximum capital of $10,000,000.

$25k Evaluation account scaling plan

$50k Evaluation account scaling plan

$100k Evaluation account scaling plan

$200k Evaluation account scaling plan

The trading instruments available for the two-step evaluation program accounts encompass a diverse range, including forex pairs, commodities, indices, bonds, and shares.

Two-step evaluation program account rules

Profit Targets:

- Evaluation Stage: 6%

- Advanced Stage: 4%

- Funded accounts: No specific profit targets.

Maximum Loss:

- All account sizes: 5% (4% once funded).

Minimum Trading Days:

- Evaluation Stage: 29 days (15 calendar days for swing traders).

- Advanced Stage: No minimum trading day requirements.

Stop-Loss Requirement:

- Mandatory for every position before initiating a trade.

Martingale Prohibition:

- No use of martingale strategies allowed during trading.

Third-Party EA Risk:

- Cautionary note on potential risk if using a third-party EA that duplicates strategies used by others, which might breach maximum capital allocation rules.

Third-Party Copy Trading Risk:

- Caution about potential risk when using third-party copy trading services mirroring strategies already in use by others, leading to potential denial of funded accounts/withdrawals if maximum capital allocation rules are exceeded.

Single Segment Trading:

- Restriction allowing trading in only one segment (forex, commodities, or indices) per account, excluding simultaneous trading across all segments.

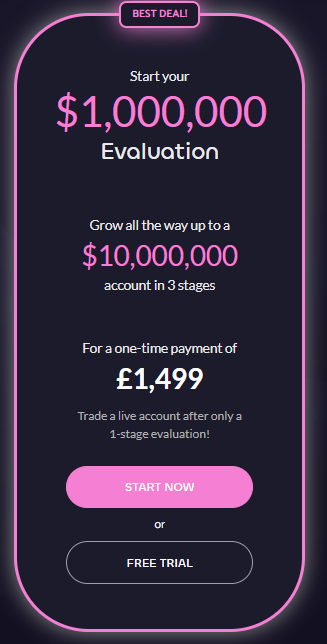

Lux Trading Firm’s one-step evaluation challenge account is designed to recognize and reward consistent and disciplined traders within a singular evaluation phase. This particular account, valued at $1,000,000, offers the opportunity to trade with a leverage of 1:10.

To successfully meet the criteria of the one-step evaluation challenge account, traders must achieve a 15% profit target while adhering to the 5% maximum loss rule. The Evaluation stage allows for unlimited trading time, with a minimum requirement of 29 calendar days (15 calendar days for swing traders) before advancing to the next phase. Upon successful completion of the Evaluation stage, traders are granted a live-funded account.

Upon concluding the one-step evaluation challenge, traders receive a funded account with a 10% profit target. Adherence to the 4% maximum loss rule is mandatory. The initial profit split stands at 75%, calculated based on the achieved 10% profit target during the unrestricted trading period on the funded account.

One-step evaluation program account scaling plan

The one-step evaluation program accounts at Lux Trading Firm incorporate a scaling plan. Traders are obligated to achieve a 10% profit target to elevate their account to the subsequent growth stage, with the potential to scale up to a maximum capital of $10,000,000.

$1M One-step evaluation account scaling plan

The trading instruments available for one-step evaluation program accounts encompass a diverse range, including forex pairs, commodities, indices, bonds, and shares.

One-step evaluation program account rules

Profit Targets:

- Evaluation Stage: 15%

- Funded Accounts: 10%

- Required before evaluation completion, profit withdrawal, or scaling the account.

Maximum Loss:

- All Account Sizes: 5% (4% once funded).

- Violation if exceeded.

Minimum Trading Days:

- Evaluation Stage: 29 days (15 days for swing traders).

- Necessary before evaluation completion or withdrawal request.

Stop-Loss Requirement:

- Mandatory for every position prior to trade initiation.

Martingale Prohibition:

- No use of martingale strategies permitted during trading.

Third-Party EA Risk:

- Cautionary note on potential denial of funded account/withdrawal if a third-party EA duplicates existing strategies and breaches maximum capital allocation rules.

Third-Party Copy Trading Risk:

- Caution about potential denial of funded account/withdrawal if using a third-party copy trading service that replicates strategies already in use by others, leading to exceeding maximum capital allocation rules.

Single Segment Trading:

- Restriction to trade only in one segment (forex, commodities, or indices) per account, excluding simultaneous trading across all segments.

What makes Lux Trading Firm different from other prop firms?

Lux Trading Firm stands out from its industry counterparts by offering two distinctive funding programs: a unique two-step evaluation and a $1 million one-step funding initiative. Additionally, the firm distinguishes itself by providing traders with genuine funded accounts.

In contrast to conventional prop firms, Lux Trading Firm’s two-step evaluation program is a distinctive two-phase process that necessitates traders to successfully navigate both phases before becoming eligible for payouts. The initial phase requires a profit target of 6%, followed by a 4% target in the second phase, while adhering to a 5% maximum loss rule. During the Evaluation stage, traders must engage in a minimum of 29 calendar days (15 calendar days for swing traders), whereas there are no minimum trading day requirements during the Advanced stage. The two-step evaluation programs also incorporate a scaling plan. Notably, Lux Trading Firm sets itself apart from other leading prop firms by offering relatively lower profit targets and imposing no maximum time limitations.

Example of comparison between Lux Trading Firm & Funding Pips

Trading Objectives

Lux Trading Firm

Funding Pips

Phase 1 Profit Target

6%

8%

Phase 2 Profit Target

4%

5%

Maximum Daily Loss

No Limit

5%

Maximum Loss

5%

10%

Minimum Trading Days

Evaluation Stage: 29 Calendar Days (Swing Traders: 15 Calendar Days)

No Minimum Trading Days

Maximum Trading Period

Phase 1: Unlimited Phase 2: Unlimited

Phase 1: Unlimited Phase 2: Unlimited

Profit Split

75%

80% up to 90%

Example of comparison between Lux Trading Firm & FundedNext

Trading Objectives

Lux Trading Firm

FundedNext (Evaluation)

Phase 1 Profit Target

6%

10%

Phase 2 Profit Target

4%

5%

Maximum Daily Loss

5% No Limit

5%

Maximum Loss

5%

10%

Minimum Trading Days

Evaluation Stage: 29 Calendar Days (Swing Traders: 15 Calendar Days)s

5 Calendar Days

Maximum Trading Period

Phase 1: Unlimited Phase 2: Unlimited

Phase 1: 30 Calendar Days Phase 2: 60 Calendar Days

Profit Split

75%

80% up to 90%

Example of comparison between Lux Trading Firm & E8 Funding

Trading Objectives

Lux Trading Firm

E8 Funding (Normal)

Phase 1 Profit Target

6%

8%

Phase 2 Profit Target

5%

5%

Maximum Daily Loss

No Limit

5%

Maximum Loss

4%

8% (Scaleable up to 14%)

Minimum Trading Days

Evaluation Stage: 29 Calendar Days (Swing Traders: 15 Calendar Days)

No Minimum Trading Days

Maximum Trading Period

Phase 1: Unlimited Phase 2: Unlimited

Phase 1: Unlimited Phase 2: Unlimited

Profit Split

75%

80%

In contrast to other prop firms, Lux Trading Firm’s one-step evaluation program is a streamlined single-phase process, requiring traders to successfully complete one phase before becoming eligible for payouts. The profit target for the evaluation phase stands at 15%, accompanied by a 5% maximum loss rule. Additionally, traders are obligated to engage in a minimum of 29 calendar days (15 calendar days for swing traders) during the Evaluation stage. One-step evaluation programs feature a scaling plan, setting Lux Trading Firm apart from industry-leading prop firms by establishing a relatively high profit target without imposing maximum trading period limitations.

In summary, Lux Trading Firm distinguishes itself from other industry-leading prop firms by offering two distinct funding programs alongside the provision of genuine live funded accounts for traders. Notably, they stand out further by implementing no maximum trading period limitations for the completion of both the Evaluation and Advanced stages.

Is getting Lux Trading Firm capital realistic?

When assessing prop firms that align with your forex trading style, it’s crucial to evaluate the realism of their trading requirements. Opting for a company that boasts a high % profit split on a generously funded account might seem appealing, but if they demand lofty % gains per month coupled with low % maximum drawdowns, the likelihood of success diminishes significantly.

Obtaining capital through two-step evaluation programs proves realistic, primarily due to their relatively modest profit targets (6% in phase one and 5% in phase two). Moreover, the maximum overall loss limit is set at 5%, and the absence of maximum time limitations allows traders to accumulate profits at a comfortable pace without feeling pressured.

Similarly, obtaining capital through one-step evaluation programs is deemed realistic, given their slightly above-average profit target of 15%, coupled with a maximum overall loss limit of 5%. The absence of maximum time limitations provides traders with the flexibility to steadily accumulate profits without the need for hurried decision-making.

Taking all these factors into consideration, Lux Trading Firm emerges as an outstanding choice for securing funding. The availability of two distinct funding programs ensures that traders can opt for objectives and conditions that align with realistic trading goals, enhancing the likelihood of successful outcomes and timely payouts.

Payment proof

Lux Trading Firm, an established proprietary firm, was officially incorporated on January 27, 2021. Evidence of payment success is attested by the reviews of two individuals, Richard C. and Jack Pechler, available on Trustpilot.

Traders’ Comments about Lux Trading Firm

Lux Trading Firm has excellent feedback from their reviews.

On Trustpilot, they have a large variety of their community commenting and giving positive feedback with an incredible score of 4.3/5 out of 561 reviews. They also have fast and reliable support that will provide you with all the necessary information that you require from them.

The majority of their user base expresses satisfaction with the design and content coverage of their dashboard. The platform streamlines users’ experiences by handling the calculation of maximum relative drawdowns, relieving them of this task.

Their educational resources provide valuable assistance to individuals, offering precise rules and guidelines that compel customers to enhance their risk management practices for the better.

Conclusion

Lux Trading Firm stands out as a legitimate proprietary trading entity that provides traders with the flexibility to choose between two distinct funding programs: the unique two-step evaluation and the $1 million one-step funding initiative.

The two-step evaluation programs present a distinctive two-phase challenge, requiring traders to successfully navigate both phases to become funded and eligible for profit splits. Lux Trading Firm sets realistic trading objectives by requiring traders to achieve profit targets of 6% in phase one and 4% in phase two, all within the framework of a reasonable 5% maximum loss rule. The program allows traders to earn profit splits of 75% and offers the potential to scale the account balance up to $10,000,000.

On the other hand, the one-step evaluation program is a streamlined one-phase challenge, demanding successful completion before traders become funded and eligible for profit splits. Lux Trading Firm maintains realistic trading objectives by setting a profit target of 15%, aligned with a 5% maximum loss rule. Similar to the two-step program, traders can earn profit splits of 75% and have the potential to scale the account balance up to $10,000,000.

Lux Trading Firm is recommended for more experienced traders equipped with well-developed trading and risk management strategies. The firm’s straightforward rules, absence of maximum time limitations, and relatively high minimum trading day requirements for account scaling suggest a focus on attracting consistent traders. Taking everything into account, Lux Trading Firm emerges as an excellent choice for those with robust trading strategies seeking consistent and gradual profit accumulation.

Trustpilot hosts a diverse range of community members providing overwhelmingly positive feedback, resulting in an impressive score of 4.6 out of 5 based on 284 reviews. The majority of the community commends Glow Node for its clear and concise trading objectives and regulations. Additionally, they appreciate the active engagement with the community, particularly through the Discord channel.